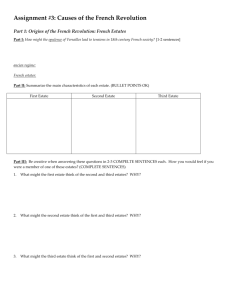

Chapter 2

Property Ownership and Interests

Learning Objectives

Define and give examples of real property and personal property

Define and give examples of fixtures, as well as describe tests for

determining if an item is a fixture

Define and list the freehold estates

Define severalty and concurrent property ownership including

condominiums, townhouses, cooperatives, PUD’s, and timeshare

property

List and define types of liens

List and define types of easements

Define encroachments, water, air, and subsurface rights

© OnCourse Learning. All Rights Reserved.

Chapter 2

Property Ownership and Interests

Real Property

Real property consists of land, improvements, rights and privileges

Conveyed by deed

Tenements and Hereditaments

Tenements include those things that can be touched and seen

(buildings) as well as things that are intangible (easements)

Hereditaments are those things capable of being inherited

Plants include fruits of the soil (fructus naturales or perennials) or

fruits of industry (fructus industrials or annuals)

Plants requiring annual cultivation are considered personal property

Plants not requiring annual cultivation are considered real property

unless in a movable container

© OnCourse Learning. All Rights Reserved.

Chapter 2

Property Ownership and Interests

Appurtenances

Rights or privileges that “runs with the land”

Subsurface Rights

Rights that exist under the surface of the earth (i.e. mineral rights)

Air Rights

Rights that exist above the surface of the earth

Limited to what the owner is reasonably expected to use

Riparian Rights

Rights of an owner bordering a flowing body of water

© OnCourse Learning. All Rights Reserved.

Chapter 2

Property Ownership and Interests

Lateral and Subjacent Support

Lateral - Right of land to be supported in it’s natural state by adjacent

land

Subjacent – Right to have land supported from below (i.e. mining)

Personal Property

Anything not considered real property

Conveyed “Bill of Sale”

© OnCourse Learning. All Rights Reserved.

Chapter 2

Property Ownership and Interests

Fixtures

Item that was once personal property that has become real property by

virtue of its’ attachment

Total circumstance test:

1. Intent – major determinant

2. Relation of the attacher

3. Method of attachment

4. Adaptation or customization

Trade fixtures – fixtures used in the conducting of commerce.

Considered personal property and can be removed at end of lease

Uniform Commercial Code – provides for a lender to have a fixture

considered personal until paid off

© OnCourse Learning. All Rights Reserved.

Chapter 2

Property Ownership and Interests

Improvements

Anything attached that increases the value or utility of the land

Can be “to the land” or “on the land”

“To the land” includes roads, utilities, grading, etc.

“On the land” includes buildings

© OnCourse Learning. All Rights Reserved.

Chapter 2

Property Ownership and Interests

Estates and Real Property

Eminent Domain

The Right to take private property for a public use by paying the

owner fair and just compensation

The actual taking of the land is considered condemnation

Police Power

The right of a government to make and pass reasonable rules and

regulations to promote and protect the public welfare (i.e. building,

fire, health, and sanitation codes)

© OnCourse Learning. All Rights Reserved.

Chapter 2

Property Ownership and Interests

Estates and Real Property

Taxation

Real property taxes is the largest source of income for local

government

Escheat

When an owner dies without leaving a valid will, and no apparent

heirs, the property will convey (escheat) to the state

© OnCourse Learning. All Rights Reserved.

Chapter 2

Property Ownership and Interests

Estates in Land

Either “freehold” or “Nonfreehold” (leasehold or less than freehold)

© OnCourse Learning. All Rights Reserved.

Chapter 2

Property Ownership and Interests

Freehold Estates

Freehold lasts for at least a lifetime

Can be inheritable or non-inheritable

Estates of Inheritance

Fee Simple Absolute:

• Also known as “fee simple” or “fee”

• The highest and best form of ownership available in real property

Fee Simple Determinable

• Grantor sets conditions on future use of real property

• Title AUTOMATICALLY reverts to grantor if conditions are violated

© OnCourse Learning. All Rights Reserved.

Chapter 2

Property Ownership and Interests

Estates of Inheritance

Fee Simple Subject to Condition Subsequent:

• Grantor sets conditions on future use of the property in some way

• Grantor, his heirs, or the remainderman must take action to regain

title if conditions are violated

• Note: Both Fee Simple Determinable and Fee Simple Subject to a

Condition Subsequent are defeasible or qualified fee estates

Estate Pur Autre Vie:

• Estate based on the lifetime of another (i.e. Person A conveys title to

Person B for the lifetime of Person C)

© OnCourse Learning. All Rights Reserved.

Chapter 2

Property Ownership and Interests

Estates of Not of Inheritance

Conventional Life Estate:

• For the life of the named life tenant

Marital Life Estate:

• Allows surviving spouse a life estate in 1/3 of real property owned

in severalty by the deceased anytime during the marriage

Dower/Courtesy:

• Wife’s/Husband’s right to a life estate in the property owned by a

deceased spouse during the marriage

• Abolished and replaced by the Marital Life Estate created by North

Carolina Intestate Succession Statutes

© OnCourse Learning. All Rights Reserved.

Chapter 2

Property Ownership and Interests

Life Estates

Conventional Life Estate:

• Created by the act of parties

• Non-inheritable freehold estate

Marital Life Estate:

• Created by the operation of law

• Governs the distribution of property for a spouse who dies intestate

• A will cannot defeat the marital interest of a surviving spouse

• Statute does not apply to property owned as tenants by the entirety

• Surviving spouse has a choice of EITHER:

• Marital life estate

OR

• Property of the deceased spouse willed to the surviving spouse

© OnCourse Learning. All Rights Reserved.

Chapter 2

Property Ownership and Interests

Life Estates

The grantor or his/her heirs will have a reversionary interest in the

estate

• At death of life tenant, estate will revert to grantor or his/her heirs

Grantor

Grantee (life tenant)

© OnCourse Learning. All Rights Reserved.

Chapter 2

Property Ownership and Interests

Life Estates

Alternatively, the conveyance of the life estate could specify that the

estate pass on to someone other than the grantor or his/her heirs (life

estate in remainder)

• This person would be called a remainderman and has a

remainder, or future, interest in the property

Grantor (in a deed)

Grantee

© OnCourse Learning. All Rights Reserved.

Remainderman

Chapter 2

Property Ownership and Interests

Life Estates – Rights of Responsibilities of Life Tenants

Right of alienation:

• Life tenant may transfer his/her title to another

• May pledge the title as security for a debt

• Note: May only transfer or pledge title to life estate, not to whole

bundle of rights

Responsibility of preservation:

• Must not commit waste

• Must preserve the estate for the benefit of the remainderman or

holder of the reversionary interest

Right of estovers:

• Allows life tenant to cut and use a reasonable amount of timber

from the land to repair buildings or to use as fuel

• Does not allow the tenant to cut and sell timber for profit

© OnCourse Learning. All Rights Reserved.

Chapter 2

Property Ownership and Interests

Life Estates – Rights of Responsibilities of Life Tenants

Responsibility for taxes:

• Has an obligation to pay the real property taxes on the property in

which he/she has a life estate

Responsibility to repair:

• A duty to make repairs to the improvements on the land

• Cannot permit the property to deteriorate due to lack of repairs

causing depreciation of improvements

© OnCourse Learning. All Rights Reserved.

Chapter 2

Property Ownership and Interests

Non-Freehold Estates

Estate for years:

• For any fixed period of time

• Automatically terminates at the end of that period

• No notice required to terminate

Estate from year to year (periodic estate):

• A periodic estate that automatically renews at the end of its period if the

parties do not provide otherwise

• Notice is required to terminate

Estate at will:

• An indefinite duration

• May be terminated by either party instantaneously by giving notice to the

other party

• Payment of rent would change this to a periodic estate

Estate at sufferance:

• A holdover situation created when the tenant’s lease has expired and

he/she fails to vacate the premises

• Differs from trespassing in that tenant originally entered property legally

© OnCourse Learning. All Rights Reserved.

Chapter 2

Property Ownership and Interests

Forms of Ownership

Ownership in Severalty:

• Title is held in the name of only one person

Concurrent (Joint) Ownership:

• Simultaneous ownership of real property by two or more people

Tenancy in Common:

• Two or more people holding title to property at the same time with no right

of survivorship

• Each tenant in common holds an undivided interest in the entire property

• These interests may be, but need not be equal

Joint Tenancy:

• Must acquire interests at the same time and on same deed

• If joint tenant sells his/her share, the new owner will become a tenant in

common

• No automatic right of survivorship in North Carolina

© OnCourse Learning. All Rights Reserved.

Chapter 2

Property Ownership and Interests

Forms of Ownership

Tenancy by the Entirety:

• Limited to ownership of husband and wife

• Right of survivorship

• Surviving spouse receives title by operation of law

• Marriage does not create tenancy by entirety for property one spouse brings

into the marriage

• One spouse may convey ownership to both spouses as tenants by the

entirety

• Both spouses must sign deed to convey property held as tenants by the

entirety to one of them in severalty

• After decree of divorce, ownership reverts to tenancy in common

Community Property:

• Not practiced in North Carolina

© OnCourse Learning. All Rights Reserved.

Chapter 2

Property Ownership and Interests

Condominiums

Includes the ownership of the airspace of the individual unit in any form of

ownership

Airspace owners own common areas as tenants in common however, the right

to partition is waived

© OnCourse Learning. All Rights Reserved.

Chapter 2

© OnCourse Learning. All Rights Reserved.

Chapter 2

Property Ownership and Interests

Combination (Hybrid) Forms of Concurrent Ownership

Condominiums

Ownership of the individual unit plus co-ownership of the common areas

The 1986 North Carolina Condominium Act

Pertains primarily to residential condominiums

Public offering statement:

• Must be provided by the developer to the prospective buyer before the

contract is signed

• Must disclose certain information pertaining to the project, including the

right to cancel

• Does not apply to resale

© OnCourse Learning. All Rights Reserved.

Chapter 2

Property Ownership and Interests

The 1986 North Carolina Condominium Act

Purchaser’s right to cancel:

• Can cancel for any or no reason, within SEVEN DAYS after signing

contract

• Does not apply to resale

Escrow of deposit:

• Deposits must be kept in an escrow account the full SEVEN DAYS or until

cancellation and refund occurs

Resale certificates:

Disclosure of monthly assessments for common areas and other fees for

which owners are responsible is required

Warranties:

• Unit is constructed in an acceptable manner, free from defects, and suitable

for the purpose intended unless warranty has been disclaimed so as to void

it

© OnCourse Learning. All Rights Reserved.

Chapter 2

Property Ownership and Interests

Combination (Hybrid) Forms of Concurrent Ownership

Townhouses

Ownership of the unit as well as the specific portion of land upon which the

individual unit is located

The Home Owner’s Association owns the common areas

Cooperatives

Ownership of shares of stock in a corporation that owns a building containing

cooperative apartments

Right of possession is provided by a proprietary lease

© OnCourse Learning. All Rights Reserved.

Chapter 2

Property Ownership and Interests

Combination (Hybrid) Forms of Concurrent Ownership

Time Shares

Any right to occupy a property for five or more separated time periods over a

span of five or more years

Purchasers must be given a public offering statement

Five day right of rescission

Escrow requirement ten days

Planned Unit Developments (PUD’s)

Small community that includes some form of housing, recreational areas, and

supporting commercial activities

Any form of residential ownership may be present; such as single-family

homes, condominiums, or townhouses

Concept of land development rather than a form of ownership

© OnCourse Learning. All Rights Reserved.

Chapter 2

Property Ownership and Interests

Encumbrances to Real Property

Liens

A claim or a charge against the property that can result from a contractual

agreement or from the operation of law

Easements

The right someone has in the lands of another

Encroachments

A trespass on the land of another as a result of an intrusion or invasion by some

structure

As disclosed by a survey

© OnCourse Learning. All Rights Reserved.

Chapter 2

Property Ownership and Interests

Classification of Liens

© OnCourse Learning. All Rights Reserved.

Chapter 2

Property Ownership and Interests

Classification of Liens

Specific Liens

Mortgage

• Pledges a specific property as security for a debt

• North Carolina uses deed of trust as security instrument

• Default on repayment of the mortgage or deed of trust note will cause

the lender to foreclose by having the property sold at public auction

• The proceeds of the sale are used to satisfy the debt

Real property tax

• Taxes levied by a local government

• This type of lien has priority over all other liens

• Real property tax liens are good for ten years

© OnCourse Learning. All Rights Reserved.

Chapter 2

Property Ownership and Interests

Classification of Liens

Specific Liens

Special assessment:

• A charge against a property for the prorata cost of some improvements

made to areas adjoining the property (i.e. street paving, water and

sewer lines, sidewalks)

Mechanic’s lien:

• A lien filed by anyone who provides labor or material to a property

• Must file within 120 DAYS from the last day that labor or material

was furnished to the property

• Effective from the first day that labor or material was furnished to the

property

• Must be enforced within 180 DAYS from the last day of work

© OnCourse Learning. All Rights Reserved.

Chapter 2

Property Ownership and Interests

Classification of Liens

General Liens

A court decree of the amount one person is indebted to another

Judgment:

• General lien against all real and personal property the judgment debtor

owes in the county in which the judgment is recorded

• May be recorded in any county in the state

Personal property tax:

• Annual tax assessed on certain personal property owned as of January

1st of the tax year

• Covered in detail in Chapter 3

Income tax:

• A general lien for federal and state income taxes

• This lien does not have a special priority

© OnCourse Learning. All Rights Reserved.

Chapter 2

Property Ownership and Interests

Classification of Liens

General Liens

Estate & inheritance tax:

• Federal government imposes a tax on the estate (real and personal

property) of deceased persons, called the estate tax

• States also impose a state inheritance tax upon the inheritance of real

and personal property

• Taxes continue until they are paid

© OnCourse Learning. All Rights Reserved.

Chapter 2

Property Ownership and Interests

Classification of Liens

Priority of Liens

Priority generally based on the time (day and hour) the lien is recorded with

those recorded first taking priority

This system is also known as the pure race system

Exceptions to this priority are:

• Real property taxes – always given priority over all other liens

• Personal property taxes – like real property taxes, given priority over all

other liens

• Mechanic’s liens – priority relates to the first date of work on the job rather

than the date of recordation

© OnCourse Learning. All Rights Reserved.

Chapter 2

Property Ownership and Interests

Classification of Easements

Appurtenant easement:

• An easement between two or more adjoining properties, owned by two or

more separate owners, and is said to, “Run with the land”

• Land that is benefited from the easement is the dominant tenement and the

land encumbered by the easement is the servient tenement

Easements in gross – not dependent upon ownership of an adjoining property.

No dominant tenement; only a servient tenement

• Commercial easements in gross are assignable and can be conveyed

• Most common use of commercial easement in gross is for the purpose of

installing power lines, telephone or cable lines, and gas lines above, on, or

under the surface of the earth

• Personal easements in gross are:

• Not assignable

• Cannot be conveyed

• Not inheritable

• Personal easements in gross are rare

© OnCourse Learning. All Rights Reserved.

Chapter 2

Property Ownership and Interests

Classification of Easements

Appurtenant easement:

• An easement between two or more adjoining properties, owned by two or

more separate owners, and is said to, “Run with the land”.

• The land that is benefited from the easement is the dominant estate and the

land encumbered by the easement is the servient estate.

Easements in gross – An easement between a parcel of land and a person or

legal entity. This involves a servient interest only.

• Commercial easements in gross are assignable and can be conveyed

• Most common use of commercial easement in gross is for the purpose of

installing power lines, telephone or cable lines, and gas lines above, on, or

under the surface of the earth

• Personal easements in gross are rare

© OnCourse Learning. All Rights Reserved.

Chapter 2

Property Ownership and Interests

Creation of Easements

© OnCourse Learning

Chapter 2

Property Ownership and Interests

Creation of Easements

Express (specifically stated or written)

• Grant or reserve:

• Seller may grant or buyer may reserve easement by including

appropriate language into the deed

© OnCourse Learning. All Rights Reserved.

Chapter 2

Property Ownership and Interests

Creation of Easements

© OnCourse Learning. All Rights Reserved.

Chapter 2

Property Ownership and Interests

Creation of Easements

Party walls:

• Used by adjoining neighbors to support the side wall of each unit

• When the property line is in the middle of the wall, each owner has a cross

easement into the others property or tenancy in common

• When the wall is entirely within the property of one party, the other has an

easement in the use of the wall

Dedication

• An easement granted for public use such as water and sewer lines

Implied

• Necessity:

• Implied when the actions of a party demonstrate an intent to create an

easement

• Reference to recorded plat:

• Implied from a plat showing the existence of an easement

© OnCourse Learning. All Rights Reserved.

Chapter 2

Property Ownership and Interests

Creation of Easements

Operation of law – Easement acquired by continuous, long term adverse use

• Prescription:

• Using another’s land for a prescribed period of time

• Must be used without permission

• Must file suit to quiet title to prove conditions have been met before

acquiring title

• Condemnation:

• Enables the government to take private land for the benefit of the

general public under the power of eminent domain

• Commonly used to obtain easements for rights-of-way, not to obtain

title

• Statutory cartway proceeding can be created when the owner of a

landlocked property petitions to have a cartway sectioned off of another

owner’s property for ingress/egress

© OnCourse Learning. All Rights Reserved.

Chapter 2

Property Ownership and Interests

Termination of Easements

Easements may be terminated as follows:

• Release of the easement by the dominant owner to

the servient owner

• Combining the dominant and servient properties

into a single tract

• Abandonment of the easement by the dominant

owner

• Cessation of the purpose for which the easement

was created

• Expiration of a specified time for which the

easement was created

© OnCourse Learning. All Rights Reserved.