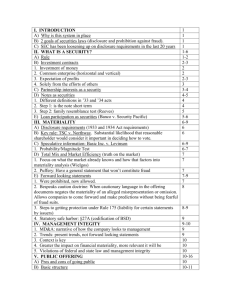

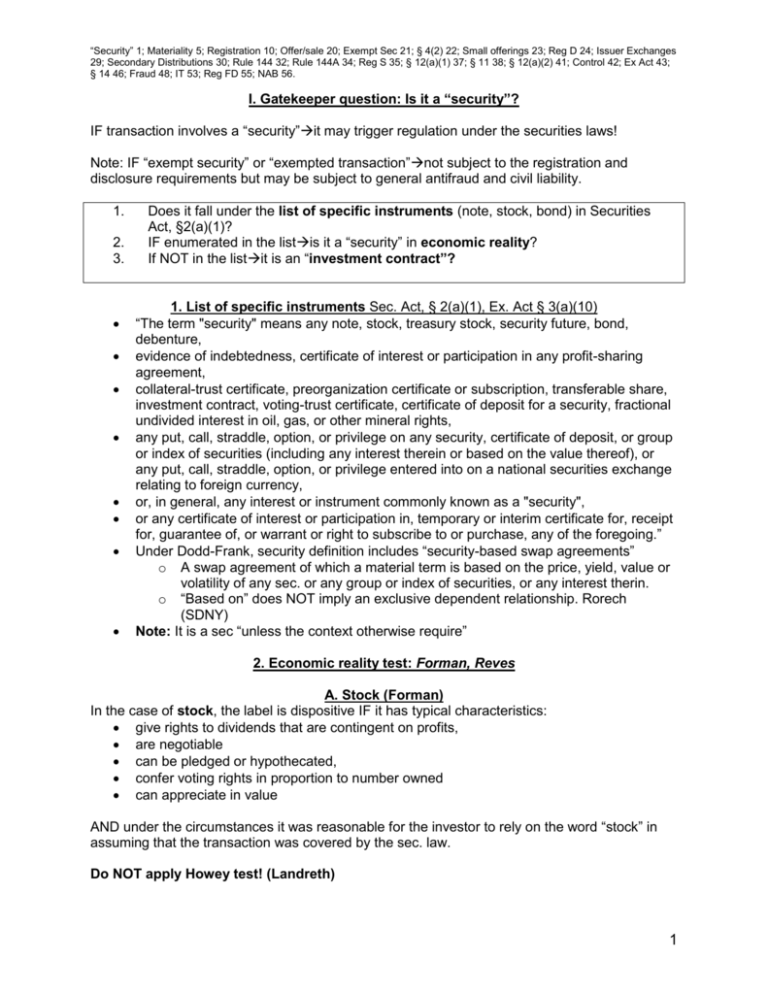

I. Gatekeeper question: Is it a “security”?

advertisement