14. Boršodiová, Vahula

advertisement

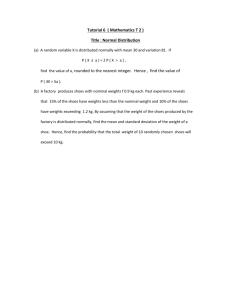

Exchange Rates and Asset Returns – numerical example Viktória Boršodiová Viera - Anna Vahula Exchange rates play a central role in international trade because they allow us to compare the prices of goods and services produced in different countries. An exchange rate can be quoted in two ways: a) as the price of the foreign currency in terms of dollars (for example, $0.01194 per yen) b) or as the price of dollars in terms of the foreign currency (for example, ¥83.77 per dollar) In USA a handbag costs $54 and in Britain a pair of shoes costs £70. a) At an exchange rate of $1.50 per pound, what is the price of a pair of shoes in terms of a handbag? b) At an exchange rate $1.50 per pound, what is the price of a handbag in terms of a pair of shoes? c) All else equal, how does this relative price change if the dollar depreciates to $1.25 per pound? d) Compared with the initial situation, has a pair of shoes become more or less expensive relative to a handbag? Suppose the interest rate on a dollar deposit is 2%, the interest rate on an euro deposit is 5%. The exchange rate today is $1,32/€1. What should the expected rate look like in a year if the exchange market is in equilibrium?