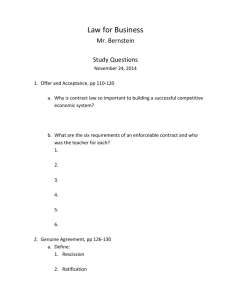

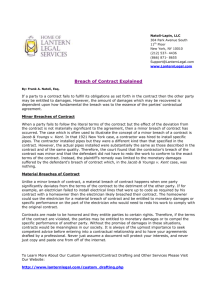

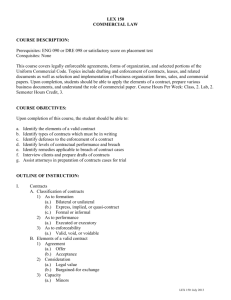

1. Breach of Contract

advertisement