PAPC_T1_Key

advertisement

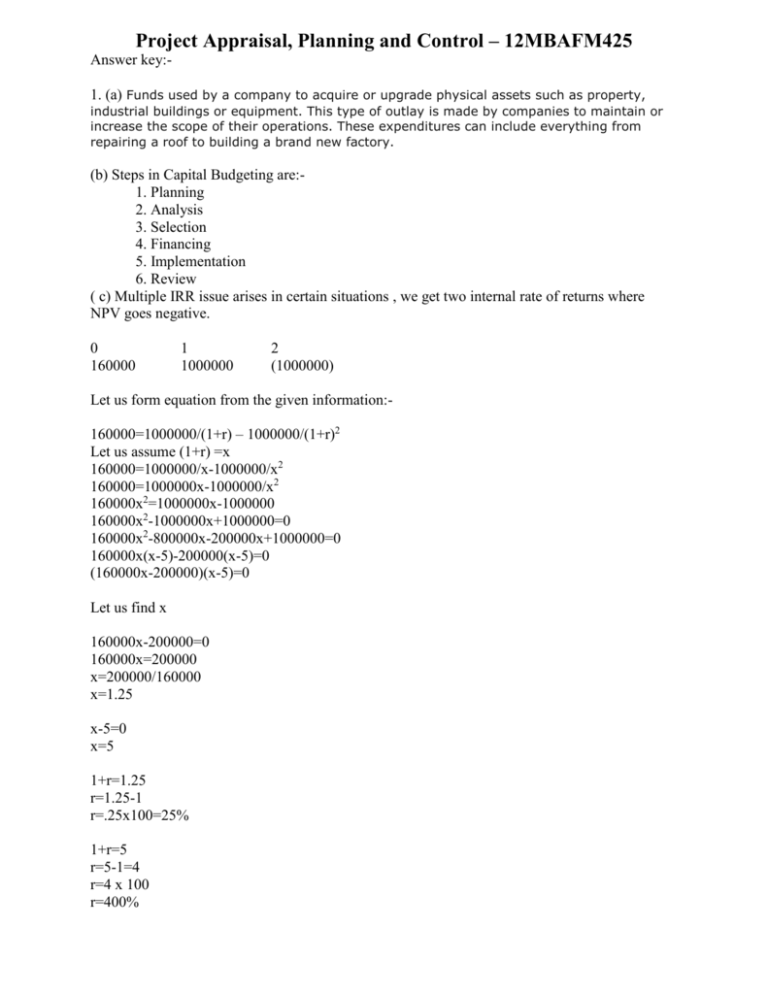

Project Appraisal, Planning and Control – 12MBAFM425 Answer key:1. (a) Funds used by a company to acquire or upgrade physical assets such as property, industrial buildings or equipment. This type of outlay is made by companies to maintain or increase the scope of their operations. These expenditures can include everything from repairing a roof to building a brand new factory. (b) Steps in Capital Budgeting are:1. Planning 2. Analysis 3. Selection 4. Financing 5. Implementation 6. Review ( c) Multiple IRR issue arises in certain situations , we get two internal rate of returns where NPV goes negative. 0 160000 1 1000000 2 (1000000) Let us form equation from the given information:160000=1000000/(1+r) – 1000000/(1+r)2 Let us assume (1+r) =x 160000=1000000/x-1000000/x2 160000=1000000x-1000000/x2 160000x2=1000000x-1000000 160000x2-1000000x+1000000=0 160000x2-800000x-200000x+1000000=0 160000x(x-5)-200000(x-5)=0 (160000x-200000)(x-5)=0 Let us find x 160000x-200000=0 160000x=200000 x=200000/160000 x=1.25 x-5=0 x=5 1+r=1.25 r=1.25-1 r=.25x100=25% 1+r=5 r=5-1=4 r=4 x 100 r=400% 2 A work breakdown structure (WBS) is a chart in which the critical work elements, called tasks, of a project are illustrated to portray their relationships to each other and to the project as a whole. The graphical nature of the WBS can help a project manager predict outcomes based on various scenarios, which can ensure that optimum decisions are made about whether or not to adopt suggested procedures or changes. When creating a WBS, the project manager defines the key objectives first and then identifies the tasks required to reach those goals. A WBS takes the form of a tree diagram with the "trunk" at the top and the "branches" below. The primary requirement or objective is shown at the top, with increasingly specific details shown as the observer reads down. (b) Demand forecasting seeks to investigate and measure the forces that determine sales for existing and new products. Generally companies plan their business – production or sales in anticipation of future demand. Hence forecasting future demand becomes important. The art of successful business lies in avoiding or minimizing the risks involved as far as possible and face the uncertainties in a most befitting manner. Methods of Forecasting: Demand forecasting is a highly complicated process as it deals with the estimation of future demand. It requires the assistance and opinion of experts in the field of sales management. Demand forecasting, to become more realistic should consider the two aspects in a balanced manner. Application of commonsense is needed to follow a pragmatic approach in demand forecasting. Broadly speaking, there are two methods of demand forecasting. They are: 1) Survey methods and 2) Statistical methods ( c) Sources of funds EBIT DEP SECURED LOANS(20-5) UNSECURED LOANS Amount 80 20 15 10 125 DISPOSITION OF FUNDS INTEREST TAX DIVIDEND FIXED ASSETS INCREASE IN WC AMOUNT 20 30 10 30 25 115 20 10 30 OPERATING CASH BALANCE SURPLUS/DEFICIT (A-B) CLOSING CASH BALANCE 3. Computation of Cash Flow Years 0 1 Initial (100) investment Revenue -cost EBDBT -DEP EBT - TAX EAT S.V P/M W/C INV PAT + DEP + SAL CASH FLOW 120 80 40 12 38 11.4 26.6 2 3 4 5 120 80 40 10.20 29.8 8.94 20.86 120 80 40 8.67 31.33 9.4 21.93 120 80 40 7.37 32.63 9.8 22.83 120 80 40 6.26 33.74 10.12 23.62 30 20 100 26.6 12 20.86 10.20 21.93 8.67 22.83 7.37 38.6 31.06 30.60 30.2 23.62 6.26 50 79.88 Calculation of NPV Yr 1 2 3 4 5 Cash flow 38.6 31.06 30.60 30.2 79.88 INITIAL INVESTMENT NPV 10% dis.factor 0.909 0.826 0.753 0.683 0.621 P.V 35.1 25.66 23.04 20.63 49.61 154.04 100 54.04