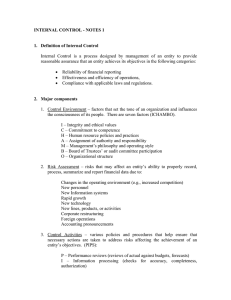

AIS Internal Control

advertisement

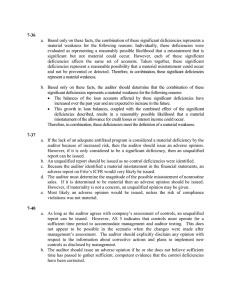

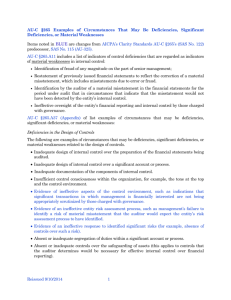

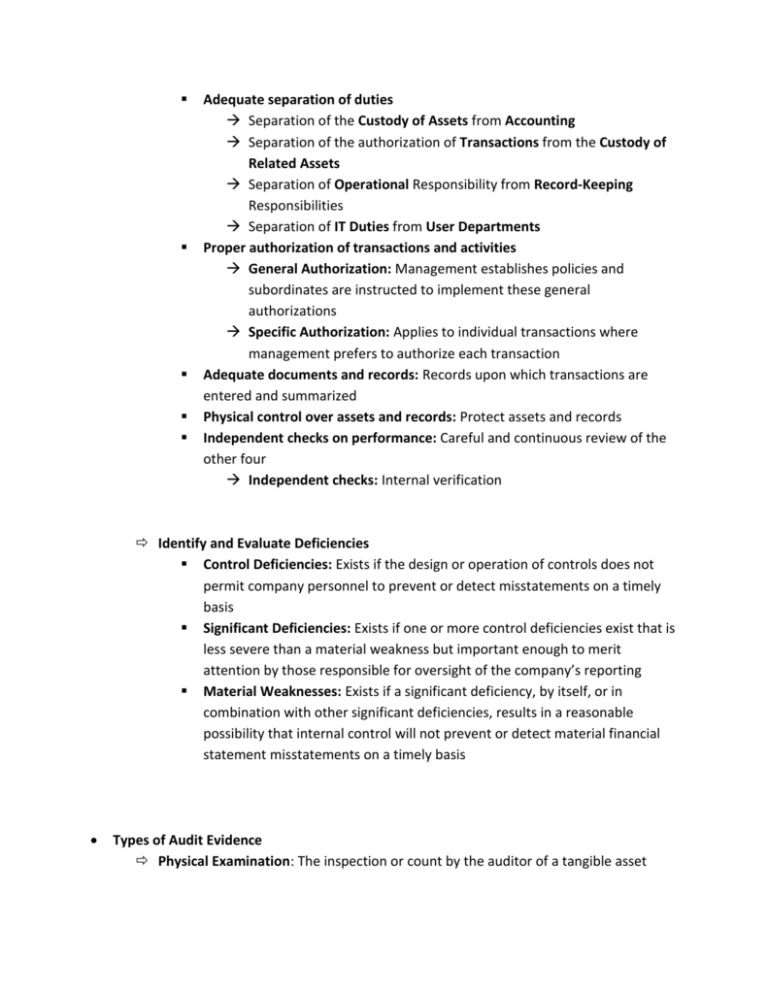

Adequate separation of duties Separation of the Custody of Assets from Accounting Separation of the authorization of Transactions from the Custody of Related Assets Separation of Operational Responsibility from Record-Keeping Responsibilities Separation of IT Duties from User Departments Proper authorization of transactions and activities General Authorization: Management establishes policies and subordinates are instructed to implement these general authorizations Specific Authorization: Applies to individual transactions where management prefers to authorize each transaction Adequate documents and records: Records upon which transactions are entered and summarized Physical control over assets and records: Protect assets and records Independent checks on performance: Careful and continuous review of the other four Independent checks: Internal verification Identify and Evaluate Deficiencies Control Deficiencies: Exists if the design or operation of controls does not permit company personnel to prevent or detect misstatements on a timely basis Significant Deficiencies: Exists if one or more control deficiencies exist that is less severe than a material weakness but important enough to merit attention by those responsible for oversight of the company’s reporting Material Weaknesses: Exists if a significant deficiency, by itself, or in combination with other significant deficiencies, results in a reasonable possibility that internal control will not prevent or detect material financial statement misstatements on a timely basis Types of Audit Evidence Physical Examination: The inspection or count by the auditor of a tangible asset Confirmation: The receipt of a written or oral response from an independent third party verifying the accuracy of information that was requested by the auditor Documentation: The auditor’s inspection of the client’s documents and records to substantiate the information that is, or should be, included in the financial statements Internal Document: Prepared and used within the client’s organization and is retained without ever going to an outside arty External Document: Handled by someone outside the client’s organization who is a party to the transaction being documented, but which are either currently held by the client or readily accessible Vouching: Process of auditors using documentation to support recorded transactions or amounts Analytical Procedures: Comparison and relationships to assess whether account balances or other data appear reasonable compared to the auditor’s expectations Purpose Understand Client’s Industry and Business Asses Entity’s Ability to Continue as a Going Concern Indicate Presence of Possible Misstatements in Financial Statements Reduce Detailed Audit Tests Inquiries of the Client: Obtaining of written or oral information from the client in response to questions from the auditor Recalculation: Rechecking a sample of calculations made by the client Re-performance: The auditor’s independent tests of client accounting procedures or controls that were originally done as part of the entity’s accounting and internal control system Redo the task and follow it through the system Sales walk-through Observation: The use of senses to assess client activities Evaluate Internal Control Implementation Update and evaluate auditor’s previous experience with the entity Make inquiries of client personnel Examine documents and records Observe entity activities and operations Perform walkthroughs of the accounting system