Resource and Referral & Self Employment

advertisement

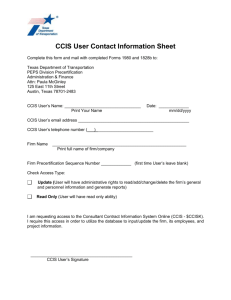

Resource and Referral & Self-Employment Brett Grumbine brgrumbine@state.pa.us Revised 10/08 1 Housekeeping Roll call Please mute your phones after roll call 5 minute break between chapters 2 Teleconference Agenda Self-Employment – one hour. Cover PowerPoint content Cover specific received questions Open forum for questions if time allows Resource and Referral – one hour. Cover PowerPoint content Cover specific received questions Open forum for questions if time allows 3 Self-Employment 4 Self-Employment - General Self-employed (SE) persons: Pay their taxes directly; Must have profit; Must meet the hourly work requirement; Verify need for care hours by selfcertification 5 Self-Employment – Identifying Who pays the taxes? Types of self-employment and the corresponding tax documents used are explained in section 342.4. CCIS not expected to be thoroughly knowledgeable about various types, but is listed in the chapter for your quick reference. 6 Self-Employment - Verification Acceptable Verification: Tax returns, business records, or other documents establishing profit; Collateral contact; Self-Declaration (30 days) PER REGULATION – a tax document is NOT required to satisfy SE income verification. 7 Self-Employment – The CCIS Role SE is the most complex tax structure to interpret – even for a tax professional. It is not the expectation of OCDEL for CCIS staff to have the knowledge and expertise of a tax professional. Nor does OCDEL expect the CCIS to conduct the work of a tax professional. It is expected that when verifying SE income, totals presented to staff are checked for accuracy. 8 Self-Employment – CCIS Role IRS website resources are provided in section 342.8 for your quick reference to print out forms or provide information to a client who is seeking it. The CCIS is expected to be able to refer and use these resources as needed, but not to be experts of the resource content. 9 Self-Employment – The CCIS Role The responsibility to provide clear and comprehendible totals for verification is the client’s. When acceptable verification documents other than tax forms are presented to the CCIS, if the client does not present paperwork to staff in an understandable fashion, the client should be referred to a tax professional or accountant. Until the client can produce clear documentation – they are ineligible. 10 Self-Employment – Business Process A tax document (i.e. quarterly statements, 1040, Schedule C, etc.) should be the first thing requested from a SE client. This presents their information clearly and does not require accompanying documents for verification. If a tax document is unattainable and other various documents are used, they must be accompanied with the “Client Self-Employment Income Worksheet” (Appendix A). 11 Self-Employment – Business Process The worksheet is a tool for the client to complete and allows totals to be presented to the CCIS in a simple way. Staff must still assure the accuracy of information given, but the worksheet should help client straighten out their paperwork prior to submitting to the CCIS. 12 Self-Employment – Business Process Therefore, verification takes place in two ways: 1. A tax document alone. Easiest. Should be the first item requested – for the ease of the client and staff alike. 2. All other acceptable verification as accompanied by Appendix A. Responsibility is the client’s. 13 Self-Employment – Collateral Contact Acceptable verification if documents can not be produced. Typical collateral contacts would be for document clarification, to the client’s tax preparer, business associate, or the P/C’s clientele. Always document collateral contact into case comments. 14 Self-Employment – Care Hours Need for care is established by self-certification. Appendix C is used to self-certify selfemployment work/need for care hours. 15 Self-Employment – Self-Dec Self-Dec is used to satisfy the income verification requirement for 30 days in the absence of acceptable verifying documentation. Appendix B is used for the self-declaration of SE income and standard Self-Dec procedure applies to SE. 16 Specific SE Questions and Scenarios 17 SE – Tax Documents Q: In the past we calculated self employment by using gross income minus certain deductions. A while ago, we were told to simply use line number 31, net profit (loss) on the 1040 tax form and simply divide that number by 12 months, and not do anything with the deductions. As long as there was a profit, they were okay. Are we now going back to how it was done before and using gross income minus only these certain deductions that apply? 18 SE – Tax Documents A: As instructed in the chapter, line 12 on the 1040 is used for self-employment income. This line reflects the total annual profit or loss from SE after all SE adjustments have been made. This total could be divided by 12 and entered as a monthly amount or the entire total could be entered as annual in PELICAN. The only deductions to be applied are those typically used for employed clients as well (i.e. child support, medical, etc.) – NOT calculating SE deductions. 19 SE – Tax Documents Q: On the 1040 form line 27 should the self employment tax be deducted? A: No, it should not be deducted. eligibility is determined on gross profit earned, not adjusted gross. Q: Line 29 on the 1040 form should the self employment health insurance deductions be entered into the self deductions under medical in PELICAN? A: Yes. Medical deductions are allowed for the selfemployed (if 10%, was incurred in the past 90 and will continue for the next 6 months). Line 29 on the 1040 would be an annualized amount that can be used, though the deduction may be verified in other ways also. 20 SE – Tax Documents Q: On the 1040 form line 19 if there is unemployment compensation included would this be entered into PELICAN? A: Yes, if the income occurred in the most recent six-week period. Unemployment income is always counted - whether the individual is self-employed or not. 21 SE – Tax Documents Q: For clients who receive a 1099 from their "employer" is this sufficient documentation of self-employment income. The clients we are seeing work for hairdressers, contractors etc. and do not file taxes as self-employed persons. A: The 1099 is a form used to report a variety of miscellaneous income and is normally "in addition" to their typical income. If the individual has a standard wage job and their employer pays their tax, this person does not fit the definition of selfemployed and the 1099 income would be other income. The 1099 is also used as a "per job" document for freelancers. If a 1099 form is used to verify self employment income and the self employment income is the only source of workrelated income, it must be entered on the self employment page in PELICAN. This links the work hours to the income so PELICAN can determine whether the eligibility criteria are met. If a 1099 is used to report any other income, it should 22 be entered on the other income page. SE – Tax Documents Q: Can a parent submit a 1099 only as proof of income from self-employment or does the parent need to complete the self-employment Income SelfDeclaration form also? A: A 1099 is a valid document that represents a particular income. If a 1099 form is used to verify self employment income and the self employment income is the only source of work-related income, it must be entered on the self employment page in PELICAN. This links the work hours to the income so PELICAN can determine whether the eligibility criteria are met. If a 1099 is used to report any other income, it should be entered on the other income page. The Self-Dec does not need completed. 23 SE – “Odd Jobs” Q: How will the CCIS determine if the occasional odd jobs should be considered self employment? (The P/C states they are not planning on reporting it to the IRS or paying taxes on it and says no one else is responsible for taxes.) A: Income is only considered as self-employment when the individual meets our definition (§ 3041.3. Definitions - Operating one’s own business, trade or profession for profit). If not self employed, the "odd job" income is still counted in the eligibility determination - but as other income, not SE income. 24 SE – Various Policy Q: If the tax return/schedule shows that p/c was only in business for a portion of the prior year, can we take that income and determine a weekly or monthly amount and annualize the income or must the P/C submit other documentation? A: If the SE has ended, it no longer represents the client’s current income and should not be counted in the eligibility determination. 25 SE – Various Policy Q: We currently use a Self Employment Verification form which simply states that a parent is Self Employed. On this form the parent also writes in their weekly schedule, showing the days and hours worked. The parent signs and dates this form, to self certify this information. Is it okay to continue to use this form for Self Certification of Self Employment to indicate a need for care or should we be using an actual Self Certification form? A: SE need for care is established with the "SelfEmployment Work Hours Self-Certification" Appendix C of the SE chapter. Though per regulation, any written statement submitted by the P/C is acceptable so long as it contains all of the pertinent information to determine eligibility and income. 26 SE – Various Policy Q: Does a client who does house cleaning as employment, need to submit the worksheet? A: If the client meets the definition of being selfemployed, the SE income verification process is no different. If a tax document is used – no. If other documents are used – yes. Q: When calculating the income from selfemployment, is it acceptable that they list $0 for expenses? A: If no expenses were incurred – yes, this is acceptable. 27 SE – Various Policy Q: If the CCIS receives a copy of the IRS 1040 and sees interest income or rental income on the tax return that the P/C did not report otherwise, are we still permitted to use that income information? The chapter tells us specifically what lines of the various tax documents we are to use for our calculations, should we be looking at any other lines? A: The chapter does address specific lines for self-employment reference only, but if other types of unreported income are witnessed, this gives the CCIS cause to investigate. Follow your normal procedures for this. 28 SE – Various Policy Q: The CCIS determines that a parent is selfemployed and they use a tax return for verification. How does the CCIS proceed if income is reported on a different line other than those listed here as acceptable. For example, many parents will report self-employment income as regular income on line 1 instead of using the proper IRS form or line. A: If the CCIS has determined an individual as SE and tax documentation is filled out incorrectly or inconsistent to where self-employment income should be listed, the CCIS may determine from the document the correct total to use. 29 SE – Various Policy Q: One of the examples given for identifying self employment was providing child care. Are we saying that a parent who provides care for other people’s children, can qualify under CCIS and get help paying child care for their own children? What if they provide this service out of their own home? Are we saying CCIS is available for their children to attend a daycare, while that self employed parent stays home and watches other people’s children? A: Generally no. Though under certain circumstances, the CCIS will pay to have the P/C’s own child in care at another facility. However, the P/C may not request care for his child during the hours he is caring for another individual's children and/or must verify there is no space available at his child care facility as set forth in 3041.16(c) (relating to subsidy limitations). 30 SE – Various Policy Q: If a P/C does not submit a tax return/schedule as proof of income, what period of information is acceptable? Can it only be 4wks of the last 6 wks or 60 days worth as Appendix A states or could it be their Qtrly Earnings Statement as page 7 refers to? It sounds like 4wks is the minimum and 60 days is the maximum permitted without a tax return. If so, then why would we need a Quarterly Earnings Stmt or better yet - how would we determine the last 30 or 60 days of income from the Qrtly statement? A: The parent/caretaker must submit 4 weeks of income verification out of the most recent 6-week period. The reference to 60 days was incorrect and will be removed. 31 SE – Various Policy Q: If a parent submits supporting documents without submitting the Self-Employment Income Worksheet is it still necessary for the parent to submit the Self-Employment Worksheet when CCIS can calculate the income? A: The worksheet assists staff when interpreting the documentation and provides a consistent and recognizable document to file. An Appendix A must be completed and filed. The intent is for the client to fill out the worksheet, but if the CCIS wishes to fill out for the client, they may. 32 SE – Seasonal SE Q: If self employment is seasonal, (fruit picker, cement truck driver, school bus driver, brick layer, road construction worker) is income calculated the same as for any other seasonal worker? A: Yes. All seasonal employment is handled in the same manner with regard to calculating income. 33 SE – Married SE Clients Q: Married couple applies - the tax return lists wife as a homemaker and husband as the self-employed person. They tell CCIS that they both work the business however for tax purposes she is listed as a homemaker. What do we require of the wife in order to make this family eligible? Can the husband fill out an EV form for his wife? A: Although wife helps in the business, if she is not listed as a co-owner and all of the profit from the business goes to her husband, she is not self-employed. She has no income from the business to report. This couple is ineligible because wife does not meet the work requirement. However, if the husband pays his wife as an employee, it is acceptable for him to complete the EV to verify her income and hours. 34 SE – Married SE Clients Q: There is a 2 parent family that is self employed. The husband is the owner and the wife is employed by him (She is not a partner). The husband files taxes but does not count the wife's income as wages (#26 on Schedule C for wages is $0). Does the wife need to file taxes or can her husband complete an EV and Cash Form? 35 SE – Married SE Clients A: If husband and wife are legally partners in the business their total income from the business is split between them. If the husband is the sole owner of the business, two scenarios apply: 1. If wife works for husband, earns a wage and husband pays her taxes, wife is not self employed. She is an employee of the business and must provide proper verification of work hours and income. 2. If wife works for husband, but earns no wage or profit, she does not meet the self-employment definition nor does she meet the work requirement. The couple is ineligible. 36 SE – Future Profit Q: What can we do for a P/C that does the work one month and has the expenses for the work that month but doesn't get paid for the job until 1 or 2 months after it is completed? They show a loss because the income hasn't been received yet. A: Is work in progress? If yes, an estimate from the P/C provided to the individual paying for the service will suffice as estimated income - related to the expenses for that job/project only. If an estimate is not available or work has not begun, the P/C is ineligible until profit can be verified. 37 SE – Future Profit Q: Are there any exceptions for clients who are just starting a business in regards to showing a profit within the 30 day self-declare time frame? Most clients if they are billing their customers will not have completed their first billing cycle within this time frame. A: Is work in progress? If yes, an estimate from the P/C provided to the individual paying for the service will suffice as estimated income - related to the expenses for that job/project only. If an estimate is not available or work has not begun, the P/C is ineligible until profit can be verified. 38 SE – PELICAN Q: In PELICAN you find acceptable verification selections for the "Tax Document" field. Are these the acceptable verification documents? Or is this just for PELICAN? A: If a tax document is used as verification, simply use the line amount on the tax document. The tax document field in PELICAN is only used when a client verifies using a tax document. This field is not mandatory and other methods of verification are allowable other than a tax document. 39 SE – PELICAN Q: More clarification on determining and entering wages paid to themselves. A: If a person owns a business and then pays themselves a wage, the profit from the business would be entered on the SE screen and the wage would be entered on the employment screen. 40 SE – Multiple Jobs Q: If P/C meets the work requirement at one job and starts a second job that is self employed but doesn't make a profit at the self employed job, are they still eligible? A: By definition, the P/C is not self-employed if no profit is earned. In this example, the P/C meets the work req. at one job, so eligibility continues. Because the P/C is not considered self-employed, the P/C need for care hours does not include the time being "selfemployed". 41 SE – Multiple Jobs Q: If P/C has multiple self employed jobs and two of them make a profit and 2 of them have a loss, are we correct that we can subtract the losses from the profits and as long as the overall total is a profit, the p/c is still eligible? A: It depends on how the information is presented to you. It is possible the P/C with multiple SE jobs will present you with the total profit (or loss) from all jobs via the Schedule C line 31 or 1040 line 12 total and you may be unaware of multiple jobs. If the verification you receive denotes or the P/C reports to you that there are multiple SE jobs and that some of them do not earn profit, we will only pay for the care related to those jobs that earn a profit. In this example, we will only pay for care for two jobs earning profit. 42 SE – Rede Q: If in between rede's, the P/C becomes self-employed and submits wks of selfemployment verification and is determined to remain eligible and now the rede is due 2 months later, does the P/C have to submit new self-employment verification? A: Yes. 43 SE – Rede Q: The chapter says that verification of self employ will be completed at EVERY rede. If the P/C submitted last year's tax return and says their business is doing the same as last year, do we need them to submit another copy of the tax return at rede time or can we just carry it forward? A: If after discussion or correspondence with this individual, it is determined that the annual tax document previously provided continues to be an accurate representation of their SE income, the CCIS may copy the document to file with the new rede and reenter the information in PELICAN. 44 SE – Rede Q: At rede time, the P/C reports that her husband got a new job and submits an EV form as proof of the new job. The household remains eligible with a $65 copay eff 5/5/08. A couple of weeks later, the husband sends in a copy of his first pay stub and we discover that he is self-employed and the pay stub is just a copy of the check he was paid for his services. We get a selfemployment self-declaration from the husband and if we had known this at rede time, the copay would have been $75 instead of $65. Does the copay increase to $75 in 13 days and we forget the past or should the copay increase to $75 on 5/5/08 (backwards) and we have an overpayment now to recoup? 45 SE – Rede A: If new/prospective employment or the P/C did not submit all verification at rede, the CCIS will take the new information and apply it to the case accordingly (in this case $75 copay). If there was a misunderstanding on the part of the P/C on what was required of them, the copay would remain at $65. The information will change moving forward only. 46 SE – Rede Q: When the P/C self-declares their information and then submits the proof 30 days later and the income and expenses don't agree (Ex: Self Declared $500 profit and actually made $900 profit), do we use the $900 in PELICAN and increase the copay (if copay stabilization doesn't have the copay capped already)? What if the initial self-declare was at rede time and the proof is received after the rede, do we increase the copay because the self-declare was incorrect at rede time? 47 SE – Rede A: Verified amounts overrule self-declare amounts and all totals should be adjusted in PELICAN when verification is received. Copays are to be adjusted accordingly. An increase will only be effective in 13 days. 48 SE – Rede Q: At redetermination, if a parent chooses to submit a tax return that shows no profit, may we request a more current profit/loss statement? If so, does the parent have an overpayment for the previous period that had no income? A: Yes, the P/C may submit more current acceptable documents to establish profit in conjunction with Appendix A. The income reported will continue forward and no past overpayment will be considered unless fraudulent activity is suspected. 49 SE – Self-Dec Q: Can the P/C write up their own signed statement of income, expenses, and profit and submit it to save time, or do they have to submit an App B form if they are self declaring? (This would be important if AA for rede is almost up and there is no time to mail them a form.) A: An Appendix B should be filed for SE selfdeclaration. If taken over the phone, use standard self-declare procedures. Though per regulation, any written statement submitted by the P/C is acceptable so long as it contains all of the pertinent information to determine eligibility and income. 50 SE – Self-Dec Q: When the P/C self-declares their information and then submits the proof 30 days later and the income and expenses don't agree (Ex: Self Declared $500 profit and actually had a $200 loss), do they go on an AA for no profit and not eligible? Do we have an overpayment for the period of the self-declare that was originally thought to have a profit or do they just term on the AA and we don't worry about it? If they say their business will be improving now and they want to send in a new self-declare for the next 30 days projecting a profit for the next 30 days, will that satisfy the AA and we start over again and keep them eligible and see what happens when they send that proof in? If not, please tell us how to advise the P/C on options that could satisfy the AA. 51 SE – Self-Dec A: Yes. An AA should be generated since the follow-up verification did not confirm the original information the parent/caretaker submitted. However, there is no overpayment unless the CCIS has proof the parent/caretaker intentionally mislead or withheld the information in a fraudulent manner. Q: Can we do self employment self-declarations by telephone like all other self-declarations or must the P/C prepare and submit it to us? A: Yes. 52 SE – Self-Dec Q: When the P/C self-declares their information and then submits the proof 30 days later and the income and expenses don't agree (Ex: Self Declared $400 profit and actually made $800 profit), what are we supposed to do if the self-declare was at rede time and now the proof shows that the profit is more? Should the copay be increased? If so, when should that increase be effective - in 13 days or backwards and an overpayment exists? 53 SE – Self-Dec A: Verified amounts overrule self-declare amounts and all totals should be adjusted in PELICAN when verification is received. Copays are to be adjusted accordingly. An increase will only be effective in 13 days. We would not go backwards, only forward from when verification is received. 54 SE – Self-Dec Q: Regarding acceptable verification, specifically accounting ledgers, because every self-employed person does not have an accountant, by its nature this is something the P/C can write for themselves. If the parent writes the document, is it considered acceptable documentation, not self-declaration? A: Yes, in conjunction with Appendix A, income is considered verified and not self-declared. 55 Resource and Referral 56 R&R – New Additions Availability of email functions for the delivery of referral lists and follow-up questionnaires. Provider profile update process Availability of Provider Self-Service 57 R&R - General CCIS is the center of child care information for the local community. R&R services available to all families regardless of income. R&R services focus on the needs of parents and families. 58 R&R – General (con’t) R&R Services provides parents: Custom child care referrals A bank of information for child care, early learning programs, and other various family services Child care counseling 59 R&R – General (con’t) Other R&R Services: Maintaining the R&R client and provider database Cooperation with local groups and programs 60 R&R – Provider Complaints If a parent submits a complaint to the CCIS regarding a provider, the CCIS must follow up with the regional office to verify if the complaint has been filed. Providers remain in R&R active status until Certification closes the site. Under certain circumstances OCDEL may request the CCIS end enrollments. 61 R&R – Provider Complaints For protocol, the CCIS should consider the following: The CCIS should encourage the parent to call in the information directly to the region whenever possible. The bottom-line is, if the parent does not or will not call in the complaint, the CCIS should do so. The CCIS has a responsibility to ensure appropriate complaints get to the region. By appropriate I mean things that relate to the regulations, not stuff like “My provider charges too much” or “My provider feeds my child cake every day before I pick him, up and then he won’t eat his supper”. Real regulatory infractions such as unsafe conditions, physical discipline, overcrowding observed by the parent, lack of supervision, etc. The CCIS should get as much information as possible from the parent so they can answer as many of the regions questions as possible. That means they should have the 62 who, what, when, where and how of the situation. R&R – Consumer Education Minimum of 4 topics discussed with all clients: Keystone STARS Indicators of quality care Impact of early education on positive child development Types of care available 63 R&R – Profile Updates We are no longer printing mass profile updates for all providers and mailing them. With the advent of Provider SelfService, providers are now able to “own” their profile data and make profile changes online whenever needed. 64 R&R – Profile Updates Instead, the R&R Profile Coversheet (Appendix E) will be mailed. This single sheet will inform the provider there is the option to review their profile online or request a hardcopy update form if needed. OCDEL’s intent is to mail this coversheet with closures and/or rate surveys annually, if possible. The annual mailing of Appendix E will be required as per OCDEL instruction only. 65 R&R – Profile Updates OCDEL has postponed this year’s initial mailing to allow Certification time to enter their relevant provider data and to allow some time to stabilize the new system. CCISs will receive detailed instructions regarding the initial use of the coversheet in the future. 66 R&R – Q&A Q: We currently have an answering machine or voice mail for after hour calls. Is this sufficient? Please clarify answering service. A: Yes, an answering machine or voice mail is sufficient. Q: Does a referral need to be submitted on every p/c that contacts the CCIS for child care or only if the p/c requests one? A: Only when requested. 67 R&R – Q&A Q: For follow up phone contacts do we ask the questions from the e-mail follow up screen? A: The emailed questionnaire is worded in a more parent-friendly way because the parent will not benefit from the counsel of a CCIS staff worker via an email. When on the phone, the worker will be able to answer any questions the parent has. If an agency wishes to use the email language when talking to a parent on the phone, that is totally acceptable, but not required. 68 R&R – Q&A Q: We attempted to follow-up with 100% of our families listed on the random sample of clients report but are often unable to connect to individuals and get feedback. What is the expectation regarding actual number or percentage of completed follow-up attempts? A: 20% is the expectation. When generating the random sample report (RE802), the default percentage for the report is 20%. If the CCIS increased this percentage, then not all clients listed would need to be reached. For example, if the report requested was 40%, only half of those listed would need to be reached. 69 R&R – Q&A Q: Where is information extracted from for reports RE802 (Random Sample of Clients) and RE804 (Child Care Planning)? ? A: The 804 report pulls follow-up data entered for the selected parameters. The 802 report selects a random sample of those who have had a referral generated or modified within the selected parameters. 70 R&R – Q&A Q: We followed up with the regional office to see if a parent called them regarding a complaint (parent did also call); a few days later the child care facility called our agency and asked why we made a complaint against them. Note, we did not make complaint but were only following up as per policy and facility was told CCIS made report, are the complaints to be kept confidential? A: As a mandated reporting agency, there is no expectation of confidentiality. It is possible the regional office could mention that a CCIS had made a report. Your response to inquiry is that CCIS is a mandated reporting agency and must follow up on a report made by a parent. 71 R&R – Q&A Q: Should complaint records be entered under that particular provider in PELICAN or should these incidents be logged in the providers hard files only? A: Though the chapter states the CCIS may develop their own system for documenting, it is strongly recommended that at a minimum, comments be placed in PELICAN. This prevents loss of hardcopies and may also be accessed by HQ if needed. 72 R&R – Q&A Q: Can you provide more training or resources on how to file a child abuse complaint through ChildLine? A: Call the toll free number (1-800-932-0313) and follow the same protocol as regional office complaints. Of course, information is preferred to be reported first-hand, but if the CCIS must report, provide as much information as possible. 73 R&R – Q&A Q: When emailing referrals, do we put the four small brochures on how to make an informed child care decision in the US Mail to the client? A: No. The email provides links to the quality/STARS information. One of the benefits of emailing is agency savings on postage. 74 R&R – Q&A Q: Who is providing us with information on Accreditations for profile updates? A: Some CCIS as a business practice ask for a document to verify accreditation. OCDEL policy does not require this. In order to accommodate the business practices of some CCIS, accreditations has been made a managed update. This in essence, puts the CCIS on notice when a change for this provider characteristic is made via PSS. If it is not your office practice to verify, simply approve the change. 75 R&R – Q&A Q: How can parents know legal requirements of a regulated facility when booklets are not available from regional office and website is not user friendly? A: Legal requirements can be found on the FAQ portion of the DPW site; through clicking on “certification” or “registration” on the provider search welcome page; through the PSS homepage; or by browsing pacode.com directly. 76 R&R – Q&A Q: We could not find a way for parents to file a complaint online. A: On the provider search welcome page, on the left-hand column is a link to file complaints; or on the left-hand column of the Provider Self-Service homepage. 77 R&R – Q&A Q: Are church-run pre school programs that do not have a DPW or Dept. of Ed license operating legally? A: Possibly yes. Though not subject to certification, they are subject to “supervision”. Your regional office will know who these facilities are. If in question, call your regional office. In addition, these legal providers will not be found in PELICAN and can not accept subsidy children. Reg reference – Statement of Policy - § 3270.3A 78 R&R – Q&A Q: Is there any way to put a system fix in PELICAN in order to search a R&R client by email? We have recently been getting a lot of undeliverable email addresses in our outlook mailbox. These messages do not appear until 1 or 2 days later and the workers are unable to remember the clients full name in order to call them to get the correct email address. A: A PCR (15497) requesting the R&R case number be added to emailed correspondence was withdrawn as unnecessary by CCB. The email search parameter would be another way to achieve this. Another PCR (18300) has been entered. 79 R&R – Q&A Q: How do we get closed child care sites not to come up on providers searches? A: Due to an overlap between our CCW release 5 and Certification release 1, some closed providers have been “stuck”. PCR 17856 addresses this and a data fix needs completed for these providers. As a temporary work-around, if you are aware of closed providers who keep showing in your referral results, make them R&R inactive – not on mailing list. 80 R&R – Q&A Q: Provider Closure questionnaire is not mentioned in chapter. We have collected this for non-subsidy providers, as well as for subsidy providers. In the past we were required to do this. Is this no longer true? A: It no longer exists. 81 R&R – Q&A Q: What/Where is Appendix E? A: Appendix E accompanied the R&R chapter release on 2/29/08. Q: Provider Survey: No rates are requested when we sign up a new provider. What is the State’s expectation? Are we to send the market rate survey appendices anyway? A: The C-1 appendix of the provider agreement is used to capture rates for new providers. See Policy Communiqué #07-16. OCDEL anticipates an updated version to be released this July. 82 R&R – Q&A Q: Are comments placed only in the R&R section or also in Pelican Case if open at time of call? A: R&R actions should be documented in the R&R case comments. They do not need to be duplicated in the client's case comments unless there is rationale for doing so. 83 R&R – Q&A Q: Parent follow-ups: requirement is to use the client assistance log [CAL] to record. However, there are no categories to select that capture this activity. In the past we have used the Comment log which seems more appropriate. If we are to use the CAL, can something be added to select for this activity. A: R&R case comments is the more appropriate place for documentation. The CAL was referenced in err for the documentation of client follow-ups. Use the case comments log. 84 R&R – Q&A Q: Can you review a few sample entries in the Contact Log and Client Assistance Log? Specific examples might include: 1. A caller who needs a referral and subsidy application. The R&R Specialist was able to provide the client with verbal education and a packet of material which include a subsidy application, referral packet and the required DPW brochures. 2. A social service agency called and requested that 10 subsidy applications be sent for distribution to their clients as needed. 85 R&R – Q&A A: 1. Enter in the Client Assistance Log. 2. Enter in the Contact Log. Ask yourself: Did the caller provide me with the information I need to create an R&R case? If yes, create a case and enter appropriate information in the CAL. If not or information requested is not individual-specific (i.e. a business), enter in the CL. 86 End of Training 87