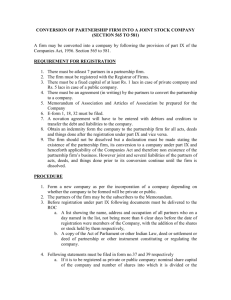

management of a company

advertisement