Assignment 3

advertisement

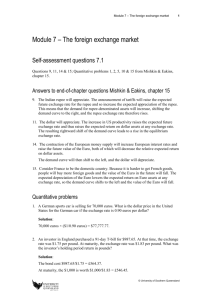

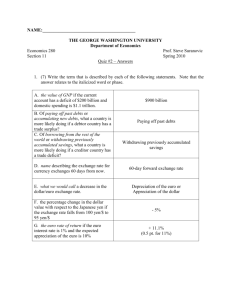

Mariela Tinajero MBA 6410 Professor Doris Geide-Stevenson Assignment 3 1. The first problem is based on the Feenstra/Taylor text. Complete parts a - g for problem 6 below. 6. Consider a Dutch investor with 1,000 euros to place in a bank deposit in either the Netherlands or Great Britain. The (one-year) interest rate on bank deposits is 2% in Britain and 4.04% in the Netherlands. The (one-year) forward euro-pound exchange rate is 1.575 euros per pound and the spot rate is 1.5 euros per pound. Answer the following questions, using the exact equations for UIP and CIP as necessary. a. What is the euro-denominated return on Dutch deposits for this investor? The investor can earn 4.04% interest on his €1,000 therefore the investor will earn an interest of (€1,000 * 0.0404) = €40.40. So his return is (€1,000 + €40.40) = €1,040.40. Another way to have done that would have been (€1,000 * (1+0.0404)) = €1,0404.40. b. What is the (riskless) euro-denominated return on British deposits for this investor using forward cover? 𝐹 CPI = (1+i$) = (1+i€)𝐸$/€ => Dollar return on dollar deposits = Dollar return on $/€ euro deposits Forward Cover = 𝐹$/€ 𝐸$/€ Using the right portion of the CPI formula, and taking into account euros per pound instead, I calculate (1 + 0.02) * (1.575/1.5) = 1.071, then I multiply 1.071 which is the pound return on euro deposits with the number of euros to get the return (1.071 * €1,000) = €1,071. c. Is there an arbitrage opportunity here? Explain why or why not. Is this equilibrium in the forward exchange rate market? There is an arbitrage opportunity, because your return will be higher in Britain than in the Netherlands. You get a 4.04% and a 7.1% return in Britain ((1+0.02)*(1.575/1.5) = 7.1%) which is in the forward exchange market. d. If the spot rate is 1.5 euros per pound, and interest rates are as stated previously what is the equilibrium forward rate, according to covered interest parity (CIP)? 1+𝑖 Forward Rate = F$/€ = E $/€1+𝑖 $ € Therefore using the equation above taking into consideration euros per pound I get 1.5*((1+0.0404)/(1+0.02)) = €1.53 per pound. e. Suppose the forward rate takes the value given by your answer to (d). Compute the forward premium on the British pound for the Dutch investor (where exchange rates are in euros per pound). Is it positive or negative? Why do investors require this premium/ discount in equilibrium? Forward Premium = 𝐹$/€ 𝐸$/€ -1 Using the equation above but for euros per pound I get (1.53/1.50)-1 = 2%. The forward premium is positive, therefore, you can conclude the euro is expected to go through a 2% rate of depreciation. So the forward rate will be higher than the spot rate in forward contracts. f. If uncovered interest parity (UIP) holds, what is the-expected-depreciation of the euro (against the pound) over one year? 𝐸𝑒 UIP = (1+i$) = (1+i€) 𝐸 $/€ $/€ UIP approx. = i$ = i€ + ∆𝐸 𝑒 $/€ 𝐸$/€ => Dollar rate of return on dollar deposits = Expected dollar rate of return on euro deposit ∆𝐸 𝑒 $/€ /E$/€ = (𝐸 𝑒 $/€ - E$/€)/ E$/€ Forecast/Expected exchange rate = 𝐸 𝑒 $/€ , expected depreciation is the change in it. We can convert UIP approx. into equation I get ∆𝐸 𝑒 $/€ 𝐸$/€ ∆𝐸 𝑒 $/€ 𝐸$/€ = i$-i€ taking into account pounds per euro in the = 4.04% - 2.0% = 2.04%. So the euro is expected to depreciate at 2.04%. Now I can change the equation to UIP to solve for 𝐸 𝑒 $/€ = E$/€ *((1+i$) /(1+i€)) again considering pounds per euro I get (1/1.5)*((1+0.02)/(1+0.0404))= 0.654 pounds per euro. Now to solve for ∆𝐸 𝑒 $/€ so I must take 0.654 * 0.0204 = 1.33%. So the depreciation in the euro is 1.33%. g. Based on your answer to (f), what is the expected euro-pound exchange rate one year ahead? Using the expected depreciation of euros 2.04% and applying it to the expected change rate 0.654 pounds per euro. I get (1+0.0204)*0.654 = 0.667 pounds per euro. Taking the difference of 0.677 – 0.654 I get 1.53 which implies the new spot rate. 2. a. Go to http://www.oanda.com/ and find the exchange rate E(Euro/British Pound) for September 1, 2009 (or the closest available date) and for September 1, 2010 (or the closest available date). State the numbers and explain whether the pound appreciated or depreciated against the euro over this time period. Make sure you use the exchange rate definition asked for in the assignment. The exchange rate on September 1, 2009 was 0.88050 euros per pound and on September 1, 2009 it was 0.82430 euros per pound. Therefore the pound depreciated is (0.824300.88050)/0.88050 = -0.0638 or a depreciation of 6.38%. b. Use the Currency Graph function at oanda.com (go to Currency Tools and scroll to Currency Graph) to show the US. dollar exchange rate (E$/ForCurrency) the Chinese yuan (renminbi), and the Venezuelan bolivar for the time period 2001 - 2010. Also, find the Euro exchange rate for the Estonian Kroon (EEuro/Kroon). Look at the graphs and make a judgment as to whether each currency was fixed (peg or band, crawling (peg or band), or floating relative to the U.S. dollar during this time period. The IMF article referred to fixed or pegged versus floating regimes. The Chinese Yuan seems to be crawling peg to the US dollar because the percent change was 0 for the beginning of the 10 years. However it seems that around 2005 they began to diversify from the U.S. dollar, because the rate of change changed during that time, recently it’s maintained a constant change rate. However, I think that the Venezuelan bolivar is relatively fixed but still crawling because it varies but it constantly stays at the same percent change with the US dollar since around 2003. The drastic moves in change but constant changes suggest monetary policy is playing a part. As for the Estonia Kroon it seems to be fixed or pegged to the Euro there hasn’t seemed to be any percent change in the Kroon and Euro for the past 10 years therefore it must have a fixed exchange rate. 3. Briefly contrast the long-run effect of an expansionary fiscal policy (argue through an increase in G or a fall in T, both of which are considered expansionary here) in the closed economy with the effect of such an expansion in the small open economy. A small open economy takes into account net exports while a closed economy does not. A closed economy is concerned with Y=C+I+G and a small open economy is concerned with Y=C+I+G+NX. In a closed economy all savings and investment happen domestically (S=I) in a small open economy all savings and investment does not happen domestically. National Savings is S= (Y-C-T)+(T-G)=Y-C-G, and S = I+NX or S-I=NX for an small open economy. An increase in G would mean that output would increase in both an open and closed economy in the short run. However, in the long run increasing G would lower savings. So a lower savings means lower investment in a closed economy because in a closed economy S=I, and for a small open economy savings also lowers which reduces NX. So the result is the same for small and closed economies that in the long run nothing happens there is no change in output. Similarly a fall in T would increase C and increase Y or output in the short run. Like before an increase in C lowers savings so that in the long run for a closed and open economy the output remains unchanged. b. In the long-run model, the difference (T-G) measures the government budget deficit or surplus. Explain the difference between the budget deficit and the trade deficit. What type of policy would reduce a budget deficit? What type of policy would reduce a trade deficit? A budget deficit occurs when spending is greater than income, and a trade deficit occurs when imports are greater than exports. To reduce budget deficit the government could reduce its overall spending and to reduce trade deficit the government could reduce imports by perhaps taxing imports greater than exports. c. Look at the historical data of the U.S. budget deficit. For recent information consult the Treasury indicator from dismalscientist.com. Provide a print out from the dismal scientist relevant to the budget deficit. For a historical view, consult the table from the Economic Report of the President (http://www.gpoaccess.gov/eop/2008/B78.xls) . Briefly describe the historical trend and the future outlook for the U.S. budget. Treasury budget, $ bil Jul Jun 10 10 Surplus/deficit -165 -68.4 Receipts 155.5 251 Outlays 320.6 319.5 May 10 Apr 10 Mar 10 Feb 10 Jan 10 Dec 09 -135.9 146.8 282.7 -82.7 245.3 328 -65.4 153.4 218.7 -220.9 107.5 328.4 -42.6 205.2 247.9 -91.4 218.9 310.3 U.S. Budget 300.0 200.0 100.0 Billions of dollars -100.0 1940. 1944. 1948. 1952. 1956. 1960. 1964. 1968. 1972. 1976. 1979. 1983. 1987. 1991. 1995. 1999. 2003. 2007. 0.0 Budget -200.0 -300.0 -400.0 -500.0 Year Historically it seems like we’ve been on target with our budget since about 1946 but then in 1978 we started accumulating a large deficit which reached its high in 1992. After 1992 the deficit started to go down, and not until between 1997 and 1998 did the budget become balanced. Then we had a surplus from 1998 to 2001, our surplus reached its peak in 2000. However, after 2001 we started accumulating a huge deficit which slightly lowered between 2005 and 2007 but went back up drastically in 2008 after which it’s estimated to go back down slightly in 2009. So overall since the forties and seventies we had maintained a fairly balanced budget and after that the U.S. has mostly seen a budget deficit. I believe the budget deficit will lower in the future but I don’t think there will be a surplus anytime close in the future; especially since we have to pay back the stimulus money. I think in general people may be saving more but the government spent a lot stimulating the economy.