04FEB2015 - National Contract Management Association

advertisement

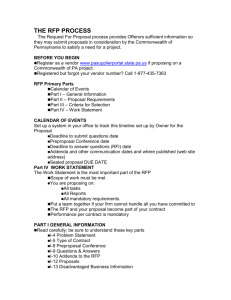

Source Selection Procedures Presented by: John Krieger (703) 805-5046 John Pritchard (703) 805-3800 WARNING! What you’ve been doing before is probably not what you’ll be doing in your next source selection. Applicability of New Procedures These procedures are not required for the following acquisitions: • • • • • • • • Competitions where the only evaluated factor is price, Basic research and acquisitions where Broad Agency Announcements (BAA) are used in accordance with FAR Part 35, Small Business Innovative Research (SBIR), Small Business Technology Transfer Research (STTR) and Small Business Technology Transfer (SBTT) acquisitions solicited and awarded, Architect-engineer services in accordance with FAR Part 36, FAR Part 12 Streamlined Acquisitions, Acquisitions using simplified acquisition procedures in accordance with FAR Part 13 (including Part 12 acquisitions using Part 13 procedures), Orders under multiple award contracts – Fair Opportunity (FAR 16.505), and Acquisitions using FAR subpart 8.4. Agenda • • • • • • The Environment Best Value Under the FAR Organization Roles and Responsibilities Pre-Solicitation Activities Tradeoff Source Selection Process Lowest Price Technically Acceptable (LPTA) Source Selection Process • How Do We Do That? • Ethics in Source Selection The Environment BBPi Comparison BBPi 1.0 Guidance Roadmap BBPi 2.0 Focus Areas Target Affordability and Control Cost Growth Achieve Affordable Programs Incentivize Productivity & Innovation in Industry Incentivize Productivity and Innovation in Industry and Government Promote Real Competition Promote Effective Competition Improve Tradecraft in Services Acquisition Improve Tradecraft in Acquisition of Services Reduce Non-Productive Processes and Bureaucracy Eliminate Unproductive Processes and Bureaucracy Control Costs Throughout the Product Lifecycle Improve the Professionalism of the Total Acquisition Workforce Note: BBPI 2.0 order has been modified to align with BBPI 1.0 order. DPAP Hot Topics 1. Target Affordability and Control Cost Growth Contract Pricing, Should Cost, Performance Based Payments 2. Incentivize Productivity and Innovation In Industry Increased attention to the use of Incentives 3. Promote Real Competition including Only One Offer 4. Improve Tradecraft in Services Acquisition and Surveillance of Services: COR certification, Limited use of T&M contracts, Inherently Governmental Functions, Reduction in Spending, and SAM & ARRT 5. Organizational Conflict of Interest (OCI) and Personal Conflict of Interest (PCI) 6. Contracting in a Combat / Contingency Environment 7. Proper Use of Interagency Agreements 8. System for Award Management (SAM) 9. Contractor Business Systems including CBAR 10. Small Business including WOSB 11. Commercial Items Defense Competition Statistics Fiscal Year 2014 Trend Contracting Agency DEPT OF THE AIR FORCE DEPT OF THE ARMY DEPT OF THE NAVY DEFENSE LOGISTICS AGENCY DEFENSE ADVANCED RESEARCH PROJECTS AGENCY DEFENSE COMMISSARY AGENCY DEFENSE CONTRACT MANAGEMENT AGENCY * DEFENSE FINANCE AND ACCOUNTING SERVICE DEFENSE HEALTH AGENCY DEFENSE HUMAN RESOURCES ACTIVITY DEFENSE INFORMATION SYSTEMS AGENCY DEFENSE MEDIA ACTIVITY DEFENSE MICROELECTRONICS ACTIVITY DEFENSE SECURITY COOPERATION AGENCY DEFENSE SECURITY SERVICE DEFENSE THREAT REDUCTION AGENCY DEPT OF DEFENSE EDUCATION ACTIVITY JOINT IMPROVISED EXPLOSIVE DEVICE DEFEAT ORGANIZATION MISSILE DEFENSE AGENCY U.S. SPECIAL OPERATIONS COMMAND UNIFORMED SERVICES UNIVERSITY OF THE HEALTH SCIENCES USTRANSCOM WASHINGTON HEADQUARTERS SERVICES TOTAL Total Actions Total Dollars Compete $ 143,096 $55,638,404,843 $24,607,568,911 302,392 $74,526,059,168 $48,637,049,690 286,230 $83,674,572,087 $37,091,138,558 588,055 $31,560,501,413 $26,524,228,400 1,165 $875,458,083 $741,492,622 137,099 $1,422,235,216 $1,314,449,782 770 $107,061,874 $74,036,856 876 $132,691,851 $113,924,492 1,882 $13,069,956,555 $11,558,167,570 779 $257,292,656 $129,256,728 66,415 $5,125,460,900 $3,940,628,843 814 $80,835,636 $57,761,546 651 $399,614,093 $383,755,750 787 $47,440,587 $32,429,871 451 $95,979,294 $76,419,637 1,789 $996,337,234 $856,732,307 2,642 $314,221,644 $226,125,024 176 $67,135,014 $56,670,541 4,521 $6,050,847,487 $2,536,652,717 7,502 $2,445,983,250 $1,832,120,816 691 $37,329,929 $24,134,582 11,432,990 $4,063,497,236 $4,045,603,216 9,062 $1,265,095,537 $750,753,246 12,990,835 $282,254,011,589 $165,611,101,706 Compete % 44.2% 65.3% 44.3% 84.0% 84.7% 92.4% 69.2% 85.9% 88.4% 50.2% 76.9% 71.5% 96.0% 68.4% 79.6% 86.0% 72.0% 84.4% 41.9% 74.9% 64.7% 99.6% 59.3% 58.7% GAO’S View Promote Effective Competition GAO-10-833 Competition in Federal Contracting One-Offer Requirement Includes Three Rules Source Selection Approaches Estimated Frequencies of Source Selection Approaches Used in Fiscal Year 2009 for New, Competitively Awarded DOD Contracts Obligating over $25 million Sealed bid Non-cost factors more important than price Lowest price technically acceptable Recent GAO findings state LPTA has increased up to 39% Non-cost factors less important than price Non-cost factors equal to price GAO Report 11-8, Figure 2 Characteristics of Contracts Estimated Frequencies of Selected Characteristics of Contracts or Agreements Awarded using a Best Value Tradeoff Process GAO Report 11-8, Figure 3 “Henceforth I expect contracting officers to conduct negotiations with all single bid offerors and that the basis of that negotiation shall be cost or price analysis, as the case may be, using non-certified data.” Best Value Under the FAR Federal Acquisition System Guiding Principles The Federal Acquisition System will – – Satisfy the customer in terms of cost, quality, and timeliness of the delivered product or service – Minimize administrative operating costs – Conduct business with integrity, fairness, and openness – Fulfill public policy objective FAR 1.102 Acquisition Team Concept The role of each member of the Acquisition Team is to exercise personal initiative and sound business judgment in providing the best value product or service to meet the customer’s needs. In exercising initiative, Government members of the Acquisition Team may assume if a specific strategy, practice, policy or procedure is in the best interests of the Government and is not addressed in the FAR, nor prohibited by law (statute or case law), Executive order or other regulation, that the strategy, practice, policy or procedure is a permissible exercise of authority. FAR 1.102(d) Successful source selection streamlining begins with the Acquisition Team and timely, effective acquisition planning. Source Selection Objective “The objective of Source Selection is to select the proposal that represents the Best Value” FAR 15.302 Best Value: “The expected outcome of an acquisition that, in the Government’s estimation, provides the greatest overall benefit in response to the requirement.” FAR 2.101 FAR 15.101 Best Value Continuum An agency can obtain best value in negotiated acquisitions by using any one or a combination of source selection approaches. In different types of acquisitions, the relative importance of cost or price may vary. For example, in acquisitions where the requirement is clearly definable and the risk of unsuccessful contract performance is minimal, cost or price may play a dominant role in source selection. The less definitive the requirement, the more development work required, or the greater the performance risk, the more technical or past performance considerations may play a dominant role in source selection. BBP 2.0 Guidance on Source Selection When Lowest Price Technically Acceptable is used, define Technically Acceptable to ensure needed quality Better define value in “best value” competitions When LPTA is used as a source selection technique, Section M of the RFP and the Source Selection Plan must clearly describe the minimum requirements that will be used to determine the acceptability of the proposal. The Department routinely sets “threshold” and “objective” level requirements for the products it acquires and also routinely defaults to threshold performance as the basis for selecting a product. This initiative directs the Components, where possible, to quantify the value, in terms of an increased premium they will pay, for proposals above the threshold level of performance and to include this information in solicitations to industry. [Tradeoff Process] Organization Roles and Responsibilities Source Selection Team Source selection is accomplished by a team that is tailored to the unique acquisition. Composition of the team generally consists of the Source Selection Authority (SSA), Procuring Contracting Officer (PCO) (if different from the SSA), Source Selection Advisory Council (SSAC), Source Selection Evaluation Board (SSEB), Advisors, Cost or Pricing Experts, Legal Counsel, Small Business Specialists, and other subjectmatter experts. Team members may include personnel from other Governmental sources such as headquarters or joint service members. Key members of the Source Selection Team (SST)—such as the SSA, SSEB, chairperson and functional leads, and the PCO— should have source selection experience. All members of the team shall be designated early in the source selection process, and agencies shall provide the needed training to execute that specific source selection. Source Selection Team — An Example SSA SSAC As Required SSEB SSEB Chair Staff Advisors (Contracting, Legal) PPET* Technical & Risk (Technical Evaluators & Advisors) Briefing Focus PCO/ Contract Team Cost/Price Analysis Team May be Combined * Use of PPET to evaluate Past Performance Source Selection Authority (SSA) The appointment of the individual to serve as the SSA shall be commensurate with the complexity and dollar value of the acquisition. For acquisitions with a total estimated value of $100M or more, the SSA shall be an individual other than the PCO. For all other acquisitions, the PCO may serve as the SSA in accordance with FAR 15.303 unless the Agency head or designee appoints another individual. The SSA is responsible for the proper and efficient conduct of the source selection process in accordance with this procedure and all applicable laws and regulations. SSA Roles and Responsibilities • • • • • • • • Appoint the chairpersons for the SSEB and, when used, the SSAC. Ensure that personnel appointed to the SST are knowledgeable of policy and procedures for properly and efficiently conducting the source selection. Ensure the SST members have the requisite acquisition experience, skills, and training necessary to execute the source selection, and ensure the highest level of team membership consistency for the duration of the selection process. For major weapon system or major service acquisitions, ensure no senior leader is assigned to or performs multiple leadership roles in the source selection in accordance with DFARS 203.170(a). Ensure that realistic source selection schedules are established and source selection events are conducted efficiently and effectively in meeting overall program schedules. The schedules should support proper and full compliance with source selection procedures outlined in the Source Selection Procedures and SSP for the acquisition. Ensure all involved in the source selection are briefed and knowledgeable of FAR 3.104 regarding unauthorized disclosure of contractor bid and proposal information, as well as source selection information; compliance with applicable standards of conduct; and sign a Non-Disclosure Agreement and a conflict of interest statement. Make a determination to award without discussions or enter into discussions. Select the source whose proposal offers the best value to the Government in accordance with evaluation established criteria in Section M. Document the rationale in the Source Selection Decision Document (SSDD). Procuring Contracting Officer (PCO) The PCO will serve as the primary business advisor and principal guidance source for the entire Source Selection. Agencies have discretion in the selection of the individual to serve as the PCO. However, the PCO, as the principal guidance source, should have experience in the source selection process. • • • • • • • • Manage all business aspects of the acquisition and advise and assist the SSA Obtain approvals and ensure notification clause is included in the RFP before non-Government personnel are allowed to provide source selection support Ensure procedures exist to safeguard source selection information and contractor bid or proposal information. Maintain documents and evaluation records as detailed in Chapter 4. Release final RFP after obtaining required approvals including the SSA’s. Serve as the single point of contact for all solicitation-related inquiries. After receipt of proposals, control exchanges with offerors. With the approval of the SSA, establish the competitive range and enter into discussions. Source Selection Advisory Council (SSAC) The SSA establishes an SSAC to gain access to functional area expertise to provide the support the SSA requires throughout the source selection process. Organizations shall establish an SSAC for acquisitions with a total estimated value of $100M or more. An SSAC is optional for acquisitions with a total estimated value of less than $100M. The primary role of the SSAC is to provide a written comparative analysis and recommendation to the SSA. When an SSAC is established, it will provide oversight to the SSEB. The SSA may convene the SSAC at any stage in the evaluation process as needed. • Composition of SSAC. – The SSAC is comprised of an SSAC Chairperson and SSAC Members. – SSAC Members should represent the specific functional areas from which the SSA may require expertise. SSAC Roles and Responsibilities • SSAC Chairperson shall: – Appoint SSAC members, subject to SSA approval. • The SSAC Members shall: – Review the evaluation results of the SSEB to ensure the evaluation process follows the evaluation criteria and the ratings are appropriately and consistently applied. – Consolidate the advice and recommendations from the SSAC into a written comparative analysis and recommendation for use by the SSA in making the best-value decision. Ensure that minority opinions within the SSAC are documented and included within the comparative analysis. Source Selection Evaluation Board (SSEB) The SSEB is comprised of a Chairperson and Evaluators (also known as SSEB Members). Frequently, the SSEB Members will be organized into functional teams corresponding to the specific evaluation criteria (e.g., Technical Team, Past Performance Team, Cost Team, etc). In those instances, a Functional Team Lead may be utilized to consolidate the evaluation findings of the team and serve as the primary team representative to the SSEB Chair. Use of non-Government personnel as voting members of the SSEB is prohibited. Government personnel assigned to the SSEB shall consider this duty as their primary responsibility. Their source selection assignment shall take priority over other work assignments. Supervisors are responsible for ensuring that other work assignments do not adversely impact the source selection process. Neither the SSEB Chairperson nor the SSEB members shall perform comparative analysis of proposals or make source selection recommendations unless requested by the SSA. SSEB Chairperson Roles and Responsibilities • • • • • • • Be responsible for the overall management of the SSEB and act as the SSEB’s interface to the SSAC (if utilized) and the SSA. Establish functional evaluation teams, as appropriate, to support an efficient source selection evaluation. Appoint chairpersons and members to the functional evaluation teams, subject to approval of the SSA. Ensure the skills of the personnel, the available resources, and time assigned are commensurate with the complexity of the acquisition. Ensure members of the SSEB are trained and knowledgeable on how an evaluation is conducted prior to reviewing any proposals. Ensure the evaluation process follows the evaluation criteria and ratings are being consistently applied. Provide consolidated evaluation results to the SSA or the SSAC if the SSAC is designated as the interface between the SSEB and SSA. Support any post source selection activities such as debriefings and postaward reviews/meetings, as required. SSEB Member Roles and Responsibilities • • • • Conduct a comprehensive review and evaluation of proposals against the solicitation requirements and the approved evaluation criteria. Ensure the evaluation is based solely on the evaluation criteria outlined in the RFP. Assist the SSEB Chairperson in documenting the SSEB evaluation results. Support any post-source-selection activities, such as debriefings and postaward reviews/meetings, as required. Source Selection Evaluation Board Membership • Career Civilian and Military Personnel • Mixed Skill Set – Contracting – Technical – Cost and Price Analysis • Non-Governmental Personnel May be Used as Advisors, but Not as Evaluators Advisors Government Advisors. When an SSAC is not used, consideration should be given to the use of Government advisors to assist the SSA. These advisors can provide expertise within specific functional areas, similar to the involvement of the SSAC, but need not provide the formal written comparative analysis required of an SSAC. Government advisors may also be used to provide assistance to the SSEB as subject-matter experts. Non-Government Advisors. Use of non-Government personnel as advisors may be authorized, but should be minimized as much as possible. Non-Government advisors, other than Federally Funded Research and Development Centers (FFRDCs), shall be supported by a written determination based on FAR 37.203 and 37.204. [Note: There are special requirements for, and limitations on, non-Government advisors.] Non-Government Advisors Requirements for use of non-Government advisors. All non-Government advisors shall sign non-disclosure agreements. They shall also submit documentation to the PCO indicating their personal stock holdings prior to being allowed access to source selection sensitive information. In addition, the PCO must ensure that before the non-Government advisor is given access to proprietary information, that the Government has received the consent of the submitting contractor(s) to provide access to the contractor who is to assist in the source selection. Limitations on use of non-Government advisors. Non-Government advisors may assist in and provide input regarding the evaluation, but they may not determine ratings or rankings of offerors’ proposals. Disclosure of past performance information to non-Government personnel is strictly prohibited. Accordingly, non-Government advisors shall not participate in the review and evaluation of past performance information. Program Management/Requirements Office The requirements community is vital to the success of the overall source selection process. The leadership of the Program Management/Requirements Office shall: • • • • Ensure the technical requirements—consistent with the cognizant requirements document—are approved and stable, establish technical specifications, and develop a Statement of Work (SOW), Statement of Objectives (SOO), or Performance Work Statement (PWS). Allocate the necessary resources including personnel, funding and facilities to support the source selection process. Assist in the establishment of the SST to include serving as an advisor or member to the SSAC and/or the SSEB as needed. Assist in the development of the evaluation criteria consistent with the technical requirements/risk. Pre-Solicitation Activities Pre-Solicitation Activities • • • • Conduct Acquisition Planning Develop an SSP Develop the Request for Proposals Release the Request for Proposals Acquisition Planning • Develop/define the requirement – Services – Supplies – Construction • Market Research – Pre-solicitation notices – Industry Days – Requests for Information (RFIs) Publicizing Business Opportunities • FedBizOps • Bulletin Boards • Pre-solicitation notices Exchanges with Industry Before Receipt of Proposals • • • • • • • • • Industry or small business conferences Public hearings Market research One-on-one meetings Presolicitation notices Draft Requests for Proposals (RFPs) Requests for Information (RFIs) Presolicitation or preproposal conferences Site visits After release of the solicitation, the contracting officer must be the focal point of any exchange with potential offerors. (FAR 15.201(f)) Independent Management Reviews Independent Management Reviews (“Peer Reviews”). Pre-Award Peer Reviews shall be conducted on all Supplies and Services, solicitations, and contracts over $1B (including options). The Director, DPAP, in the Office of the USD(AT&L), shall organize the Peer Reviews. The reviews shall be advisory in nature and conducted in a manner that preserves the authority, judgment, and discretion of the PCO and senior officials of the acquiring organization. Reference DFARS 201.170 and DODI 5000.02, Enclosure 2, Section 9 and Enclosure 9, Section 6 for specific requirements for these Pre-Award Peer Reviews of Services and Supply contracts over $1B. Finally, Pre-Award procedures in Paragraph 6.a. of Enclosure 9 shall also apply to Peer Reviews of Supplies. (Reference Enclosure 2, Procedures Section 9, Paragraph g, of DODI 5000.02.) The acquisition team must build these review requirements into their acquisition planning milestones. (See DFARS 201.170 and PGI 201.170). Evaluation Factors • • • • • • • Cost or Price – Always a factor Past performance Quality is always a consideration under the FAR Technical/Management Risk Key Personnel Others Specified in Source Selection Plan and Section M of the solicitation. Evaluation Factors and Subfactors Cost or Price. The Government shall evaluate the cost or price of the supplies or services being acquired. Quality of Product or Service. In accordance with FAR 15.304(c)(2), the quality of product or service shall be addressed in every source selection through consideration of one or more non-cost evaluation factors such as past performance, compliance with solicitation requirements, technical excellence, management capability, personnel qualifications, and prior experience. All source selection evaluations shall utilize one or more quality of product or service evaluation factors tailored to the source selection process employed. The term “technical,” used throughout the Procedures, refers to non-cost factors other than past performance. More than one “technical” factor can be used and titled to match the specific evaluation criteria appropriate for the RFP. However, the ratings in Tables 1, 2, and 3 shall be used for all quality of product or service factors other than past performance, regardless of the “technical” factor title. Technical and Technical Risk Ratings Technical. The purpose of the technical factor(s) is to assess the offeror’s proposed approach, as detailed in its proposal, to satisfy the Government’s requirements. There are many aspects which may affect an offeror’s ability to meet the solicitation requirements. Examples include technical approach, risk, management approach, personnel qualifications, facilities, and others. The evaluation of risk is related to the technical assessment. Technical Risk. Risk assesses the degree to which the offeror’s proposed technical approach for the requirements of the solicitation may cause disruption of schedule, increased costs, degradation of performance, the need for increased Government oversight, or the likelihood of unsuccessful contract performance. All evaluations that include a technical evaluation factor shall also consider risk. Risk can be evaluated in one of two ways, as one aspect of the technical evaluation, inherent in the technical evaluation factor or subfactor ratings, or as a separate risk rating assigned at the technical factor or subfactor level. Past Performance in DoD Procedures 3.1.3.3. Performance Confidence Assessment. In conducting a performance confidence assessment, each offeror shall be assigned one of the ratings in Table 5. (Reference FAR 15.305(2) (sic) for information on assigning an unknown/neutral confidence rating.) A.2.1.2. Past Performance. Note: In the case of an offeror without a record of relevant past performance or for whom information on past performance is not available or so sparse that no meaningful past performance rating can be reasonably assigned, the offeror may not be evaluated favorably or unfavorably on past performance (see FAR 15.305 (a)(2)(iv)). Therefore, the offeror shall be determined to have unknown past performance. In the context of acceptability/unacceptability, “unknown” shall be considered “acceptable.” Past Performance in USC and FAR 41 USC § 1126 - Policy regarding consideration of contractor past performance (b) Information Not Available.— If there is no information on past contract performance of an offeror or the information on past contract performance is not available, the offeror may not be evaluated favorably or unfavorably on the factor of past contract performance. FAR 15.305(a)(2)(iv) In the case of an offeror without a record of relevant past performance or for whom information on past performance is not available, the offeror may not be evaluated favorably or unfavorably on past performance. Comptroller General Decisions B-254738.3 Espey Mfg. & Electronics Corp. 03/08/1994 B-261044.4 Caltech Serv. Corp. 12/14/1995 B-271431 Quality Fabricators, Inc. 06/25/1996 B-272017 Excalibur Systems, Inc. 08/12/1996 B-272526 Hughes Georgia, Inc. 10/21/1996 B-278921.2 Braswell Services Group, Inc. 10/17/1998 B-286044.2 SWR, Inc. 11/01/2000 B-287697 Gulf Group, Inc. 07/24/2001 B-291170.4 MW-All Star Joint Venture 08/04/2003 B-295375 FR Countermeasures, Inc. 02/10/2005 B-400109 Systalex Corporation 07/17/2008 B-403085 Structural Associates, Inc. 09/21/2010 B-409148 Motorola Solutions, Inc 01/28/2014 GAO on Past Performance and Experience • Past Performance – Consideration of information collected by other evaluation boards in other procurements – Lack of relevant past performance – Unequal effort, on the agency’s part, in contacting references • Experience Evaluations – Relevant experience – Evaluation of subcontractor experience Past Performance vs. Experience Commercial Window Shield, B-400154, July 2, 2008 CWS’s argument, however, fails to recognize that the experience and past performance factors reflected separate and distinct concepts. Under the experience factor, the agency examined the degree to which a vendor had experience performing similar projects; under the past performance factor, the agency considered the quality of a vendor’s performance history. Given the fundamentally different nature of the evaluations, a rating in one factor would not automatically result in the same rating under the other. Shaw-Parsons Infrastructure Recovery Consultants, LLC; Vanguard Recovery Assistance, Joint Venture; B-401679.4, March 10, 2010 Generally, an agency’s evaluation under an experience factor is distinct from its evaluation of an offeror’s past performance. Specifically, the former focuses on the degree to which an offeror has actually performed similar work, whereas the latter focuses on the quality of the work. Cost/Price Evaluations FAR 15.305(a)(1) • Cost/Price Reasonableness Normally evaluated and assessed under price competition; may also be determined by other price analysis techniques such as parametric analysis • Cost Realism Required for cost-reimbursement contracts, an assessment that proposed price appropriately considers scope and degree of effort. As elected by the contracting officer, may be considered for other contract types such as FPIF Other Evaluation Considerations — FAR FAR 15.304(c)(3)(ii) — In solicitations that involve bundling, past performance must include extent to which the offeror attained applicable goals for small business. FAR 15.304(c)(4) — Extent of participation of small disadvantaged business concerns all be evaluated in unrestricted acquisitions expected to exceed $650,000 ($1.5 million for construction). FAR 15.304(c)(5) — In solicitations involving bundling that offer significant subcontracting opportunities, include proposed small business subcontracting participation in the subcontracting plan as an evaluation factor. Other Evaluation Considerations — DFARS DFARS 15.304(c)(i) – (iv) (i) In acquisitions that require a Small Business Subcontracting Plan, other than LPTA, extent of participation in performance of the contract shall be addressed in source selection. (ii) In accordance with 10 U.S.C. 2436, consider the purchase of capital assets manufactured in the United States, in source selections for MDAPs. (iii) Additional evaluation factors required for the direct purchase of ocean transportation services. (iv) Consider the manufacturing readiness and manufacturing-readiness processes for MDAPs. Other Evaluation Considerations — DFARS DFARS 215.370 Evaluation factor for employing or subcontracting with members of the Selected Reserve. 215.370-2 Evaluation factor. In accordance with Section 819 of the National Defense Authorization Act for Fiscal Year 2006 (Pub. L. 109-163), the contracting officer may use an evaluation factor that considers whether an offeror intends to perform the contract using employees or individual subcontractors who are members of the Selected Reserve. PGI 215.370-2 Evaluation factor. (1) This evaluation factor may be used as an incentive to encourage contractors to use employees or individual subcontractors who are members of the Selected Reserve. Evaluation Description in RFP FAR 15.304(d) — All factors and significant subfactors that will affect contract award and their relative importance shall be stated clearly in the solicitation (10 U.S.C. 2305(a)(2)(A)(i) and 41 U.S.C. 253a(b)(1)(A)) (see 15.204-5(c)). The rating method need not be disclosed in the solicitation. The general approach for evaluating past performance information shall be described. FAR 15.304(e) — The solicitation shall also state, at a minimum, whether all evaluation factors other than cost or price, when combined, are— (1) Significantly more important than cost or price; (2) Approximately equal to cost or price; or (3) Significantly less important than cost or price (10 U.S.C. 2305(a)(3)(A)(iii) and 41 U.S.C. 253a(c)(1)(C)). Source Selection Evaluation Factors Most Frequently Selected Non-cost Evaluation Factors and Their Relative Importance in 88 Contracts Using a Tradeoff Process GAO Report 11-8, Figure 4 “Worst Source Selection Criterion Ever” [a] determination of price realism and reasonableness will include a determination by the [Contracting Officer (“CO”)] that proper discounts have been offered commensurate with maximum order thresholds for prime contractors and teaming partners and in accordance with subcontractor arrangements. The Government reserves the right to reject any proposal that includes any assumption or condition that impacts or affects the Government’s requirements. . . . Evaluation of Pricing shall be based upon the proposed single, minimum “team” discount (expressed as a percentage) which shall be applicable to all labor categories, labor rates, and support products contained in the awarded BPA SINs of each team member’s GSA Schedule Contract. For price evaluation purposes, the Government will simply compare the minimum “team” discount percentage proposed, and will not apply the proposed discount to any of the underlying labor rates/support products contained in any of the proposed GSA Schedule contracts. Given this analysis, a team percentage discount of 10% will be evaluated more favorably than a discount of 5%, regardless of the underlying labor rates and/or support product prices resident in the proposed GSA Schedule contracts. UNISYS Corporation V. The United States, Court of Federal Claims, No. 09-271C A Potential Runner Up TABLE 2.1.a PAST PERFORMANCE RATINGS RATING DEFINITION SATISFACTORY Based on the offeror's performance record, the government has an expectation that the offeror will successfully perform the required effort. UNSATISFACTORY Based on the offeror's performance record, the government has a low expectation that the offeror will successfully perform the required effort. FA8625-10-R-6600 Section M, Evaluation Factors for Award, 24 Feb 2010 Evaluation Rating Schemes • Schemes are generally categorized as – Color – Adjectival – Numerical/Points (Not Generally Used) • This information is usually not provided in the solicitation • DoD now requires a combination of Color and Adjectival ratings ALL Source Selection Rating Systems are Adjectival Tradeoff Source Selection Process FAR 15.101-1 Tradeoff Process (a) A tradeoff process is appropriate when it may be in the best interest of the Government to consider award to other than the lowest priced offeror or other than the highest technically rated offeror. (c) This process permits tradeoffs among cost or price and non-cost factors and allows the Government to accept other than the lowest priced proposal. The perceived benefits of the higher priced proposal shall merit the additional cost, and the rationale for tradeoffs must be documented in the file in accordance with 15.406. Combined Technical/Risk Ratings Technical Ratings Technical Risk Ratings Past Performance Relevancy Ratings Performance Confidence Assessments Lowest Price Technically Acceptable (LPTA) Source Selection Process FAR 15.101-2 Lowest Price Technically Acceptable Source Selection Process (a) The lowest price technically acceptable source selection process is appropriate when best value is expected to result from selection of the technically acceptable proposal with the lowest evaluated price. (b) When using the lowest price technically acceptable process, the following apply: (1) The evaluation factors and significant subfactors that establish the requirements of acceptability shall be set forth in the solicitation. Solicitations shall specify that award will be made on the basis of the lowest evaluated price of proposals meeting or exceeding the acceptability standards for non-cost factors. (2) Tradeoffs are not permitted. (3) Proposals are evaluated for acceptability but not ranked using the non-cost/price factors. (4) Exchanges may occur (see 15.306). Technical Acceptable/Unacceptable Ratings Past Performance Evaluation Ratings How Do We Do That? The Under Secretary of Defense (Acquisition, Technology & Logistics) Logistics) Aug 25 1999 The Under Secretary of Defense (Acquisition, Technology & Logistics) Logistics) Aug 25 1999 MEMORANDUM FOR BRIG GEN FRANK ANDERSON SUBJECT: SUBJECT: Acquisition Management Training Reference is made to the attached letter from Ron Fox, Harvard University Graduate School of Business Administration, George F. Baker Foundation, dated August 2, 1999. I believe (and have believed for some time) that a far more extensive and different (I.e. much more case study oriented) program is requiredrequired--as Ron Fox so eloquently describes herein. I would like you to give this some serious thought and then get together (soon) with us (including those on distribution). It may be that the required acquisition management “information” which now fills much of the DSMC curriculum could be done via a program of distance/computerdistance/computer-based learning; then the time at the campus could be devoted to case studies (i.e. “how to”). Or, perhaps you have some other ideas. (Obviously, Ron’s suggestion of a 10 month program is another.) With you just taking over, this is a great time to address this issue. Signed J.S. Gansler MEMORANDUM FOR BRIG GEN FRANK ANDERSON SUBJECT: SUBJECT: Acquisition Management Training Reference is made to the attached letter from Ron Fox, Harvard University Graduate School of Business Administration, George F. Baker Foundation, dated August 2, 1999. I believe (and have believed for some time) that a far more extensive and different (I.e. much more case study oriented) program is requiredrequired--as Ron Fox so eloquently describes herein. I would like you to give this some serious thought and then get together (soon) with us (including those on distribution). It may be that the required acquisition management “information” which now fills much of the DSMC curriculum could be done via a program of distance/computerdistance/computer-based learning; then the time at the campus could be devoted to case studies (i.e. “how to”). Or, perhaps you have some other ideas. (Obviously, Ron’s suggestion of a 10 month program is another.) “The Defense Department has successfully conducted without protest a number of major program competitions in recent years. A key characteristic of these competitions was an open, on going detailed dialogue with each bidder about their proposal.” With you just taking over, this is a great time to address this issue. Signed J.S. Gansler The Under Secretary of Defense (Acquisition, Technology & Logistics) Logistics) Aug 25 1999 The Under Secretary of Defense (Acquisition, Technology & Logistics) Logistics) MEMORANDUM FOR BRIG GEN FRANK ANDERSON Aug 25 1999 MEMORANDUM FOR BRIG GEN FRANK ANDERSON SUBJECT: SUBJECT: Acquisition Management Training Reference is made to the attached letter from Ron Fox, Harvard University Graduate School of Business Administration, George F. Baker Foundation, dated August 2, 1999. I believe (and have believed for some time) that a far more extensive and different (I.e. much more case study oriented) program is requiredrequired--as Ron Fox so eloquently describes herein. I would like you to give this some serious thought and then get together (soon) with us (including those on distribution). It may be that the required acquisition management “information” which now fills much of the DSMC curriculum could be done via a program of distance/computerdistance/computer-based learning; then the time at the campus could be devoted to case studies (i.e. “how to”). Or, perhaps you have some other ideas. (Obviously, Ron’s suggestion of a 10 month program is another.) With you just taking over, this is a great time to address this issue. Signed J.S. Gansler SUBJECT: SUBJECT: Acquisition Management Training “Communication is a key element in the Department’s ability to conduct reliable and successful source selections. We need to encourage government participants involved in source selections to fully engage with industry at all stages of the competitive process.” Reference is made to the attached letter from Ron Fox, Harvard University Graduate School of Business Administration, George F. Baker Foundation, dated August 2, 1999. I believe (and have believed for some time) that a far more extensive and different (I.e. much more case study oriented) program is requiredrequired--as Ron Fox so eloquently describes herein. I would like you to give this some serious thought and then get together (soon) with us (including those on distribution). It may be that the required acquisition management “information” which now fills much of the DSMC curriculum could be done via a program of distance/computerdistance/computer-based learning; then the time at the campus could be devoted to case studies (i.e. “how to”). Or, perhaps you have some other ideas. (Obviously, Ron’s suggestion of a 10 month program is another.) With you just taking over, this is a great time to address this issue. Signed J.S. Gansler Source Selection Do’s • • • • • • • • • • • • • Maintain challenging goals Use draft RFPs Use advisory multi-step process Limit documentation requirements Limit the size of proposals Make use of oral presentations Electronic submission of cost proposals Keep evaluation factors to a minimum Establish small, expert evaluation panels Determine need for audit and field pricing support Assess proposals realistically determining competitive range Use past performance as a key determining factor Provide full and complete debriefings Source Selection Don’ts • Do not engage in “square filling” • Do not engage in “cover your six” actions • Do not encourage “brochuremanship” Pre-Solicitation Process Solicitation Preparation Requirement Market Research Acquisition Strategy & Plan Source Selection Strategy Draft Request for Proposal FedBizOpps: Advisory Multi-Step DRFP Release Reading Room Finalize RFP RFP Release Briefing to SSA Advertise RFP Release RFP Release to Industry UCF Format • Part I – The Schedule. – Section A Solicitation/contract Form. – Section B Supplies or services and prices/costs. – Section C Description/Specifications/Statement of Work. (Statement of Objective (SOO), if used) – Section D Packaging and Marking. – Section E Inspection and Acceptance. – Section F Deliveries or Performance. – Section G Contract Administration data. – Section H Special contract requirements. UCF Format • Part II – Contract Clauses. – Section I Contract Clauses. • Part III – List of Documents, Exhibits, and Other Attachments. – Section J List of Attachments. • Part IV – Representations and Instructions. – Section K Representations, certifications, and other statements of offerors or respondents. – Section L Instructions, conditions, and notices to offerors or respondents. – Section M Evaluation factors for award. [From Source Selection Plan (SSP)] Document Linkage Provided in RFP Provided in Proposal On Contract at Award Model Contract Model Contract Section L Proposal Narratives/ Volumes Contract Sections A-K IMP/IMS SOO SOW Instructions PWBS Compliance & Ref. Docs SDP Expand Expand Propose Additions IMS Section M IMP SDP (Annex to IMP) (Annex to IMP) SOW SOW CWBS CWBS Compliance & Ref. Docs Compliance & Ref. Docs CDRLs Add (optional) CDRLs CDRLs TRD Expand System Level Performance Spec CLINS Expand System Level Performance Spec CLINS CLINS Post-Solicitation Process (No Discussions) Process/RFP Release Face-to-Face Discussions/ Negotiations Request Final Proposal Revision Initial Evaluation Clarifications Limited Communications Receipt of Proposals/Pres entations Receive & Analyze Field Surveys (if requested) Receive & Analyze Final Proposal Contract Award (Distribution) Competitive Range Determination Prepare for discussions with Remaining Offerors Brief SSAC Brief SSA SSA Decision At RFP Release Offerors Complete Proposal Development Example Proposal Development Process Proposal Complexities In Government Contracts • Contracting With The Government Requires A Proposal Process – Government is Sovereign With Many Laws, Rules and Regulations • Processes Are Necessary To Insure Compliance • Government Contracting Relationships Are Complex (legally) • Competitive Acquisitions Utilize Government Procedures That Provide For Little Flexibility – Proposals Must be IAW Proposal Instructions, Laws, Regulations – Proposals Must Also Be Timely (Late proposals are rejected) Proposal Quality • Factors that often drive proposal quality – – – – – RFP and supporting document clarity Early industry involvement Understanding the requirement Contractor Pre-planning (Business Development) Proposal Development Time (Proposal Submission Dates - RFP Instructions) – Contractors Proposal Process Offerors Should Understand the RFP • Read all RFP instructions carefully – Note page limitations – Note organization requirements – Note submission dates – Note special contract requirements Offerors Should Understand the RFP • Seek clarification when necessary, – Do not make assumptions • Continuously update compliance matrix as proposal develops • Allow sufficient time to meet proposal due dates – Late proposals may not be accepted • Plan early for how your proposal will be submitted and organized Proposal & Contract Manager Interfaces The Spider’s Web Financial Customer Request For Information Sources Sought Request For Proposal Marketing & Business Development Program Manager Divisional Executives Manufacturing Corporate Executives Proposal Manager --------------------Contracts Manager Pricing Support Legal Project Planning And Scheduling Personnel Process Design Subcontract Administrator Engineering Estimating Interdepartmental Transfers (IDT) Subcontractors Purchasing Generic Proposal Process Flow Diagram 1 2 Bid/No Bid Yes RFP No Develop Program Baseline Statement of Work Make or Buy Decisions Program Schedule Work Breakdown Structure Responsibility Matrix Equipment List Analyze Customer Requirements Dissect the Source Selection Evaluation Criteria Stop 3 Determine Estimating Technique IAW RFP Develop and publish a Proposal Plan Of Action And Pricing Instructions 4 Subcontract Managers Accomplish an Analysis Subcontract Proposals Received IPT Provides Technical Evaluation Prepare Prime Contractor Estimates And Rational (BOEs) Labor, Supplier Mgt, IWA Responses Other Direct Costs 8 7 Apply Rates And Factors • FPRAs • Unique Rates Proposal Kickoff Meeting 5 6 IPTs (Proposal Mgrs) Review BOEs for sufficiency/completeness Pricing Receives Data and Begins Building the Cost Proposal Input into Pricing Software RELEASE SUBCONTRACT RFPs Also includes materials, supplies, Interdepartmental Transfers, etc 9 Provide Draft Proposals (Technical, Management, Past Performance and any other Proposals IAW RFP Sec L & M) Develop Cost/Price Develop/Integrate Cost Proposal Compile the Proposal Packages Cost Technical Management Past Performance (IPT Reviews) Estimating Manager Reviews Red Teams 10 Mgt Reviews (Divisional Corporate) 11 Proposal Submission Bid/No Bid Review Issues • The Bid/No Bid decision is crucial as proposing on contract actions consumes tremendous resources • Items often addressed include: -- Strategic Analysis -- Customer Information -- Capture/Win Strategy -- Management Baseline -- Past Performance -- Proposal Management -- Potential Profit/Loss -- Financial Information -- Competition Issues -- Technical Baseline -- Cost Estimating/Pricing Issues -- Risk (Technical/Cost/Management) -- Internal Company Considerations Proposal Plan of Action (PPOA) Issues • The Proposal Plan of Action (PPOA) is a critical document that communicates proposal instructions to all proposal participants: – General Program Information – Provides proposal instructions – Provides a Proposal Schedule (individual assignments/due dates) – Ground Rules and Assumptions • Describes the proposal (Cost, Technical, Mgt, Past Performance) – – – – Reviews the Statement of Work (SOW) Pricing Instructions (including BOE form and other instructions) Contracting Instructions Points of Contact (Proposal Mgr, Pricing Mgr, Contracts Mgr, etc) (See example Proposal Plan of Action (POA)) (See example Basis of Estimate (BOE)) Proposal Checklist Issues • Proposal Checklists help insure: – the submission of a quality proposal – meeting customer requirements – complying with any internal company procedures • Forces the review of such things as: – Competitive (did you bid to the source selection criteria?) – Bidding Ground rules and Assumptions – Cost Information (methodology, spreadsheet, WBS, Cost Detail, etc.) – Rates and Factors (DCAA Approved? Are Costs Time-Phased? etc.) – Company Resources – Basis of Estimates (clarity, debit/credit, documented the sources of BOEs) – Identifying any Proprietary Data – Management Judgments Sample Compliance Matrix This matrix is included in the solicitation with the following sections completed. DESCRIPTION CLIN / SECTION B CDRL/ SECTION J PWS/ SECTION C SECTION L SECTION M Administrative Support 0001 004A2 1.1 4.3 3.1 Records Management 0002 010A2 1.1.1 4.3.1 3.1.1 Forms and Publications 0003 020A2 1.1.2 4.3.2 3.1.2 Operations & Maintenance 0004 021A2 1.2 4.4 3.2 Equipment Records 0005 053A2 1.2.1.1 4.4.2 3.2.1 Maintenance Analysis 0006 054A2 1.2.2 4.4.3 3.2.2 Price Section B 1.5.3 4.0 6.0 5.0 Past Performance Sample Compliance Matrix This matrix is included in the solicitation with the following sections completed. DESCRIPTION CLIN / SECTION B CDRL/ SECTION J PWS/ SECTION C SECTION L SECTION M Administrative Support 0001 004A2 1.1 4.3 3.1 Records Management 0002 010A2 1.1.1 4.3.1 3.1.1 Forms and Publications 0003 020A2 1.1.2 4.3.2 3.1.2 Operations & Maintenance 0004 021A2 1.2 4.4 3.2 Equipment Records 0005 053A2 1.2.1.1 4.4.2 3.2.1 Maintenance Analysis 0006 054A2 1.2.2 4.4.3 3.2.2 Price Section B 1.5.3 4.0 6.0 5.0 Past Performance Preparer’s Name Due Date for Proposal Columns Added by Offeror Offeror Proposal Review Teams Example • Blue Team – proposal team reviewers • Green Team – “Is my pricing and cost strategy sound?” – Financial staff • Red Team – Critique and take apart proposal team efforts. Role play governments evaluation team. • Black Hat Team – projects what they expect competitors to propose and they provide their projection to the proposal team Mechanics of Offer Submission • Offer must be signed by individual authorized to bind the Offeror (Sections A/L) • Provide all information requested in the solicitation, including all representations and certifications (Section K) • Adhere to page count, if any (Sections L/M) • Provide number of copies requested (Section L) • Submit offer on time and at place designated in the solicitation (Sections A/L/M) Government Actions As Proposals Are Being Compiled and Submitted DoD Preparation and Planning • Before each Sub-Factor or Factor Team opens proposals, strongly recommend: – Team discussion of Section M criteria and parts of the proposal that will be reviewed for each criteria – Proposal parts: narrative, IMP, IMS, spec, CDRL, etc. DoD Preparation and Planning • Read key Request for Proposals (RFP) documents – Government Executive Summary (If used) – Statement of Objectives (SOO) – RFP Sections A-K, especially: • Statement of Work/Specification (Section C) • Delivery schedule (Section F) • Special Contract Requirements (Section H) – Work Breakdown Structure (WBS) and WBS Dictionary Performance Based Statement of Work (SOW) (if used) – Contract Data Requirements List (CDRL) (Data Item Descriptions (DIDs)) DoD Preparation and Planning • Read key Request for Proposals (RFP) documents – RFP Section L - Instructions, Conditions, and Notices to Offerors or Quoters • • • • Review proposal structure table Specifications and Technical Requirements Documents Statement of Work (SOW) Instructions (if used) Cost/Price Instructions – Study Section M - Evaluation Factors/Criteria for Award • Understand RFP threshold/objectives (if used) • Understand how criteria relate • Understand the uniform baseline against which each Offeror is compared – Understand RFP/Proposal/Contract Document Linkage Sample Compliance Matrix This matrix is included in the solicitation with the following sections completed. DESCRIPTION CLIN / SECTION B CDRL/ SECTION J PWS/ SECTION C SECTION L SECTION M Administrative Support 0001 004A2 1.1 4.3 3.1 Records Management 0002 010A2 1.1.1 4.3.1 3.1.1 Forms and Publications 0003 020A2 1.1.2 4.3.2 3.1.2 Operations & Maintenance 0004 021A2 1.2 4.4 3.2 Equipment Records 0005 053A2 1.2.1.1 4.4.2 3.2.1 Maintenance Analysis 0006 054A2 1.2.2 4.4.3 3.2.2 Price Section B 1.5.3 4.0 6.0 5.0 Past Performance How do we evaluate? Column Added for Source Selection Initial Evaluation Example Generate and Approve ENs Draft Proposal Analysis Report * Evaluation Notices (Deficiencies, Weaknesses and Clarifications) “Rollup” Comments Factor Chief & PCO Draft ENs Comments Subfactor Chiefs Evaluators Draft ENs Comments • Approve ENs, Assessments • Review Ratings (Colors, Risks, Price) • Draft Briefing Charts • Approve ENs, Assessments • Draft Ratings (Colors, Prop. Risk) Review Comments and Draft “Assessments” • Disregard w/disposition • Combine w/other comments • Modify with rationale Draft ENs, based in part, on Advisor Comments = Feedback Advisors (Advisor) Comments With “Suggested Questions” Comment Form 2 1 3 4 5 Mar 01 version Assessment Form Jan 01 version Evaluation Notice Form 1 2 3 4 Mar 01 version Integrating Ratings Core Team: SSEB Chair, Factor Chiefs, Sub-Factor Chiefs, PCO, Recorder (admin) Offeror A TR G R Y G B Y L HC MC TR & RR Teams Y PROPOSAL RISK H M M M L CONFIDENCE C C SC C PAST PERFORMANCE PRICE OR COST $ PRICE / $ PC C Offeror B RR L L H M M M L HC PCAG SUB SAT CONFIDENCE LIM SUB MISSION CAPABILITY Y G Y PROPOSAL RISK M M L M L CONFIDENCE SC C SC C PAST PERFORMANCE PRICE OR COST $ PRICE / $ PC C Offeror C SAT LIM L SUB = Substantial Confidence SAT – Satisfactory Confidence LIM = Limited Confidence NO = No Confidence UN = Unknown Confidence HC PRICE =$Ms /Preliminary PC at Comp Range = $Ms PRICE = $Ms/Probable Cost (PC) at Decision = $Ms MISSION CAPABILITY Y Y PROPOSAL RISK M H M L L CONFIDENCE C HC C SC PAST PERFORMANCE PRICE OR COST $ PRICE / $ PC C Offeror D MISSION CAPABILITY L Cost Team MISSION CAPABILITY R Y PROPOSAL RISK M L M M M SIGNIFICANT CONFIDENCE HC SC SC SC SC C PAST PERFORMANCE PRICE OR COST $ PRICE / $ PC Exchanges with Industry After Receipt of Proposals • Clarifications and award without discussions • Communications with offerors before establishment of the competitive range • Exchanges with offerors after establishment of the competitive range • Limits on exchanges DoD Source Selection Joint Analysis Team (JAT) Recommended Change to DFARS DFAR 215.306 Exchanges with offerors after receipt of proposals. (c) Competitive range. (1) For acquisitions with an estimated value of $100 million or more, contracting officers should conduct discussions. Follow the procedures at FAR 15.306 (c) and (d). • Significant positive correlation between high-dollar value source selections conducted without discussions and protests sustained. – Improve Quality – Reduce Turbulence – Improves industry’s understanding of solicitation requirements – Improve Government’s understanding of industry issues • May increase time to complete source selection Example Decision Phase Source Selection Evaluation Board SSA or Contracting Officer Calls Offerors Brief SSAC Notify Congress Source Selection Advisory Council SSAC Develop Recommendation SSA Decision Debriefings Brief SSA Price Differentials in Tradeoff Decisions Price Differentials in the 68 DOD Contracts Reviewed in Which a Tradeoff Analysis Was Conducted GAO Report 11-8, Figure 5 Source Selection Decision “The source selection authority’s (SSA) decision shall be based on a comparative assessment of proposals against all source selection criteria in the solicitation. While the SSA may use reports and analyses prepared by others, the source selection decision shall represent the SSA’s independent judgment.” Federal Acquisition Regulation 15.308 Source Selection Decision Document “The source selection decision shall be documented, and the documentation shall include the rationale for any business judgments and tradeoffs made or relied on by the SSA, including benefits associated with additional costs. Although the rationale for the selection must be documented, that documentation need not quantify the tradeoffs that led to the decision.” Federal Acquisition Regulation 15.308 Source Selection Decision Documentation “Contrary to Contracting Officer Shivers' position, the destruction of the individual TEP members‘ score sheets is barred by the FAR provisions. The current contract file for the challenged procurement does not “constitute a complete history of the transaction,” FAR § 4.801(b) (emphasis added), nor does it “[f]urnish[ ] essential facts in the event of litigation.” FAR § 4.801(b)(4). FAR § 4.801(b) expressly refers to § 4.803, which provides “examples of the records normally contained ... in contract files.” FAR § 4.803. Specifically, the record as submitted does not contain all “[s]ource selection documentation,” as required by FAR § 4.803(a)(13).” “Contracting Officer Shivers' destruction of the rating sheets raises issues of spoliation of evidence. “ ‘Spoliation is the destruction or significant alteration of evidence, or failure to preserve property for another's use as evidence in pending or reasonably foreseeable litigation.’ ” See United Med. Supply Co. v. United States, 77 Fed.Cl. 257, 263 (2007) (quoting West v. Goodyear Tire & Rubber Co., 167 F.3d 776, 779 (2d Cir.1999)).” Pitney Bowes Government Solutions v. United States United States Court of Federal Claims, No. 10-257C Filed Under Seal: May 28, 2010. Contract Award • • • • Affirmative Responsibility Determination Contract award Notification of unsuccessful offerors Debriefings Not all solicitations result in contract award. Solicitations may be cancelled prior to award. Debriefings of Unsuccessful Offerors • May be done orally or in writing • Minimum information to be provided – Government’s evaluation of significant weaknesses and deficiencies in the proposal – Overall evaluated cost/price and technical rating of successful and debriefed offerors – Overall ranking of all offerors, if created – Summary rationale for award • Make and model of commercial items • Reasonable responses to relevant questions Debriefing Timelines & Rules • 3 Days -- Written request for debriefing • 5 Days -- Debriefing • An offeror excluded from the competition, but failed to submit a timely request, is not entitled to a debriefing. • Untimely debriefing requests may be accommodated. • Government accommodation of a request for delayed debriefing or any untimely debriefing request, does not automatically extend the deadlines for filing protests. • Debriefings delayed pursuant to 15.505(a)(2) could affect the timeliness of any protest filed subsequent to the debriefing. Release of Data • No person or other entity may disclose contractor bid or proposal information or source selection information to any person other than a person authorized, in accordance with applicable agency regulations or procedures. • Contractor bid or proposal information and source selection information must be protected from unauthorized disclosure FAR Based Protests Forums • Agency • Government Accountability Office * • United States Court of Federal Claims * When the agency receives notice of a protest from the GAO within 10 days after contract award or within 5 days after a debriefing date offered to the protester for any debriefing that is required by 15.505 or 15.506, whichever is later, the contracting officer shall immediately suspend performance or terminate the awarded contract . . . . Protests Interested Parties Agency (PCO) Court of Appeals for Fed Circuit GAO Court of Federal Claims FY 2008 FY 2007 FY 2006 FY 2005 FY 2013 FY 2012 Cases Filed 2561 2429 2,475 2,353 2,299 1,989 1,652 1,411 1,327 1,356 Cases Closed 2458 2538 2,495 2,292 2,226 1,920 1,581 1,394 1,274 1,341 Merit (Sustain + Deny) Decisions 556 509 570 417 441 315 291 335 249 306 Number of Sustains 72 87 106 67 82 57 60 91 72 71 Sustain Rate 13% 17% 18.6% 16% 19% 18% 21 % 27 % 29 % 23 % Effectiveness Rate 43% 43% 42% 42% 42% 45% 42 % 38 % 39 % 37 % 96 145 106 140 159 149 83% 86% 80% 82% 80% 93% 78 % 85 % 96 % 91 % 8% 10% 12% 6% GAO ADR Cases ADR Success Rate Hearings 4.70% 3.36% 6.17% FY 2011 FY FY 2010 2009 FY 2014 78 62 8% 91 11 % 103 8% DoD Protests 1,400 1,200 1,000 800 600 Protests Sustained 400 200 0 DOD Contract Actions and Protests Note: In Fiscal Year 2005 the contract action reporting threshold was significantly reduced, resulting in a jump in reported contract actions. 123 Ethics in Source Selection Procurement Ethics and Transparency • Ethics and Procurement Integrity Laws – Protection of contractor bid or proposal information – Protection of source selection information – Disqualification from participation • Transparency – Contract award decisions based on factors and significant subfactors in the solicitation – No special advantage given to specific interest groups (e.g., Congressional District, Coalition Partners) Operation Ill Wind • Conviction of 46 individuals and 6 defense corporations • Fines and penalties totaling $190 million • Unisys pleaded guilty to an eight-count felony indictment – Fraud – Bribery – Illegal campaign contributions • More than a dozen former Unisys executives and defense consultants admitted to unlawful activities • Melvyn R. Paisley, Assistant Secretary of the Navy, 4 year sentence and $ 50,000 fine • Victor Cohen, Deputy Assistant Secretary of the Air Force • Litton Systems, Aydin Corp., Comptek Research, and others protest various Ill Wind-related contract awards. • Procurement Integrity Act Darleen Druyun Former Principal Deputy Assistant Secretary of the Air Force, Acquisition and Management and Former Vice-President Boeing Missile Defense Systems Michael Sears Former Boeing Chief Financial Officer • Nine months in federal prison • Seven months in a community facility • 150 hours of community service • $ 5,000 fine • Four months in federal prison • 200 hours of community service • Fined $250,000 Back -Up