SUBJECT:

Report to: Portfolio Holder for Property,

Finance and Commissioning

4 th February 2014

Subject:

Status:

Report Ref:

Ward(s):

Key Decision:

Write Off of Bad Debts

– 2013/14

Open

All

No

Key Decision Ref:

Report of: Head of Resources

Contact:

Appendices:

Phillip Hood, Management Accounting Manager e-mail

Phillip.hood@basingstoke.gov.uk

or 01256 845660

Confidential Appendix 1 - Housing Benefit Debts

Confidential Appendix 2

– Business Rates Debts

Confidential Appendix 3 - Property Debts

Papers relied on to produce this report

None

SUMMARY

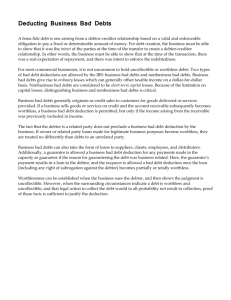

1 This Report

1.1 This report sets out irrecoverable individual debts of over £2,000, or £10,000 for

Local Tax, which are recommended for write-off in accordance with the council’s Financial Regulations.

2 Recommendation

It is recommended that:

2.1 Housing benefit debts totalling £78,491 be written off as set out in Confidential

Appendix 1.

2.2

Business rates debts totalling £173,363 be written off as set out in Confidential

Appendix 2.

2.3 Property debts totalling £18,558 including VAT be written off as set out in

Confidential Appendix 3.

1 of 8

PRIORITIES, IMPACTS AND RISKS

Contribution to Council Priorities

This report accords with the council’s Policy and Budget Framework and supports the development of an effective and efficient council.

MAIN CONSIDERATIONS

The Proposal 3

3.1 As part of the council’s debt management process, a report is produced annually to write off irrecoverable bad debts once all reasonable recovery procedures have been exhausted. The council’s financial policies ensure that an appropriate level of bad debt provision is maintained to finance these write offs.

3.2 Following the one off project that was carried out in 2012/13 to review housing benefit overpayment debts and ensure that only recoverable debts remained in the system, the level of benefit write-offs have returned to a much lower level in

2013/14.

3.3 Local Tax have made some large strides forward since February 2013 and have some further improvements planned for the coming year. The team are dealing with 85% of all correspondence within 5 working days meaning that billing can take place without unnecessary delay and therefore ensuring that recovery is more proactive. The more severe remedies for Council Tax and

Business Rates that have previously been agreed are now starting to progress with the first charging order having been taken forward and produced excellent results.

3.4 A new Senior Debt Recovery Officer with a wealth of recovery experience has also been employed recently and this new appointment will see the remaining remedies (bankruptcy and committals) propelled forward and put into practice to maximise arrears collection. An officer from the existing team has been tasked with reviewing and updating the procedures for recovery of overpaid housing benefit via invoice. This will ensure that new recovery remedies are introduced and any delays are eliminated.

4 Write-offs Agreed Under Delegated Powers

4.1 Heads of Service have delegated authority to write-off individual debts under

£2,000 (or £10,000 for Local Tax). In addition to the amounts recommended for write-off in this report by the Portfolio Holder, the following debts totalling

£364,052 were written off under delegated powers between 1 st April 2013 and

30 th September 2013. As shown in the table below, this is a significant reduction from last ye ar’s equivalent figure of £820,425 when there was a detailed review and analysis of historic council tax and benefits debts which resulted in an usually high level of write-offs.

4.2 It should be noted that the cost of council tax write-offs are shared by all precepting bodies (BDBC, HCC, fire and police) and this council bears approximately 9% of the amount written off. Following the introduction of the new business rates retention scheme in 2013, the council now bears approximately 40% of the cost of any business rates write-offs.

2 of 8

Summary of Debts Written-off Under Delegated Powers:

Reason

2013/14 2012/13

£ £

Property Rents (uneconomic to pursue)

Sundry Debtors

Council Tax

Business Rates

Housing & Council Tax Benefit:

- non-invoiced recovery from on-going benefit

- invoiced recovery where benefits ceased

Car Parking

Total

511 0

2,617 9,383

169,141 354,604

43,617 76,722

41,454 180,568

87,233 186,841

19,479 12,307

364,052 820,425

The reasons for the delegated write offs in 2013/14 were as follows:

Sundry Debtors: (£)

Reason

Uneconomical to pursue

Unexpected receipt

Debtors whereabouts unknown

Disputed and written off

Deceased

£

1,394

- 419

1,107

497

38

2,617

Council Tax: (£)

Reason

Bankruptcy

Deceased

Joint debt approach

Other

Unable to trace (*)

Credits written off

Uneconomic to pursue

Hardship/LA discretion

Prison

Total

£

22,730

6,902

7,055

17,099

62,627

-31,089

58,217

23,972

1,628

169,141

* The council uses a software tool to trace for all returned mail or if it is aware that someone has “gone away”. If searches come back successful and a new address is found, then documents are resent.

Where traces are unsuccessful, new techniques and other tools are currently being assessed with the aim of significantly improving tracing procedures over the next 12 months.

3 of 8

Business Rates: (£)

Reason

Bankruptcy etc (*note 1)

Other

Unable to trace

Uneconomic to pursue

£

-13,538

33,209

14,931

9015

Total 43,617

Note 1 - During the first half of the year there was a net write-back of business rates debt due to bankruptcy of £13,538. This was the result of timing differences between debts being written off at the end of 2012/13 and liabilities being reduced following vacations of property.

Housing & Council Tax Benefit: (£)

Reason

Hardship/LA discretion

Deceased

Joint debt approach

Other/Non recoverable

Uneconomic to pursue

Untraceable

Bankruptcy

Prison

Total

Total

£

19,147

1,290

7,045

58,807

Non-invoiced Invoiced

£ £

12,020

693

850

7,127

597

6,196

6,654 52,153

13,239

15,559

11,307

2,293

10,783

2,680

7,774

2,456

12,878

3,533

2,293

128,687 41,454 87,233

Car Parking:

4.3 Between 1st April 2013 and 30th September 2013, a total of £19,479 was written off in respect of 208 Penalty Charge Notices (PCNs) that the bailiffs were unable to recover. An unpaid PCN is only written off, as opposed to cancelled, once it is registered at the County Court i.e. once all possible avenues of challenge open to the vehicle owner are exhausted. The number of writeoffs increased by 58% or £7,172 compared to the same period in 2012/13 due to an increase in the number of PCN's issued, an increase in number of

PCN's progressed to bailiff stage and batches of returned 'warrants of recovery' from bailiffs involving persistent evaders who have accumulated 5 or more unpaid PCN's, and are not traceable.

4 of 8

5 Housing Benefit Writeoffs Greater than £2,000

5.1 Overpaid benefit generally occurs for 3 reasons:

(i) the customer delays advising the council of a change in their circumstances.

(ii) claimants fraudulently claim housing and/or council tax benefit to which they are not entitled.

(iii) the council delay the reassessment of a change of circumstances.

5.2 These debts can be recovered if the claimant would have known that they were receiving too much benefit e.g. an increase in salary.

5.3 Overpaid benefit is recovered via deductions from on-going benefit entitlement where housing benefit is still in payment. The maximum deductions allowed are prescribed by Government. In cases where entitlement to benefit has ceased, the debt is recovered via the sundry debt system which is within the local tax and benefits system (Civica Open Revenues) and is the responsibility of the

Exchequer Team to collect.

5.4 Recovery action on overpayments is undertaken in accordance with Housing

Benefit Regulations, and the council’s Joint Debt Approach which has been agreed with Internal Audit. This can involve issuing reminders followed by referral to court or a debt collection agency.

5.5 At the time the overpayment is identified, the customer is given a statutory notice advising them of the reasons for the overpayment, an invoice informing them of the amount overpaid and methods of repayment available, together with information on their statutory right to appeal against the calculation.

5.6 Recovery action is withheld until the period of appeal has expired. A County

Court Judgement (CCJ) can then be applied for or the debt can be referred to a collection agent (DCA). The Exchequer Team use information obtained from

Civica Open Revenues to analyse the individual debts, develop a collection/recovery process and collection targets, and monitor the effectiveness of these processes.

5.7 Debts which have been created during the current financial year are recovered in accordance with a recovery action timetable, which ensures that unpaid amounts are referred to a debt collection agency within 10 weeks of the invoice being issued.

5.8 In addition to the writeoffs under £2,000 set out in section 4 above, there are

14 debts totalling £78,491 that are recommended for write-off. These are detailed in Appendix 1, along with an explanation of the reason for the write-off.

The first ca se for £2,028 relates to an individual still in receipt of benefits but in all other cases entitlement to benefit has ceased.

5 of 8

6 Business Rates

6.1 As detailed in Confidential Appendix 2 there are 9 debts of over £10,000 for business rates which are recommended for write-off, for the reasons explained. The total value of these writeoffs is £173,363.

6.2 The cost of these write-offs is shared between all precepting bodies (BDBC,

HCC, fire and police) and the government, with this council’s proportion being

40% or

£69,345.

6.3 To put the level of business rates write-offs in context, a total of approximately

£71 million is due to be collected each year and write-offs, including those authorised by officers under delegated powers, amount to approximately 0.3%.

Where write-offs are due to bankruptcy or liquidation, the Council remains as a registered creditor should there be any pay-out in the future.

7 Property Debt Writeoffs Greater than £2,000

7.1 The Property Services Manager ensures that every effort is taken to check the financial stability of potential tenants before a tenancy is granted, or a lease assignment approved, including examination of accounts, bank references, trade and landlord references and the use of rent deposits and guarantors, as appropriate to the circumstances. The payment records of tenants are constantly monitored, and both reminders and statements are issued.

7.2 If it becomes evident that a tenant is falling behind with payments they are contacted by a management surveyor, from Property Services, any problems are discussed, and the matter is pursued until a solution is reached. This may result in action such as agreement of a payment plan, charging interest, setting up standing order arrangements, using rent deposits, sending in the bailiffs, pursuing under tenants or previous tenants or guarantors, or re-possessing the premises.

7.3 Should these measures have no effect the matter is referred to the Head of

Legal and Democratic Services for legal action for repayment of the debt with or without repossession of the premises.

7.4 In most cases these measures are sufficient to address the problem but inevitably some businesses fail. Businesses and individuals may file for bankruptcy, firms may go in to administration or liquidation and occasionally a tenant may become untraceable.

7.5 Procedures are in place to attempt to recover outstanding debts, which can extend over a number of years. However, there comes a time when it is clearly futile and uneconomic to attempt further recovery action and the debts are recommended for write off.

7.6 Where businesses fail either the Head of Resources or the Head of

Governance deal with the administrator/liquidator as appropriate to register our debt and ascertain whether there are any funds to meet outstanding debts.

7.7

A review of bad debts has recently been undertaken across the Council’s property portfolio, to establish which debts are unrecoverable and should be written off. This has identified 2 debts, detailed in Appendix 3 , totalling £18,558 which are recommended for write off. T his includes VAT of £2,906 which the council can reclaim. Write-offs amount to approximately 0.1% of commercial

6 of 8

property income, managed by Property and Facilities Management, which totals £15.2m.

7.8 Where write offs relate to company failures, contact with the administrator is maintained by Legal Services. Unless the council will lose the ability to reclaim

VAT on write-offs because they are more four and a half years old, the council only agrees to a write off when a formal letter is received, stating that there will not be any distribution of funds to creditors. There are several cases on going with administrators where the council is unlikely to receive any money but until this is certain they will not be written off.

8 Options Analysis

8.1 The council does have the option of writing off more or less debt than is recommended by officers.

8.2 However, officers have undertaken an analysis of all outstanding debts and are recommending the write-offs listed in the appendices for the reasons explained.

8.3 Such action does not, of course, prevent the debt being resurrected and pursued if new information comes to light in the future.

9 Financial Implications

9.1 The council’s financial policies ensure that sufficient bad debt provisions are maintained and included in the c ouncil’s accounts each year. A 100% bad debt provision is maintained for all housing benefit overpayment debtors and for property and sundry debts over three months old.

9.2 The bad debt provisions are sufficient to meet the cost of the recommended write offs as detailed in the table below. The bad debt provisions are reassessed annually as part of the final accounts process to ensure appropriate levels are maintained.

Bad Debt Write Off Provision

Bad Debt

Provision at

31/3/2013

Recommended

Write Offs (excl

VAT)

Write Offs

Agreed Under

Delegated

Powers

Balance of

Provision After

Recommended

Write Offs

£'000 £'000 £'000 £'000

Property rents

Sundry Debtors/Car Parking

Hsg & CTax Benefit

Council Tax

Business Rates

347

749

1,224

2,435

550

5,305

16

0

78

0

173

268

1

22

129

169

44

364

331

727

1017

2266

333

4,673

10 Risk Issues

10.1 In order to ensure that debt collection levels are maintained at a high level, it is important to ensure that Council policy is to rigorously pursue debts and only to write debts off when all reasonable recovery actions have been taken and they become uneconomic to pursue.

7 of 8

10.2 Human Resources (HR) Issues

10.2.1 There are no HR issues.

10.3 Equalities Issues

10.3.1 There are no equalities issues.

10.3.2 Legal Implications

10.3.3 There are no legal implications.

10.4 Any Other Implications

10.4.1 None

11 Communication and Consultation

11.1 The council will communicate its drive to recover debts and that writing off debts is a last resort only when pursuing them is no longer financially viable.

12 Portfolio Holder Comments

12.1 It is encouraging that the new measures and techniques officers are deploying is reducing the overall amount of bad debts and I would wish to thank our team for their continuing efforts to improve collection in the interests of those rate payers who do pay their bills on time. The total amount of bad debt write off is still too high particularly in terms of those who deliberately and persistently seek to avoid paying what they owe the council for services provided to them or receive payments to which they are not legally entitled. We will continue to work to find solutions for those in genuine difficulty but I will be looking for further progress to be made in reducing the overall bad debt provision.

13 Conclusion

13.1 This report recommends that the debts contained in the attached appendices are approved for write-off by the portfolio holder as all reasonable actions have been taken to recover the debts and it is uneconomic to pursue them further.

8 of 8