ACCOUNTING MIDTERM OUTLINE Generally Accepted Accounting

advertisement

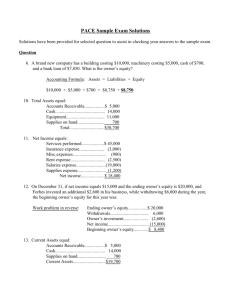

ACCOUNTING MIDTERM OUTLINE I. Generally Accepted Accounting Principles a. Facilitates the comparability of financial statements among business entities and with respect to a particular business entity over time i. Guidelines for how financial statements are prepared—enhances reliability b. Defines standards of practice and professional conduct for accountants c. May influence the definition of negligence for accountants d. GAAP is a continuum i. Organization can choose how to value its inventory; GAAP does not mean that every financial statement is exactly the same ii. SEC can get involved if an org goes beyond aggressive e. Financial Accounting Standards Board (FASB) i. Leading contributor of GAAP ii. Independent body composed of CPAs, corporate executives, financial analysts and academics iii. Allows alternative ways of handling matters, as long as the method chosen falls within GAAP and is fully disclosed iv. Objectives: 1. To provide info to present and potential external users so they can make rational economic decisions 2. To provide info relating to an entity’s cash inflows and outflows because these flows eventually trickle down to creditors and investors a. It is easy to make a company look profitable, but hard to make it look like it generates cash (a company can make a lot of profit but generate no cash) 3. To provide info relating to assets, liabilities and equity and changes in the during each reporting period f. Accounting Information Qualities i. Relevant: timely recording and presentation of info so it can be used to forecast future performance and to aid understanding past performance ii. Reliable: info should be free from error and bias—number must be accurate and verifiable by independent parties iii. Comparable: users should be able to compare accounting info of one entity with that of other similar entities using the same accounting measure and with statements of the same entity over succeeding periods of time iv. Consistent: the entity should use the same accounting methods and procedures from year to year (if it’s not consistent, you won’t be able to tell whether the company is getting better or not) g. Accounting Principles i. Matching: expenses should be matched to benefits, which means recorded in the period of time that benefited from the expenditure rather than the period of time in which the expenditure occurred. 1. ie. log the same of a fridge in the same period as the company’s cost for the fridge ii. Conservatism: requires that “bad news” be recognized when the condition becomes possible and the amount can be estimated, whereas “good news” is recognized only when the even has actually occurred. 1. Ie. record possible and potential expenses, but record revenue when it actually happens iii. Consistency: use the same method on financial statements over and over again. iv. Lower of Cost or Market: assets are presented at their historical cost or their current market value, whichever is lower. GAAP rules do not permit reflection if improved market value of assets. v. Materiality: an event that is material, or significant, is one that may affect the judgment, analysis or perception of the reader of the info. This is a relative concept. 1. Determines how you record something; how material it is so the organization (ie. buying a filing cabinet at a small law firm v. the same at a Wal-mart office) h. American Institute of Certified Public Accountants (AICPA) i. Mission: provide members with resources, information, and leadership ii. Promotes uniform certification and licensing standards (CPA) iii. Similar to ABA for lawyers i. SEC i. Federal agency 1. Administers federal securities laws 2. Only publicly traded organizations are subject to SEC a. Have to file financial statements with the SEC every 3 months ii. Participated with GAAP formation with FASB iii. Chief legal authority having jurisdiction over accounting rules and practices iv. Prescribes manner and timing of the disclosure of info about the financial condition and performance of business entities v. Has the power to: 1. Specify the accounting rules that govern entities subject to its jurisdiction 2. Review the resulting financial statements and to bring legal proceedings against those who fail to comply vi. Securities Exchange Act II. 1. Provisions generally prohibit material misrepresentations in, or omissions from, informational documents required to be prepared by entities issuing securities to the public j. Sarbanes Oxley Act i. CEO and CFO must certify that financial statements accurately reflect the financial condition of the company 1. Board dictates the direction of the company. President reports to CEO and CEO reports to the Board. But President and CEO can be the same person. 2. CFO: prepares and presents the financial statements to the public and SEC; budget, etc. a. With this Act, the CEO and CFO can be made to pay more personally for fraud (takes some burden off of the shareholders, because before the company could get sued if something happened) ii. Officers are required to certify company’s internal controls iii. New standard for attorneys 1. An attorney who becomes aware of “credible evidence” that a material violation of law or duty has occurred or is going to occur is REQUIRED to report that evidence “up the ladder” in the company 2. The attorney has to satisfy that herself that an appropriate response has been made. If not, the attorney has to report further up—board of directors or board committee 3. Attorney is PERMITTED, but not required, to reveal confidential info to the SEC if the attorney thinks it will be necessary to prevent the company official from committing a material violation. iv. Act was enacted to help boost confidence in the stock market and to avoid fraud k. Internal Controls keep track of things you value—make sure the components are in place: i. Control environment ii. Risk assessment iii. Control activities iv. Information and communication v. Monitoring vi. *separation of duties/checks & balances; important checks on handling of cash 1. internal controls need to be documented and you have to make sure that people are following through with the procedures Income Statements a. Displays financial condition over a limited period of time (has a definite beginning and end) i. Comparable to a movie (income statement) v. a snapshot (BS) b. Primary components: III. i. Revenues 1. Always listed first 2. Assets that a person or business receives from selling goods or performing services 3. Also includes dividends and interest from investments (separate reporting line) 4. Increases Owner’s Equity on balance sheet ii. Expenses 1. Listed second 2. It is what you have to give up to generate your revenue 3. Assets that a business consumes in producing revenues 4. Decreases Owner’s Equity 5. Examples a. COGS b. Salaries c. Depreciation d. Rent iii. Gain/(losses) 1. Difference between revenue and expense 2. Income statement is affected by the profitability of the organization c. Year-to-date i. How have you operated during this time period (how they performed for the specific month, and then a column with performance for the whole year) 1. Everything is zero-ed out every year (gain/loss is brought over to the balance sheet) d. Pension v. Defined Contribution Plans i. If pension plans are frozen, employees still get their pensions, they just don’t grow ii. 401(k) and defined contribution plans are similar iii. funding a pension plan is an expense on the income statement Balance Sheets a. What is your financial condition? (keeps rolling over) i. Starts when the organization starts; shows the net worth of an organization b. Static picture of the financial position of an individual or business at a particular point in time i. A financial photo ii. Displays the financial status of the organization from inception to the specified date c. Consists of three different sections: i. Assets 1. “Good will” value has to be re-evaluated every year (could change on the balance sheet) ii. Liabilities d. e. f. g. h. i. iii. Equity Net worth = (assets) – (liabilities) ASSETS i. Economic resources owned by an organization 1. Physical assets 2. Intangible assets (value with no physical existence) a. Patents, copyrights, trademarks, etc. ii. Always on the left side of the balance sheet 1. Cash has to be turned into cash within one year 2. Accounts receivable hopefully your customers will pay you within one year 3. List your most liquid assets first (liquidity goes down from top to bottom) iii. Note: a security deposit is an asset because you will get it back eventually LIABILITIES i. Debts owed ii. Examples 1. Accounts payable, bonds payable, loans, etc. 2. Your car is an asset, the loan on it is a liability iii. Right side of balance sheet 1. Accounts payable you have purchased items, but you haven’t paid for them yet 2. Accrued liability you owe it, but you haven’t paid it yet 3. Bonds are basically longer termed loans 4. Pension liability (longer term; don’t have to pay them back within one year) EQUITY i. Assets – Liabilities = Equity [net worth] 1. This is what the balance sheet shows Key Balance Sheet Equation i. Assets = Liabilities + Equity 1. Assets [debit (+)/credit (-)] = Liability [debit (-)/credit (+)] + Equity [debit (-)/credit (+)] ii. Debits must equal credits on all entries Double-Entry Bookkeeping i. Journal Entries 1. Used to record the transactions on either the balance sheet and/or the income statement 2. Every transaction recorded produces equal and offsetting entries to accounting records 3. The left side (DEBIT) of the equation must always equal the right side (CREDIT) of the equation 4. Three essential questions a. What has happened? i. What has come into equity, what has gone out? j. IV. b. Which accounts are affected? i. What account should be used to reflect the activity? c. Which direction are the affects accounts moving? i. Should the account be increased or decreased? T-Accounts i. A way to keep a running total of the amount in each account ii. All combined T-Accounts must balance 1. Every account has its own “bucket” or T-Account (ie. cash, accounts payable, etc.) iii. This is how info is summarized during a period and then displayed at the end of the month on the balance sheet 1. At any given time, you can strike a total on these accounts 2. The running total from the T-Accounts are put into the balance sheet Accruals a. When and how do you record things? i. Cash basis v. Accrual basis 1. Organization has to choose which method a. Both determine net income; timing is the difference between them b. Sometimes allocate revenue and expenses to different periods, resulting in different net incomes/losses b. CASH BASIS i. Simpler ii. Focuses on the movement of cash and allocated revenues and expense to the accounting period in which cash revenues are received or expenses are paid 1. When you’re paid for something, you recognize the revenue. When you pay for something, that is when you recognize the expense 2. When the service is performed/goods are delivered is irrelevant iii. When the company actually delivers the goods or performs the services are irrelevant iv. Account method most often used for personal federal income tax purposes v. Not accepted by GAAP because of the matching principle 1. GAAP seeks to track transactions based on when the revenue was earned or when the expense was incurred 2. Companies subject to SEC regulation cannot use cash basis c. ACCRUAL BASIS i. Recognize it when you OWE it ii. Revenues are recognized when they are earned by sales or services, not when payment is received V. iii. Expenses are charged against income in the period that those expenses provide benefits not when they are paid iv. Allocated revenues expense to the income statement before the cash actually changes hands v. Matches expenses to the revenues they produce 1. E.g. when you receive cash, the cash account increases and accounts receivable is eliminated in a corresponding amount 2. You can recognize an expense early under the accrual method, but not under the cash method d. Deferrals i. Recognize it when you EARN it ii. When an event should not be realized until some later period even though the cash related to that event is pair or received in the current period 1. Ie. delay when you recognize something (after the cash changes hands) iii. Do not want to benefit the income statement of any period unless the work is done in that period iv. Deferred revenue/income: revenue that you haven’t recognized yet because you haven’t earned it 1. Once you represent the client and do the work, that’s when you recognize the revenue and replace the deferral v. Deferred Expense: 1. If a lawyer pre-pays six years of rent under the cash basis, the entire expense can be recorded this year; under accrual basis, pre-paid rent is an asset on the balance sheet because the time hasn’t past yet e. Adjusting Entries i. Apportionment (defer to future period) 1. Advance cash for services not yet rendered 2. Prepaid insurance or prepaid rent ii. Unrecorded expenses or revenues (accrue to current period) 1. Revenues earned but cash not collected 2. Expenses incurred but not paid in current period iii. Balance sheet adjustments iv. *balance sheet and income statements look different depending on whether the organization uses accrual or cash basis Inventory a. An asset on the balance sheet not an expense on the income statement until the item is sold i. The revenue from that item is then matched with the expense (COGS) from initially purchasing that item b. Valued on the balance sheet at cost i. The cost of the inventory is the sum of all the expenditures and charges directly or indirectly incurred in bringing the inventory to its present condition and location (valued at lower of cost or market) c. Inventory = goods a business holds for sale to its customers in the regular course of business i. Merchandising companies buy things that are already in sellable/finished format ii. Manufacturing companies produce/change the format of something d. Types i. Raw Materials: materials used to make the goods which the company manufactures ii. Work in Progress: unfinished goods that the company has begun to make but not yet completed 1. Each step in the process makes the item cost a little bit more (this is how it is valued in the company’s inventory) iii. Finished Goods: completed goods, ready for sale e. Levels i. Beginning Inventory: inventory on hand at the beginning of an accounting period ii. Ending Inventory: inventory on hand at the end of an accounting period iii. COGS: cost of inventory sold during the period (**on the income statement) f. Formulas i. Beg. Inv. + Inv. Purchased or Manufactured – COGS = Ending Inv. ii. COGS = Beg. Inv. + Inv. Purchased or Manufactured – Ending Inv. iii. *worthless inventory/spoilage becomes an expense g. Lower of Cost or Market i. The cost of the inventory will be reduced on the balance sheet due to: 1. Physical damage 2. Deterioration 3. Obsolescence 4. Decline in price ii. If the book value of inventory is reduced using LCM, the reduction is treated as an addition to COGS for the period shown separately as a loss on the statement iii. Write off the inventory as an expense on the income statement when it fades, deteriorates, etc. h. Inventory Tracking Systems i. Periodic 1. Neither the inventory or the COGS account is kept up to date during the reporting period a. Count all of the inventory and establish an inventory balance in periodic intervals—know where everything is and then get orders and pick the items out of the warehouse 2. Physical inventory to determine inventory balance and COGS ii. Perpetual i. 1. All elements of every merchandising transaction are recorded when they occur 2. Physical inventory to verify inventory counts a. Know how many items you have and where the items are at any given time Inventory Costing Methods (*method affects the reported profitability) i. Specific Identification 1. The actual cost of each item of inventory is specifically identified to the goods during the merchandising process – form the time they are purchased or produced through the time they are sold 2. Makes sense for goods that are unique and/or very valuable (ie. artwork or cars) 3. Does not make sense for fungible items (ie. gas) ii. FIFO 1. Assumes that goods are sold in the order in which the business originally purchased them 2. The first units of inventory purchased—the ones the business has held the longest—are assumed to be first ones sold 3. Visualize a pipeline 4. During an inflationary period, your gross profit will be higher with FIFO (assuming that your product increases in price) a. A company using FIFO should look more profitable than one using LIFO (makes it hard to compare a company using LIFO with one using FIFO) iii. LIFO 1. Assumes that the goods are sold in exactly the opposite of the order in which the business originally purchases them 2. The units purchased most recently- the ones the business has held the shortest amount of time- are assumed to be the first ones sold 3. Visualize a bucket 4. The maj of organizations use LIFO b/c it is more conservative than FIFO a. LIFO shows lower gross profits and higher COGS (orgs can thus pay lower taxes due to lower net income shown) b. You can have the same cash flow whether you use LIFO or FIFO, just use LIFO to have a lower reported net income i. How you actually move inventory and how you cost it can be different iv. Average Cost 1. Averages the costs of all the units in inventory 2. The total cost basis of the inventory is divided by the total number of units to produce an average cost per unit VI. VII. 3. To determine the COGS, multiply this average cost by the number of units sold j. Inventory Method Decisions i. Method chosen affects both income and the valuation of inventory on the balance sheet ii. If costs are rising (inflationary economy), then inventory purchased more recently cost more than older inventory. 1. In this case, the LIFO method produces a higher COGS an a lower income than FIFO iii. LIFO results in a lower inventory value on the balance sheet than FIFO k. Inventory- Tax Matters i. LIFO reports lower income which results in a lower income tax obligation ii. Entity must use the SAME inventory reporting method for GAAP financial statements and for calculating income tax liability iii. An entity can only change inventory flow assumptions one time in the life of the company – it cannot shift back and forth between LIFO and FIFO depending on inflation forecasts or any other factor COGS a. On the balance sheet b. Reducing labor and lay-offs can lower COGS Costs a. Fixed i. Costs that will be the same regardless of the volume produced. They are regular and recurring 1. Ex: admin expenses, rent, management salaries b. Variable i. Costs that are volume-driven. They increase or decrease in response to changes in production and distribution volume 1. Ex: production labor, materials, certain admin and distribution costs ii. More control over profitability here—produce more, pay more c. Direct i. Costs that are specifically identifiable to an individual profit center/product. They include the costs of producing the product, operating and staff expenses, and the costs of any service or functions that the profit center outsources to others. ii. You can see/touch them; directly related to the product d. Indirect/Overhead i. All of the support efforts that are necessary if the entire organization is to function, such as accounting, legal, corporate staff, and management information systems. ii. Also includes all spending that supports all of the profit centers combined and is really not divisible among them iii. Organizations try to allocate overhead costs to certain products 1. Some allocate based on revenue; units sold, etc. VIII. IX. Assets a. Fixed assets i. Assets that have an expected useful life of over one year ii. Contributes to the earning power of the enterprise over that time iii. Matching Principal dictates that the expense of the item should be spread over the useful life of the asset iv. Depreciation, depletion and amortization are methods of spreading the expense v. Examples: buildings, autos, etc. b. Allocating Expenses i. Depreciation [see IX, too] 1. Used for plant and equipment 2. Land is the only major long-loved asset whose cost does NOT depreciate (assumption that land has an infinite useful life) ii. Depletion 1. Equivalent of depreciation when the asset is a natural resource like oil, gas, or timber 2. Divide the total cost of the natural resources by the total number of available units 3. An expense to be deducted from revenue in calculating net income 4. Affects the balance sheet in the same way as depreciation iii. Amortization 1. Used for intangible assets like patents or trademarks 2. Allocates the cost of an intangible asset over its useful life 3. Usually amortized using the straight-line method 4. Usually do not use “accumulated amortization” accounts. The value of the patent is simply reduced by the amount of amortization Depreciation a. Does NOT attempt to match cost recognition to the actual physical wearing out of the fixed asset over time due to the difficulty and subjectivity associated with conducting periodic appraisals [more simplified] b. Two Methods: i. Straight Line 1. Cost allocated equally over the useful life a. Don’t look at the actual wear and tear on the vehiclejust spread the cost out b. Take the depreciable value and spread it out over the number of years ii. Accelerated Method [orgs use to lower taxes] 1. Sum-of-the-years’ Digits a. Numerator = # of years of useful life remaining at the beginning of the year b. Denominator = sum of the years of useful life c. Front loads the expenses c. d. e. f. g. 2. Double Declining Balance a. The normal, straight-line rate is doubled and the doubled rate is applied each year to the book value of the asset Effect of Depreciation i. Income Statement 1. Expense, which reduces net income ii. Balance Sheet 1. Reduces the net carrying value of the asset 2. Retained earnings affected by net income iii. Cash Flow Statement 1. No affect in any way 2. Entire cash payment made at acquisition Depreciation allocates a purchase—the cash previously paid for the asset when it was acquired The process of depreciation provides NO cash to purchase the new asset when the old one wears out Three judgments necessary in allocating the cost of a fixed asset over time: [all have significant consequences for the income statement and balance sheet over time] i. Historical Cost 1. What did you pay for the asset? Original purchase price of asset; original installation and adaptation cost 2. Repairs and maintenance a. YES- if it extends the useful life of the asset b. NO- if it is simply a necessary repair incidental to the ordinary operation of the asset 3. Sometimes, there is more than the purchase price of that asset to take into account ii. Scrap value and the depreciable base 1. Portion of a fixed asset which will not be used up over the life of the asset 2. Original cost (what you paid for it) – Scrap value (what you can sell it for) = depreciable base [what you spread out over the life of the value] 3. Depreciable base is allocated over the expected useful life iii. Expected useful life 1. Educated guess of how long the asset will remain in use 2. Accountants draw on guidelines contained in the Internal Revenue Code to determine appropriate estimates a. Land: none b. Buildings: 30-40 years c. Equipment: 10-15 years d. *can stay within these ranges to be acceptable Significance of judgments i. High acquisition cost 1. Reduces current expenses, increases future expense ii. High scrap value 1. Reduces the depreciable base reducing future expenses recognized iii. High useful life 1. Reduces the impact on reported income in any given period, but extends the expense over a longer period of time iv. *These judgment affect how profitable a company looks. Depends on whether you want to bunch your expenses up and get them out of the way, or spread them out over a longer period (do you want your future/current financial statements to look better/worse) 1. but have to stay within GAAP h. Bookkeeping Presentation i. Leave what you paid for that asset the same as long as that asset is on your books ii. Depreciation expense is on the INCOME STATEMENT iii. Accumulated depreciation is on the BALANCE SHEET 1. Called a contra-asset 2. Net fixed assets are on the balance sheet i. Gain/Loss v. Income/Expense i. Gains: increases in equity generally from non owner sources, which result from peripheral or incidental transactions ii. Gains/Losses 1. Incidental interest received or paid 2. Profit or loss on incidental sales of investments, property, plant and equipment 3. Profits or losses resulting from litigation and casualties 4. Gains also include dividends received on investments j. Mid-Course Changes i. GAAP permits changes to be made in the depreciation calculations based on changes in original assumptions (ie. how long the asset will last) ii. Prior financial statements do not have to be restated iii. Apply revised assumptions to REMANING book value k. Consistency Principle i. GAAP prohibits changing from straight line to accelerated method for a particular asset (but ALLOWS changes from accelerated to straight line) – you can change to be more conservative but not the other way around ii. Consistency principle does NOT require that all assets of an entity be depreciated according to the same method l. Financial v. Tax Reporting i. COGS (valuing inventory): must use same method for financial reporting and tax reporting (ie. FIFO and LIFO) ii. Depreciation: can use one method for financial reporting and a different method for tax reporting 1. Financial reporting: straight line method 2. Tax reporting: accelerated method (reports lower earnings, thus reduces income tax liability) CREDITS/DEBITS Debit & Credit example: You can learn to understand to identify the two basic components of each transaction: 1. 2. What did you get? Where did it come from? The debit is what you got and The credit is the source of the item you received. Let's imagine that you purchase a computer with your credit card. Since the computer is what you received it's going to result in a debit to the asset account for your computer. The credit will be applied to the credit card liability account for the same amount. The banks tend to confuse us because they are telling us the entry to their liability account. When you deposit money in the bank, their liability to you increases. Since liabilities are credit accounts they are crediting our account. When they reduce their liability to us, they are debiting their liability account. So, if you can identify what you received and where it came from in every transaction you have debits and credits mastered. AFTER MIDTERM OUTLINE Won’t ask about increasing/decreasing debits/credits Ch. 6 Statement of Cash Flows o When buying stocks, look at revenue side of the BS, price/earnings ratio, dividends o Find earnings at the bottom of the I/S o Find shares outstanding in the equity section of the BS o Orgs can pay dividends when they generate cash (you can’t just slice up net income and distribute it) o When buying stock look at demand, what competitors are doing; the type of business o Statement of Cash Flows Measures the financial viability of an entity An entity’s ability to meet its debts as they come due Depends on the way in which cash in the business is managed and the way in which it flows through the business Accrual method of accounting obscures the actual inflow and outflow of cash (so look at this statement to see the cash side of it) A company can show a profit and not have any cash o Statement of Changes in Financial Position Accounting statement that tracks an orgs’ cash flow for a specified period It shows how much cash the company had at the start of the period, the amount of cash it received during the period, the amount of cash it paid out during the period, and how much cash it has at the end of the period o Categories of Statement Cash flows from operations Wages from job, buying books, tuition, etc. Cash flows from investing activities Selling or buying a car/coin collection, etc. Cash flows from financing activities Relates to liabilities and equity accounts o Stock sales, dividends, etc. Loans o Methods of Calculation (GAAP allows either, but direct is better) Direct method Tracks each of the operating activities that affect cash directly Indirect method Starts with the net income during the period and then identities the types of transactions that would impact net income in a way that differs from the impact of those transactions on cash flows o Depreciation expense hits income statement but you’re not paying out cash each month for depreciation expense (you have to adjust for it) o Cash to Current Debt Ratio Retained operating cash flow = cash flow provided by operations less cash paid out in dividends Comes from cash flow statement Short term debt and current portion of long term debts comes from the BS o Quality of Income Ratio Compare how much cash you’re showing to the amount of profit you’re showing Operating income comes from the bottom of IS (the profit you show on the IS) Ch. 7 – Capital Accounts o Equity = assets (-) liabilities Net worth o Talking about the bottom right (equity) section of the BS o Forms of Ownership Sole proprietorship One owner and one equity account Has not taken legal steps necessary to form some other kind of organization A withdrawal of capital is not an expense b/c the withdrawal has nothing to do with producing income Easy to organize; owner has complete control; owner receives all income Owner has unlimited liability; may have difficulty attracting quality EEs; could experience difficulties raising capital o Can attach personal assets/go beyond sole proprietorship Partnership More than one owner Separate capital account is used for each owner Can loan money to org—noted on the statements as loans Income is allocated to each partner’s equity account according to the % of profits each partner is entitled to (as determined by law or the partnership agreement) Increased ability to raise funds; profits flow directly through partners’ tax return (don’t have to follow a separate return); easy to establish (just an agreement not a bunch of paperwork) Partners are J/S liable; Increased opportunity for disagreements; Profits must be shared; Life limited to life of partners; unlimited liability from all partners? Limited liability partnership Has one general partner and one or more limited partners o General partner is responsible for management o Limited partners have liability limited to their investment When profits are generated in operating the business are paid to partners, those payments are reflected in accounts called drawing accounts. Each partner has his own drawing account. Corporation [can be public or private] Separate legal entity Equity investments are represented by shares of stock Corporations do not create a separate equity account for each investor Equity section segregated into: o Capital/common stock o Additional paid in capital o Retained earnings Advantages o Shareholders have limited liability o Can raise funds through sale of stock o Life of business is unlimited Disadvantage o Incorporation takes time and money o May result in higher taxes overall (double taxation) Have to file Articles of Incorporation to set up a corporation o Basic structure of the corporation and why it is created Bylaws o Govern the internal conduct of the corporation o Private orgs can choose their accting methods; public orgs have to use accrual method o Unlike articles of incorporation, the bylaws are not required to be filed with the secretary of state Board of directors can be vested with the power to alter or repeal bylaws unless the power to do so is reserved for the shareholders in the articles of incorporation Stock represents actual partial ownership of a corporation Additional Paid-in Capital Difference b/w what you sold stock for and the par value (par value = minimum, below which stock won’t sell) Retained Earnings Cum amount of earnings generated over time minus dividends paid out