ACCT 351 casebook - University of Delaware

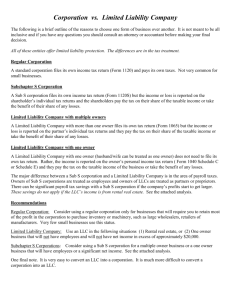

advertisement