Exchange Rates

advertisement

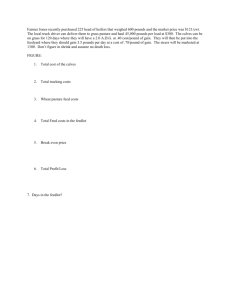

Exchange Rates S Exchange rates S The exchange rate refers to the rate at which national currencies can be exchanged for each other in the foreign exchange market. S For example, presently: S 1 Euro = $1.30, so $1.30 must be given to receive 1 euro, or S $1 = .77 euro, so .77 euros must be given to receive $1 Determining Exchange Rates S So how are these values arrived at? Why can $1 only be exchanged for .77 euros, while 1 euro can be exchanged for $1.30? S In order to answer that question we must consider two types of exchange rate systems, floating exchange rates and fixed exchange rates Floating Exchange Rate System S In the floating (flexible) exchange rate system, currency values are determined by market forces, aka the forces of supply and demand. S Currencies values are always quoted in reference to another currency, because there is no independent unit that can be used to express the value of all currencies. Therefore we speak of the value of the $ compared to the euro, or British pound, or any other currency. Equilibrium Exchange Rate Equilibrium Exchange Rate S The previous graph shows the market for British pounds, with the horizontal axis measuring the quantity of pounds, and the vertical axis measuring the price of pounds in terms of $ S The demand and supply curves show demand for and supply of British pounds. Demand for pounds S U.S. citizens and firms demand pounds in order to do business or travel to the UK. The demand for British pounds (and all other currencies) is downward sloping because when the price of pounds in terms of $ falls, US residents buy more pounds. S So if $2 is needed to buy 1 British pound, US residents will buy fewer pounds than if $1 was needed to buy 1 British pound. Supply of pounds S The supply of British pounds (and all other currencies) is upward sloping because when the price of pounds in terms of $ increases, UK residents buy more dollars by supplying pounds. S If a US resident receives only .5 pounds for a dollar, she will supply less dollars than if she were able to receive .8 pounds per dollar. As the US resident gets more pounds for her dollar, she will supply more dollars to buy cheaper British goods Equilibrium Exchange Rate S Previously, the equilibrium exchange rate of pounds to dollars was 1 pound = $2. If the exchange rate changed, and 1 pound was equal to $3, there would be an excess quantity of pounds supplied, as UK residents would want to take advantage of buying “cheaper” US goods S Conversely, if the exchange rate changed to 1 pound = $1, there would be an excess quantity of pounds demanded, as US residents would want to take advantage of “cheaper” UK goods Equilibrium Exchange Rate S So in a freely floating exchange rate system, the equilibrium exchange rate is determined by supply and demand forces. Currency Appreciation and Depreciation S Exchange rates change on a daily basis depending on how the forces of supply and demand affect different currencies. S The equilibrium exchange rate is always changing, leading to appreciation and depreciation of different currencies. S Let’s begin at looking at the ways currencies appreciate Currency Appreciation S Let’s continue talking about the value of the British pound. What are two scenarios that may occur that can lead to an appreciation of this currency? Currency Appreciation S The value of the pound (in terms of the $) will appreciate if there is an increase in demand for pounds. How would that look on our diagram? S The value of the pound will also appreciate against the dollar if there is a decrease in supply of pounds. How would that look on our diagram? Currency Depreciation S Currencies can and do depreciate as well. S The value of the pound (in terms of the $) will depreciate if there is an decrease in demand for pounds. How would that look on our diagram? S The value of the pound will also depreciate against the dollar if there is a increase in supply of pounds. How would that look on our diagram? Practice Question S Suppose US customers have recently become disenchanted with US autos and are more interested in buying German autos. Using a diagram, show the impacts this would have on: S The value of the $, and of the euro S Which currency will appreciate and which will depreciate? Causes of changes in exchange rates S Like we said before currency exchange rates are constantly changing. What are some of the economic factors that cause these changes to occur? Interest rate changes S Let’s assume that interest rates increase in the UK from 4% to 6%, while in the US they remain at 4%. Smart investors would quickly realize that the smart move would be to convert $ to pounds and then move that money to a UK financial institution. S Financial capital will flow to countries that have higher rates of interest, thus strengthening (appreciating) the pound and weakening (depreciating) the $. Rates of inflation S If Japan experiences rising rates of inflation, this increased price level makes Japanese products more expensive, thus reducing the amount of goods Japan will be able to export abroad. S This decrease in demand for Japanese goods will lead to a decrease in demand for Yen, thus weakening (depreciating) the Japanese currency against the currency of countries with lower rates of inflation. Changes in income S If Vietnam experiences a rapid rise in income levels due to economic growth, residents will begin importing more foreign goods than previously. S This will lead to an increase in supply of the Vietnamese currency as they exchange their currency for the currency of foreign producers, and the Vietnamese currency will weaken (depreciate). Changes in taste S If Indian goods suddenly become fashionable around the world, foreigners will begin demanding and importing more Indian goods than before. S To purchase these goods, foreigners will supply their local currency and demand rupees, thus leading to an appreciation (strengthening) of the Indian rupee. Speculation S Investors often try to predict changes in the foreign currency markets just like they do in the bond or stock markets. If a trader suspects that the Mexican peso will appreciate in the near future, he may by pesos and then sell them at a later date to realize a profit. S The speculative purchase of the peso increases demand for pesos and will have the affect of appreciating the currency. Practice Questions S 1—Interest rates rise in the US faster than elsewhere. What is the effect on the $ and on the euro? S 2—Inflation rises in Thailand faster than in Singapore. What is the effect on the Thai baht and Singapore dollar? S 3—Currency speculators bet on the South African rand to depreciate. How will the Yen be affected? More Practice Questions S 4—China is in recession and incomes are falling. What will happen to the Chinese yuan? S 5—Switzerland welcomes a record number of tourists. How will the Swiss franc react? S 6—People around the world discover the beauty of Canadian jewelry. How will the Canadian dollar be affected? Imports and Exports S If a country’s currency appreciates, its citizens are in a better position to import foreign goods, but manufacturers are less able to export their goods abroad. S So when a country sees it’s currency appreciate, oftentimes this will have a negative effect on a countries balance of trade. S The opposite is true as well, a depreciated currency will lead to more exports and fewer imports Currency exchange rate fluctuations and the BOP S If EU customers begin importing more US goods, they must supply Euros and demand $, leading to an appreciation of the $ and a deficit in the EU current account, and a surplus in the US capital (financial) account. S This would seem to create an imbalance in both countries BOP, but luckily floating exchange rates can fix this problem….. Currency exchange rate fluctuations and the BOP S Under floating exchange rates, the currencies will automatically adjust (the $ strengthens and the euro weakens) and create a situation where the quantity of each currency demanded equals the quantity of each currency supplied. S This change in the value of the currencies will eliminate the imbalance in the BOP without any outside actions needing to be taken