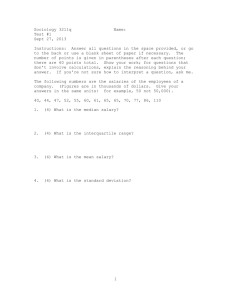

Report - Tasmanian Industrial Commission

advertisement