Haskel_BoE_roundtable_capacity_10Dec10

advertisement

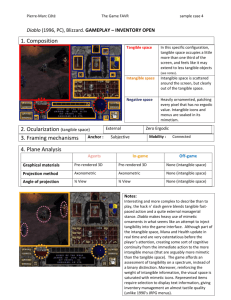

Inflation and capacity utilisation: some issues of measurement and an intangibles perspective Jonathan Haskel Imperial College Business School and CEPR j.haskel@ic.ac.uk Bank of England presentation, December 2010 1 Capacity utilisation: the puzzle Output per hour indicates spare capacity……but surveys do not Output per hour Capacity utilisation surveys Source: Bank of England inflation report (a) Output per hour. (b) Pre-recession trends are calculated by projecting forward labour productivity from 2008 Q2 using the average quarterly growth rate between 1996 Q1 and 2008 Q1. 2 Is trend productivity growth lower than we think? Extrapolation above includes late 1990s. Productivity growth in the late 90s: 1. Seems unusually high 2. Revised up strongly with FISIM in BBook09 Labour Productivity Growth (% p.a) Contribution of Human Capital Deepening (% p.a) Contribution of Tangible Capital Deepening (% p.a) Without intangibles 1990-1995 1995-2000 2000-2007 2.94% 3.25% 2.65% 0.20% 0.29% 0.19% 1.09% 0.89% 0.86% With intangibles 1990-1995 1995-2000 2000-2007 2.94% 3.53% 2.69% 0.17% 0.25% 0.17% 0.95% 0.74% 0.68% Source: Haskel et al (2010), work for NESTA innovation index Contribution of TFP Growth (% Intangible Capital p.a) Deepening (% p.a) 1.66% 2.07% 1.60% 0.64% 0.67% 0.55% 1.19% 1.87% 1.30% 3 Is current productivity mismeasured? • 1. Hours – Labour hoarding suggested by • Productivity fall and • limited hours fall relatively large output fall – Seems counter to popular discussion of flexible labour market – Possibility: are hours overstated? • Levels of hours overstated in LFS especially for non-manual professions – 30% of LFS hours responses are imputed – comparison with employer-based ASHE shows over-reporting – (note US data are employer-based) • No evidence on cyclical variation, but if downsizing disproportionately affect manual occupations, overstatement might rise 4 Is current productivity mismeasured? (Contd) • 2. Output – For around 17% of services value added deflators are not based on prices but costs – =(% ch earnings- %ch service sector productivity) – Measured service sector productivity • Rises in booms • Falls in recessions – Thus via deflators: measured real service sector output • Rises in booms • Falls in recessions – Thus, some tendency for • Current measured service productivity is too low • Past measured service productivity was too high • So service sector is closer to true productivity trend than measured: output gap is lower 5 Is current productivity mismeasured? (contd) • 3. Output: financial services – FISIM has cushioned the GDP fall • • Directly measured financial services volume has fallen But volume of deposits/loans hardly changed, margins have risen, so share of real FISIM has risen 1.50% 1.00% 0.50% 0.00% -0.50% 2007 Q2 2007 Q3 2007 Q4 2008 Q1 2008 Q2 2008 Q3 2008 Q4 2009 Q1 2009 Q2 2009 Q3 2009 Q4 2010 Q1 2010 Q2 -1.00% -1.50% -2.00% -2.50% -3.00% GDP without FISIM GDP with FISIM 6 Future productivity trends • Long run productivity trends drive by (intangibles view) • • • • Physical capital Intangible capital (knowledge = software, R&D, design, training etc.) Labour Technical progress – Years 2000-07 dln(Y/L) driven by • • Intangibles = 20% • Computers/tangible = 25% • Labour composition = 5% • TFP = 50% Additional questions raised by intangibles – Manufacturing v services. Intangible investment in manufacturing > tangible investment. So manufacturing becoming more like services. Doubts over interpretation of capital utilisation in services spill over into manufacturing? – If future increase in uncertainty/cost of capital, intangible investment falls? – What has happened to intangible K/L in the recession: does this help explain and predict future Y/L? 7 Intangible v tangible investment when tangible falls: 1991-2 recession 100 90 S/ware 80 70 R&D 60 50 40 Adv 30 20 Tang 10 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 1984 1983 1982 1981 1980 1979 1978 1977 1976 1975 1974 1973 1972 1971 1970 0 Intangible investment holds up. But, intangibles depreciate faster than tangibles, so net effect on stocks and hence contributions to dln(Y/H) ends up similar… 8 Contributions of intangibles and computers to dln(Y/H) 0.014 0.012 0.01 0.008 cont comp 0.006 cont intan 0.004 0.002 0 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 Contributions show similar paths post-recession even though investment in intangibles is less cyclical. 9 Summary • Service sector productivity – True output might be • Higher due to deflator effect • Lower due to FISIM – True hours might be less • Long run productivity trend may be slightly lower than we think – because 1990s overstated – if higher cost of capital in the future • But what does inflationary pressure via capacity utilisation mean in a service economy? – Y* in a car company : capital => at Y* factory is full – Y* in a design company? • Capital – = a MacBook per designer – = Ideas from designer teams/experience – So even if Y close to Y*, less inflationary pressure if • • • • Supply of MacBooks is elastic Teams have been hoarded Immigration of high-skilled labour is relatively easy Service tasks can be out-sourced 10