Chapter 3 (part 2)

Chapter 3

Adjusting the Accounts

ACCT 100

Objectives of the Chapter

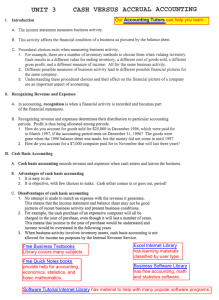

I. Introduce the accrual accounting concept.

II. Introduce the adjusting entries.

Accrual Accounting and the Financial Statements 2

I. Accrual Accounting

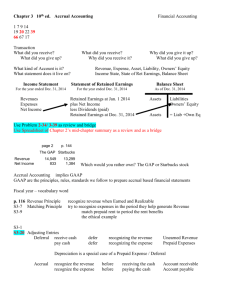

1. The time-period concept, the revenue recognition and the matching principles.

2. Accrual versus cash basis accounting.

Accrual Accounting and the Financial Statements 3

The Time-Period Concept (Periodicity)

Income and financial position of a business are reported periodically, not until the end of life of a business.

Accrual Accounting and the Financial Statements 4

Revenue Recognition Principle

(SFAS No. 5) (-An Accrual Basis)

Revenue is recognized when it is earned and realized.

Earned : the entity has substantially accomplished what it must do to be entitled to compensation.

Realized : goods are exchanged for cash or claims

.

In general, these conditions are met at time of sale (delivery) or when services are rendered regardless whether cash is collected or not .

Income Measurement And Profit Analysis 5

The Matching Principle

If revenues are recognized in a period, all related expenses should be recognized in the same period regardless whether expenses are paid or not.

The related expenses include traceable costs (i.e., product costs), period costs, (i.e., interest and rent expenses) and estimated/allocation expenses

(i.e., depreciation expense and bad debt expense).

Accrual Accounting and the Financial Statements 6

Accrual vs. Cash Basis Accounting

Accrual-basis accounting :

Revenues are recognized based on revenue recognition principle (i.e., recognized when realized and earned regardless whether cash is collected or not).

Expenses are recognized based on matching principle.

Note: revenue and expense recognize before cash settlement

.

Accrual Accounting and the Financial Statements 7

Accrual vs. Cash Basis Accounting

(contd.)

Cash-basis accounting :

The accountant does not record a transaction until cash is received or paid.

Cash-basis accounting is NOT acceptable for financial reporting.

Accrual Accounting and the Financial Statements 8

II. Adjusting Entries

Due to the periodicity concept, financial reports are prepared periodically.

Based on revenue recognition principle, adjusting entries are prepared at the end of a period to recognize revenues earned during the period but not yet recorded (i.e., accrued revenues).

Accrual Accounting and the Financial Statements 9

Adjusting Entries (contd.)

Based on the matching principle , the accrued expenses (i.e., expenses incurred but not yet paid/recorded) and estimated expenses (i.e., depreciation expense and bad debt expense) are recorded at the end of a period.

Accrual Accounting and the Financial Statements 10

Type

s

of Adjusting Entries

A. Accruals

B. Deferrals

C. Estimated Expenses

Accrual Accounting and the Financial Statements 11

A. Accruals

Unrecorded revenues or expenses (i.e., revenues earned or expenses occurred but not yet recorded).

a. Accrued expenses.

b. Accrued revenues.

Accrual Accounting and the Financial Statements 12

a. Accrued Expenses- An Example

A one-year note payable was issued on

11/1/x1 to purchase an equipment. The full amount of the note is $2,400. The annual interest rate is 10% and interests are paid on

4/30/x2 and 11/1/x2.

11/1/x1 Equipment

Note Payable

Adjusting Entry:

2,400

2,400

12/31/x1 Interest Expense 40

Interest payable 40

Accrual Accounting and the Financial Statements 13

b. Accrued Revenues – An

Example

A one year note was received from a credit sale with a face amount of $3,000 and an annual interest rate of 12% on 9/1/x1.

Interests are received on 3/1/x2 and 9/1/x2.

9 /1/x1 Note Receivable 3,000

Sales Revenue

Adjusting Entry:

12/31/x1 Interest Receivable 120

3,000

Interest Revenue 120

Accrual Accounting and the Financial Statements 14

B. Deferrals

Postponing the recognition of Revenues or expenses a. Unearned revenues b. Prepaid expenses

Accrual Accounting and the Financial Statements 15

a. Unearned Revenues

Receiving $2,400 for a one-year advanced rent payment from a tenant on 12/1/x1

(B/S Approach)

12/1/x1

Cash 2,400

Unearned Rent 2,400

12/30/x1

Unearned Rent 200

Rent Revenue 200

(I/S Approach)

12/1/x1

Cash 2,400

Rent Revenue 2,400

12/30/x1

Rent Revenue 2,200

Rent Unearned 2,200

Accrual Accounting and the Financial Statements 16

b. Prepaid Expense

Prepaid a 12 month insurance premium of

$1,200 on 11/1/x1

(B/S Approach)

Prepaid Insur. 1,200

Cash 1,200

12/31/x1

Insurance Exp. 200

Prepaid Insurance 200

(I/S Approach)

Insurance Exp. 1,200

Cash 1,200

12/31/x1

Prepaid Insur. 1,000

Insurance Exp.

1,000

Accrual Accounting and the Financial Statements 17

C. Estimated Expenses

(based on the matching principle)

Depreciation Expense

12/31 Depreciation Expense

Accumulated Depreciation

XXX

XXX

Bad Debt Expense

12/31 Bad Debt Expense

Allowance for B/D

Income Tax Expense

12/31 Income Tax Expense

Income Tax Payable

XXX

XXX

XXX

XXX

Accrual Accounting and the Financial Statements 18

Example

(from Financial Accounting by Harrison and Horngren)

:

Information for Adjustments at 4/30/ 19x1

(a) Prepaid rent expired, $1,000.

(b) Supplies on hand, $400 (balance of supplies equals $700 before adjustment).

(c) Depreciation on furniture, $275.

(d) Accrued salary expense, $950.

(e) Accrued service revenue, $250.

(f) Amount of unearned service revenue that has been earned, $150.

(g) Accrued income tax expense, $540.

Accrual Accounting and the Financial Statements

Adjusting Entries

(a) Rent Expense

Prepaid Rent

To record rent expense.

(b) Supplies Expense

Supplies

To record supplies used.

1,000

300

(c) Depreciation Exp. - Furniture

Accumulated Depr. - Furniture

275

To record depreciation on furniture.

(d) Salary Expense

Salary Payable

To accrue salary expense.

950

Accrual Accounting and the Financial Statements

1,000

300

275

950

Exhibit 3-9 Panel B (contd.)

(e) Accounts Receivable

Service Revenue

To accrue service revenue.

250

250

(f) Unearned Service Revenue

Service Revenue

150

150

To record unearned revenue that has been earned.

(g) Income Tax Expense

Income Tax Payable

To accrue income tax expense.

540

540

Accrual Accounting and the Financial Statements