The Japanese Auto Industry A Window on Japan's Economy

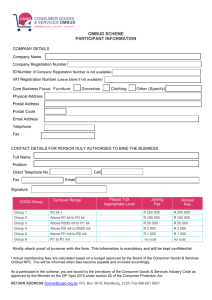

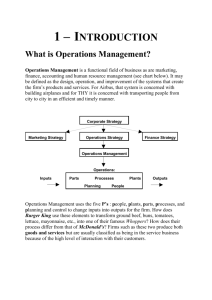

advertisement

The Japanese Auto Industry A Window on Japan's Economy Michael Smitka Professor of Economics Washington and Lee Alumni College July 20, 2000 Japan's Car Market…?! Enjoy the strong yen! Big Sale Now…! Price -- a mere ¥16,800,000 • Exchange rate: ¥108 per US$ (Wednesday's rate) • Price in dollars: $155,555.55 • And this is after the 10% "strong yen" sale discount!! Luxury Cars aren't Representative • Mercedes will sell 50,000 cars in 2000 • 2.8 million -- regular cars • 2.0 million -- minicars • 1.0 million -- light trucks • 0.3 million -- imports Japanese Auto Firms • • • • • • Toyota Daihatsu Nissan Hino Honda Nissan Diesel Mitsubishi Motors Suzuki Mazda Isuzu Fuji Heavy Industries (Subaru) • Defunct: Prince .. Ohta .. Kurogane .. Several others The Domestic Industry's Geography • Firm All Cars Regular • Toyota 917,120 917,120 • Daihatsu 286,555 • Nissan 388,548 388,548 • Honda 375,725 223,506 152,219 • Mitsubishi 307,949 161,815 146,134 • Mazda 165,613 142,436 23,177 • Suzuki 324,059 • Fuji (Subaru) 151,100 64,799 • Isuzu 35,529 35,529 • Cars 3.061 2.043 • Trucks & Buses 0.051 mil mil Minicars 286,555 324,059 mil 86,301 1.018 m Import Brands • • • • • VW D/C BMW GM Ford 33,078 28,248 20,110 14,217 13,511 • All less than 1% share in a 3 million car market…. Definitions • Production inside Japan versus global production – Honda is almost as much American as Japanese! – Toyota is rapidly internationalizing Missing from List?! • Nissan is owned by Renault • Mazda is owned by Ford • Isuzu is owned by GM • Suzuki, Fuji are partly owned by GM • Mitsubishi will be owned by DaimlerChrysler • Hino & Daihatsu are now owned by Toyota • Nissan Diesel is (?) Volvo Definitions (ii) • Production by Japanese firms – Mazda, Isuzu and Nissan are all controlled by non-Japanese companies – Suzuki, Fuji Heavy Industries (Subaru) and Mitsubishi have foreign firms as major if not dominant shareholders – Only Honda and Toyota are "Japanese" Production outside of Japan NAFTA EU Asian expansion "The" Auto Industry • 888,000 Manufacturing (1.3% of labor force) – 262,000 assembly – 626,000 parts and body • 1,280,000 Sales & Repair • 957,000 Materials • 1,106,000 Ancillary • 3,033,000 Transport services (2.0% " " ") (Steel, rubber, paint…) (Gas Stations, Insurance….) (Truck drivers….) • 7,260,000 Total -- 11% of Labor Force • 13% of mfg shipments, 20% of exports Definitions (iii) • Parts versus Assembly – Employment is in parts, not assembly – Dealerships and repair shops, too • Dealerships in Japan are unprofitable! – Gas stations, too? • Deregulation has overturned the industry! Peak 13.5 mil Now < 10 mil Historical Development • Typical LDC Pattern of Industrialization – Initial domination by foreign producers – Excess entry by "national" firms and extreme inefficiency under subsequent protectionism • Industrial consolidation - the Year 2000 theme! – Assemblers going or gone – Now it's the parts sector's turn Auto sales • The Japanese market was for trucks until 1968 – businesses were the predominant customer – many vehicles were 3-wheelers! • Japan was advanced in the late 1920s and 1930s – Ford from 1925, GM from 1927 – Military halted construction of a new, state-of-theart integrated Ford plant in 1936 – Took 45 years to catch up again! Motor Vehicle Production 1950-1968 Truck & 3-Wheeler Era 2,5 00,0 00 Turning points • 1961 cars surpass 3-wheelers • 1968 cars surpass trucks 2,0 00,0 00 1,5 00,0 00 Trucks 1,0 00,0 00 Cars 500 ,000 3-Wheelers 0 195 0 195 1 195 2 195 3 195 4 195 5 195 6 Cars 195 7 195 8 195 9 196 0 Trucks & Bus es 196 1 196 2 196 3 3-Wh eele rs 196 4 196 5 196 6 196 7 196 8 Distinctive Features • Competitiveness – Success in American market from late 1970s – But in the 1990s poor profitability on a global basis, so-so success in the EU Management details for Q&A?! – – – – – Just-in-time kanban methods of production control Rapid product development cycle Quality control techniques Supplier management / purchasing strategy Labor relations patterns distinctive from those of the US. "Lifetime" employment system, annual wage hikes, biannual bonuses US-Japan Topics (I) Japanese success was due to US! • Japanese entry rode a small car wave • We paid Japan off!! – VER - voluntary export restraint - cum - cartel • Our subsidies financed – Japan's mid-sized cars – Japan's overseas plants • Absent US policy . . . . no Japan?? US-Japan Topics (II) American revitalization was due to Japan • Until Japanese entry in the 1980s, the Big Three formed a tight cartel • Competition forced a reformation the last 15 years • Japanese inroads are almost exactly matched by GM's decline • US firms' superior financial controls helped offset poor manufacturing The "Bubble" • Japan would rule the world in autos… • Exports, domestic market boomed in mid-1980s • Low interest rates fed the boom • So what do you do? -- add capacity! – 1.5 million units in a shrinking market – Now 15 mil units capacity, 10 mil units output – Toyota alone has 1 mil units excess capacity The "Bubble" Denouement • Plaza Accord of September 1985 – yen appreciated – exports fell • Domestic asset bubble broke – home demand fell • Foreign producers recovered – skills improved – light truck / minivan boom favored them Today’s status • Huge excess capacity within Japan – 10 years of delay while hoping for recover (cf. GM) – Little restructuring until 2000, and then only at a few assemblers • Aging labor force & population – costs will rise – demand won't • Debt, poor profitability – can Japanese firms invest abroad profitably?? Looking Forward • Improved efficiency in Japan?? – continued exit / restructuring esp. at parts firms • Maturation in other markets – international expansion will slow, firms will see occasional sales downturns • How to manage a global firm? – few precedents in Japan – US firms don't always do well, either! (in 2000, Ford in EU) – Firms with high export shares (Honda, Mazda) remain vulnerable to exchange rate swings Summary & Lessons • Many features of Japan reflect its economic transition from a developing country • The "bubble" legacy is still present 10 years later • Maturation will not proceed smoothly • How similar are the US? Korea? China? Addenda • GDP growth chart – GDP – Unemployment • Big 3 cartel (oligopoly) era • Today's structure -- competition galore! • Major parts suppliers – Sales size – Nationality (by headquarters location) GDP growth Mfg growth U Old Vs New: the Old GM Ford Chrysler AMC (imports < 10% of market) VW (Briefly in Pennsylvania) ====== Big 3 (+ 1-2 little firms) Old vs. New: the New NAFTA Producers • GM Subaru BMW • Ford Isuzu VW (Mexico) • Toyota Mitsubishi Saturn (GM) • Honda Mazda (AutoAlliance) • Chrysler Suzuki (CAMI) • Nissan Mercedes-Benz • Big 6 plus The Little 9 firms (Hyundai*) (VW - US*) (Volvo*) (plus 13% imports!) Top Suppliers - A Multinational Base (1998 OEM sales; *Subsequent M&A) • • • • • • • • Delphi Bosch Visteon Denso Lear* JCI TRW* US $26 bil $18 bil $18 bil $12 bil $9 bil $9 bil $7 bil German Dana $7 bil Aisin Seiki $7 bil Valeo $7 bil Yazaki $6 bil Magna $6 bil Mannesmann $6 LucasVarity* $5 Japanese Other Bibliography • David Halberstam, The Reckoning. 1986. – A good read, and a good depiction. • Maryann Keller, Rude awakening : the rise, fall, & struggle for recovery of General Motors. 1989. – Another good read. See also her Collision: GM, Toyota, Volkswagen and the Race for the 21st Century, 1993. • Japan Automobile Manufacturers Association: http://www.jama.or.jp – Includes auto industry overview .pdf file and current statistics • Mike Smitka, Competitive Ties. Columbia University Press, 1989. – The parts sector in Japan • Department of Commerce, Office of Automotive Affairs: http://www.ita.doc.gov/td/auto/ – US data, links, trade data • Keizai Koho Center Japan: An International Comparison (Annual, 1998-2000 available online) www.kkc.or.jp/english/activities/publications/aic2000.pdf – Handbook of statistics on social / political / economic facets of Japan. 100 pages of downloadable tables & graphs, most with comparative data for the US and EU.