Winter 2008 – Quiz 2

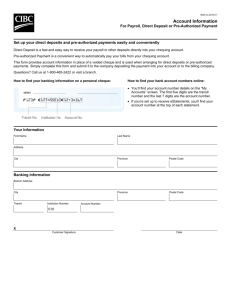

advertisement

Quiz 2 Question 1 The prime interest rate is 1 / 1 point a) set by the Bank of Canada. b) the interest rate used for unsecured loans. c) the interest rate on Canada Bonds. d) the interest rate the financial institutions charge their best customers. Question 2 The fewest financial services would probably be offered by a(n) 1 / 1 point credit union. trust company. chartered bank. investment company. Question 3 The rate of return on a savings account may also be referred to as 1 / 1 point yield. compounding. liquidity. equity. Question 4 The savings plan that is likely to have a set rate of return is a 1 / 1 point money market account. guaranteed investment certificate. debit card account. money market fund. Downloaded for free at www.uofgexamnetwork.com 1 Question 5 A personal cheque with guaranteed payment is a 1 / 1 point certified cheque. bank draft. cashier's cheque. money order. Question 6 The effective annual rate (EAR) formula is used to 1 / 1 point take inflation into account. calculate the nominal rate of return. incorporate compounding. determine your real rate of return. Question 7 The best method of comparing credit cost is to use the 1 / 1 point time value of money. effective annual cost. declining balance method. add-on and adjusted balance method. 1 / 1 point Question 8 Some creditors add finance charges after subtracting payments made during the billing period. This is called the previous balance method. average daily balance method. adjusted balance method. annual percentage rate method. Question 9 Consumer credit counselling services Downloaded for free at www.uofgexamnetwork.com 1 / 1 point 2 are nonprofit organizations that help families with severe financial difficulties. extend consolidation loans. sell credit insurance. are lending institutions. 1 / 1 point Question 10 Most lending institutions believe that an individual or family can afford to spend about _____ percent of their gross income on housing costs. 20 30 40 50 Question 11 A _____________ allows a person to borrow on the paid-up value of a home. 1 / 1 point conventional mortgage vendor-take-back mortgage home equity line of credit second mortgage After-tax return 1 / 1 point Question 12 What is the after-tax return if the interest rate is 4% on a GIC and you have a MTR of 31.15% ? 1.25% 2.75% 3.12% Installment loan payment 0 / 1 point Question 13 John took out a $15,000 loan for 3 years with an 8% annual interest rate. What is the monthly loan payment? 416 Downloaded for free at www.uofgexamnetwork.com 3 470 525 747 Question 14 The major difference between a term deposit and a GIC is 1 / 1 point the length of time to maturity. the size of the minimum deposit required. the accessibility of the funds. the eligibility for CDIC insurance 1 / 1 point Question 15 Peter needs to reconcile his chequing account. His chequing account record shows a balance of $1681.45 and his bank statement shows a balance of $1753.23. His account earned interest of $.03, had bank fees of $6.25 and there is a cheque for $78 that has not cleared. What is the balance of his chequing account after the reconciliation? (use following format $#,###.##) Answer: $1,675.23 Downloaded for free at www.uofgexamnetwork.com 4