4-H GEN Presentation Nov 2011 - Indiana State 4-H

advertisement

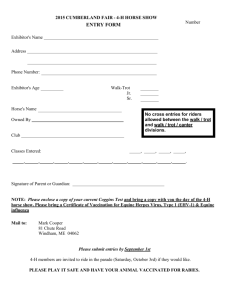

Wednesday, November 16, 7:30 – 9:00 p.m. Chuck Hibberd, Renee McKee, Steve McKinley, Deb Trice • History of 4-H tax exempt status • IRS/EIN updates beginning in 2007 • 4-H Headquarters and IRS decision to “sunset” 4-H Group Exemption Number 2704 • Discussions among: • State 4-H Office • CES Administration • Purdue Legal Counsel • Purdue Business Office • Comptroller, Internal Audit • Each 4-H Entity will: • File an annual IRS 990-series tax form • Maintain an active Employer Identification Number (EIN) • Submit an annual financial report to the Extension office • Have an audit/review of their finances conducted at least every 5 years (or when the primary volunteer handling finances changes) • Purdue University will hold the GEN for… • all 4-H Clubs • those 4-H Affiliates which respond that they wish to be included by the application deadline and which are invited to join • Per IRS regulations, Purdue must be able to demonstrate evidence of general supervision and control over each 4-H entity that is included in the GEN. • • Each of the 2,305 4-H Clubs in Indiana will adopt a constitution with standardized language (template provided). Each 4-H Club will sign a standardized authorization letter indicating its desire to be included in the Purdue GEN (template provided). • Have additional tax options beyond what is available to 4-H Clubs. • Will make decisions regarding their tax status. • • • • • • • 4-H Councils 4-H Fair Boards Adult Leader Organizations Parent Advisory Boards Township Committees Project Committees Event Committees (e.g., Queen contest, Livestock Auction, etc.) • • • Many 4-H Affiliates have formed over the years as groups or committees of a county governing body. The county governing body will now serve as a parent organization of these groups for IRS purposes. The assets of these groups will be listed as line items within the parent entity’s budget. • • • Day-to-day operations of the group may continue. A separate bank account using the parent organization’s EIN may be established. These groups will not file a separate IRS 990series return (they will report their finances through the parent organization’s 990 return). Each 4-H Affiliate will choose one of these tax options: 1. Join the Purdue Group Exemption Number (PU GEN) 2. Seek independent status as a 501(c)(3) entity 3. Seek independent status as a 501(c)(5) entity 4. Become a taxable entity • • A chart outlining the advantages and disadvantages of each option has been provided. • • Provides non-profit status to entity as a subordinate organization under Purdue at no financial cost to the entity. Maintains eligibility to apply for grants as a non-profit entity and to accept deductible charitable contributions. • • • The entity will need to adopt five (5) standardized provisions into its governing document(s) (e.g., articles of incorporation or constitution). These provisions establish Purdue’s “general supervision and control” of the entity as required by the IRS. Exact wording for these provisions has been provided. #1 Purpose of entity #2 Use of earnings #3 Activities consistent with Internal Revenue Code #4 Dissolution of entity #5 Generation of federal tax exempt status Wording for each of these 5 provisions must be included as provided in the entity’s governing document (Constitution or Articles of Incorporation). • • • Educational, scientific, charitable purposes Provide 4-H Youth Development experience If entity has existing statement of purpose, it would be replaced by this wording. • • • Earnings may not be used to personally benefit individual members of entity. Does NOT prohibit entity from deciding to give scholarships or awards to individuals. Blank space in #2 allows you to fill in the actual Article # that describes the entity’s purpose in the governing document. • Entity’s activities must comply with section 501(c)(3) of Internal Revenue Code for tax exempt organizations • Examples of prohibited activities include: • Supporting political parties/campaigns • Gambling/games of chance • • • Describes distribution of assets in the unlikely event that an entity should cease to exist Assets may be used only for future 4-H educational programming/new 4-H entities Transferred temporarily to County office of Purdue Extension and held in trust for a future 4-H entity • • • • In this option, federal tax exempt status would be obtained through a Group Exemption Number held by Purdue University EIN required Annual filing of IRS 990-series return required Purdue will NOT file a 990 on behalf of the entities in the GEN An Authorization Letter will be signed by the 4-H Council or 4-H Fair Board representative (template provided). • Amended governing document(s) will be submitted. • Information is due to the County Extension Office by February 1, 2012. • • • The ability of 4-H Affiliates to participate in the PU GEN is subject to the final approval of the Purdue administration. It is expected that the majority of 4-H Affiliates will be invited to join. Criteria include: • Purpose of entity’s existence • Level of annual gross receipts • • Exempt from paying taxes on income received. Maintains eligibility to apply for grants as a nonprofit entity and to accept charitable contributions. • • Will sign an MOU with 4-H describing how work is accomplished together in respect to state and national 4-H policies (e.g., use of 4-H Name & Emblem, fund raising, etc.) Requires substantial application process (50-100 pages), involving time (~100 hours) and application and professional fees (~$3,000$5,000). Exempt from paying taxes on income received. Will sign an MOU with 4-H describing how work is accomplished together in respect to state and national 4-H policies (e.g., use of 4-H Name & Emblem, fund raising, etc.) • Cannot acknowledge charitable contributions. • May not be able to apply for grants as a non-profit entity. • • • • • • • Will sign an MOU with 4-H describing how work is accomplished together in respect to state and national 4-H policies (e.g., use of 4-H Name & Emblem, fund raising, etc.) Pay taxes on income received and property owned. Cannot acknowledge deductible charitable contributions. Ineligible to apply for grants as a non-profit entity. Will be the default choice for those entities who decide not to choose option 1, 2, or 3. • Affiliates need to choose their tax option and submit a signed MOU to the County Extension Office by February 1, 2012 regardless of the tax option chosen. • A draft version of a sample MOU has been provided. • Some standard language is provided that must be included; additional entries may also be included to meet local needs/situations. • Each incorporated entity has annual filing requirements with the Indiana Secretary of State • Filing notice is e-mailed from Secretary of State to • • responsible party. • Visit: http://www.in.gov/ai/appfiles/sos-berf/ to file a report. For a list of entities in your county, visit: http://www.in.gov/sos/business/index.htm; then click on Business Search (left column) Conduct two searches: • One with your county name • One with 4-H • Click on the entity name to check its filing status. Some of the options you’ll see: • Current • Report due date • Entity is past due on report (with option to click to file • • • • report) Inactive Date Status: Admin Dissolved Other (former) names for this entity Option to view filing history, report information, registered agents, etc. • Entities that have past due reports can be reinstated: • Submit a Certificate of Clearance • Complete the Application for Reinstatement • Complete the Business Entity Report, submitting filing fees for each year ($10/year for non-profits) and reinstatement fees ($30). • For Reinstatement Directions, visit: http://www.in.gov/sos/business/files/domestic_packet.pdf • Please share this information with the volunteers responsible for filing these reports for the respective entities. NOTE: A recording of this program will be made available.