Development Reference Guide (doc)

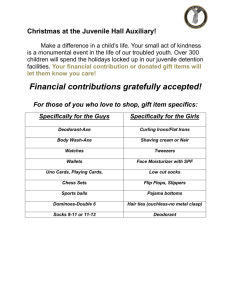

advertisement