Chapter 6

Finance Companies

McGraw-Hill/Irwin

© 2008 The McGraw-Hill Companies, Inc., All Rights Reserved.

Historical Perspective

Finance companies originated during the

depression.

Installment credit

General Electric Capital Corporation.

Competition from banks increased during

1950s.

Expansion of product lines

GMACCM is one of the largest commercial

mortgage lenders in U.S.

6-2

-2

Finance Companies

Activities similar to banks, but no

depository function.

May specialize in installment loans (e.g.

automobile loans) or may be diversified,

providing consumer loans and financing to

corporations, especially through factoring.

Commercial paper is key source of funds.

Captive Finance Companies: e.g. GMAC

Highly concentrated

Largest 20 firms: 65 percent of assets

6-3

-3

Major Types of Finance Companies

Sales finance institutions

Personal credit institutions

Ford Motor Credit and Sears Roebuck

Acceptance Corp.

HSBC Finance and AIG American General.

Business credit institutions

CIT Group and FleetBoston Financial.

Equipment leasing and factoring

Key Bank locally

6-4

-4

6-5

-5

https://www.hfc.com/learn-aboutloans/home/default_customer.html?WT_srch=&DCSext_sot=SelfDirected&WT_seg_1=Prospect

http://www.hsh.com/not-the-associates.html

https://www.beneficial.com/learn-aboutloans/home/default_customer.html?WT_srch=&DCSext_sot=SelfDirected&WT_seg_1=Prospect

http://www.kefonline.com/

http://www.docshop.com/education/vision/refractive/lasik/financing/

6-6

-6

6-7

-7

Largest Finance Companies

Company Name

Total Assets

(Millions)

General Electric Capital

Services

$333,780

Citigroup

164,205

GMAC

154,764

Ford Motor Credit Company

153,000

J. P. Morgan Chase

144,835

6-8

-8

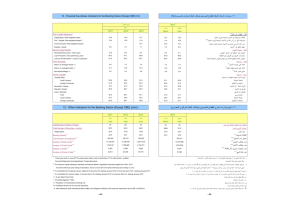

Balance Sheet and Trends

6-9

-9

Business and consumer loans are the major

assets

52.8% of total assets, 2006.

Reduced from 95.1% in 1977.

Increases in real estate loans and other

assets.

Growth in leasing

Finance companies face credit risk, interest

rate risk and liquidity risk.

Balance Sheet and Trends

6-10

-10

Consumer loans

Primarily motor vehicle loans and leases.

Anomalous low auto finance company rates are

anomalous following 9/11 attacks.

Attempts to boost new vehicle sales via 0.0% loans

lasted into 2005.

By 2003, rates 3.5% lower than banks on new

vehicle rates

Consumer loans (continued)

6-11

-11

Generally riskier customers than banks

serve.

Subprime mortgage lenders

Jayhawk Acceptance Corp.

From auto loans to tummy tucks and nose jobs

Increase in “loan shark” firms with rates as

high as 30% or more.

Payday loans

390 percent APR (Implication for EAR is

staggering!)

Balance Sheet and Trends

6-12

-12

Mortgages

Recent addition to finance company assets

Smaller regulatory burden than banks

May be direct mortgages, or as securitized

mortgage assets.

Growth in home equity loans since passage of

Tax Reform Act of 1986.

Tax deductibility issue.

Conversion of credit card debt

2006 average home equity loan $82,872

Defaults in subprime and relatively strong

credit mortgages in 2007

Business Loans

6-13

-13

Business loans comprise largest portion of

finance company loans.

Advantages over commercial banks:

Fewer regulatory impediments to types of

products and services.

Not depository institutions hence less regulatory

scrutiny and lower overheads.

Often have substantial expertise and greater

willingness to accept riskier clients.

Business Loans

6-14

-14

Major subcategories:

Retail and wholesale motor vehicle loans and

leases

Equipment loans

tax issues and other associated advantages when

finance company leases the equipment directly to the

customer

Other business loans and securitized business

assets

Liabilities

6-15

-15

Major liabilities: commercial paper and other

debt (longer-term notes and bonds).

Finance firms are largest issuers of

commercial paper (frequently through direct

sale programs).

Commercial paper maturities up to 270 days.

Consequently, management of liquidity risk

differs from commercial banks relying on

deposits

Industry Performance

Strong loan demand and solid profits for the

largest firms in the early 2000s

Effects of low interest rates

Not surprisingly, the most successful

became takeover targets

6-16

-16

Citigroup/Associates First Capital,

Household International/HSBC Holdings

Mid 2000s problems arose

2005, 2006: falling home prices and rising

interest rates

Pullback from subprime loans

Regulation of Finance Companies

Federal Reserve definition of Finance

Company

Firm, other than depository institution, whose

primary assets are loans to individuals and

businesses.

Subject to state-imposed usury ceilings.

Much lower regulatory burden than

depository institutions.

Not subject to Community Reinvestment Act.

Lack the banks’ regulatory safety-net

6-17

-17

Regulation

6-18

-18

With less regulatory scrutiny, finance

companies must signal safety and

soundness to capital markets in order to

obtain funds.

Lower leverage than banks (11.4% capitalassets versus 10.36% for commercial banks

in 2006).

Captive finance companies may employ

default protection guarantees from parent

company or other protection such as letters

of credit.

Global Issues

6-19

-19

In foreign countries, Finance companies are

generally subsidiaries of commercial banks

or industrials

In Japan, ownership of finance companies

by banks created opportunities when banks

hit by increase in nonperforming loans

GE Capital/Japan Leasing Corporation

Pertinent Websites

American General www.aigag.com

Federal Reserve www.federalreserve.gov

Citigroup www.citigroup.com

Consumer Bankers Association www.cbanet.org

Ford Motor Credit www.fordcredit.com

General Electric Capital Corp. www.gecapital.com

General Motors Acceptance Corp. www.gmacfs.com

HSBC Finance www.hfc.com

Household International www.household.com

6-20

-20