Report_changes_Impactrac

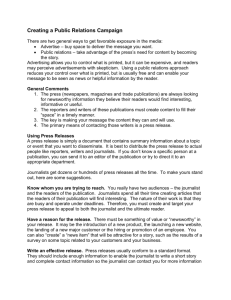

Methodology

ImpacTrac provides a detailed summary of your media coverage for a specific analysis period and monitors both editorial and journalistic bias. Exposure value of your PR activity, Top Publications and Journalists, as well as number of articles and positioning are standard within the report.

If required, the above information can be tracked at a regional / divisional and / or competitor level.

A structured approach is used to analyse all media content both quantitatively and qualitatively. Ornico’s advanced technological capabilities enables the data to be collected and collated, whilst human intervention provides the necessary qualitative insight and analysis.

Each customers unique requirements are taken into account when deciding on the key topics to monitor and analyse.

Clear criteria have been agreed when determining

Editorial and Journalistic Bias. It is based on public perception, i.e. the common man’s perception of the mention, taking into account the use of both positive and negative words in relation to the company or topic being monitored.

AMEC membership

Ornico is the only African company to have full membership of the International Association for

Measurement and Evaluation of Communication

(AMEC). AMEC is the leading organization for media analysis and measurement globally with more than

100 members in over 40 countries.

Their purpose is to define and develop the industry on an international scale with better professional standards for both companies and individuals.

All AMEC Full members are bound by the AMEC

Quality Assurance Code and provide professional, independent and impartial communications planning, evaluation and research. They guarantee technical expertise and ensure best practice, best quality and best value to their clients.

Ornico’s membership means that your reports comply with AMEC’s strict standards. (www.amecorg.com)

Executive Summary

The Executive Summary is a short synopsis of the key findings uncovered in the analysis.

The current periods coverage will be discussed, highlighting various points of interest, as well as any trends that are picked up when comparing to previous analysis periods.

Overall Tonality (bias) of the coverage will be included, broken down into the main media types for ease of reference. Additional items such as Top Spokesperson /

Journalist and Publication (based on volume) can also be included in the summary.

Should the client’s report include ongoing measurement and / or competitor analysis, then the Executive Summary as well as most Analysis sections will highlight any relevant differences and / or trends.

The Key Metrics Table is a summary of the main findings for the current analysis period’s coverage. The various fields in the table can be adapted to reflect the needs of the client, i.e. by including comparisons to previous periods / competitor results, where applicable.

Key Metrics

Volume of coverage (count)

Tonality of coverage (%)

Main Topic (mentions)

Main Spokesperson (mentions)

Main Coverage (count)

Journalist

Source

Overall

Broadcast

Online

Positive

60

January 2015

550

250

100

200

Neutral

30

Negative

10

Overall

Broadcast

Online

30

10

10

60

80

30

10

10

60

Print / Broadcast Mr X involved in corruption

(150)

Online

All media

Company Y poor performance

(50)

Mr A Brown (20)

Broadcast

Online

Positive

Negative

ABC Times (30)

Channel X (10)

Site Y (20)

Mrs B Jones

Mr C Doll

Trend

(by Media type)

The section on Trends shows the volume of coverage for the client analysed by media type over an agreed measurement period.

The trend period can be altered to accommodate the requirements of the client.

Insights into the peaks and / or troughs will be highlighted, so that any potential opportunities and / or shortcomings are identified for future action.

The Tonality of the coverage analysed by Media type can also be illustrated.

In a competitive analysis report (compares a client’s coverage with that of selected competitors), additional graphs will be provided highlighting the volume of mentions of each company in the coverage analysed.

Company X - Monthly Trend

300

250

200

150

100

50

0

Jan Feb

March

Название оси

Apr

Broadcast Online

May June

Key trends:

Coverage for the past 6 months was dominated by Online coverage of the impending court case for the CEO

.

Trend

(including Tonality)

This graphic shows the proportions of positive, neutral and negative client coverage over the period analysed

(daily, weekly, monthly).

The various peaks and troughs can be used to link past media actions to the resultant outcome, i.e. to what extent was the message covered by the media and how was the message / coverage received by those who where exposed to the various media items.

Example:

The proportionally large increase in negative coverage on the 5 th January, was as a result of the publication of

Company X’s poor financial results in most Daily

Newspapers and Online News websites.

400

350

300

250

200

150

100

50

0

Daily trend

Negative coverage due to poor financial results

Sponsorship of Charity positively covered in most media

Positive Neutral Negative

Key trends:

Significant negative coverage in January in all media due to the Financial crisis at

Company X.

Company AVE

Advertising Value Equivalency (AVE) has historically been used as the sole metric for evaluating PR success.

Although this metric is not supported by leading industry organisations such as AMEC (of which

Ornico is a member), it is still widely used as a metric for tracking purposes. At the request of our clients,

Ornico will continue to provide the AVE values for the coverage analysed.

Currently there no single replacement metric. Public

Relations is a broad discipline that requires multiple metrics tied to well-defined business objectives

(AMEC – Barcelona principles).

Company X - AVE value

60000

50000

15000

40000

30000

5000

10000

5000

3000

20000

30000

15000

10000 20000

0

Print Broadcast

Media

Postive Neutral Negative

5000

Online

Key trends:

Broadcast had the highest AVE during January of which 30% was Negative

Competitor / Divisional

Landscape

The graphic compares a client’s coverage with that of selected Competitors or Company Divisions.

Additional information regarding the achieved AVE can also be provided.

Depending on the major trends in the data, the various media types (Print / Broadcast / Online) can be included in the analysis of the Competitors

/Divisions.

Competitors

- AVE value

50000

45000

40000

35000

30000

25000

20000

15000

10000

5000

0

Company A

Neutral

Company B

Industry

Negative

Company C

Postive Mentions

Key trends:

Company B had the highest Negative coverage due to articles regarding potential

“Pollution” at their factories.

300

250

200

150

100

50

0

Share of Voice

In a Competitive and / or Divisional analysis report, the clients Share of Voice “SOV” can be effectively illustrated by a Pie chart, which shows the proportions of mentions of each company / division in the coverage analysed.

The SOV can be drilled down to provide additional insight regarding the media landscape, i.e. SOV by media type / Tonality SOV

26%

Share of Voice

42%

32%

Company A Company B Company C

Key trends:

Company A is dominating coverage in the media due to the release of their annual financial results

Spokesperson Sentiment

Based on the clients requirements, the coverage received by a pre-determined list of Company employees / spokespeople can be captured and analysed. The “tonality / bias” of the coverage is also captured, i.e. positive, neutral, negative. The tonality is that of the media report in which the spokesperson is cited – not that of the spokesperson.

By analysing the coverage received by the Company’s spokespeople, you are able to determine and track how effective they have been in promoting a positive message / opinion regarding their Company.

Key trends:

Sentiment towards coverage by Company A’s spokesperson has declined into

Negative territory over the past 3 months

Reputational Drivers

Key Drivers can be tracked in the analysis to provide additional insight when evaluating the impact of media coverage on the Company’s reputation.

By identifying and allocating “Drivers” within the relevant report, Company’s can ensure that any future activities are aimed at addressing those areas which are receiving less than favourable reviews.

A Driver is only allocated once per media report, even though a report may contain many different topics, eg. a media item that’s main focus is a company’s financial results may also mention its corporate social responsibility efforts in passing. Examples of Drivers include:

• Competition

• Innovation

• Leadership & Vision

• Trust / Client satisfaction

• Products & Services

• Staff & Workplace

• Corporate Social Responsibility

Driver 5 10

Driver 4

Driver 3

Driver 2 20

20

40

60

20

Reputational Drivers

60

50

50

40

40

30

Driver 1 50 30 70

0 20 40 60 80

Volume

100

Positive Neutral Negative

120 140 160

Key trends:

The increase in Negative coverage pertaining to “Driver 1” will need to be addressed by the Companies CEO.

Topics /Messages

Topics and / or messages are a key part of the qualitative analysis performed by the Media Analysts. For consistency purposes, a list of key topics / messages to be tracked should be agreed with the client prior to analysis.

There is room to make changes to the list over time, however it is advisable to keep a core list in place so that trends can be identified and key strategic messages tracked over an extended period.

Together with the allocated Reputational Drivers, as well as

Tonality of the message, this analysis will assist in providing a more complete story of the company’s portrayal in the media.

Topic 5 10

Topic 4

Topic 3

Topic 2 20

Topic 1

20

40

20

50

0

60

20

40

Topic /Message

60

50

50

40

40

30

30

60 80

Volume

100

Positive Neutral Negative

70

120 140

Key trends:

The main story dominating coverage was regarding “ Person X”, with most of the

Negative coverage originating during the last 2 weeks of the month.

160

Journalists – Top 10

This graph shows the journalists (by volume) who wrote articles or commented on the client over the analysis period. The tonality of the report is also included.

Coverage and Tonality of reports by key journalists can be a good yardstick of whether a company’s key messages are being taken up by journalists or their publications / media houses.

This analysis can be used to identify which resources

(journalists) to target with future company and / or product information.

Journalists

160

140

120

100

80

60

40

20

0

Journalist 1 Journalist 9 Journalist 7 Journalist 3 Journalist 4 Journalist 8 Journalist

10

Journalist 6 Journalist 2 Journalist 5

Positive Neutral Negative Total

Key trends:

Journalist 10 focused on the Positive coverage surrounding the Companies CSI program, while Journalists 3 / 4 / 9 covered the poor Financial results of Company X.

Publications – Top 10

This graph reflects the volume and tonality of coverage in different publications / media that reported on the company within a specified time period.

As with the Journalists, the analysis by Publication will assist in identifying future Media Houses to target in order to achieve the desired outcome.

Depending on volume of coverage, usually only the

Top 10 Publications will be included in the graph.

Publication

Publication 2

Publication 1

Publication 3

Publication 5

Publication 4

Publication 6

Publication 7

Publication 8

Publication 10

Publication 9

0 20 40 60 80

Volume

100

Positive Neutral Negative

120 140

Key trends:

Publication 2 dominated coverage of Company X, with over 30% of its articles focusing on impending corruption charges against the Company CEO.

160

Placement

It is important to review the placement of company mentions in the various media. The impact of the articles are also influenced by the inclusion of relevant images as well as quotations from company spokespeople.

All of the above can be tracked in the analysis in order to highlight the quality of the coverage received by the Company.

“Prominent mention” means that the company was mentioned in the first two paragraphs (press and internet) or the leading section of a broadcast report, or three times overall.

“Passing mention” means that the company was mentioned only once or twice in the body of the report.

Placement

120

100

80

60

40

20

0

Headline /

Intro

Prominent Passing Spokesperson quoted

Photo / logo / graphic

Positive Neutral Negative

Front page

/lead story

Key trends:

Articles regarding the Companies financial results received “Prominent” coverage, with Company spokespeople being quoted in two thirds of the articles.