®

Assurant

Plan Enhancer

amplify your coverage

ASSURANT PLAN ENHANCER PROVIDES LIMITED BENEFITS

For agent use only

1

Individual Medical Plans

Something’s missing

• People have major medical insurance to be covered

for major injuries and illnesses

• But today’s plans have out-of-pocket limits that

leave people exposed — and often they don’t know,

or don’t care, until after they’ve had a claim

2

Assurant Supplemental Coverage I Assurant Plan Enhancer

It’s a real problem

• Most U.S. households don’t have the available cash

needed to pay today’s out-of-pocket limits*

• This forces customers to make trade offs with their

health insurance coverage

Reduce my premium

and pay more outof-pocket expenses

Pay a higher

premium to have

fewer out-of-pocket

expenses

*Source: Kaiser Family Foundation analysis of 2013 Survey of Consumer Financial (SCF) data.

3

Assurant Supplemental Coverage I Assurant Plan Enhancer

What if you offered a solution?

Deliver the benefits customers desire most

Have more-satisfied customers

Solidify your position as the go-to insurance advisor

Promote persistency in your book of business

4

Assurant Supplemental Coverage I Assurant Plan Enhancer

Assurant® Plan Enhancer

amplify your coverage

5

Assurant Supplemental Coverage I Assurant Plan Enhancer

Building a better plan

6

Assurant Supplemental Coverage I Assurant Plan Enhancer

One plan covers multiple possibilities

• Customers choose a benefit amount that fits their needs

and budget, and they can receive benefits for:

– Accidents

• Plan pays covered out-of-pocket expenses up to the benefit amount per accident

– Cancer and heart attack or stroke

• The benefit amount is paid as a lump sum upon a first covered diagnosis

– Inpatient admissions for illnesses

• The benefit amount is paid as a lump sum upon the first covered day in the

hospital

7

Assurant Supplemental Coverage I Assurant Plan Enhancer

It goes with everything

• Simple product

– Easy-to-explain benefits go hand in hand with any carrier’s

medical plan

• Quick sales process

– Quickly move to the next sale with quoting and submission that

can be completed in as few as 5 minutes

– Sickness Hospitalization benefit requires three health questions*

• Many benefit amount options

– Align benefit amounts with out-of-pocket limits to fill gaps in

other plans

*Select states have four enrollment questions for Sickness Hospitalization benefit.

8

Assurant Supplemental Coverage I Assurant Plan Enhancer

It can work for anyone

• Those who:

– Have metallic, grandfathered

or extended plans

• Their own coverage

• Coverage through an employer

• Any carrier

9

Assurant Supplemental Coverage I Assurant Plan Enhancer

– Have other employersponsored plans

– Have short-term medical plans

It ends the trade off

• Now you can offer a real alternative to the paying-ahigher-premium-or-paying-more-out-of-your-ownpocket dilemma

I have the medical

coverage I need and

can afford

Plan Enhancer helps

me with my out-ofpocket expenses

Offer customers a solution with Assurant Plan Enhancer

10

Assurant Supplemental Coverage I Assurant Plan Enhancer

Assurant® Plan Enhancer

Product overview

11

Assurant Supplemental Coverage I Assurant Plan Enhancer

Plan Enhancer overview

•

Accident Medical Expense (AME) plan

–

•

•

Optional Cancer and Heart/Stroke benefit

–

Pays the full benefit amount in a lump sum for a first-ever

cancer diagnosis

–

Pays the full benefit again for first heart attack or stroke

Optional Sickness Hospitalization benefit

–

12

Pays covered out-of-pocket expenses up to the benefit amount

per accident

Pays the full benefit amount in a lump sum upon the first

covered day of admission into a hospital for an illness

Assurant Supplemental Coverage I Assurant Plan Enhancer

Benefit amount options

• Customers select a benefit amount for their package —

the same amount applies to Accident Medical Expense,

Cancer and Heart/Stroke, and Sickness Hospitalization

• Options range from $2,000 to $10,000:

13

– $2,000

– $6,000

– $2,500

– $6,500

– $3,000

– $6,600

(2015 out-of-pocket limit)

– $3,500

– $6,850

(2016 out-of-pocket limit)

– $4,000

– $7,500

(Sickness Hospitalization rider not available)

– $4,500

– $8,000

(Sickness Hospitalization rider not available)

– $5,000

– $9,000

(Sickness Hospitalization rider not available)

– $5,500

– $10,000

(Sickness Hospitalization rider not available)

Assurant Supplemental Coverage I Assurant Plan Enhancer

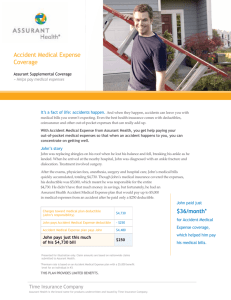

Accident Medical Expense plan

Features

• Pays covered out-of-pocket expenses for every accident

• Cash payouts go directly to customer

• No waiting period*

• No networks

• No annual or lifetime limits — no matter how many accidents

• Low $250 deductible per accident/person

• Includes an accidental death & dismemberment benefit

• Guaranteed issue

*

14

The accident must have occurred after the policy is in effect.

Assurant Supplemental Coverage I Assurant Plan Enhancer

More details — Accident Medical Expense

Cash payouts go directly to customer

Pays covered out-of-pocket expenses for every accident — no annual limit

Coverage details

Deductible

$250 per accident/person

Accidental Death and Dismemberment

Lump-sum payout is:

• 100% of selected benefit amount upon death

• 25% to 100% of selected benefit amount for

dismemberment (dependent on affected

body part)

Ground Ambulance Limitation

$300 per accident/person

Physical Medicine Limitation

$25 per visit up to $250 per accident/per person

Durable Medical Equipment Limitation

$100 per accident/per person

Benefits vary by state, see state-specific benefit schedule for details.

15

Assurant Supplemental Coverage I Assurant Plan Enhancer

Cancer and Heart/Stroke rider

Features

• Guaranteed issue when purchased with Assurant Plan Enhancer

• Lump-sum payout goes directly to customer upon first covered

diagnosis

– Customers use the cash however they want

– No deductible, coinsurance or copay

• Two full benefit amounts available:

1.

For first-ever cancer diagnosis

2.

For heart/stroke events

• Pays regardless of other coverage

• Customers choose the doctors and hospitals they wish

16

Assurant Supplemental Coverage I Assurant Plan Enhancer

More details — Cancer and Heart/Stroke

Lump-sum payout for first-ever cancer diagnosis and lump-sum payout for heart attack or stroke*

When partial Heart/Stroke benefits are paid, customers are still protected by remaining benefits

If customer is diagnosed with

The plan pays

Cancer (first-ever diagnosis)

100% of the selected benefit amount

Coronary artery disease or cardiac

arrhythmia resulting in heart attack

100% of the selected benefit amount

Coronary artery disease or cardiac

arrhythmia resulting in coronary artery

bypass

25% of the selected benefit amount

and has 75% benefit remaining

Coronary artery disease resulting in coronary

angioplasty

10% of the selected benefit amount

and has 90% benefit remaining

Cerebrovascular disease resulting in stroke

100% of the selected benefit amount

*Specific conditions listed on slides 27-29.

Pre-existing condition limitation applies. Waiting periods apply in most states. Where waiting periods do not apply,

benefit payouts will be reduced for a limited time.

17

Assurant Supplemental Coverage I Assurant Plan Enhancer

Sickness Hospitalization rider

Features

• Full benefit is paid upon admittance into the hospital for a covered

illness

• Lump-sum payout goes directly to the customer

• Pays regardless of any other coverage

• Customers use the cash however they want

• No deductible, coinsurance or copay

• Customers choose the doctors and hospitals they wish

• Only three health questions for enrollment*

*Four health questions in some states.

18

Assurant Supplemental Coverage I Assurant Plan Enhancer

More details — Sickness Hospitalization

Lump-sum payout goes directly to the customer the first day of an inpatient

hospital stay for a covered illness

Customers don’t have to wait for daily payments

Coverage details

• Applicant must attest to having minimum essential coverage

• Pre-existing condition limitation applies

Benefit waiting period

30 days from effective date of policy

Lump-sum benefit limitations

One time per year/person

Two times per year/family

Other limitations

No benefits for hospitalizations related to:

• Behavioral health

• Substance abuse

• Pregnancy

19

Assurant Supplemental Coverage I Assurant Plan Enhancer

Availability

Alabama

Texas

Arkansas

Wisconsin

Indiana

West Virginia

Michigan

Illinois

Mississippi

(CHS not available)

Nevada

Montana

(Sickness Hospitalization not available)

Oklahoma

More states coming soon

20

Assurant Supplemental Coverage I Assurant Plan Enhancer

Eligibility

• Accident Medical Expense

– Up to age 65 (Through 64)

– Child only

• Optional Cancer and

Heart/Stroke and Sickness

Hospitalization benefits

– Up to age 60 (Through 59)

– No child only

21

Assurant Supplemental Coverage I Assurant Plan Enhancer

Enrollment

Make more

money in three

easy steps

Go to assuranthealthsales.com and complete the demographic

fields for the customer.

Select Accident Medical Expense benefit amount and optional

riders.

Check the quote summary.

22

Assurant Supplemental Coverage I Assurant Plan Enhancer

Plan Enhancer wrap up

• One plan covers multiple possibilities

– Accidents, cancer, heart attack, stroke and hospital stays due

to illness

• Goes with anything and works for anyone

– Fits with any carrier’s medical plan

– For those with employer-sponsored, short-term and individual

medical plans

• Be the solution

– Ease the burden of high out-of-pocket costs

– Deliver the benefits customers desire most

– Have more-satisfied customers

23

Assurant Supplemental Coverage I Assurant Plan Enhancer

Accident Medical Expense exclusions

We will not pay benefits for any charges, dismemberment or death that result from or are related to an accident

sustained prior to the effective date of the coverage under this policy, or claims resulting from or related to

sickness.

In addition, charges directly or indirectly resulting from any of the following are not covered:

•

Medical event, treatment, services or supplies for which benefits equal to or in excess of such charges are

received under any other benefits

•

Treatment, services or supplies that:

–

Are not included in the covered treatment definition

–

Are due to complications of a non-covered service

–

Are incurred before the covered person’s effective date or after the termination date of coverage

•

Dental treatment except as otherwise covered for a dental injury

•

Tendonitis, tenosynovitis, bursitis, overuse, strains, repetitive motions or stress, repetitive or cumulative

traumas including, but not limited to, carpal tunnel syndrome, tennis elbow and thoracic outlet syndrome

•

Hernia or heat exhaustion

•

Treatment of mental or emotional disorders, alcoholism, substance abuse and drug addiction

•

Cosmetic service; treatment that is not medically necessary; treatment, services and supplies for experimental

or investigational services

•

Treatment, services and supplies provided for or by a masseur, masseuse or massage therapist, a rolfer;

massage therapy; meditation or relaxation therapy; aromatherapy; holistic therapies; acupuncture,

biofeedback, neurotherapy, and electrical stimulation

24

Assurant Supplemental Coverage I Assurant Plan Enhancer

Accident Medical Expense exclusions

•

Services or supplies ordered, directed or performed by a health care practitioner or supplies purchased from a

medical supply provider who is a covered person, an immediate family member, employer of a covered person

or a person who ordinarily resides with a covered person

•

Treatment incurred outside of the United States, its possessions or Canada

•

All prescription and over-the-counter products, drugs or medicines

We will not pay benefits for accidental injury, accidental dismemberment or accidental death resulting from or

related to any of the following:

•

An accident that occurred before the covered person’s effective date or after the termination date of coverage

•

Participation in the military service

•

War or any act of war

•

Voluntarily taking, absorbing, or inhaling any gas, poison or drugs

•

Voluntary use of alcohol or any controlled substance, as defined by statute, except when administered in

accordance with the advice of the covered person’s health care practitioner, including accidents that occur

while the covered person is under the influence of alcohol or drugs

•

Participation in an assault or commission of a felony

•

Any hazardous activity including, but not limited to: parachute jumping, hang-gliding, bungee jumping, air or

space travel in any vehicle other than a regularly scheduled flight by an airline, racing any motorized or nonmotorized vehicle, including a pit crew, rock or mountain climbing, mountaineering, spelunking and cave

exploration, parkour, intercollegiate sports and extreme sports. Also excluded are treatment and services

required due to accidental injury received while practicing, exercising, undergoing conditioning or physical

preparation for any such activity

25

Assurant Supplemental Coverage I Assurant Plan Enhancer

Accident Medical Expense exclusions

26

•

Any hazardous occupation or other activity for which compensation is received in any form, including

sponsorship, such as, but not limited to: operating a taxi or delivery service; participating, instructing,

demonstrating, guiding or accompanying others in skiing, horse riding, rodeo activities, professional or semiprofessional sports, adult sporting competition at a national or international level and extreme sports. Also

excluded are treatment and services required due to accidental injury received while practicing, exercising,

undergoing conditioning or physical preparation for any such compensated activity

•

Suicide or attempted suicide

•

Intentionally self-inflicted injury

Assurant Supplemental Coverage I Assurant Plan Enhancer

Cancer and Heart/Stroke covered conditions and exclusions

Covered conditions

Cancer

A malignant tumor, including an in situ, and hematopoietic malignancy for which any of the following is recommended by

your health care practitioner:

•

Radiation

•

Chemotherapy

•

Immunotherapy

•

Complete excision of an internal organ without need for further treatment

•

Any metastatic cancer for which no therapy is recommended

For purposes of this policy, cancer does not include:

•

Noninvasive dermatologic carcinomas (basal cell carcinoma BCC, squamous cell carcinomas SCC, melanoma in-situ),

cervical carcinoma in situ or other premalignant conditions such as myelodysplastic and myeloproliferative disorders,

leukoplakia, hyperplasia; or

•

An incidental pathological diagnosis found following surgical excision of an organ unless additional chemotherapy,

radiation therapy and/or immunotherapy is recommended

27

Assurant Supplemental Coverage I Assurant Plan Enhancer

Cancer and Heart/Stroke covered conditions and exclusions

Heart

Coronary artery disease: acute coronary occlusion, coronary atherosclerosis, aneurysm and dissection of the heart, and

coronary atherosclerosis due to lipid rich plaque.

Cardiac arrhythmia: cardiac dysrhythmias, paroxysmal supraventricular tachycardia, paroxysmal ventricular tachycardia,

atrial fibrillation and flutter, and ventricular fibrillation and flutter.

Heart attack: a myocardial infarction resulting in the death of an area of the heart muscle due to insufficient blood supply

to that area.

The basis of the diagnosis must include:

• Serial measurements of cardiac biomarkers showing a pattern and level consistent with an acute myocardial infarction

• New electrocardiographic changes consistent with acute myocardial infarction

For the purposes of this policy, heart attack does not include:

• Any other disease or injury involving the cardiovascular system

• A cardiac arrest that is not caused by myocardial infarction

Coronary artery bypass: a procedure which uses a saphenous vein or internal mammary artery graft to surgically bypass

obstructions in a native coronary artery or arteries to treat coronary artery atherosclerosis. Coronary artery bypass does

not include balloon angioplasty, laser relief of obstruction or any other intra-arterial procedures.

Coronary angioplasty: an interventional procedure to widen or unblock the right coronary artery; left main stem; left

anterior descending; or circumflex artery.

28

Assurant Supplemental Coverage I Assurant Plan Enhancer

Cancer and Heart/Stroke covered conditions and exclusions

Stroke

Brain tissue infarction due to acute cerebrovascular incident, embolism, thrombosis or hemorrhage. The basis of the

diagnosis must include imaging documentation of new brain tissue infarction in association with acute onset of symptoms

consistent with central nervous system neurological damage.

For the purposes of this policy, stroke does not include:

• Transient ischemic attacks (TIAs)

• Transient global amnesia (TGA)

• External trauma causing accidental injury to the brain

• Brain damage due to infection, vasculitis, encephalopathy and inflammatory disease

• Ischemic disorders of the vestibular system

29

Assurant Supplemental Coverage I Assurant Plan Enhancer

Cancer and Heart/Stroke covered conditions and exclusions

Pre-existing condition definition

A specified disease:

•

For which medical advice, consultation, care or treatment was sought, received or recommended from a

provider or prescription drugs were prescribed during the 24-month period immediately prior to the covered

person’s effective date, regardless of whether the condition was diagnosed, misdiagnosed or not diagnosed; or

•

That produced signs or symptoms during the 24–month period immediately prior to the covered person’s

effective date, which were significant enough to establish manifestation or onset by one of the following tests:

–

The signs or symptoms reasonably should have allowed or would have allowed one learned in medicine to

diagnose the condition; or

–

The signs or symptoms reasonably should have caused or would have caused an ordinarily prudent person

to seek diagnosis or treatment

Pre-existing conditions limitation

A pre-existing condition is not eligible for benefits unless the first-ever diagnosis occurs after the pre-existing

condition limitation period has expired. We will not pay benefits for specified diseases that are, result from, or are

related to a pre-existing condition that is diagnosed within the first 12 months this rider is in force.

30

Assurant Supplemental Coverage I Assurant Plan Enhancer

Cancer and Heart/Stroke covered conditions and exclusions

Exclusions

In most states, we will not pay benefits for a cancer diagnosis within the first 90 days and heart and stroke events

occurring within the first 30 days immediately following the rider effective date.

We will not pay benefits for claims resulting, whether directly or indirectly, from specified diseases that are related

to, or are resulting from any of the following:

•

Any disease the covered person was diagnosed with prior to effective date of this rider

•

Any disease first diagnosed within the pre-existing conditions limitation

•

Arrhythmia resulting in heart attack in association with use of an illegal drug or controlled substance, except

when administered in accordance with the advice of the covered person’s health care practitioner

•

Suicide or attempted suicide

•

Self-inflicted sickness

The Exclusions section in the Accident Medical Expense insurance policy is not applicable to this rider’s specified

disease benefits.

31

Assurant Supplemental Coverage I Assurant Plan Enhancer

Sickness Hospitalization exclusions

Pre-existing condition definition

A sickness and related complications:

•

For which medical advice, consultation, diagnosis, care or treatment was sought, received or recommended

from a provider or prescription drugs were prescribed during the 12-month period immediately prior to the

covered person’s effective date, regardless of whether the condition was diagnosed, misdiagnosed or not

diagnosed; or

•

That produced signs or symptoms during the 12–month period immediately prior to the covered person’s

effective date, which were significant enough to establish manifestation or onset by one of the following tests:

–

The signs or symptoms reasonably should have allowed or would have allowed one learned in medicine to

diagnose the condition; or

–

The signs or symptoms reasonably should have caused or would have caused an ordinarily prudent person

to seek diagnosis or treatment

A pregnancy that exists on the day before the covered person’s effective date will be considered a pre-existing

condition.

Pre-existing conditions limitation

We will not pay benefits for hospitalizations that result from or are related to a pre-existing condition, or its

complications, until the covered person has been continuously insured under this rider for 12 months. After this

period, benefits will be available for hospitalizations resulting from or related to a pre-existing condition, or its

complications, provided that the covered hospitalization occurs while this rider is in force.

32

Assurant Supplemental Coverage I Assurant Plan Enhancer

Sickness Hospitalization exclusions

Exclusions

We will not pay benefits for claims resulting, whether directly or indirectly, from hospitalizations or losses that are

related to, or are resulting from any of the following:

33

•

Hospitalization due to sickness within the first 30 days immediately following the rider effective date

•

Any treatment or services for behavioral health or substance abuse

•

Any treatment or services whether medical or surgical, for purposes of controlling the covered person’s weight

or related to obesity or morbid obesity

•

Capsular contraction, augmentation or reduction mammoplasty, except for all stages and revisions of

reconstruction of the breast following a medically necessary mastectomy for treatment of cancer, including

reconstruction of the other breast to produce a symmetrical appearance and treatment of lymphedemas

•

Outpatient or inpatient confinement in an emergency room or a facility other than a hospital

•

Outpatient or inpatient confinement primarily for rehabilitation or custodial care

•

Prophylactic treatment, services or surgery including, but not limited to, prophylactic mastectomy or any other

treatment, services or surgery performed to prevent a disease process from becoming evident in the organ or

tissue at a later date

•

Treatment or services related to the following conditions, regardless of underlying causes: sex transformation;

gender dysphoric disorder; gender reassignment; treatment of sexual function, dysfunction or inadequacy;

treatment to enhance, restore or improve sexual energy, performance or desire

•

Treatment or services related to: infertility; maternity; pregnancy (including complications of pregnancy); routine well

newborn care at birth including nursery care; abortion; surrogate pregnancy; fetal surgery, treatment or services

•

Hospitalizations ordered or directed by a health care practitioner or provider who is a covered person, an immediate

family member, employer of a covered person or a person who ordinarily resides with a covered person

Assurant Supplemental Coverage I Assurant Plan Enhancer

Sickness Hospitalization exclusions

•

Hospitalization that is not medically necessary or is for experimental or investigational services

•

War or any act of war, whether declared or undeclared; foreign or domestic acts of terrorism; participation in

the military service

•

Cosmetic services

•

Voluntary use of alcohol or any controlled substance, as defined by statute, except when administered in

accordance with the advice of the covered person’s health care practitioner; voluntarily taking, absorbing, or

inhaling any gas, poison or drugs, except when administered in accordance with the advice of the covered

person’s health care practitioner

•

Hospitalization incurred outside of the United States, its possessions, or Canada

•

Suicide or attempted suicide

•

Self-inflicted sickness

•

A hospitalization when the confinement period began before the covered person’s effective date, after the

termination date of coverage, or during the benefit waiting period

•

A hospitalization resulting from an accident

The Exclusions section in the Accident Medical Expense insurance policy is not applicable to this rider’s inpatient

hospitalization for sickness benefits.

34

Assurant Supplemental Coverage I Assurant Plan Enhancer

Renewability

Renewability

Coverage is renewable to age 75 for the Accident Medical Expense Coverage and to age 65 for the Cancer and

Heart/Stroke rider and the Sickness Hospitalization rider provided: there is compliance with plan provisions,

including dependent eligibility requirements; there has been no discontinuation of the plan or Assurant Health’s

business operations in the state; and/or the insured has not moved to a state where this plan is not offered. Assurant

Health has the right to change premium rates upon providing appropriate notice.

This presentation provides a summary of benefits, limitations and exclusions. In certain states, an outline of coverage is available from the

agent or the insurer. Please refer to the outline of coverage for a description of the important features of the health benefit plan. Please

read the coverage documents carefully for a complete listing of benefits, limitations and exclusions. Benefits vary by state.

Product Forms: 8227, B827 and B828 series

For agent use only. Not for distribution to consumers.

Assurant Health is brand name for products underwritten and issued by Time Insurance Company.

J-118232 (Rev. 04/2015) © 2015 Assurant, Inc. All rights reserved.

35

Assurant Supplemental Coverage I Assurant Plan Enhancer

36

Assurant Supplemental Coverage

For more information, contact Kerri at

1-800-544-8250 ext. 120

37

Assurant Supplemental Coverage