Tues-1035-JaimePurvis

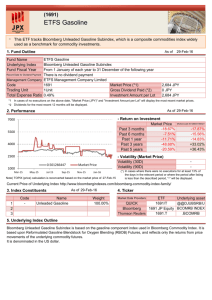

advertisement

HORIZONS ETFs PROFIT OR PROTECT IN BEAR OR BULL MARKETS™ Host: Jaime Purvis, Horizons Exchange Traded Funds October 26, 2010 ETF INDUSTRY OVERVIEW Global ETF industry Q3 2010 Global ETF assets US$1,181.3 BN 2,379 ETFs from 129 providers on 45 exchanges 478 new ETFs (YTD) Average daily trading volume US$58.2 BN 3,257 Exchange Traded products Source: Barclays Global Investors 2 BETA FUNDS ORIGINATED IN THE U.S. ‘Beta ETFs and Funds’ are the fast growing segment of U.S. mutual funds and ETFs with current AUM in excess of an estimated $50BN Initial growth was driven by “discretionary” retail market, but institutional use has grown rapidly, and now takes up approximately 55% of market share Market is dominated by two players: Rydex & ProFunds, both established in the mid ’90s, Direxxion growing fast (3x) ProShares, part of the ProFunds Group, launched the first Bull & Bear ETFs in the United States in June 2006 on the AMEX • AUM is already in excess of $4BN with 52 ETFs BetaPro Management entered into a 10-yr exclusive sub-advisory contract with ProFunds Group in 2005 Leveraged ETFs introduced in US in June 2006, in Canada in January 2007 3 ABOUT HORIZONS BETAPRO ETFs Offers investors four types of ETF structures to profit or protect in all market conditions HBP Single ETFs: provide exposure to the performance of 4 underlying commodity and 1 equity benchmark, before fees and expenses HBP Inverse ETFs: provide exposure to the inverse daily performance of 7 underlying benchmarks before fees and expenses HBP Bull+ & Bear+ ETFs: provide double exposure to the daily performance (or inverse daily performance) of 15 underlying benchmarks before fees and expenses. Risk limited to initial capital invested HBP Spread ETFs: provide daily long exposure to one underlying commodity benchmark and inverse daily exposure to another underlying commodity benchmark, before fees and expenses HBP offers the most ETFs listed on the TSX with 44 and accounted for over 60%* of all trading volume on the TSX. Exclusive provider of leveraged, inverse leveraged and spread ETFs in Canada World's first leveraged and inverse leveraged commodity ETFs tracking NYMEX® Crude Oil, NYMEX® Natural Gas, COMEX® Gold, COMEX® Silver and COMEX® Copper *For the period from Jan 1 to June 30, 2010 4 HORIZONS ETFs ASSET GROWTH 5 HORIZONS BETAPRO SERVICE PROVIDERS Horizons BetaPro ETFs are managed by BetaPro Management Inc. Currently have 44 ETFs listed on TSX Account for over 60% of CDN ETF trading volume* Currently account for almost 10% of all TSX trading volume Parent Company: Jovian Capital Corporation (JOV: TSX) JOV owns approximately 60% of HBP Financial services holding company with over $12BN in client assets** Murray Edwards holds a 30% minority interest in JOV Custodians Primary: State Street Trust Company Secondary: CIBC Mellon Sub-Advisor: ProShare Advisors LLC U.S. based ETF provider with over $27 BN in AUM across 174 ETFs and Mutual Funds*** *For the period from Jan 1 to June 30, 2010. **As at September 30, 2010. ***as at June 30, 2010 6 HORIZONS BETAPRO ETFs: PROFIT OR PROTECT IN BULL & BEAR MARKETS™ The Horizons BetaPro family of ETFs Underlying benchmarks ETF Ticker Equities S&P/TSX 60TM BetaPro S&P/TSX Capped FinancialsTM BetaPro S&P/TSX Capped EnergyTM BetaPro S&P/TSX Global GoldTM BetaPro S&P/TSX Global Base MetalTM BetaPro S&P 500® BetaPro NASDAQ-100® BetaPro MSCI Emerging Markets Bull+(+2x) Bear+ (-2x) Inverse (-1x) Single (+1x)BetaPro HXU HXD HIX HXT HFU HEU HGU HMU HSU HQU HJU HFD HED HGD HMD HSD HQD HJD HIF HIE HIG Fixed Income BetaPro U.S. Dollar BetaPro U.S. 30-Year Bond HDU HTU HDD HTD Commodities BetaPro COMEX® Copper BetaPro COMEX® Gold BetaPro COMEX® Silver BetaPro NYMEX® Crude Oil BetaPro NYMEX® Natural Gas HKU HBU HZU HOU HNU HKD HBD HZD HOD HND HIU Inverse (-1x) Single (+1x) HIO HIN HUG HUZ HUC HUN Commodity spreads Spread (+1x) + (-1x) BetaPro NYMEX® Long Crude Oil/Short Natural Gas Spread HON BetaPro NYMEX® Long Natural Gas/Short Crude Oil Spread HNO 7 THE S&P/TSX 60™ INDEX CANADA’S 60 LARGEST STOCKS The 60 largest Canadian stocks by market capitalization Represents 73%* of the market capitalization of the Canadian stock market Currently about $25 billion** of Canadian investment assets are benchmarked to the S&P/TSX 60™ Index The most widely invested in ETF benchmark in Canada, with securities there on currently representing more than $11 billion in assets and approximately 30% of all Canadian ETF assets Typically these ETF securities are the most actively traded on the TSX *Source: Standard and Poor’s as at August 2010. **Source: TD Securities 8 INTRODUCING HXT: CANADA’S LOWEST COST ETF Name: Horizons BetaPro S&P/TSX 60™ Index ETF (HXT:TSX) Index: S&P/TSX 60™ Index (Total Return) Management Fee: 7 basis points* Operating Expenses: None Quarterly Dividends: None; no dividend tax liability *Plus applicable sales taxes 9 HOW LEVERAGED AND INVERSE LEVERAGED ETFs WORK HOW LEVERAGED AND INVERSE LEVERAGED ETFs WORK Key attributes of leveraged ETFs Risk limited to capital invested Never lose more than principal invested RSP eligible CAD denominated Hedged back into CAD 11 INVERSE VS. SHORTING Interest on short proceeds accrues to the NAV, not to Financial Institution No margin calls RSP Eligible No call risk No borrow rate No cash coverage of dividends owing 12 WHY WE REBALANCE Limit risk to current amount invested Same experience for everyone No margin calls Non-recourse leverage or exposure 13 HXU CORRELATION TO BENCHMARK y = 2.0007x + 4E-05 R2 = 0.9999 HXU 25.00% 20.00% 15.00% % Change in ETF 10.00% 5.00% -12.00% -7.00% 0.00% -2.00% 3.00% 8.00% 13.00% -5.00% -10.00% -15.00% -20.00% -25.00% Source: Bloomberg Change in Index % Change in% S&P/TSX 60™ Index Inception to Jul 30, 2010 14 HXD CORRELATION TO BENCHMARK y = -2.0005x - 2E-05 2 R = 0.9998 HXD 25.00% 20.00% 15.00% % Change in Fund 10.00% 5.00% -12.00% -7.00% 0.00% -2.00% 3.00% 8.00% 13.00% -5.00% -10.00% -15.00% -20.00% -25.00% % Change in Index Source: Bloomberg % Change in S&P/TSX 60™ Index Inception to Jul 30, 2010 15 UNIVERSAL EFFECTS OF COMPOUNDING ON INVESTMENT RETURNS Compounding affects all investments over time Upward trending periods enhance returns Downward trending periods reduce losses Volatile periods reduce returns and may increase losses Positive and negative effects of compounding are magnified in leveraged and inverse funds The impact of compounding on a 2x leveraged fund is greater than 2x 16 EXAMPLES OF COMPOUNDING ON INDEXES AND LEVERAGED FUNDS INDEX -1x F U N D -2x F U N D Daily Return Daily Return Daily Return UPWARD TREND Day 1 Return 10% -10% -20% Day 2 Return 10% -10% -20% Compounded 2-day Return 21% -19% -36% DOWNWARD TREND Day 1 Return -10% 10% 20% Day 2 Return -10% 10% 20% Compounded 2-day Return -19% 21% 44% VOLATILE MARKET Day 1 Return 10% -10% -20% Day 2 Return -10% 10% 20% Compounded 2-day Return -1% -1% -4% None of the returns shown contemplate fees or expenses; not actual returns, for illustrative purposes only. 17 LEVERAGED AND INVERSE FUNDS AFFECTED BY RECORD VOLATILITY Highest short-term volatility levels for (S&P 500®) U.S. equities in 80 years affected all investments, including leveraged funds 80% 72% 66% (12/16/08) (12/31/29) 70% 69% ( 1 0/21/32) 60% (1/11/88) 60% 50% 40% 30% 20% 10% 0% Source: Bloomberg 18 MARKETS: PAST AND PRESENT HISTORICAL MARKET CYCLES: DJIA 1900 - PRESENT 19 MARKETS: PAST & PRESENT CURRENT MARKET CYCLE: DJIA 2000 - PRESENT 15,000 14,000 13,000 12,000 11,000 10,000 9,000 8,000 7,000 27-Jun-04 10-Sep-02 23-Nov-00 31-Dec-99 17-Oct-01 4-Aug-03 30-Jan-08 14-Apr-06 21-May-05 8-Mar-07 16-Nov-09 23-Dec-08 10-Oct-10 Source: Bloomberg. 20 IMPACT OF VOLATILITY ON RETURNS OF BULL+ ETFs Estimated return over 1 year when the fund objective is to seek daily investment results, before fund fees and expenses and leverage costs, that correspond to twice (200%) the daily performance index. ‘Expected Returns’ = 200% One Year Index Performance. Source of Data: ProShare Advisors LLC 21 INDEX VOLATILITY 2007 – 2010 2007 2008 2009 YTD 2010* S&P/TSX 60TM Index 14.90% 41.46% 27.28% 12.31% S&P/TSX Capped Financials IndexTM 13.22% 42.56% 37.21% 13.68% S&P/TSX Capped Energy IndexTM 19.81% 60.22% 39.21% 17.49% S&P/TSX Global Gold IndexTM 28.92% 80.36% 47.50% 24.75% S&P 500® Index 15.95% 41.05% 27.28% 17.23% NYMEX® Crude Oil 29.25% 57.61% 49.87% 25.27% NYMEX® Natural Gas 44.83% 47.03% 62.10% 36.53% *Data as of Oct. 18, 2010 Source: Bloomberg 22 HORIZONS BETAPRO ETFs PERFORMANCE SUMMARY* HBP ETFs track (+/-2X, -1x) well on a daily basis Over periods longer than a day, performance is market path dependent – focus on your economic exposure Directional markets are favourable for performance: Earn greater than 2X, or lose less than -2X, -1x period returns The greater the two-way volatility, the further performance will deviate (be worse) from +/-2X or -1x the period return HBP Single Commodity ETFs (1x) track the daily and period performance of the rolling underlying futures contracts 23 HOW COMMODITY ETFs WORK HORIZONS BETAPRO COMMODITY ETFs All HBP Commodity ETFs reference the futures contract of each of their respective commodities All existing US dollar exposure is hedged back to Canadian dollars None of the HBP Commodity ETFs hold the physical commodity Commodity Bull+ Bear+ Inverse Single NYMEX® Crude Oil HOU HOD HIC HUC NYMEX® Natural Gas HNU HND HIN HUN COMEX® Gold HBU HBD HUG COMEX® Silver HZU HZD HUZ COMEX ® Copper HKU HKD 25 IMPLICATIONS OF CONTANGO Futures Curve in Contango $72.00 $70.00 Price $68.00 $66.00 $64.00 $62.00 $60.00 $58.00 Jan Feb Mar Apr May Jun Jul Aug Sept Oct Nov Dec Futures Contract Date 26 IMPLICATIONS OF BACKWARDATION Futures Curve in Backwardation $62.00 $60.00 Price $58.00 $56.00 $54.00 $52.00 $50.00 $48.00 Jan Feb Mar Apr May Jun Jul Aug Sept Oct Nov Dec Futures Contract Date 27 UNDERLYING MARKET HOURS: E.S.T. Open Close ETFs 9:30 a.m 4:00 p.m NYMEX® Crude Oil 9:00 a.m 2:30 p.m NYMEX® Natural Gas 9:00 a.m 2:30 p.m COMEX® Gold 8:20 a.m 1:30 p.m COMEX® Silver 9:00 a.m 2:30 p.m CAD Futures 8:20 a.m 3:00 p.m U.S. 30yr Bond Futures 8:20 a.m 3:00 p.m 28 ETF TRADING AND INVESTMENT STRATEGIES 29 TRADING AND INVESTING STRATEGIES Exchange Traded Funds provide flexibility to an investor for: Downside Protection Hedge Existing Long Positions to dampen volatility Alpha Generation Directional Plays or Pair Trading Cash Equitization Instant market exposure or part of tax loss harvesting strategy Beta Efficiency Index exposure with only 50% of capital requirement Enables a portable alpha strategy Straddles Buy the pair of Long and Short ETFs in anticipation of a large, but unknown, directional move up or down 30 CASH EQUITIZATION Use ETFs to gain immediate market exposure Leveraged ETFs only require 50% of allocated capital Liberates balance to invest in specific names at a specific price point Gradually reduce Leveraged ETF exposure as individual stock positions are built Tax loss harvesting 31 DIRECTIONAL STRATEGY EXAMPLE 150 HBU CN Gold Spot $/OZ 149.20 122.84 140 130 120 110 100 90 Oct. 2009 Nov. 2009 Dec 2009 Jan 2010 Feb. 2010 Mar. 2010 Apr. 2010 May 2010 Jun. 2010 Jul. 2010 Aug. 2010 Sept. 2010 Source: Bloomberg 32 PAIR TRADE STRATEGY EXAMPLE 160 HBU CN HMU 152.04 90.02 140 120 100 80 60 Apr. 2010 May 2010 Jun. 2010 Jul. 2010 Aug. 2010 Sept. 2010 Source: Bloomberg 33 STRADDLE TRADE STRATEGY EXAMPLE Performance % 250 200 150 100 50 27-Apr-09 18-Jun-09 9-Aug-09 30-Sep-09 21-Nov-09 12-Jan-10 5-Mar-10 26-Apr-10 4-Jun-10 14-Jul-09 7-Feb-10 4-Sep-09 1-Apr-09 26-Oct-09 17-Dec-09 31-Mar-10 23-May-09 22-May-10 HNU HND CMDYNGER Index Source: Bloomberg 34 SUMMARY ETFs are: Efficient Cheaper Faster Relatively tax efficient ETFs provide access to passive benchmarks and active strategies ETFs are intelligent solutions for many investors 35 DISCLAIMER Horizons BetaPro Bull Plus and Bear Plus Exchange Traded Funds ("HBP Plus ETFs") use leveraged investment techniques that magnify gains and losses and result in greater volatility in value. Horizons BetaPro Spread Exchange Traded Funds (“HBP Spread ETFs”) which combine long and short exposure, also use leveraged investment techniques that magnify gains and losses and which may result in greater volatility in value. HBP Plus ETFs and HBP Spread ETFs are subject to leverage risk, and along with Horizons BetaPro Single Exchange Traded Funds ("HBP Single ETFs"), Horizons BetaPro Inverse Exchange Traded Funds ("HBP Inverse ETFs"), HBP Plus ETFs and HBP Spread ETFs (collectively, “HBP ETFs”) are subject to aggressive investment risk and price volatility risk, which are described in the HBP ETF’s prospectus. Each HBP Plus ETF seeks a return, before fees and expenses, that is either 200% or -200% of the performance of a specified underlying index, commodity or benchmark (the "target") for a single day. Each HBP Spread ETF seeks a return, before fees and expenses, that is the sum of 100% of the performance of one specified underlying target plus -100% of the performance of a second specified underlying target for a single day. Each HBP Single ETF or HBP Inverse ETF seeks a return that is 100% or - 100%, respectively, of the performance of a specified underlying target. Due to the compounding of daily returns, an HBP Plus ETF’s, HBP Spread ETF’s or HBP Inverse ETF’s, returns over periods other than one day will likely differ in amount and possibly direction from the performance of the specified underlying target(s) for the same period. Investors should monitor their holdings, as frequently as daily, to ensure that they remain consistent with their investment strategies. Commissions, management fees and expenses all may be associated with HBP ETFs. HBP ETFs are not guaranteed, their values change frequently and past performance may not be repeated. "Standard & Poor's®" and "S&P®" are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”) and "TSX®" is a registered trademark of the TSX Inc. (“TSX”). These marks have been licensed for use by BetaPro Management Inc. The HBP ETFs are not sponsored, endorsed, sold, or promoted by S&P or TSX and its affiliated companies and none of these parties make any representation, warranty or condition regarding the advisability of buying, selling and holding units/shares in the HBP ETFs. All trademarks/service marks are registered by their respective owners and licensed for use by BetaPro Management Inc. and none of the owners thereof or any of their affiliates sponsor, endorse, sell, promote or make any representation regarding the advisability of investing in HBP ETFs. Complete trademark and service-mark information is available at www.hbpetfs.com/pub/en/Trademark.aspx. Please read the prospectus before investing. 36 THANK YOU!