Property - Phi Delta Phi

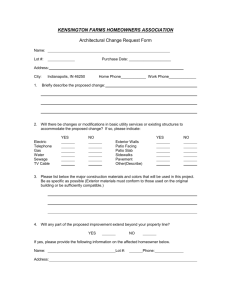

advertisement