ACCT 201 Course Embedded Questions

advertisement

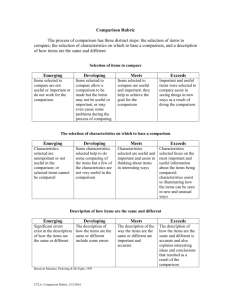

Assurance of Learning Program (including applicable rubrics) ACCT 201 Course Embedded Questions Fundamental Objectives for Accounting 201 1) Understand the elements of the Accounting Equation, the Accounting Principles involved in recording economic transactions and the preparation of financial statements, including Income Statement, Equity Statement, Balance Sheet and Statement of Cash Flow with a focus on the corporate form of business. 2) Understand the Accrual basis of Accounting and why Adjusting Entries (both accruals and deferrals) are necessary. 3) Understand how Accounting for a Merchandising Entity differs from a Service Entity. 4) Understand types and purposes of Internal Controls with an emphasis on cash controls and the preparation of a bank reconciliation. 5) Understand the valuation of and accounting for long-term assets (fixed), short-term assets (inventory and accounts receivable), long-term debt (bonds) and equity (common stock & retained earnings). A series of embedded questions test whether these objectives are being met. ACCT 202 Course Embedded Questions Fundamental Objectives for Accounting 202 1) Understand the differences between financial and managerial accounting. Understand the differences in the financial statements for a merchandising and a manufacturing entity specifically as they relate to product and period costs. 2) Understand how costs are accumulated for both the Job Order Cost Accounting System and the Process Cost Accounting System. 3) Understand why and how a company sets standards. Calculate variances from standards for materials and labor. 4) Understand how fixed costs and variable costs behave. Be able to make calculations using Cost-Volume-Profit Analysis and Incremental Analysis. 5) Understand the basics of the budgeting process and be able to prepare a basic income statement budget and a basic balance sheet budget. Understand the concepts of capital budgeting. Compare budgeted costs with standards to evaluate variances. A series of embedded questions test whether these objectives are being met. ACCT 303 Systems Understanding Aid Project Accounting 303 - Systems Understanding Aid - Assessment Rubric Student Name: Example based on maximum points possible Assignment Number BI DI PJI BAC CAC PE Totals BI DI PJI BAC CAC Results vs. Expectations 1 2 3 4 5 Total Exceeds Meets Fails 6.0 9.0 3.0 1.0 1.0 0.0 20. 0 7.0 5.0 4.0 1.0 3.0 0.0 7.0 4.0 3.0 1.0 5.0 0.0 0.0 0.0 0.0 7.0 8.5 4.5 4.0 0.0 0.0 9.0 4.5 2.5 24.0 18.0 10.0 19.0 22.0 7.0 22-24 15-18 9-10 17-19 18-22 7 19-21 11-14 7-8 13-16 13-17 5-6 <19 <11 <7 <13 <17 <6 20.0 20.0 20.0 20.0 100.0 Following basic instructions such as cover sheet, name, date, company name, and items like signatures and complete forms on later assignments. These items are easy enough that with attention to very basic details they should be completed correctly by most students. Following detailed (complex) instructions such as date shipped, shipped via, endorsing checks on the early assignments and adding deposits in transit to the bank reconciliation. These instructions are spread throughout the documentation, are not necessarily in an easy order to find, and present a bigger challenge to the students. Proper journal identifications involve making the entry in the proper journal. The students struggle with this on the first assignments but become generally proficient over the later assignments. Basic accounting calculations involve extensions in the early assignments and carrying the result of more complex calculations forward in the later assignments, e.g., cost of goods sold is considered complex on assignment 4 and basic on assignment 5. Detailed (complex) accounting calculations that include calculating bad debt expense, cost of goods sold with returns and discounts, and calculating the cash flow numbers for the statement of cash flows. The calculations also include calculating payroll expense using the actual IRS tables, overtime, and year end bonuses. PE Proper entries include selecting the correct ledger account and proper adjusting journal entries. Exceeds Exceeds expectations. Meets Meets expectations. ACCT 303/305 Pretest/Posttest Accounting 303-305 Pre/Post Tests Results A test is given at the beginning of the first intermediate accounting course (ACCT 303) and again at the end of the third intermediate accounting course (ACCT 305). The purpose of the pretest/posttest design is to help assess student knowledge prior to the intermediate accounting series (i.e., retention of earlier coursework) and assess improvement and retention at the end of the sequence (the questions in the third intermediate are administrated via questions that are part of the final). Specifically tested are the following areas: Purpose of depreciation Calculation of gross profit Correcting error in bank reconciliation Transaction not effecting cash Cash flow classification of office equipment purchase Generally accepted accounting principles are? Common characteristic of assets Balance sheet reflects Cash effects on accrual based accounting Understanding of 2/10 n/30 FOB shipping point meaning Calculation of cost of goods sold Calculation of depreciation expense Maintenance expense Primary objective of financial reporting (as per FASB) B/S classification of merchandise inventory Net realizable value of accounts receivable Benefit of debt financing Stock holders' equity includes Shares outstanding Accumulated depreciation represents In accrual accounting, revenue is recognized when Calculation of A/R and allowance after write off Understanding of FASB Book value of plant assets Number of test takers by class Average score by class Average score by academic year ACCT 304 Ethical Assessment Date____________________________________ Course________________________ Name___________________________________________________________________ ACCT 304 ETHICAL ISSUES/WRITING RUBRIC 0-1 Identifies the Does not understand ethical issues or the ethical issues or problems problems involved in the case Lists the facts Unable to correctly that influence list the facts the decision Trait Identifies those who might be affected by the decision Determines a course of action Cannot identify Has difficulty identifying an acceptable course of action Design Does not use document so paragraphs to that information develop decision and is easily information is not accessible easily accessible Language Uses words that are unclear. Sentence structure is inadequate. Errors are distracting. Spelling and Writing contains Grammar numerous errors in spelling and grammar which interfere with understanding. 2-4 5-7 Able to identify Identifies the ethical most of the ethical issues and problems in issues and problems detail and is able to state with clarity Lists some of the Lists all or most of the facts facts that would influence an ethical decision Identifies most Clearly identifies all who would be impacted by the decision Identifies an acceptable course of action Paragraphs are used but information is not organized in a logical manner Sentence structure is adequate Minor errors in spelling and grammar. Identifies a course of action and is able to explain why this approach would be best Paragraphs are used and information is arranged in a logical order to persuasively develop decision Employs words with fluency, develops concise sentences The writing is essentially error free in terms of spelling and grammar. ACCT 305 Application of Analytical Skills ACCOUNTING 305 – Assessment Rubric Student Name:______________________________________ Evaluation Criteria 1. Balance Sheet Analysis 2. Income Statement Analysis 3. Statement of Cash Flows Analysis 4. Notes/ Supporting Schedules Analysis 5. Ratio Analysis 6. Industry Comparison Fails to Meet Expectations (1) Incorrect or inappropriate data used Incorrect or inappropriate data used Incorrect or inappropriate data used Unable to identify information and issues needed Meets Expectations (2) Correct data used with minimal errors Correct data used with minimal errors Correct data used with minimal errors Mostly able to identify information and issues needed Incorrect or Correct data used inappropriate data with minimal used for ratio errors; mostly calculation; vague accurate and minimal interpretation of knowledge of financial ratios financial ratios Inappropriate competitor identified; incorrect comparison and conclusion drawn Correct competitor identified; generally correct comparison and conclusion drawn Date: ____________ Exceeds Expectations (3) Correct data used without any errors Score Correct data used without any errors Correct data used without any errors Able to identify information and issues needed Correct data used without any errors, or assumption(s) made for unavailable data; accurate interpretation of financial ratios Correct competitor identified; correct comparison and conclusion drawn Total score: _______ Scoring: 18 ~ 16: Exceeds expectations 15 ~ 12: Meets expectations 11 ~ : Fails to meet expectations Accounting Objective An accounting student should be able to understand and analyze the annual report of a publicly traded company. Students in Accounting 305 will complete the workbook, “Understanding Corporate Annual Reports—A Financial Analysis Project.” They will become familiar with various filings required by the SEC and be able to locate information using EDGAR (Electronic Data Gathering, Analysis and Retrieval System). This project will be completed during the Spring Quarter and will consist of the following: Income Statement – calculate growth ratios, trends and explain reasons for the change in revenue, gross profit, operating expenses, net income, etc. Balance Sheet – calculate growth ratios, vertical analysis and explain reasons for changes in assets, liabilities and equity. Cash Flow Statement – Perform trend analysis by charting the cash flow with net income. Changes in Stockholders Equity – calculate and explain why each item in equity changed. Notes to Financial Statements – answer questions relating to Inventory, Depreciation, Capitalized Leases, Pension Plans, etc. Students will calculate a number of additional ratios and analyze their company’s profitability, liquidity and solvency. These ratios will be used for industry or competitor comparisons. Students will use Excel spreadsheets using data that has been utilized in this project. These spreadsheets will consist of Common Size and Ratio Analysis, Competitor Analysis, Trend Analysis and Seasonality. From this data, charts will be created. This information will help students confirm and support their findings. Portions of the project will be completed and turned in during the quarter. Suggestions, recommendations and corrections will be made prior to the end of the quarter. Each student will make a 5 to 10 minute presentation about their company based on the annual report information. The presentation should include at least: 1) An assessment of the corporation’s revenue performance over the past 3 years and a projection of future earnings with evidence to support these projections. 2) How will the economy, competition, etc. influence earnings in the future? 3) Identify strengths and weaknesses of the corporation. 4) If you had sufficient funds, would you invest in your corporation or a competitor? 5) If you were a public accounting firm, would you accept this corporation as a new client? Why or why not. Everything will be assessed using a Rubric. An outsider will be invited to evaluate presentations. Intended Outcome: An accounting student will be able to understand and analyze the annual report of a publicly traded company. Assessment: Students in Accounting 305 will complete the workbook, “Understanding Corporate Annual Reports—A Financial Analysis Project.” This project will be completed during the Spring Quarter. Portions of the project will be completed and turned in during the quarter. Suggestions, recommendations and corrections will be made by the professor. Each student will make a 5 to 10 minute presentation about their company based on the annual report information. Members of the Accounting Assessment Committee or a person designated by the Accounting Assessment Committee will examine these projects and evaluate oral presentations using selected criteria. ACCT 305 Effective Communication Worksheet To Average Oral Presentation "Scores" For Assessment Purposes Course: Accounting 305 Student Trait 1 Trait 2 Trait 3 Trait 4 Trait 5 Overall Number Score Score Score Score Score Score 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Trait Ave. n=15 0 0 0 0 0 0 Trait Definition: 1 2 3 4 5 Voice Mannerisms (appropriate projection, formality, etc.) Physical Mannerisms (appropriate posture, hand movement, etc.) Familiarity With Subject Matter (appropriate reliance on notes or slides, etc.) Familiarity With Technologies (appropriate use of software/hardware, etc.) Information Requirements (appropriate data/graphs, etc.) Overall Scoring: 0 - 8 Does Not Meet Expectations 9 - 11 Meets Expectations 12 - 15 Exceeds Expectations Trait Scoring: 1 Does Not Meet Expectations 2 Meets Expectations 3 Exceeds Expecations Distribution: 0 Does Not Meet Expectations 25 Meets Expectations 0 Exceeds Expectations ACCT 413 Effective Communication Date________________________________ Course________________________ Rater___________________________________________________________________ ACCT 413 EXPLANATION OF EVALUATION TRAITS FOR AUDIT TEAM PRESENTATIONS (Each team member is individually assessed) TRAIT Presentation was organized and coherent Presenter was well-prepared and confident Communication aids were clear and useful Information was useful and informative Voice quality and pace EXCEEDS EXPECTATIONS Opening statement clearly explains objectives. Presenter stays focused throughout. Excellent delivery of material. Uses body language effectively to maintain interest. PowerPoint is used to enhance presentation. MEETS EXPECTATIONS Opening statement is relevant to topic. Mostly organized. Presenter loses focus only once or twice. Average delivery of material. No distracting mannerisms. DOES NOT MEET EXPECTATIONS No opening relevant statement. Loses focus throughout the presentation. Has to look at PowerPoint to keep on track with presentation. Information provided goes beyond expected requirements. Modulates voice and projects enthusiasm. Provides information that would be helpful in making decisions. Relies heavily on PowerPoint or notes. Makes little eye contact. Some key points not on PowerPoint. Does not meet assignment requirements. Information is not current. Can be easily understood—appropriate pace and volume. Rating Scale: 9-10 6-8 Below 6 Exceeds Expectations Meets Expectations Does Not Meet Expectations Below average delivery of material. Demonstrates one or more distracting mannerisms. Hard to understand. Speaks too fast, too soft, etc. ACCT 507 Oral Presentation Skills ACCT 507 Oral Communication Evaluation Checklist Traits (3) Point Values (2) (1) (0) 1. Opening Statement with Purpose ___ ___ ___ ___ 2. Organization ___ ___ ___ ___ 3. Content: a. Currency ___ ___ ___ ___ ___ ___ ___ ___ 4. Quality of Conclusion ___ ___ ___ ___ 5. Voice Quality, Pace ___ ___ ___ ___ 6. Mannerisms ___ ___ ___ ___ 7. Professionalism ___ ___ ___ ___ 8. Use of Media, Technology ___ ___ ___ ___ 9. Ability to Persuade ___ ___ ___ ___ 10. Display of Confidence ___ ___ ___ ___ b. Relevance Scoring 0-20 21-29 30-33 Does not meet expectations Meets expectations Exceeds expectations ACCT 507 Written Communication Skills ACCT 507 Written Communication Assessment Paper Characteristics (Score Superior to Poor -- 10 to 1) 1. Introduction shows paper’s purpose (offers guidance to reader) 2. General guidance throughout paper (use of headings, subheadings, abstract, page numbers, table of contents, as needed) 3. Grammatically Correct 4. Writing Clarity (general expression, word choice, structure) 5. Logical Flow of Paper 6. Logical Reasoning in Paper (e.g. – illustration of arguments) 7. Currency & Relevancy of Topic 8. Technical Accuracy & Level of Paper 9. Creativity (Originality) 10. Quality of Conclusion Total (Range 10 – 100) Scoring 10-84 85-93 94-100 Does not meet expectations Meets expectations Exceeds expectations ACCT 508 Case Analysis Accounting 508 Cases and Grading Rubric The Accounting 508 Case Grading Rubric provides a mapping of the numerical and analytical components of the grading of the four cases into the assessment of the following two learning goals of the MPA program. MPA Learning Goal – Graduates will apply accounting theory/principles to solve accounting problems. MPA Learning Goal – Graduates will be proficient in technology (software) used in the discipline. Included Below: The Accounting 508 Case Grading Rubric The Accounting 508 Case Grading Rubric – Notes Case requirements from syllabus – Accounting 508 – Fall 2005 Copies of cases from Accounting 508 – Fall 2005 Accounting 508 Case Grading Rubric Case Number Expectations Assessment Area 1 2 3 4 Title Bill's Custom Planters Case 1 involves preparing a quarterly production budget and cash budget for a company with credit and cash flow problems. Although no perfect solutions exist, there are several viable alternatives. Case 1 also requires the use of impounded "what-if" statements in Excel. Ruston Trailer Company Case 2 involves calculating and analyzing standard costing variances. These variances must be used to support manager evaluations. This case also includes missing inventory and a correct solution will alert the owners to this fact. Louisiana Wood Products Case 3 requires the use of "solver" in Excel to solve a system of linear constraints and determine the optimal product mix flowing from a "joint product" process. This case also includes discussion on quantitative and qualitative issues and the determination of "committed" vs. "discretionary" fixed costs. Ruston Techtronics Company Case 4 is a capital budgeting problem that includes tax effects on interest expense and MACRS cost recovery. This case also deals with a range based sales forecast and decreasing expected prices over the production life of the product. Case Description Pts. Excds. Meets Fails 24 22-24 19-21 ≤20 56 50-56 43-49 ≤42 40 36-40 31-37 ≤30 memo format - same on all cases, includes to:, from:, date:, re: numbers formatted - same on all cases, includes $5,000, $2.53, 4,951, etc. Writing labels and headings - must be descriptive and applies to all tables on all cases complete sentences - applies to all cases Numbers Interpretations & Recommendations spelling, punctuation, & neatness - same on all cases Income Statement: revenue; cost of Production and Hardware Order schedules (2) Cash Budget goods sold at std. cost including including cash collections, hardware missing finished goods; dm, dl, & payments, direct labor, var. overhead, & overhead variances; other expenses; interest expense (5) & income tax expense (benefit) (10) Schedule of CGM including dm, dl, Balance Sheet: cash; accounts overhead (2) Income receivable; finished goods & dm inv; Statement including rev. & cost of goods ppe (net); liabilities; & equity (4) sold (2) Balance Sheet including cash, ar (net), & equity (3) Production Schedule: meet desired end inv. Manager Evaluation: provide or meet credit limit. (3) evaluations of each of three managers Hardware Schedule: must meet production based on at least two variances per schedule without excess end inv. (2) manager (3) Variance Direct Labor: defend overtime or temps. pro Interactions: discuss variance and con (2) Credit-Line: must interactions (2) not exceed credit limit without a workable Adjustments: adjusts. made by plan and must meet compensating balance (3)managers (1) Recommendations: improve profitability (2) Control Issues: identify both control issues (2) Solver Solution: including optimal quantities and total contribution margin (10) Income Statement: including total revenue and total costs. Total cost includes the capitalized costs of the trees, variable costs, and fixed costs (4) Recommendations: must be consistent with numbers and in original units (2) Binding Constraints: ID (2) Profitable: (1) Committed vs. Discretionary: consistent discussion (2) Sensitivity: (1) Recommendations: improve profitability (1) Qualitative Issues: (1) Weighted Average Cost of Capital: (2) Net Present Value: including tax effects, expected revenue, variable costs, fixed cost, working capital invest. & recovery, and salvage value (10) Internal Rate of Return: (2) Recommendations and Sensitivity (4) Early Abandonment: (2) Qualitative Issues: (1) Recommendations: improve profitability (1) Advantages vs. Disadvantages of Debt vs. Equity Capital: (2) Accounting 508 Case Grading Rubric – Notes General The Accounting 508 cases involve calculation, analysis, and communication in an accounting setting. The calculation range from simple calculations of revenue and cost to more complicated calculations of minimum cash balances with credit-line compensating balance restrictions that are non-liners (using imbedded what-if statement in Excel, Case 1) and calculating the optimal product with a complex set of linear constraints using the solver function in Excel (Case 3). The cases also involve making and defending business decision using quantitative and qualitative information when no perfect solution exists. Case 1 Production schedule and credit limit: The student must produce a production schedule in the absence of a perfect solution. If the student recommends a level of production that meets all sales and desired ending inventory needs, the company will exceed its credit-line limit and must provide the owner with information that will help justify raise the limit to the owner’s bank (accounts receivable are increasing because of seasonally high credit sales. Alternatively, if the student tries to stay within the credit-limit they must explain to the owner that ending inventories will have to be scaled back in the short run although all sales demands can be met. Hardware order schedule: This direct material must be ordered 30 days in advance (long lead time) in large batches (batches that are not even multiples of monthly production). The key is for the order to be made soon enough for production without exacerbating the cash flow problems by ordering too early and/or too often. Credit limit/compensating balance: This case also requires the use of impounded what if statement to calculate the minimum borrowing each month that will meet the cash needs and maintain the minimum compensating balance that follows a non-linear formula, i.e., either a fixed amount or a percentage of the credit-line balance, which ever is greater. Case 2 Standard cost variances and managerial evaluations: The calculation of the standard cost variance is fairly straightforward, but the key is for the student to understand that the responsibility for a variance, or related variances, may be interrelated, e.g., a favorable price variance and unfavorable direct material efficiency variance may not represent a good job by the purchasing agent and a bad job by the production manager if the price variance was the result of inferior quality. Control Issues: Two control issues in this case are (1) the physical inventory is short and (2) one of the two unfavorable direct material efficiency variance represents a discrete component that should be one-to-one with output. Unlike a continuous direct material, this unfavorable efficiency variance appears to represent more than simple inefficiency. The students do not expect auditing issues in a managerial accounting class and these factors facilitate the assessment of whether the students are using all of their accounting knowledge and paying attention to all the facts. Case 3 Solver: This case requires the use of “Solver” in Excel to determine an optimal product mix in a “joint product” environment. The case involves several linear constraints that are presented in normal units for the various inputs and outputs, e.g., number of trees, board feet of lumber, and cubic yards of bark. The case also requires the student to think about the proper numbers to use in calculating the contribution margins per unit for this purpose, e.g., should the capitalized cost of the trees be used if (1) the trees are diseased and will be worthless if not harvested or (2) the market value is expected to far exceed the capitalized cost in the near future. Binding constraints: The student must identify what factors are restricting profit; limited resources or limited markets. Committed vs. Discretionary Fixed Cost: The case leads the student in the direction that the cost of operating the sawmill is fixed and committed. However, if a large portion of these cost could be eliminated over a short period of time, the optimal solution may be to shut down the sawmill and only sell pulpwood. Qualitative issues: This case also facilitates the assessment of the students’ ability to incorporate qualitative issues, e.g., the effect on the community of closing the sawmill or the effect of the environment of harvesting more or fewer tress. Case 4 Weighted average cost of capital: The student must calculate a weighted average cost of capital using CAPM information and the tax effects on debt financing. Range forecast and sensitivity: This case gives both point and range estimates of sales with potential negative NPV in the lower part of the range requiring the students to apply judgment to the final invest vs. not invest decision. IRR calculation: This case also requires the use of the IRR function in Excel or the IRR function in a financial calculator to calculate the IRR of the project over a set of numbers that very by year. Expectations Excds. – exceeds expectations. Meets – meets expectations. Fails – fails to meet expectations. Accounting 508 Case and Research Project Requirements Case Requirements Objective: The objective of the case assignments is to integrate your skills in: (1) obtaining numerical solutions to cost accounting problems, (2) interpreting those results in light of decision making, and (3) presenting the results in a professional manner. Presentation: All solutions to the case assignments must be either typed or printed. HAND WRITING IS NOT ALLOWED (other than your initials on the memos). Answers to questions must be in complete sentences, include proper spelling and grammar, and include one-inch margins, top, bottom, and both sides. Numerical solutions will require the use of a spreadsheet and/or word processing and must be presented with headings, labels, and in proper format. Answers to questions will require a memo, letter, or report with reference to the numerical solutions. Grading: Each case assignment is worth a maximum of 30 points. 6 pts – Writing and presentation including: proper format of written communication, proper format of numerical presentation, labels, complete sentences, spelling, punctuation, and neatness. 14 pts – Numerical solutions. 10 pts – Written answers to questions, interpretation of data, and analysis of numerical solutions. Fatal Errors: Assignments containing fatal errors will not be accepted for credit. However, assignments containing fatal errors that were submitted on time will be allowed one re-submission for reduced credit (maximum of 20 pts). Fatal errors include: (1) any handwriting, (2) excessive spelling or punctuation errors, and (3) lack of neatness. Independent Work: Each student is responsible for his or her own interpretation and analysis. You may consult with fellow students on the numerical portion of the assignment, but you are responsible for your answers. While you are free to discuss the analysis of the results and the questions with your fellow students, each student must prepare his or her own memo in their own words. If two or more assignments contain identical written answers, or overly similar answers, all those assignments will receive zero points. ACCT 513/542 Ethics Evaluation Ethical Considerations Rubric—Accounting 513/542 TRAIT Identifies Dilemma Unacceptable (0 points) Has a vague idea of what the dilemma is and is uncertain what must be decided. Considers Stakeholders Is unsure as to who should be involved in the decision-making process. Analyzes Alternatives and Consequences Begins to appraise the relevant facts and assumptions and identifies some alternatives. Chooses an Action Has difficulty identifying and appropriate course of action from among alternatives. Acceptable (1 point) Identifies the dilemma, including pertinent facts, and ascertains what must be decided. Determines who should be involved in the decision making process and accurately identifies all the stakeholders. Clarifies at least two alternatives and predicts their associated consequences in detail. Formulates an implementation plan that delineates the execution of the decision. Student: ________________ Overall Scoring: 0 – 3 Unacceptable; 4 – 6 Acceptable; 7 - 8 Exemplary Exemplary (2 points) Score Describes the dilemma in detail having gathered pertinent facts. Ascertains exactly what must be decided. Determines who should be involved in the decision making process and thoroughly reflects on the viewpoints of the stakeholders. Clarifies a number of alternatives and evaluates each on the basis of whether or not there is interest and concern over the welfare of all stakeholders. Formulates an implementation plan that delineates the execution of the decision and that evidences a thoughtful reflection on the benefits and risks of action. Overall Score: __________________ ACCT 513 Audit Case Experience PEACH BLOSSOM Audit Case Evaluation Rubric—Accounting 513—2009 TRAIT Working Paper Organization Tick Mark Usage— Appropriate Items Tick Mark Usage— Appropriate Spelling Tick Mark Usage— Appropriate Grammar Tick Mark Usage— Appropriate Explanations Unacceptable (0 points) Little, if any, apparent organization. Few, if any, tick marks noted. Acceptable (1 point) Somewhat inefficient, but sufficient organization. Some “over auditing” noted (i.e., some tick marks were not needed). Exemplary (2 points) Efficient and effective organization. Several items not spelled correctly. No spelling errors noted but word selection could be improved. No spelling errors noted and word selection was excellent. Several grammatical errors noted. No grammatical errors noted. Grammar was generally excellent. Explanations, if any, were inadequate. Explanations were generally adequate. Explanations were generally excellent (effective). Student: ________________ Efficient use of tick marks noted. Overall Score: __________________ Overall Scoring: 0 – 4 Unacceptable; 5 – 7 Acceptable; 8 - 10 Exemplary Check One: _____ Winter Quarter _____ Spring Quarter Score Check One: _____ PRE-TEST _____ POST-TEST CPA EXAM PERFORMANCE CPA EXAM RESULTS We look at CPA exam results for Louisiana Tech and several schools in the region that can offer us a comparison in evaluating our progress. These schools should have students that are similar to our students. We also break down our results by exam parts to see if this information might assist the School of Accountancy towards improving the results. Schools that we use for comparative purposes are: University of Arkansas Louisiana State University University of Mississippi Mississippi State University DBA (Accounting) Assurance of Learning Program DBA Learning Assessment Program 2006 Learning Goals: Our accounting doctoral graduates will: Be proficient with essential research tools to perform original research. Display an in-depth understanding of accounting thought in their area of interest. Be able to critically appraise research and design proposals to further knowledge in the field. Be effective communicators (written and oral). 1. Students/Graduates will produce a peer-reviewed quality research articles. Method: Students and graduates will have a research article in which they are an author (or co-author) reviewed and deemed publication-worthy by external peer review. Status: Annually, information is collected on journal publication and proceedings activity by doctoral students and graduates. Failure in this area indicates the need for program review and revision. 2. Students will design and implement a theory-grounded research project that advances knowledge in the accounting discipline. Method: Each doctoral student will complete a dissertation proposal defense and a final dissertation defense. Dissertation committee review and peer review will take place in open forums. Status: Dissertation proposal and final dissertation defenses will occur as the candidate reaches these stages following coursework. 3. Students will have expert, comprehensive, and current knowledge of accounting theory and research, and research methods. Method: Comprehensive exams (oral and written) are administered to each doctoral student. Status: Each doctoral student will be scheduled for comprehensive exams as coursework is completed. 4. Students will competently judge, compare and synthesize the quality of research in the field. Method: The comprehensive written exam will require written analysis focusing on research areas. Status: Each doctoral student will be scheduled for written comprehensive exams as coursework is completed. 5. Students will professionally prepare and deliver their research findings. Method: Each student will have a final dissertation defense that is attended by faculty and doctoral student peers. It will be an open forum with questions following the presentation of the research findings. Status: Each doctoral student will defend his/her dissertation based upon the dissertation committee’s recommendation. D.B.A. RESEARCH PAPER ASSESSMENT Student Name __________________________________ _______________________________________ Evaluator Name Performance Level (check one for each performance dimension) Evaluator Comments Exceeds Expectations Conceptual Adequacy/ Mastery of Literature Coherence and Organization of Presentation Technical Adequacy Significance of Contribution to the Field Meets Expectations Does Not Meet Expectations D.B.A. RESEARCH PAPER ASSESSMENT Performance Level Exceeds Expectations Conceptual Adequacy/ Mastery of Literature Coherence and Organization of Presentation Technical Adequacy Significance of Contribution to the Field Meets Expectations Does Not Meet Expectations Research question(s) and hypotheses were well chosen and constructed Proper steps were taken in the research project; extra steps may have been taken Literature review was high quality Conclusions are appropriate to research findings and address not only future research, but practical implications Paper is well organized and easy to read Very few errors from lack of proofreading A reader who is unfamiliar with the specific topic can understand the paper Use of language and word choice is good Mostly organized, but some writing seems disjointed Noticeable errors from lack of proofreading Need specific topic knowledge to understand parts of the paper Some problems with word choice (e.g,. overuse of jargon) Seems disorganized and is hard to follow; needs extensive rewriting Many errors from lack of proofreading Need specific topic knowledge to understand all of the paper Many problems with word choice (e.g,. overuse of jargon) Methods are appropriate to research question(s) Methods are appropriate to research question(s) Methods were not appropriate to research question(s) Reader can determine what methods were used, what analyses were conducted, and what conclusions were drawn Reader may have a little difficulty to determine what methods were used, what analyses were conducted, and what conclusions were drawn Reader cannot determine what methods were used, what analyses were conducted, and what conclusions were drawn All analyses used were appropriate Most analyses used were appropriate Some analyses used were not appropriate Conducts analyses correctly Some errors in analyses Many errors in analyses Appropriate conclusions drawn from results Not all conclusions drawn from analyses were appropriate Many conclusions drawn from analyses were not appropriate Very high: creates new theory, applies innovative methods, collects unique data Good: addresses a topic of concern or an area that is under-researched, applies theory to a new area Lacking: addresses a topic that is overresearched or not currently relevant, adds nothing new to existing literature Research question(s) and hypotheses are clear Proper steps were taken in research process Appropriate literature review was conducted Conclusions are appropriate to research findings Research question and hypotheses are not clear or do not fit Steps in the research process were skipped Literature review had noticeable omissions Conclusions did not fit research findings