Click here to details

advertisement

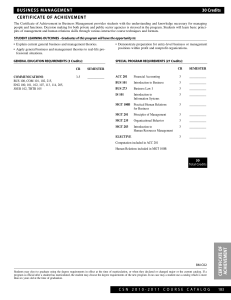

UNIVERSITY OF JOS, JOS – NIGERIA FACULTY OF MANAGEMENT SCIENCES DEPARTMENT OF ACCOUNTING REVISED POSTGRADUATE PROGRAMMES (a) Postgraduate Diploma in Accounting (PGDA) (b) Master of Science (M.Sc.) in Accounting, and (c) Master of Philosophy/Doctor of Philosophy (M.Phil/Ph.D) in Accounting. March, 2015 1 UNIVERSITY OF JOS, JOS – NIGERIA FACULTY OF MANAGEMENT SCIENCES DEPARTMENT OF ACCOUNTING REVISED PROGRAMME FOR POSTGRADUATE DIPLOMA IN ACCOUNTING (PGDA) 2 1. THE POSTGRADUATE DIPLOMA IN ACCOUNTING (PGDA) The Department of Accounting shall offer courses leading to the award of a Postgraduate Diploma in Accounting (PGDA). Philosophy The philosophy of PGDA is to reinforce the intellectual capacity of students in the accounting discipline so as to equip them with adequate knowledge required for understanding and analyzing basic issues relevant in both the public and private sectors of the Nigerian economy. Objectives The objectives of the Postgraduate Diploma in Accounting of the University of Jos are to: (a) develop the competence of students in the basic accounting concepts and conventions; (b) teach students about the functions of accountants in recording, classifying, summarizing and analyzing data to assist the process of decision making in both private and public sectors; (c) train non-accounting graduates who are already serving as accountants in the economy and those wishing to be accountants into the field of accounting; (d) provide intellectual foundation in Accounting for students to enable them, on graduation, pursue further studies at the professional or higher degree level, and (e) to equip students with the theoretical and conceptual tools for problem solving in the administration of industrial, commercial, public and other human organizations. Entry qualifications Holders of the following qualifications may be considered for admission into the PGDA programme of the University: (a) First degree of the University of Jos or of any other recognized university with a pass at not less than Second Class Honours (Lower Division) in Economics, Business Administration, Marketing, Mathematics, Computer Science, Statistics or any other field but with credits in English Language and Mathematics/Statistics at the ‘O’ Level examinations; (b) Bachelor’s Degree in Accounting from any recognized University not lower than Third Class Honours Division; (c) Higher National Diploma at Upper Credit Level in addition to professional accounting certification. Duration of the Course The PGDA programme shall spread over a minimum of two (2) semesters and a maximum of four (4) semesters. Mode of Study The PGDA programme shall be run on full-time basis. The programme shall consist of course work and a final research project. 3 Examinations The pass mark for each course is 50%. Candidates shall be assessed by: (a) Continuous assessments which shall comprise of written and oral tests, attendance and participation in class work, paper presentation, and group works which shall account for 30%; and (b) End of semester examinations which shall account for the remaining 70% to make up the maximum score of 100%. At the end of the programme, candidates failing to make a pass mark in any subject shall be allowed to re-sit such a paper provided that such failed papers on the aggregate do not add up to more than 8 credit units. Candidates failing in more than 8 credit units but not more than 12 credit units shall be required to repeat the failed courses. Candidates failing in any paper during the re-sit examination shall be required to repeat the relevant subject(s). Re-sit examination candidates shall be credited with a maximum of 50%. There shall be a re-sit examination fee which is subject to review from time to time. Candidates failing in more than 12 credit units in each academic year shall be required to withdraw from the programme. Credit Load The required credits to qualify a candidate for the award of the Postgraduate Diploma in Accounting of the University of Jos is a minimum of 30 and a maximum of 34. Fees and Charges Fees and charges for the PGDA programme shall be guided by the University of Jos Postgraduate School decision on fees and charges of non-NUC funded postgraduate diploma programmes. 4 Course Structure 1st Semester Course Code Course Title PGDA 701 Principles of Accounting “ 702 Principles of Taxation “ 703 Quantitative Techniques “ 704 Principles of Micro Economics “ 705 Principles of Management “ 706 Auditing Principles and Practice “ 707 Research Methods PGDA 708 “ 709 Credit Hour 2 2 2 2 2 2 2 14 Electives Public Finance Computer Applications in Business 2 2 2nd Semester PGDA 711 “ 712 “ 713 “ 714 “ 715 “ 716 “ 700 Principles of Finance Intro to Cost and Management Accounting Intro to Inter Fin Reporting Standards Principles of Macro Economics Business Law Public Sector Accounting Research Project PGDA 717 “ 718 Electives Small Business Finance Nigerian Economy 5 2 2 2 2 2 2 4 16 2 2 Course Description PGDA 701 Principles of Accounting 2 Credits The aim of this course is to inculcate in the students the understanding of the principles and concepts of accounting and the ability to prepare accounting records up to balance sheet level. At the end of the course students are expected to know: Accounting concepts, history of accounting, the books of original entry, bank reconciliation statements, ledger accounts, trial balance, correction of errors, trading account, profit and loss account, the balance sheet, final accounts with adjustments, manufacturing accounts, accounts of non-trading organizations, and single entry book keeping. PGDA 702 Principles of Taxation 2 Credits The course is designed to provide the students with the understanding of the Nigerian tax system, at the end of the course students should understand: general principles of taxation, personal income administration, income tax regulation in Nigeria, company income tax system, tax reliefs, capital gains tax, petroleum tax, capital transfer tax, property tax, provision of Industrial Development Act, computation of the various types of taxes. PGDA 703 Quantitative Techniques 2 Credits The nature and objectives of Statistics, frequency distributions, measures of dispersion, essentials of probability, statistical distribution, basic sampling techniques, decision theory, index numbers, time series, correlation and regression analysis, introduction to linear programming, practical in the use of computer in problem solving. PGDA 704 Principles of Micro Economics 2 Credits Economics system and organization, demand and supply, individual consumer behavior, the utility and indifference curve approaches, market classifications, the principles of production, the firm and perfect competition, pure monopoly, monopolistic and oligopolistic competitions, pricing and employment of resources. PGDA 705 Principles of Management 2 Credits The course is designed to inculcate in the students the knowledge of organizations, the various theories of management and organizational behavior. At the end of the course students should understand: Organization and organizational structure, management styles, classical organization theory, human relations school,, informal organization, bureaucracy, politics and administration relations, personal administration, administrative decision making, control and accountability, organization of job design, analysis and staffing. PGDA 706 Auditing Principles and Practice 2 Credits The aim of this course is to inculcate in the students the understanding of the essence and objective of an audit and general auditing practice in relation to the requirements of the various types of organizations within the legal and economic environment. At the end of the course students are expected to know: definition and scope of auditing, nature and purpose of auditing, audit planning, audit procedures, audit report, regulatory and professional requirements, audit policy, and investigations. 6 PGDA 707 Research Methods 2 Credits The course aims at enabling students acquire and apply statistical skills necessary for the conduct and evaluation of research problems. At the end of the course students are expected to understand choice of researchable topics, research design, writing of proposals, formulation of hypothesis, methods of data collection, statistical measures of data, and research report writing. PGDA 708 Public Finance 2 Credits Federalism and public finance, direct and indirect taxation in Nigeria, operation of federal and state finance, fiscal system, public debt policy, role of public corporations, role of central bank, commercial and development banks, the budgeting cycle and public expenditure control, the budget process. PGDA 709 Computer Applications in Business 2 Credits Introduction to basic programming, data types, constant and variables, statement types, assignment statements, input-output statements, control statements. PGDA 711 Principles of Finance 2 Credits It is expected that the course will inculcate in the students the workings of the Nigerian Financial System, competence to evaluate alternative courses of action, ability to consider optimum deployment of resources, ability to judge performance and competence to assess investment possibilities. At the end of the course students should understand: Nigerian Financial System, financial reports, working capital management, dividend policy, cost of capital, capital investment appraisal, valuation of the firm, theory of capital structure, business failures and liquidation, reorganization of businesses, mergers and acquisition, and financing of the small business. PGDA 712 Intro to Cost and Magt Accounting 2 Credits This course is designed to introduce the students to costing principles and applications of management accounting in both manufacturing and service industries. At the end of the course students are expected to understand: differences between cost accounting and financial accounting, costing elements, costs classification, installation of costing system, store organization and stock valuation, labour cost control and remuneration schemes, overheads and methods of cost absorption, pre–planning through break-even analysis, job/batch costing and contract accounts, service costing, process costing, budgets and budgetary control, standard costing, variance analysis and performance evaluation and control, and investment appraisal. PGDA 713 Intro to International Financial Reporting Standards 2 Credits Brief history of IFRSs; the financial reporting hierarchy, first-time adoption of IFRS; IFRS financial statements; Assets and Liabilities; revenue and expenses; IFRS for SMEs IFRS for special transactions such as business combinations, leases, government grants and assistance; etc; Current and future developments. 7 PGDA 714 Principles of Macro Economics 2 Credits The emphasis in this course is on the macro, or aggregative aspect of the economy. Topics include national income account, the determination of the level of aggregate output, employment and prices, the monetary system, monetary and fiscal policies, economic growth, and international monetary economics. PGDA 715 Business Law 2 Credits The aim of this course is to enable the students understand the basic law relating to business. At the end of the course students should understand: nature of law of contract, form of contract, formation of contract, terms of contract, discharge of contract, remedies, law of a sale of goods, negotiable instruments, hire-purchase, the various statutory provision of sale, and elements of partnership and company law. PGDA 716 Public Sector Accounting 2 Credits Introduction to Public Sector Accounting; - distinction between Public and Private sectors, basic accounting for notfor profit (NFP), Classification of NFP, basic characteristics of governmental accounting. Structure of Governmental Accounting in Nigeria, the Treasury. Audit Department, Consolidated Revenue Fund, Capital and Development Fund, Financial Accounting and Analysis - Use of sel f accounting system, fund . accounting system, · and standardized uniforms for transactions. Decision making and planning and control of public fund - application of costing methods, budgeting processes the use of Audit Department, Accounting for Local Government, Educational and Health institutions. History of international public sector accounting standards setting; IPSAS; current and future developments. PGDA 717 Small Business Finance 2 Credits This course focuses on the nature and operational character of the small business in Nigeria in terms of its socio-economic significance, operational procedures and problems. Topics covered include: the nature of small business, incorporating and starting a small business in Nigeria, ideal generation for a small business, raising small business finance and the small scale industries credit scheme, investment strategies for the small business, production management, marketing and personnel administration in the small business, ensuring cost effectiveness and greater productivity, planning for growth in the small business, succession crises, problems and future of small business in Nigeria. PGDA 718 Nigerian Economy 2 Credits The national development plans and their implications for growth and economic development, the ideological conflicts in economic planning, capitalism, socialism, mixed economy, international trade and bilateralism, economic cooperation in West Africa, major economic infrastructures, the Nigerian capital and money markets, economics of housing and urban development, the problems of growth and investment opportunities in Nigeria, indigenization, study of selected industries and public corporations, the policies of oil and OPEC, the agricultural development programmes, functions and accomplishments of Nigerian cooperatives, land tenure and the impact on agricultural development, manpower development, shortages and implications, the supply and demand situation in Nigeria. 8 PGDA 500 Research Project 2 Credit The course is compulsory. Students are expected to individually conduct a research on the topic of their choice in the area of accounting under the supervision of an assigned academic staff in the department. Facilities S/No Description 1 Internet/Computer Lab (Faculty Wide) 2 Departmental Postgraduate Research Centre 3 Digital Projector 4 Public Address System 5 Class Room (100-Seater) 6 Digital Photocopier 7 Faculty Library/e-resources S/N Staff List Name 1 A. A. Okwoli 2. 3. Qualification Rank Research interest B.Sc (1983) MBA (1986) Ph.D (2000) AMNIM (1989) CNA (2000) Professor Finance, Public Sector Accounting & Financial Accounting J. O. M. Ande B.Sc Acct (1979) (Mrs.) MSc. Accounting & Finance (1985) Ph.D (Accounting 2003) MNIM 1993 CNA 2000 Professor Management Information Systems, Auditing and Managerial Accounting F. Ojaide M.Sc Econs (1986) Ph.D Econs (1994) ACA (1982) FCA (1989) ACTI Professor Management Accounting Taxation BSc Mgt Studies (1987) MBA (1991), Ph.D (2006) ACA (1996) License to Practice (ICAN) 1997 ACTI (2004) Professor E. B. Ekoja 4. Quantity 2 1 2 1 1 1 1 9 and International Business & Finance 5. T. M. (Mrs) Nmadu B.Sc Bus Admin Professor (1979) MPA (1985) Ph.D (2006) 6. S. S. Maimako B.Sc Mgt Studies Professor (1987) MBA 1991, Ph.D 2006, ACA TQM, Accounting, and Auditing 7. S. A. Ocholi B.Sc Mgt Studies Professor (1981) MBA (1984) Ph.D (2008) Personnel Mgt, Industrial Relations, Comparative Mgt, Entrepreneurship 8. P. E. Arinze BBA (1975) M.Sc (1978) Ph.D (1985) Reader Public Finance, Managerial Economics. 9. E. S. Echu B.Sc Econs (1983) MBA (1987) Senior Lecturer 10 H. Bulus Senior Lecturer 11 K. O. Oladele 12 I. Othman M.Sc Statistics (1995) Ph.D Statistics (2006) B.Sc. Accounting 1989; M.Sc. Accounting and Finance 2003; MBA 2004, Ph.D 2013, CDS, 2013; MDS 2014, ACA, AMNIM B.Sc Mathematics MSc Mathematic MBA Management, Marketing Research, Business Analysis Research Method, Quantitative Technique, Statistics 13 M. Ogenyi 14 S. L. Jim Suleiman 15 U. V.Jatau 16 E. Egegwu 17 B. V. Gonji BSc Accounting MSc Economics MBA, ACA BSc Accounting MBA, PhD, ACA Senior Lecturer Research Methods, Quantitative Techniques, Cost & Mgt Accounting; Lecturer I Mathematics, Statistics, Quantitative Technique, Production Mgt Taxation Economics Lecturer I Lecturer I BSc Accounting Lecturer I MBA BSc Accounting Lecturer I MSc Accounting, ACA BSc Accounting Lecturer II MBA 10 HRM, Mgt theory, and Strategic Mgt and and Taxation, Auditing, International Accounting MIS, International Accounting Financial Accounting, Financial Management, IFRS International Accounting, Cost and Management 18 O. Moses 19 S. Nyahas BSc Accounting Lecturer II MSc Accounting, CNA BSc Accounting Lecturer II MSc Accounting, ACA 11 Accounting Financial Management, MIS, Financial Accounting International Accounting, Oil and Gas Accounting 2. MASTER OF SCIENCE (ACCOUNTING) DEGREE PROGRAMME: The Department of Accounting shall offer courses leading to the award of a Master of Science (M.Sc.) degree in Accounting and Finance. Philosophy The philosophy of the M.Sc. programme of the University of Jos is to provide graduate education and training in accounting which develops and deepens the spirit of enquiry and responsibility in the students, so as to take on research, teaching and administrative responsibilities in the public and private sectors of the national and global economies. To this end, the Department of Accounting teaches modern techniques and conducts functional researches to advance, impart and sustain knowledge and applications in financial reporting and analysis, management controls, and finance and investments. The Department ignites critical thinking in the students and provides extensive theoretical and practical skills required in order to function effectively and competitively as financial controllers, financial auditors, tax consultants, financial analysts and bank managers. As the global financial challenges expand, the Department nurtures intellectualism that provides a balance among competing quality parameters of strategic financing planning. Objective The basic objective of the M.Sc. in Accounting and Finance degree programme is to develop in the students’ sound knowledge and skills in the area of accounting and finance so as to provide high-level manpower for financial institutions, accounting firms, management consulting, tax consulting, industry, insurance, banking, stock broking, government and academia. The programme strives to provide a blend between technical skills on one hand, and in-depth theoretical knowledge on the other hand, so as to achieve an overall functional knowledge base. Specifically, the M.Sc. programme is designed to: (a) inculcate the requisite intellectual/conceptual foundations that will permit meaningful participation in the discussion or resolution of the problems which confront the accounting discipline in the contemporary world; (b) encourage research into problems which impede the maximum contribution of accounting to national development and well being of the people; (c) develop skill in logical reasoning and critical analysis and improve the capacity of students in formulating sound accounting policies and strategies. Entry Qualifications Holders of the following qualification may be considered for admission into the M.Sc (Accounting and Finance) programme of the University. (a) First Degree in Accounting of the University of Jos or of any other recognized university with pass at not less than Second Class Honours (Lower Division). 12 (b) (c) First Degree in Management Studies (Accounting major) of the University of Jos or of any other recognized university with a pass at not less than Second Class Honours (lower Division). Postgraduate Diploma in Accounting of the University of Jos or of any other recognized university with a minimum aggregate score of 60%. Duration of the Course The M.Sc. (Accounting) shall be run over a minimum of four (4) semesters and a maximum of six (6) semesters. Mode of Study The M.Sc. (Accounting) Degree programme shall be run on full- time basis. The programme shall consist of course work and dissertation. Examination The pass mark for each course is 50%. Candidates shall be assessed by: (a) Continuous assessments which shall comprise written and oral tests, attendance and participation in class work, paper presentation, and group works which shall account for 30%. (b) End of semester examinations which shall account for 70% to make up the maximum score of 100%. At the end of the first academic year, candidates failing to make a pass mark in any subject shall be allowed to re-sit such a paper provided that such failed papers on the aggregate do not add up to more than 8 credit units. Candidates failing in more than 8 credit units but not more than 12 credit units shall be required to repeat the failed courses. Candidates failing in any paper during the re-sit examination shall be required to repeat the relevant subject(s). Re-sit examination candidates shall be credited with a maximum score of 50%.There shall be a re-sit examination fee which is subject to review from time to time. Candidates failing in more than 12 credit units in each academic year shall be required to withdraw from the programme. Credit Load The required credit units to qualify a candidate for the award of the Master of Science (Accounting) of the University of Jos are a minimum of 38 and a maximum of 48. Fees and Charges Fees and charges for the M.Sc (Accounting) programme shall be guided by the University of Jos Postgraduate School decision on fees and charges of NUC funded professional master’s programme. 13 Course Structure Course Code ACC 801 “ 802 “ 803 “ 804 “ 805 1ST SEMESTER Course Title Financial Accounting Theory Management Accounting Theory Auditing Theory Corporate Finance Research Methods ACC 806 “ 807 Electives Portfolio Theory and Investment Analysis Management Theory and Practice ACC “ “ “ “ 2ND SEMESTER Management Information Systems International Accounting Public Sector Accounting Taxation Theory and Practice Economic Theory 811 812 813 814 815 Credit Hour 2 2 2 3 2 11 ACC 816 ACC 817 ACC 818 Electives Business Policy and Strategic Management International Business Finance Management of Financial Institutions ACC “ “ “ “ 3RD SEMESTER Oil and Gas Accounting Forensic Accounting and Investigation International Financial Reporting Standards Ethics and Corporate Governance M.Sc. Seminar 821 822 823 824 825 2 2 2 2 2 2 3 11 2 2 2 2 2 2 2 2 10 ACC 826 “ 827 “ 828 Electives Mining Accounting Public Finance Environmental Accounting 2 2 2 ACC 800 4TH SEMESTER Dissertation 6 14 Detailed Course Descriptions ACC 801 Financial Accounting Theory (2 Credits) This course is designed to introduce the students to theories of financial accounting. At the end of the course the students should have learnt theories surrounding most accounting practices. Areas of to cover include a review of basic accounting procedures, including the rationale of financial accounting and the economic foundations of accounting generally, elements of the history of accounting, working papers and interpretations of financial statements, including the analysis of working capital and statements of the cash flows, generally accepted accounting principles and net income concepts, including the valuation of stock and work-in-progress, the theory and techniques relating to balance sheet categories including cash, debtors, stock, investments, tangible and intangible non-current assets, liabilities and reserves, elements of the impact of price-level changes on financial statements. ACC 802 Management Accounting Theory (2 Credits) This course is designed to introduce the students to theories of management accounting. Areas covered include advanced treatments of: nature, scope and purpose of costing, theory of costing, elements of costing, material, labour and overhead (in outline only), cost allocation, apportionment, methods of costing, marginal costing, cost ascertainment, cost/volume/profit analysis, break-even analysis, standard costing, profit contribution, mix and yield variances, interpretation of variances and their relationships. ACC 803 Auditing theory (2 Credits) Advanced principles in external and internal auditing; practices and techniques, principles and practices of internal control, the auditor’s report, audit programme, international auditing standards, and professional ethics. ACC 804 Corporate Finance (3 Credits) Theory and measurement of business income, finance and growth-investment selection, business valuation, financial planning and budgeting, capital structure, sources of finance, gearing, cost of capital, financial criteria, new issue market and role of institutions, international comparisons. ACC 805 Research Methods (2 Credits) At the end of the course students are expected to understand: choice of researchable topics, writing of proposals, research design, formulation of hypothesis, methods of data collection, statistical and other measures of data, and research report writing. Research in Nigeria, ethics in management of research, business and social responsibility in research, research presentations, guest lectures. ACC 806 Portfolio Theory and Investment Analysis (2 Credit) Evaluation of securities, efficiency and technical analysis, ratio analysis, profit planning, definitions of capital projects, capital budgeting techniques, application of linear programming in capital projects, feasibility studies, project conceptualization, design, markets, technical economic analysis. ACC 807 Management Theory and Practice (2 Credits) Conventional and modern conceptions of management, definitions and dynamics of management theory, levels and features of theory in management, applications and relevance of theory in the Nigeria context, organizational design and outline 15 managing of group processes, problems of integration and control, managing change and development, modern issues in management theory. ACC 811 Management Information Systems (2 Credits) This course is aimed at inculcating in the students the ability to grasp the fundamentals, organization and uses of management information system in modern organizations. At the end of the course students should be able to understand: elements of mechanical and electronic computing, types of computers and their applications, computer programming using BASIC, COBOL and FORTRAN, manual and mechanized data processing systems, systems analysis and design, evaluation and administration of MIS with emphasis on computer based systems, meaning of information technology and its application in business finance and management. ACC 812 International Accounting (2 Credits) The course is designed to aid students in understanding accounting and financial problems of international organizations and their control. At the end of the course students should understand multi-national companies, accounting and control problems of foreign companies, and practical accounts of multi-national foreign companies. Foreign exchange market, interest rates and exchange rates, international investment decisions, currency risks, cost of capital for foreign investment, financing foreign operations, mergers, divestiture, financial and political risk, dividend policy and capital flight. ACC 813 Public Sector Accounting (2 Credits) The course is aimed at inculcating in the students the knowledge of the acquisition, allocation, and control of public funds, theory and practice of financial accounting in the public sector and problem of financial management in the public sector, areas to cover includes: Basis of government accounting methods, statutory laws of financial administration, budgets and budgeting, financial warrant, development planning, privatization and commercialization, sources of finance, financial control organs, books of accounts, pensions and gratuities, government Parastatals, auditing practice in government, federation account, fund accounting, government accounting theory and practical appropriation accounts, accounting process, treasury control accounts, ministry accounts, consolidation process. History and membership of International Federation of Accountants (IFAC), International Public Sector Accounting Standards (IPSAS), the need for convergence. ACC 814 Taxation Theory and Practice (2 Credits) The principle, practice and theory of the Nigerian system of income tax, corporation tax, capital gains tax and VAT. Tax theories and optimal taxation, computation and assessments in relation to individuals, partnerships and limited companies, procedures and practice relating to claims and appeals, Nigerian taxation in relation to foreign taxation. ACC 815 Economic Theory (3 Credits) The details are still being developed with assistance from the Department of Economics. ACC 816 Business policy and strategic management (2 Credits) The nature and dynamics of business policy, the strategy concept, missions and objectives. The strategic planning process, stakeholders, management, techniques 16 for strategic appraisal, SWOT, industry and competitive analysis, portfolio analysis, development of strategic options, turn around and recovery strategies, mergers, acquisitions and divestment. ACC 817 International Business Finance (2 Credits) The risks of doing business overseas, tools available to minimize those risks, foreign exchange risks, political risk, working capital management, long-term investments, financial and accounting control and management control. ACC 818 Management of Financial Institutions (2 Credits) A survey of the structure and operation of the market for medium and long-term securities, nature, types, sources and uses of term securities as well as the nature, objectives, structure, functions and practices of institutions such as the stock exchange, acceptance houses, trusts, investment banks, insurance companies, and international financial institutions. Economics and legal aspects of the capital market, analysis of interest rates, cost of capital, pricing securities, risk and dividend policies, and their implications for investment decision and income. ACC 821 Oil and Gas Accounting (2 Credits) Nigeria oil and gas industry; oil and gas accounting methods in historic perspective; successful efforts and full cost; accounting for revenue from oil and gas; oil and gas contracts; analysis of oil and gas companies’ financial statements. Gas pipeline accounting; Oil and gas tax accounting. ACC 822 Forensic Accounting and Investigation (2 Credits) Financial crimes, evidence gathering, net worth theory and solutions, expenditure theory and solutions, scenario case, accounting and audit techniques, fraud prevention, money laundering, banking and finance, audit programmes, computer crimes, fraud examiner, case review, use of Web CAAT for forensic investigation. ACC 823 International Financial Reporting Standards (2 Credits) Brief history of IFRSs; the financial reporting hierarchy, first-time adoption of IFRS; IFRS financial statements; Assets and Liabilities; revenue and expenses; IFRS for SMEs IFRS for special transactions such as business combinations, leases, government grants and assistance; etc; Current and future developments. ACC 824 Ethics and Corporate Governance (2 Credits) This course deals with specialized knowledge of elements of systems of corporate governance, their impact, applications and interdependencies. It covers: Meaning of corporate governance; code of corporate governance; issues of corporate governance; specific code of governance issued relating to specialized sectors in Nigeria, such as financial institutions, capital market etc; case study; Corporate Governance and the Theory of the Firm, The Board of Directors, The rationale for and impact of Best Practice Codes for Corporate Governance, Investors and Corporate Governance, Insider Ownership and Corporate Performance, Executive and Board Remuneration Decisions, The Market for Corporate Control: theory and evidence, Corporate Governance and Corporate Finance: capital structure and investment decisions, International aspects of corporate governance Code of ethics for professional accountants issued by International Ethics Standards Board of Accountants (IESBA) 17 ACC 825 M.Sc. Seminar (2 Credits) Each student is expected to present two seminar papers at the department. The seminar shall relate to an examination of current issues in accounting. ACC 826 Mining Accounting (2 Credits) History of the Nigerian extractive industry; the extractive industry, preproduction and reserve recognition; preparation of financial statements of extractive industries; IFRS 6: Exploration for and evaluation of mineral resources. Capital investment appraisal of mineral development; cost of capital and the consideration of taxation and inflation; options and their applicability to the extractive industry. Taxation of the mineral sector; mineral taxation method; fiscal policy and its implication for mineral taxation; mineral taxation regimes; Minerals and economic development; international best practice mineral policy and development; mineral development and the environment; Nigerian Minerals and Mining Act, 2007. ACC 827 Public Finance (2 Credits) The nature and scope of public finance, comparative models of financial management, profit maximization, welfare maximization, value for money and accountability models, objectives and functions of government, organization of government for financial management, the functions and responsibilities of the Chief Executive and Accounting Officer, the Accountant-General, the Revenue Collector, the Board of Survey, the Board of Inquiry, the Treasury Cash Officer/SubAccountant, the Store Officer etc. Finance and supplies, principles of revenue sharing in a federal system with Nigeria as case study, sources of revenue and their relative importance, the politics of revenue allocation in Nigeria, the allocated and unallocated stores system, the rationale for one establishment of allocated stores, the Nigerian public debt and its management, funded and unfunded methods of debt payments and provision for debt repayment. ACC 828 Environmental Accounting (2 Credits) Cost and control processes of the effects of productive activities on the environment, social responsibilities of organizations, social responsibility accounting. ACC 800 Dissertation (6 Credits) This course deals with creating the student’s ability to conduct sound and independent theoretical and empirical research in accounting. It is a compulsory course and each student is required to conduct individual research on a topic of his/her research interest under the supervision of an assigned lecturer in the department. The choice of a topic must meet the following criteria: New, Interesting, Researchable, Replicable and Defendable. A research proposal must be defended at the Faculty by each student before the actual conduct of the research. The completed dissertation shall be submitted at the end of the fourth semester of the programme. To qualify for the award of the degree, the dissertation must be successfully defended before an appointed external examiner. 18 Facilities S/No Description 1 Internet/Computer Lab (Faculty Wide) 2 Departmental Postgraduate Research Centre 3 Digital Projector 4 Public Address System 5 Class Room (100 Seater) 6 Digital Photocopier 7 Faculty Library/e-resources Quantity 2 1 2 1 1 1 1 S/N Staff List Name 1 A. A. Okwoli 2. J. O. M. Ande B.Sc Acct (1979) (Mrs.) MSc. Accounting & Finance (1985) Ph.D (Accounting 2003) MNIM 1993 CNA 2000 Professor Management Information Systems, Auditing and Managerial Accounting 3. F. Ojaide M.Sc Econs (1986) Ph.D Econs (1994) ACA (1982) FCA (1989) ACTI Professor Management Accounting Taxation BSc Mgt Studies (1987) MBA (1991), Ph.D (2006) ACA (1996) License to Practice (ICAN) 1997 ACTI (2004) Professor E. B. Ekoja 4. 5. T. M. (Mrs) 6. S. S. Maimako Qualification Rank Research interest B.Sc (1983) MBA (1986) Ph.D (2000) AMNIM (1989) CNA (2000) Professor Finance, Public Sector Accounting & Financial Accounting International & Finance and Business Nmadu B.Sc Bus Admin Professor HRM, Mgt theory, and (1979) Strategic Mgt MPA (1985) Ph.D (2006) B.Sc Mgt Studies Professor TQM, Accounting, and 19 (1987) MBA 1991 Ph.D 2006 ACA Auditing 7. S. A. Ocholi B.Sc Mgt Studies Professor Personnel Mgt, (1981) Industrial Relations, MBA (1984) Comparative Mgt, Ph.D (2008) Entrepreneurship 8. P. E. Arinze BBA (1975) M.Sc (1978) Ph.D (1985) Reader Public Finance, Managerial Economics. 9. E. S. Echu B.Sc Econs (1983) MBA (1987) Senior Lecturer 10 H. Bulus Senior Lecturer 11 K. O. Oladele 12 I. Othman 13 M. Ogenyi 14 S. L. Jim Suleiman M.Sc Statistics (1995) Ph.D Statistics (2006) B.Sc. Accounting 1989; M.Sc. Accounting and Finance 2003; MBA 2004, Ph.D 2013, CDS, 2013; MDS 2014, ACA, AMNIM B.Sc Mathematics MSc Mathematic MBA BSc Accounting MSc Economics MBA BSc Accounting MBA, PhD, ACA Management, Marketing Research, Business Analysis Research Method, Quantitative Technique, Statistics 15 U. V.Jatau 16 E. Egegwu Senior Lecturer Research Methods, Quantitative Techniques, Cost & Mgt Accounting; Lecturer 1 Mathematics, Statistics, Quantitative Technique, and Production Mgt Taxation and Economics Lecturer 1 Lecturer I Taxation, Auditing, International Accounting BSc Accounting Lecturer I MIS, International MBA Accounting BSc Accounting Lecturer I Financial Accounting, MSc Accounting, Financial Management, ACA IFRS 20 3. MASTER OF PHILOSOPHY/DOCTOR OF PHILOSOPHY (M Phil/Ph.D) DEGREE PROGRAMME IN ACCOUNTING Introduction The Department of Accounting offers courses leading to the award of a Doctor of Philosophy (Ph.D.) Degree in Accounting. Candidates who wish to pursue the programme leading to the award of Ph.D must first apply for and be admitted onto the M.Phil/Ph.D programme. Candidates on the M.Phil level are upgraded to full Ph.D status after successfully completing course work and presenting an acceptable proposal at the faculty level. Philosophy Accounting research is essentially empirical-archival, analytic or behavioral. The department therefore provides the requisite intellectual base for the promotion of high level learning that ensures quality and functional knowledge for teaching, research, and writing. The department encourages the creation of new research ideas that contribute to existing knowledge in a variety of areas in accounting. Objective The objective of the Ph.D. in Accounting degree programme is to provide doctoral students with a comprehensive and integrated knowledge on technical, research, publication and teaching capabilities in the area of accounting. It is designed to provide specialist education and training for researchers in tertiary institutions as well as for high level business managers. It provides general familiarity with critical knowledge of the various segments in the accounting discipline so that the doctoral graduate can impart his or her knowledge to others as colleagues, subordinates or students. Entry Qualifications Holders of the following may be considered for admission onto the M.Phil/Ph.D (Accounting) programme of the University: M.Sc (Accounting) of the University of Jos or of any other recognized university with a pass at not less than an average of 60% or a weighted score average (WSA) of 3.5 on a 5 point scale. Mode of Study The M.Phil/Ph.D (Accounting) degree programme shall be run on both fulltime and part-time bases. The programme shall consist of a course work and a thesis which must be defended to the satisfaction of an appointed external examiner. Candidates are required to present three seminars before graduation – a research programme seminar after one year of study, a seminar for upgrading from M.Phil to full Ph.D status and a seminar for the final report at both departmental and faculty levels. As part of the development of candidate’s communication skills and the training in the presentation of research findings, all candidates may be required to teach one or more undergraduate or postgraduate course(s) during the programme. A breakdown of the work load is as follows: (a) A minimum of 24 credit units of course work and 12 credit units of Thesis is required. This makes a total of 36 credit units as minimum. (b) The maximum credit units shall be 42. 21 (c) A Ph.D. Student from other recognized University may be allowed a credit transfer of not more than 18 credit units passed at the M.Phil/Ph.D., course work level in addition to a minimum of 60% or a weighted score average (WSA) of 3.5 on a 5 point scale at the Masters Degree level. Duration of the Course The duration of the M.Phil/Ph.D. (Accounting) programme is broken down as follows: Full Time A minimum of six (6) semesters and a maximum of ten (10) semesters. Part-Time A minimum of ten (10) semesters and a maximum of twelve (12) semesters. Extensions Request for extensions require a special approval of the School of Postgraduate Studies Board. Withdrawal A candidate may be required to withdraw from the M.Phil/Ph.D programme at any time if he or she does not display proven ability to benefit from research at that level. Examination This is guided by the University of Jos Postgraduate School guidelines on Ph.D examinations in force from year to year. Fees and Charges Fees and charges for the M.Phil/Ph.D (Accounting and Finance) programme shall be guided by the University of Jos Postgraduate school decision on fees and charges of NUC funded professional M.Phil/Ph.D programmes. Course Structure Course Code ACC 901 “ 902 “ 903 “ 904 “ 905 “ 906 ACC 907 CES 902 1ST SEMESTER Course Title Credit Hour History of Accounting Thought 3 Advanced Financial Accounting Theory 3 Advanced Management Theory 3 Advanced Research Methodology 3 Advanced Auditing Theory 3 Advanced Management Accounting Theory 3 18 Electives Advanced IT Applications 3 Seminar in Entrepreneurship 0 22 2ND SEMESTER ACC 911 912 913 914 915 “ 916 ACC ACC PGY ICT 910 917 903 904 ACC 900 Contemporary Issues in Accounting Advanced Theory of Corporate Finance 3 Contemporary Issues in Finance 3 Advanced Portfolio Theory & Management Environmental Accounting 3 Ph.D. Seminar 18 Electives Public Sector Accounting 3 Strategic Management 3 Pedagogy 0 Information and Communication Technology 0 3RD - 6TH SEMESTERS Thesis 3 3 3 12 Detailed Course Descriptions ACC 901 History of Accounting Thought (3 Credits) The nature and scope of accounting and its evolution, the accounting function and its relationship with the information systems of organization, accounting procedures and systems, source documents, books of original entry and books of accounts, double entry bookkeeping systems, the trial balance, accruals, prepayments and adjustments, provisions and reserves, classification of expenditure between capital and revenue, methods of recording accounting data in manual and mechanical form, manufacturing and trading accounts, accounting treatment of control accounts and bank reconciliation. ACC 902 Advanced Financial Accounting Theory (3 Credits) Further work on advanced company accounts including the accounts of banks and insurance companies, and the relevant acts, valuation of goodwill and company shares, divisible profits and company dividends, royalty and hire-purchase accounts, consolidated and other group accounts, elements of mechanized accounting, including the application of computers and related systems to business accounts, governmental, municipal and public utility accounting, with reference to Nigerian organizations, seminars on accounting systems, including business, governmental, municipal, and public utility accounting systems. ACC 903 Advanced Management Theory (3 Credits) Conventional and modern conceptions of management, definition and dynamics of management theory, levels and feature of theory in management, applications and relevance of theory in Nigerian context, organizational design and outline managing group processes, problems in integration & control, managing change & development, modern issues in management theory. ACC 904 Advanced Research Methodology (3 Credits) Introduction to research methodology, research in social sciences, research in physical and natural sciences, problems of research in developing countries, common errors in research, research in practice such as problem identification, 23 literature review, materials and methods (methodology), results (data analysis), discussions, summary, conclusions and recommendations, report writing. ACC 905 Advanced Auditing Theory (3 Credits) Evaluation of auditing procedures with particular reference to internal control systems, internal audit functions, sampling and statistical techniques, international standards of auditing, post audit review, audit of accounts of solicitors, charitable and non-trading organizations. ACC 906 Advanced Management Accounting Theory (3 Credits) This course aims at introducing students to the advanced theories and practice of management accounting in the decision making process. ACC 907 Advanced IT Applications (3 Credits) Computer simulation, modeling, management information systems, job shop scheduling, inventory and queuing systems and management games with examples from business, health, public and education administration. CES 902 Seminar in Entrepreneurship (3 Credits) Students will gain a well-developed understanding of business enterprises and entrepreneurial thinking that drives them in a dynamic, competitive, regional, national and global economy. Students will learn to apply entrepreneurial practices (e.g. using case analysis) to organizations of varying sizes. An integral component, futures studies, shall an introduction into thinking about the future, the foundation of the field, its methodologies, link to planning, decision-making, strategy and public policy, the relationship between core competences and key success factors. ACC 910 Public Sector Accounting (3 Credits) Basic accounting for non-profit organization, basic characteristics of government accounting, structure of governmental accounting in Nigeria, the treasury, audit department, consolidated revenue fund, capital and development fund, planning, programming and budgeting system (PPBS), international public sector accounting standards. ACC 911 Contemporary Issues in Accounting (3 Credits) Discussion and articulation of recent developments in the accounting literature. ACC 912 Advanced Theory of Corporate Finance (3 Credits) The principles and procedures underlying financial statements, financial transactions, alternative accounting statements, tools of analysis of ratios and other quantitative measures, accounting information useful for managerial action, application of information in decision situations, project appraisal, analysis of investment projects, the impact of risk, tax and inflation, the term structure of interest rates, the cost of capital and target rate of return, capital markets – efficiency, role of intermediaries, sources of finance, the borrowing decision and company valuation and optimal portfolio allocation, capital structure – optimal capital structure of firms, mergers and acquisition and the market for corporate control, gearing, the basis of hedging and international finance. ACC 913 Contemporary Issues in Finance (3 Credits) This is a seminar to address emerging issues in theoretical and empirical literature in finance. 24 ACC 914 Advanced Portfolio Theory & Management (3 Credits) This course provides an advanced treatment of investment portfolio theories, computer enhanced models used to provide instruction in capital asset portfolio management and technique, advanced treatment of diversification theories & applications in asset selection, analysis & management, and risk management. ACC 915 Environmental Accounting (3 Credits) Cost and control processes of the effects of productive activities on the environment, social responsibilities of organizations, social responsibility accounting. ACC 914 Ph.D. Seminar (3 Credits) The Ph.D. seminar is divided into two parts: seminar on contemporary accounting topics, and teaching seminar. Seminar on Contemporary Accounting Topics (also called the Ph.D. Lyceum) This is an introductory seminar that connects Ph.D. students with a variety of faculty members. Each accounting faculty introduces his/her research and teaching interests to the doctoral students. For each accounting faculty, students are required to discuss a wide range of readings relating to research and teaching expectations of an accounting educator, as well as the integration of research and teaching. Subsequently, each student is expected to present two seminar papers at the department. The seminar shall relate to an examination of current issues in accounting. Teaching Seminar It is a compulsory requirement for all Ph.D. students to teach one (1) course per semester during the one (1) year of course work. However, teaching staff of University of Jos are exempted from this seminar. Similarly, Ph.D. students with university teaching experience may be exempted from this seminar depending on departmental need. The essence is to develop and sharpen the Ph.D. students’ teaching skills with the ultimate objective of turning them into proven accounting educators. ACC 917 Strategic Management (3 Credits) The nature and dynamics of business policy, the strategy concept, missions and objectives. The strategic planning process, stakeholders, management, techniques for strategic appraisal, SWOT, industry and competitive analysis, portfolio analysis, development of strategic options, turn around and recovery strategies, mergers, acquisitions and divestment. ACC 900 Thesis (12 Credits) A Ph.D. student is expected to produce a sound thesis proposal under the guidance of his/her supervisor. The thesis proposal must comprehensively deal with introduction, literature review, and expected methodology. When the supervisor is satisfied with the student’s progress, the supervisor will present the student at the faculty to propose his or her research. If the proposal is successfully defended, the student then advances to Ph.D. candidacy. If the student did not show evidence of scholarship and failed in the proposal defense, he/she will not advance to Ph.D. candidacy and will be awarded an M.Phil. in Accounting. 25 When the final thesis of a Ph.D. candidate obtains the approval of the supervisor, the candidate is presented to the faculty to defend his/her entire research before an appointed internal examiner. If the candidate successfully defended the thesis at the internal defense, he/she must also successfully defend the thesis before an appointed external examiner to qualify for the award of the degree. The style and format of the thesis is as advised from time to time by the Postgraduate School. Facilities S/No Description 1 Internet/Computer Lab (Faculty Wide) 2 Departmental Postgraduate Research Centre 3 Digital Projector 4 Public Address System 5 Class Room (100 Seater) 6 Digital Photocopier 7 Faculty Library/e-resources S/N Staff List Name 1 A. A. Okwoli 2. 3. Qualification Rank Quantity 2 1 2 1 1 1 1 Research interest B.Sc (1983) MBA (1986) Ph.D (2000) AMNIM (1989) CNA (2000) J. O. M. Ande B.Sc Acct (1979) (Mrs.) MSc. Accounting & Finance (1985) Ph.D (Accounting 2003) MNIM 1993 CNA 2000 Professor Finance, Public Sector Accounting & Financial Accounting F. Ojaide Professor Management Accounting Taxation M.Sc Econs (1986) Ph.D Econs (1994) ACA (1982) FCA (1989) ACTI 4. E. B. Ekoja 5. T. M. (Mrs) Professor Management Information Systems, Auditing and Managerial Accounting and BSc Mgt Studies International Business (1987) Professor & Finance MBA (1991), Ph.D (2006) ACA (1996) License to Practice (ICAN) 1997 ACTI (2004) Nmadu B.Sc Bus Admin HRM, Mgt theory, and (1979) Professor Strategic Mgt 26 MPA (1985) Ph.D (2006) B.Sc Mgt Studies TQM, Accounting, and (1987) Professor Auditing MBA 1991 Ph.D 2006, ACA 6. S. S. Maimako 7. S. A. Ocholi B.Sc Mgt Studies Professor Personnel Mgt, (1981) Industrial Relations, MBA (1984) Comparative Mgt, Ph.D (2008) Entrepreneurship 8. P. E. Arinze 9. H. Bulus 10 K. O. Oladele BBA (1975) M.Sc (1978) Ph.D (1985) M.Sc Statistics (1995) Ph.D Statistics (2006) B.Sc. Accounting 1989; M.Sc. Accounting and Finance 2003; MBA 2004, Ph.D 2013, CDS, 2013; MDS 2014 27 Reader Public Finance, Managerial Economics. Senior Lecturer Research Method, Quantitative Technique, Statistics Senior Lecturer Research Methods, Quantitative Techniques, Cost & Mgt Accounting;