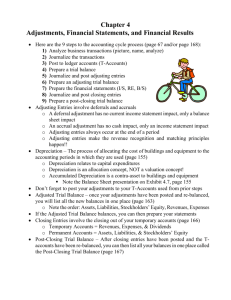

Chapter 4 Classwork

advertisement

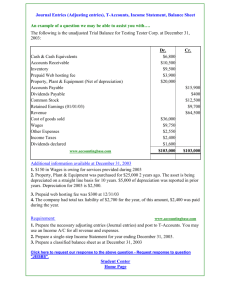

Chapter 4 Classwork 4-1. Short Golf Club of Marsh, Alaska sells season memberships for $200 each. During January of 2015, 300 season memberships were sold. As of March 31, 2015, only $10,000 of season membership fees had been collected from customers. The season runs for 4 months starting June 1, 2015. Which one of the following is an amount reported on the financial statements for the period ending March 31, 2015? a. Unearned membership revenue of $60,000 b. Unearned membership revenue of $10,000 c. Accounts receivable of $10,000 d. Membership revenue of $10,000 4-2. Brownfield Equipment sells new trucks and pays each salesperson a commission of $2,000 for each truck sold. During the month of August, a salesperson, Jim, sold 6 new trucks. Brownfield pays Jim on the 10th day of the month following the sale. Jim operates on the cash basis; the truck dealer operates on the accrual basis. Which of the following statements is true? a. Jim will recognize commission revenue earned in the amount of $12,000 in August. b. Brownfield will recognize commission expense in the amount of $12,000 in August. c. Brownfield will recognize commission expense in the amount of $12,000 in September. d. Jim will recognize revenue in the same month that the truck dealer recognizes expense. 4-3. Smello Catering is a local catering service. Conceptually, when should Smello recognize revenue from its catering service? a. At the date the customer places the order b. At the date the meals are served c. At the date the invoice is mailed to the customer d. At the date the customer's payment is received e. At the end of the year 4-4. Hill Corp. purchased equipment at a cost of $250,000 in January, 2010. As of January 1, 2015, depreciation of $75,000 had been recorded on this asset. Depreciation expense for 2015 is $15,000. After the adjustments are recorded and posted at December 31, 2015, what are the balances for the Depreciation Expense and Accumulated Depreciation? Depreciation Expense Accumulated Depreciation $ 15,000 $ 90,000 a. $ 75,000 b. $ 15,000 $ 75,000 $ 90,000 c. $ 75,000 d. $ 90,000 Classwork 4-5 Revenue Recognition. The Jovian Co. provides movie theater access in the DFW area. During 2015, Jovian sold 10,000 subscriptions at $150 each. Each subscription allows 20 movie entrances. During 2015, the subscribers used the passes to enter movie theaters 100,000 times. 1. Record the entry for the sale of the subscriptions. 2. Record the entry for the recognition of revenue at the end of 2015. Classwork 4-6 Office Supplies. Solace Corp. purchases office supplies once a month and prepares monthly financial statements. The asset account Office Supplies on Hand has a balance of $2,000 on September 1. Purchases of supplies on account during September amount to $5,000. Supplies on hand at September 30 amount to $1,000. 1. Prepare the entry for the purchase of the office supplies on September 5, which increases the Office Supplies on Hand account. 2. Prepare the necessary adjusting entry on Solace's books on September 30th. 3. What will be the effect on net income for September if this entry is not recorded? Classwork 4-7 Depreciation. On July 1, 2015, Doltan Corp. buys construction equipment for $380,000 in cash. Assume that the computer is expected to have a 6-year life and an estimated salvage value of $30,000 at the end of that time. Required 1. Prepare the journal entry to record the purchase of the equipment on July 1, 2015. 2. Compute the depreciable cost of the equipment. _______ 3. Using the straight-line method, compute the monthly depreciation. 4. Prepare the adjusting entry to record depreciation at the end of July 2015. 5. Compute the computer's carrying value that will be shown on Doltan's balance sheet prepared on December 31, 2015. Classwork 4-8 Prepaid Insurance—Annual Adjustments. On July 1, 2015, Big Corp. purchases a 24-month property insurance policy for $48,000. The policy is effective immediately. Assume that Big prepares adjusting entries only once a year, on December 31. Required 1. Compute the monthly cost of the insurance policy. 2. Prepare the journal entry to record the purchase of the policy on July 1, 2015 for cash. 3. Prepare the adjusting entry on December 31, 2015. 4. Assume that the accountant forgets to record an adjusting entry on December 31, 2015. Will net income for the year ended December 31, 2015, be understated or overstated? Explain your answer. Classwork 4-9 Customer Deposits. Jill and Jason Co. collected $45,000 from a customer on November 1 and agreed to provide services during the next three months. Jill and Jason Co. expects to provide an equal amount of services each month. Required 1. Prepare the journal entry for the receipt of the customer deposit on November 1. 2. Prepare the adjusting entry on December 31. 3. What will be the effect on net income if the entry in (2) is not recorded? Classwork 4-10 Interest Payable—Quarterly Adjustments Toomuch Co. takes out a 12%, 90-day, $1,000,000 loan with First State Bank on November 1, 2015. Assume that Toomuch prepares adjusting entries only four times a year: on March 31, June 30, September 30, and December 31. Required 1. Prepare the journal entry on November 1, 2015. 2. Prepare the adjusting entry on December 31, 2015. 3. Prepare the entry on January 30, 2016, when Toomuch Co. repays the principal and interest to First State Bank. Classwork 4-11 The Effect of Ignoring Adjusting Entries on Net Income For each of the following independent situations, determine whether the effect of ignoring the required adjusting entry will result in an understatement (Under), will result in an overstatement (Over), or will have no effect (NE) on net income for the period. Effect on Net Income Example A company fails to record interest on a loan payable Over 1 Wages for the last 4 days of the year are not recorded. 2 Interest earned on a note receivable is ignored. 3 Depreciation on some buildings is overlooked. 4 Deposits from customers are recorded as revenues, but they work has not yet been completed. 5 Office supplies purchased are recorded as expenses, but half remain at the end of the year. 6 Magazine subscriptions have be recorded as a liability, but magazines mailed have not been recorded as a revenue 7 The company prepays rent for the 6 months on December 1st, but fails to record the rent for December as an expense. Classwork 4-12 Trial Balance Preparation. The following account titles, arranged in alphabetical order, are from the records of Ramshackle Realty Co. The balance in each account is the normal balance for that account. The balances are as of December 31, after adjusting entries have been made. Categorize the accounts as: (1) assets; (2) liabilities; (3) stockholders’ equity accounts, including dividends; (4) revenues; and (5) expenses. Indicate the normal balance of each account (D for debit, C for credit). 2-C Accounts Payable $29,520 Interest Expense 480 Accounts Receivable 50,952 Interest Payable 480 Accumulated Depreciation—Automobiles 28,800 Land 96,000 Accumulated Depreciation—Buildings 36,000 Notes Payable 48,000 Automobiles 115,200 Office Supplies 4,032 Buildings 144,000 Office Supplies Expense 12,768 Capital Stock 60,000 Prepaid Insurance 2,880 Cash 5,904 Rent Expense 5,760 Commissions Earned 41,808 Retained Earnings 205,068 Commissions Expense 5,520 Wages and Salaries Expense 2,988 Dividends 3,600 Wages and Salaries Payable 1,128 Insurance Expense 720 Classwork 4-13 Closing Entries. Prepare the closing entries required for Ramshackle Realty in 4-12. Classwork 4-14 Accrual of Interest on a Loan. On July 1, 2015 Peace Corp. takes out a 12%, 12-month, $10,000,000 loan at Happy National Bank. Principal and interest are to be repaid on June 30, 2016. Required 1. Prepare the journal entries for July 1, 2015 to record the borrowing, for December 31, 2015 to record the accrual of interest, and for June 30, 2016 to record repayment of the principal and interest. July 1, 2015 December 31, 2015 June 30, 2016 2. Evaluate the following statement: It would be much easier not to bother with an adjusting entry on December 31st and simply record interest expense on June 30th when the loan is repaid. Classwork 4-15 Adjusting Entries—Annual Adjustments. Azure Industries prepares annual financial statements and adjusts its accounts only at the end of the year. The following information is available for the year ended December 31, 2015. Prepare the adjusting entries in journal form. 1. Azure purchased equipment two years ago for $13,000. The equipment has an estimated useful life of five years and an estimated salvage value of $1,000. 2. The Office Supplies account had a balance of $4,000 on January 1, 2015. During 2015, Azure added $16,000 to the account for purchases of office supplies during the year. A count of the supplies on hand at the end of December 2015 indicates a balance of $2,000. 3. On October 1, 2015, Azure credited a liability account, Customer Deposits, for $54,000. This sum represents an amount that a customer paid in advance and that will be earned evenly by Azure over a six-month period. Three months have passed. 4. Azure rented some office space on November 1, 2015, at a rate of $3,000 per month. On that date, Azure debited Prepaid Rent for three months’ rent paid in advance. Two months have passed. 5. Azure took out a four month, 6%, $800,000 note on November 1, 2015, with interest and principal to be paid at maturity. Interest for two months is needed. 6. Azure operates five days per week with an average daily payroll of $2,000. Azure pays its employees every Tuesday for the previous week. December 31, 2015, is a Thursday (4 days need to be accrued). Assume that Azure's accountant forgets to record the adjusting entries on December 31, 2015. Will net income for the year be understated or overstated? by what amount? (Ignore the effect of income taxes.)