Financial Options In Depth

advertisement

Financial Options In Depth Zachary Emig MBA Class of 2005 Ross School of Business Finance Club 1 Today’s Agenda I. What are options? II. Payoff diagrams and risk profiles III. Option pricing: the intuition IV. Binomial models and Black-Scholes V. Implied volatility VI. Other terminology VII. Uses of options 2 What Are Options? Options are securities which give the holder the right, but not the obligation, to buy or sell another instrument at a fixed price before or at a fixed expiration date. Options that grant the holder the right to buy are call options; those that grant the holder the right to sell are put options. 3 What Defines Options? What would you need to know in order to identify an option? 1. Whether it is a Call or a Put. 2. What the underlying security is. Options can be written on almost anything: stock prices, stock indexes, FX rates, interest rates, etc. 3. The expiration date (tomorrow? Next month? Next year?) 4. The fixed price (called the strike price or exercise price) you can buy or sell at. 4 What Else Defines Options? There are many different styles of options, related to when you can exercise. European option: holder can only exercise on the expiration date. Most common type. American option: holder can exercise anytime up through the expiration date. Bermudan option: holder can exercise every n months up until the expiration date. 5 Today’s Agenda I. What are options? II. Payoff diagrams and risk profiles III. Option pricing: the intuition IV. Binomial models and Black-Scholes V. Implied volatility VI. Other terminology VII. Uses of options 6 Payoff Diagrams When speaking about options, using “hockey stick” payoff diagrams greatly simplifies things. An option’s payoff takes into account only what the holder gets at expiration (or when exercised), not what they paid for the option up front. 7 An Example: Union Pacific (UNP) http://finance.yahoo.com/q/bc?s=UNP • Closed at $64.69 on Nov. 12 • Considerable volatility over past year • All examples represent European options 8 Payoff Diagrams Payoff diagrams plot option holder’s payoff versus the price of the underlying security. K=Strike Price. Call Option, K=$75 Put Option, K=$55 Option Payoff Option Payoff $0 $0 $75 Underlying Price Why Once exercise UNP call is and above pay$75, $75, when call holder you buy willUNP exercise on theoption markettofor buy less UNP than at $75. $75? $K Underlying Price With a put, on the other hand, But say UNPexercise drops toright $45,tothe holder won’t will exercise sell sellput at holder $55 if they can sell to UNP at $55, afordifference of $10. $65. 9 Terminology • An option is said to be in the money if, were it able to • • be exercised immediately, the payoff would be positive. An option is at the money if the underlying is at the strike price. An option is out of the money if the holder wouldn’t execute immediately, were they able to. Call Option, K=$75 In the money Option Payoff Option Payoff Out of the money Put Option, K=$55 In the money Out of the money $0 $0 $75 At the money Underlying Price $55 At the money Underlying Price 10 Too Good To Be True?!? Payoff diagrams suggest that holding options has no downside. Is this possibly true? Call Option, K=$75 Option Profit Payoff $0 Option Premium $75 Underlying Price Of course not. To buy a call or put option, investors must pay a premium, which must equal the value of option. This is reflected by changing the payoff diagram to a P&L daigram. 11 Risk Profiles Think about the risk profile for the 4 basic option positions. Long Call Position Long Put Position Option P&L Option P&L $0 $0 $75 Underlying Price $55 Short Call Position Underlying Price Short Put Position $0 $0 Underlying Price Option P&L Option P&L $75 $55 Underlying Price 12 Today’s Agenda I. What are options? II. Payoff diagrams and risk profiles III. Option pricing: the intuition IV. Binomial models and Black-Scholes V. Implied volatility VI. Other terminology VII. Uses of options 13 Example: Option Pricing • Let’s say you bought UNP back in August at $55, • • and have seen a 19% gain since Now you want to lock in some profits, and protect yourself in case it plummets How much would you pay for a Feb ’05 $60 put? 14 What Does the Put Do For You? You are here! If UNP is still above K=$60 in February, the put expires worthless, and all you’ve lost is the premium you paid for it. If UNP is at the strike on expiration, there’s no point in exercising; the put expires worthless. But if UNP has fallen to $55 by the end of Feb. ’05, you’ll be able to exercise the put and sell at $60, recouping $5 of that loss. A long put position like “insurance” for a long stock position. 15 Think About It: What Factors Go Into Pricing An Option? • What changes would make this put option more valuable? • What would make it less valuable? 16 Option Pricing Factors 1. How does option value move in relation to underlying price? For a put option, it’s value goes up when the underlying price goes down: the holder can sell at price K something available at the market for < K (for a call, the opposite is true). Option Payoff $0 $K Underlying Price 17 Option Pricing Factors 2. How does option value move in relation to strike price? For a put option, the lower the strike price, the lower it’s value (for a call, the opposite is true). It is less likely the put will end up below the strike price. 18 Option Pricing Factors 3. How does option value move in relation to time to expiration? Whether it’s a put or call, the longer the time to expiration, the more valuable the option is. This is intuitive from the graph below; the stock has less chance of dropping into the money by the end of next week than it does by the end of Feb. 05. 19 Option Pricing Factors 4. How does option value move in relation to underlying volatility? For a both calls and puts, the greater the underlying stock’s volatility, the more likely that the option will move into the money. 20 Option Pricing Factors 5. How does option value move in relation to interest rates? Options provide potential future payouts to holders; the present value of those potential payouts is discounted by the interest rate, so the higher the rate, the less valuable those payouts (whether a call or put). 21 Summary of Pricing Factor Relationships Call Value Put Value Underlying Price Positive Negative Strike Price Negative Positive Time to Maturity Underlying Volatility Interest Rates Positive Positive Positive Positive Negative Negative 22 Today’s Agenda I. What are options? II. Payoff diagrams and risk profiles III. Option pricing: the intuition IV. Binomial models and Black-Scholes V. Implied volatility VI. Other terminology VII. Uses of options 23 Option Pricing: Binomial Models Basic method for option pricing is through Binomial Models: assume stock can either go up or down. Period 2 Stock Price: Option Value: Method also provides hedging ratios as a convenient side effect. Period 1 Stock Price: Option Value: Hedge Ratio : B: Period 0 Stock Price: Option Value: Hedge Ratio : B: Hedge Ratio : - B: - Payoff $73.33 $6.42 0.7122 -45.8013 Period 2 Stock Price: Option Value: $64.71 $3.15 0.3958 -22.4636 Period 1 Stock Price: Option Value: $83.09 $13.09 $64.71 $0.00 Hedge Ratio : - B: - Payoff $57.11 $0.00 Hedge Ratio : 0.0000 B: 0.0000 Period 2 Stock Price: Option Value: Hedge Ratio : B: $50.40 $0.00 - Payoff 24 - Option Pricing: Black-Scholes Black-Scholes is a formula that incorporates statistical methods to more accurately determine option value; it, and customized variants, are widely used throughout the street. Do you have to memorize the Black-Scholes formula for interviews? No, but you should know the 5 inputs (s=stock price, r=riskfree rate, x=strike price, t=time to maturity, =volatility), how they affect value. http://www.riskglossary.com/articles/black_scholes_1973.htm 25 Today’s Agenda I. What are options? II. Payoff diagrams and risk profiles III. Option pricing: the intuition IV. Binomial models and Black-Scholes V. Implied volatility VI. Other terminology VII. Uses of options 26 How to Find Option Prices Yahoo! Finance lists options prices for different maturities and strike prices. Here are the Nov. 15 UNP call prices for Dec. 04, Jan. 05, and Feb. 05 expiration. maturity = increasing value. As expected, increasing strike = decreasing value. 27 http://finance.yahoo.com/q/op?s=UNP Implied Volatility Think about it; Black-Scholes is: Poption=f(Sstockprice,Kstrike,Tmaturity,Vvolatility,Rriskfreerate) Set by the market Set by the market Contract specific Contract specific ? Set by the market Knowing 5 of the 6 properties above, we can easily solve for volatility. This is called the implied volatility of the stock, because it is the volatility the market is pricing in for the next T years. In I-Banks, often times options traders are called “volatility traders”, since going long an option implies you are going long vol. 28 Volatility Trading CBOE (Chicago Board Option Exchange) created Volatility Index (VIX) in 1993. VIX “measures the market's expectation of 30-day volatility, but in a way that conforms to the latest thinking and research among industry practitioners. The New VIX is based on S&P 500 index option prices and incorporates information from the volatility "skew" by using a wider range of strike prices rather than just at-the-money series.” 25 20 15 10 5 http://www.cboe.com/micro/vix/historical.aspx http://www.cboe.com/micro/vix/faq.aspx Nov 04 Oct 04 Oct 04 Sep 04 Sep 04 Aug 04 Aug 04 Jul 04 Jul 04 Jul 04 Jun 04 Jun 04 May 04 May 04 Apr 04 Apr 04 Mar 04 Mar 04 Feb 04 Feb 04 Jan 04 Jan 04 0 Jan 04 VIX futures trade at a value of 10x the VIX index value. Also known as the “fear gauge”. Daily VIX Closing Prices 29 Volatility Surfaces Most trading desks get daily reports with the charts of the vol surface (implied volatility for different maturities and strike prices). What should that look like? Unlike what might be expected, implied vol is not flat; it shows both smile and skew. Read Hull for more details. Volatility Surface 70% 60% 50% 40% 60 30% http://www.riskglossary.com/articles/volatility_skew.htm 1 2 3 Months 6 12 18 24 45 Strike Prices 30 Today’s Agenda I. What are options? II. Payoff diagrams and risk profiles III. Option pricing: the intuition IV. Binomial models and Black-Scholes V. Implied volatility VI. Other terminology VII. Uses of options 31 The Greeks Traders will often talk about “the Greeks” in relation to securities with optionality; what do they mean? No, the Greeks are five letters used to describe an option’s behavior. For interviews, it’s probably enough just to know what each represents: •Delta – Sensitivity of option to underlying’s price changes •Gamma – Sensitivity of Delta to underlying’s price changes •Vega – Sensitivity of implied vol to underlying’s price changes •Theta – Sensitivity of option to the passage of time •Rho – Sensitivity of option to interest rate changes http://www.riskglossary.com/articles/greeks.htm 32 How are the Greeks used? Trading desks with complex option positions will have daily reports on their exposures to different risks. Volatility/Variance swap trader: sample Vega report Book: S&P Volatility Swaps Current S&P: Maturity Position Vega Z4 $811,223.00 1.23 F5 $1,941,578.00 1.27 G5 $1,756,614.00 1.34 H5 $423,014.00 1.36 J5 ($148,914.00) 1.37 K5 $2,141,048.00 1.39 M5 ($570,140.00) 1.45 N5 ($104,184.00) 1.50 Q5 $98,014.00 1.51 U5 $234,189.00 1.59 V5 $174,911.00 1.63 X5 ($80,141.00) 1.67 Z5 $560,002.00 1.69 F6 $284,014.00 1.77 1,181.94 33 Other Concepts: Intrinsic Value Option prices can be decomposed into the option’s intrinsic value and time value. Intrinsic value is the payoff value of the option were it possible to exercise immediately; if out of the money, zero, otherwise the difference between the strike and current stock price. Example: The Jan’05, $40 strike call is selling for $24.70. The closing UNP price was $64.47. So $64.47$40.00=$24.47 is the intrinsic value of the option. 34 Other Concepts: Time Value Example: The Jan’05, $40 strike call is selling for $24.70. The closing UNP price was $64.47. So $64.47-$40.00=$24.47 is the intrinsic value of the option. The remaining $0.23 of the option’s price is it’s time value, i.e. what you’ll pay for the chance that over the next 2 months it’s payoff will increase. For a deep in the money call option, this is small compared to it’s [current] intrinsic value. In comparison, the out of the money $70 option has $0 intrinsic value. So its $0.35 price is all time value, i.e. the chance that over 2 months the stock price will rise to above $70. 35 Today’s Agenda I. What are options? II. Payoff diagrams and risk profiles III. Option pricing: the intuition IV. Binomial models and Black-Scholes V. Implied volatility VI. Other terminology VII. Uses of options 36 What’s the Big Deal? So, why are options so important? Because of the breakthrough of Black-Scholes in 1973, we now have a standard, accurate way of valuing them. Almost every security either has optionality in or can be represented with options. • Mortgage securities are straight debt with the homeowner holding a call option (repayment). • Convertible bonds are straight corporate debt with the owner holding a call option on the stock. • Common stock can be thought of as a call option on a firm’s assets with strike price of $0! 37 Option Strategies - Straddle Options also allow investors to take “quirky” views on underlying securities. Pure volatility play; investor neutral on stock appreciation/depreciation. Long Put P&L Long Call P&L $0 View: Believe that by January UNP will either go up or down by a lot. Go long a call and a put. P&L Example: Straddles $65 Underlying Price Net P&L 38 Option Strategies – Covered Call In a covered call, investor expects mild stock appreciation but not a large increase. http://biz.yahoo.com/opt/education.html Net P&L $0 See Yahoo! Finance for all the basic options strategies. P&L Investor goes long the stock and then writes (sells) an OTM (out of the money) call option for its premium. $K Long Stock P&L Underlying Price Short Call P&L 39 Conclusion •Nearly every trading desk I sat on this summer used options or option pricing in some way. •What to know for interviews? The underlying concepts: risk profiles, inputs to Black-Scholes, the Greeks, basic option strategies. •The jargon is tricky. Traders now a days talk about going “long gamma” or “long vega”. Focus on what that actually means (“long vega”=“long volatility”=“holding an option”?). •Remember: almost any security can be represented as an option. 40 The Next Steps If you are set on going into sales and trading, you will have to know this stuff. Courses to take: •FIN 580 – Options & Futures – Very good introduction to valuing options •FIN 618 – Derivatives – Builds upon FIN 580 •FIN 615/645 – Valuations/Adv. Valuations – Touches upon real options •FIN 622 – Corporate Financial Engineering – Discuss uses of options and derivatives for solving corporate financing needs. 41

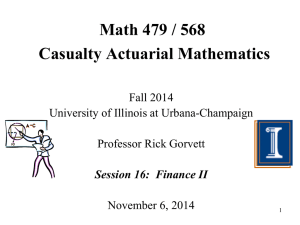

![[These nine clues] are noteworthy not so much because they foretell](http://s3.studylib.net/store/data/007474937_1-e53aa8c533cc905a5dc2eeb5aef2d7bb-300x300.png)