Crafting & Executing Strategy 18e

advertisement

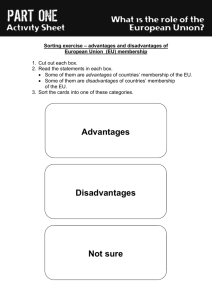

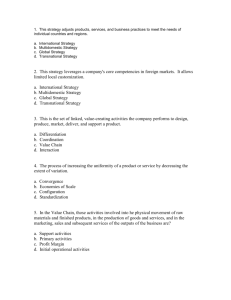

CHAPTER 7 STRATEGIES FOR COMPETING IN INTERNATIONAL MARKETS Copyright ®2012 The McGraw-Hill Companies, Inc. McGraw-Hill/Irwin 1. Develop an understanding of the primary reasons firms choose to compete in international markets. 2. Learn how and why differing market conditions across countries and industries make crafting international strategy a complex undertaking. 3. Learn about the major strategic options for entering and competing in foreign markets. 4. Gain familiarity with the three main strategic approaches for competing internationally. 5. Understand how international firms go about building competitive advantage in foreign markets. 7–2 WHY COMPANIES DECIDE TO ENTER FOREIGN MARKETS To gain access to new customers To exploit core competencies To achieve lower costs and economies of scale To spread business risk across a wider market base To access resources and capabilities in foreign markets 7–3 WHY COMPETING ACROSS NATIONAL BORDERS MAKES STRATEGY MAKING MORE COMPLEX 1. Industry competitiveness factors that vary from country to country 2. Location-based advantages for certain countries 3. Differences in government policies and economic conditions 4. Currency exchange rate risks 5. Differences in cultural, demographic, and market conditions 7–4 7.1 The Diamond of National Advantage Demand Conditions Home-market relative size; domestic buyers’ needs Related\Supporting Industries Firm Strategy, Structure, and Rivalry Proximity of suppliers, end users, and complementary industries Different management styles and organization; degree of local rivalry Factor Conditions Availability, quality, and relative prices of inputs (e.g. labor, materials) 7–5 The Diamond Framework ♦ Answers important questions about competing on an international basis by: ● Predicting where new foreign entrants are likely to come from and their strengths. ● Highlighting foreign market opportunities where rivals are weakest. ● Identifying the location-based advantages of conducting certain value chain activities of the firm in a particular country. 7–6 Reasons for Locating Value Chain Activities for Competitive Advantage ♦ Lower wage rates ♦ Higher worker productivity ♦ Proximity to suppliers and technologically related industries ♦ Lower energy costs ♦ Proximity to customers ♦ Fewer environmental ♦ Lower distribution costs regulations ♦ Available\unique natural resources ♦ Lower tax rates ♦ Lower inflation rates 7–7 The Impact of Government Policies and Economic Conditions in Host Countries ♦ Positives ♦ Negatives ● Tax incentives ● Environmental regulations ● Low tax rates ● ● Low-cost loans Subsidies and loans to domestic competitors ● Site location and development ● Import restrictions ● Tariffs and quotas Worker training ● Local-content requirements ● Regulatory approvals ● Profit repatriation limits ● Minority ownership limits ● 7–8 Political and Economic Risks ♦ Political Risks ● Stem from instability or weaknesses in national governments and hostility to foreign business. ♦ Economic Risks ● Stem from the stability of a country’s monetary system, economic and regulatory policies, lack of property rights protections, and risks due to exchange rate fluctuation. 7–9 The Risks of Adverse Exchange Rate Shifts ♦ Effects of Exchange Rate Shifts: ● Exporters experience a rising demand for their goods whenever their currency grows weaker relative to the importing country’s currency. ● Exporters experience a falling demand for their goods whenever their currency grows stronger relative to the importing country’s currency. 7–10 Thinking Strategically ♦ What effects has the adoption of the euro had on the ability of European Union (EU) countries (and firms) to respond changes in intra-national economic conditions in other EU countries given that they now share a common currency? ♦ What should a EU firm do to respond to a adverse currency exchange rate shift in a non-EU country? 7–11 Cross-Country Differences in Demographic, Cultural, and Market Conditions To customize offerings in each country market to match the tastes and preferences of local buyers Key Strategic Considerations To pursue a strategy of offering a mostly standardized product worldwide. 7–12 THE CONCEPTS OF MULTIDOMESTIC COMPETITION AND GLOBAL COMPETITION ♦ Multidomestic Competition ● Exists when competition in each country market is localized and not closely connected to competition in other country markets. ♦ Global Competition ● Exists when competitive conditions and prices are strongly linked across many different national markets. 7–13 Features of Multidomestic Competition ♦ Buyers in different countries are attracted to different product attributes. ♦ Sellers vary from country to country. ♦ Industry conditions and competitive forces in each national market differ in important respects. 7–14 Features of Global Competition ♦ The same group of firms competes in countries where sales volumes are large and having a presence is important to a strong global position. ♦ Competitive advantage is gained from the transfer of expertise, economies of scale, and worldwide brand-name recognition. ♦ Global competition is increasing in multidomestic markets where custom mass production is coinciding with converging consumer tastes. 7–15 STRATEGIC OPTIONS FOR ENTERING AND COMPETING IN INTERNATIONAL MARKETS ♦ Maintain a national (one-country) production base and export goods to foreign markets. ♦ License foreign firms to produce and distribute the firm’s products abroad. ♦ Employ an overseas franchising strategy. ♦ Establish a wholly-owned subsidiary by either acquiring a foreign company or through a “greenfield” venture. ♦ Form strategic alliances or joint ventures with foreign companies. 7–16 Export Strategies ♦ Advantages ● Low capital requirements ● ♦ Disadvantages ● Economies of scale in utilizing existing production capacity Maintaining relative cost advantage of homebased production ● Transportation and shipping costs ● No distribution risk ● Exchange rates risks ● No direct investment risk ● Tariffs\import duties ● Loss of channel control 7–17 Licensing and Franchising Strategies ♦ Advantages ♦ Disadvantages ● Low resource requirements ● Maintaining control of proprietary know-how ● Income from royalties and franchising fees ● Loss of operational and quality control ● Rapid expansion into many markets ● Adapting to local market tastes and expectations 7–18 Acquisition Strategies ♦ Advantages ♦ Disadvantages ● High level of control ● Costs of acquisition ● Quick large-scale market entry ● Complexity of acquisition process ● Avoids entry barriers ● ● Access to acquired firm’s skills Integration of the firms’ structures, cultures, operations and personnel 7–19 Greenfield Strategies ♦ Advantages ♦ Disadvantages ● High level of control over venture ● Capital costs of initial development ● “Learning by doing” in the local market ● ● Direct transfer of the firm’s technology, skills, business practices, and culture Risks of loss due to political instability or lack of legal protection of ownership ● Slowest form of entry due to extended time required to construct facility 7–20 Alliance and Joint Venture Strategies ♦ Advantages ♦ Disadvantages ● Avoid entry barriers ● ● Allow for resource and risk sharing Cultural and language barriers ● Partner’s knowledge of local market conditions Costs of establishing the working arrangement ● Issues of joint control ● ● Joint learning and sharing ● Protection of proprietary technology or competitive ● Preservation of partner advantage independence 7–21 COMPETING INTERNATIONALLY: THE THREE MAIN STRATEGIC APPROACHES Competing Internationally Multidomestic Strategy Global Strategy Transnational Strategy 7–22 Approaches to International Strategy ♦ Multidomestic Strategy ● Varies product offerings and competitive approaches from country to country. ♦ Global Strategy ● Employs the same basic competitive approach in all countries where the firm operates. ♦ Transnational Strategy ● Is a think-global, act-local approach that incorporates elements of both multidomestic and global strategies. 7–23 7.2 Three Approaches for Competing Internationally 7–24 7.1 Advantages and Disadvantages of Multidomestic, Global, and Transnational Approaches Multidomestic Approach Advantages Disadvantages • Can meet the specific needs of each market more precisely • Hinders resource and capability sharing or cross-market transfers • Can respond more swiftly to localized changes in demand • Higher production and distribution costs • Can target reactions to the moves of local rivals • Not conducive to a worldwide competitive advantage • Can respond more quickly to local opportunities and threats 7–25 7.1 Advantages and Disadvantages of Multidomestic, Global, and Transnational Approaches (cont’d) Transnational Approach Advantages Disadvantages • Offers the benefits of both local responsiveness and global integration • More complex and harder to implement • Conflicting goals may be difficult to • Enables the transfer and sharing reconcile and require trade-offs of resources and capabilities • Implementation more costly and across borders time-consuming • Provides the benefits of flexible coordination 7–26 7.1 Advantages and Disadvantages of Multidomestic, Global, and Transnational Approaches (cont’d) Global Approach Advantages Disadvantages • Lower costs due to scale and scope economies • Unable to address local needs precisely • Greater efficiencies due to the ability to transfer best practices across markets • Less responsive to changes in local market conditions • Higher transportation costs and • More innovation from knowledge tariffs sharing and capability transfer • Higher coordination and integration • The benefit of a global brand and reputation costs 7–27 THE QUEST FOR COMPETITIVE ADVANTAGE IN THE INTERNATIONAL ARENA Build Competitive Advantage in International Markets Use international location to lower cost or differentiate product Share resources, competencies, and capabilities Gain cross-border coordination benefits 7–28 Using Location to Build Competitive Advantage To customize offerings in each country market to match the tastes and preferences of local buyers Key Location Issues To pursue a strategy of offering a mostly standardized product worldwide. 7–29 When to Concentrate Activities in a Few Locations ♦ The costs of manufacturing or other activities are significantly lower in some geographic locations than in others. ♦ There are significant scale economies in production or distribution. ♦ There are sizable learning and experience benefits associated with performing an activity in a single location. ♦ Certain locations have superior resources, allow better coordination of related activities, or offer other valuable advantages. 7–30 When to Disperse Activities across Many Locations ♦ Buyer-related activities can be conducted at a distance. ♦ There are high transportation costs. ♦ There are diseconomies of large size. ♦ Trade barriers make a central location too expensive. ♦ Dispersing activities reduces exchange rate risks. ♦ Dispersion helps prevent supply interruptions. ♦ Dispersion helps avoid adverse political developments. ♦ Dispersion allows for location-based technology and production cost competitive advantages. 7–31 Cross-Border Coordination: Sharing and Transferring Resources and Capabilities ♦ Build a Resource-Based Competitive Advantage By: ● Using powerful brand names to extend a differentiation-based competitive advantage beyond the home market. ● Coordinating activities for sharing and transferring resources and production capabilities across different countries’ domains to develop market dominating depth in key competencies. 7–32 PROFIT SANCTUARIES AND CROSSBORDER STRATEGIC MOVES ♦ Profit Sanctuaries ● Are country markets (or geographic regions) in which a firm derives substantial profits because of its protected market position or its competitive advantage. ♦ Cross-Market Subsidization ● Is the diversion of resources and profits from one market to support competitive offensives in another different market. 7–33 7.3 Profit Sanctuary Potential of Domestic-only, International, and Global Competitors 7–34 Dumping as a Strategy ♦ Dumping ● Selling goods in foreign markets at prices that are either below normal home market prices or below the full costs per unit. ♦ Why A Firm Engages in Dumping: ● To reduce or avoid the high fixed costs of idle production capacity. ● To use below-cost pricing to gain market share and drive weak firms from the market. 7–35 Using Cross-Border Tactics to Defend against International Rivals International Firm A International Firm B Profit Sanctuary Firm A moves against Firm B in Country B Firm B counters with a response in Country C 7–36 STRATEGIES FOR COMPETING IN THE MARKETS OF DEVELOPING COUNTRIES ♦ Prepare to compete on the basis of low price. ♦ Prepare to modify the firm’s business model or strategy to accommodate local circumstances. ♦ Avoid developing markets where it is too costly to accommodate local circumstances. ♦ Try to change the local market to better match the way the firm does business elsewhere. 7–37 DEFENDING AGAINST GLOBAL GIANTS: STRATEGIES FOR LOCAL COMPANIES IN DEVELOPING COUNTRIES ♦ Develop a business model that exploits shortcomings in local distribution networks or infrastructure. ♦ Utilize knowledge of local customer needs and preferences to create customized products or services. ♦ Take advantage of aspects of the local workforce with which large multinational firms may be unfamiliar. ♦ Use local acquisition and rapid-growth strategies to defend against expansion-minded internationals. ♦ Transfer the firm’s expertise to cross-border markets. 7–38