Original Plan of the CTA

advertisement

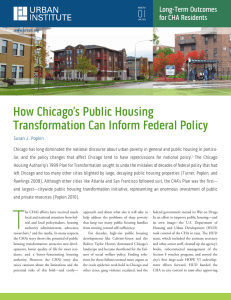

Problems that Consist Original Plan of the CHA to provide decent housing for poor and low- income households. National Housing Act of 1934 Passed to make houses and home mortgages more affordable Created the Federal Housing Administration (FHA) and the Federal Savings and Loans Insurance Corporation Used as base for the mortgage and home building industries Did little to improve inner city housing, it intensified segregation of races, and further promoted the single family detached dwelling as the prevailing mode of housing, which furthered the phenomenon of suburban sprawl National Housing Act of 1937 Provided for subsidies to be paid from the U.S. government to local public housing agencies (PHA's) to improve living conditions for low-income families. Founding CHA was founded in 1937 in response to the Housing Act of 1937 Responsible for all public housing in Chicago The Beginnings Four low rise projects prior to WWII 1938- built three new projects for whites Jane Addams Houses (32 buildings, 1027 families) Julia C. Lathrop Homes (925 families) Trumbull Park Homes (426 families) Only one built for blacks Ida B. Wells Homes (1662 families) FEDERAL HOUSING ACT 1949 Provided funds for 800,00 new units of public housing across the U.S. First time responsibility of slum clearing was viewed as more than a local issue. CHA’s map of proposed sites originally shut down by white aldermen. Resulted in concentration of public housing in Chicago’s South and West sides. GANG VIOLENCE Why was this a problem? •Adults lost control •Neighborhood quickly deteriorated •Less tenant checking •Cyclical Drugs Their effect on public housing Crack brought from Los Angles, CA Way to “quick cash” http://www.youtube.com/watch?v=o80wKKJI6uc No need to leave home to “work” Public housing has come full circle Maintenance Industry died down after World War II City had less revenue; made budgets cuts Began withdrawing from maintaining the housing projects Grass paved over Fire-stricken units were boarded up Broken elevators Maintain Maintenance Provide funds through tax equity Place slightly higher taxes on rich State income tax is at 3% $250,000-$500,000: increase rate to 3.5% $500,000+: Increase to 4% Equity will create efficiency in community Tax Policy Chart for $250,000+ Pre-Tax Income Original State Income Tax New, Proposed Income Tax (3.5%-4%) Revenue Total Increase Income per Person Tax paid Under Obama (42.5-43%) Total Income Tax paid Under McCain (38.5-39%) (3%) $250,000 $7,500 $8,750 $1, 250 $106,250 $96,250 $500,000 $15,000 $20,000 $5,000 $215,000 $195,000 Creating Jobs Create businesses that serve people’s needs Grocery stores, clothing, etc. Provide proper funding for aspiring business owners Many would not have the resources otherwise Treat payment as a loan; paid back to the city Mutually beneficial Circular flow to guide local economy Eventual source of revenue for the city Mentoring Program Provide a mentoring program whereby individuals and families successful in relocating out of public housing advise and counsel individuals and families trying to move up and out The mentoring program should emphasis the individuals success and comfort in living in their new community to reduce fears that the tenants may have such as the sense of loosing their of community and face prejudices in their new housing Incentive Program In order to encourage market rate tenants to purchase properties in mixed income developments builders can: 1. Provide incentives through gifting equity at closing; for example, the builder or owner of a mix income development will offer to pay $20,000 at closing. This allows the home prices to stay high, while giving the market rate purchaser instant equity in their property 2. The builder can also offer a program to pay a percentage, say 3% of the purchases property taxes over a five year period. This is will encourage the purchaser to stay in the mixed income housing development over time Market Rate Buyers Builders of mixed income development should also introduce potential purchasers to attractive mixed income development that have already been established and have a proven track record and allow them to talk to market rate tenants in the existing developments to overcome any hesitations they may have about purchasing Issue: Chicago Public Schools Unqualified Teachers According to Chicago Tribune, 5,000 school teachers will need to go back to school. In 2006 the average ISAT reading scores for 3rd graders in CPS was 190.67, while students in the rest of the state was 208.33. Solution: Better Teachers TEACH Grant: Federal money to education majors in exchange for working in low income school districts. Leads to better educated teachers in CPS Results in better test scores for students Higher test scores earns school more money from federal government for better education resources. Education Problems Inadequate funding No incentives Broken buildings Overcrowding; shifts of students What’s the point? Crux of the problem Education Solutions Cycle needs to be broken Room 405 http://www.projectcitizen405.com/ActionPlan.ht m Trade schools