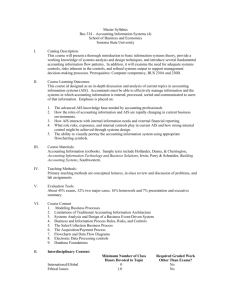

Accounting Information Systems: Essential Concepts and

advertisement

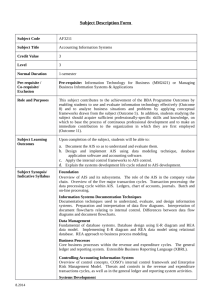

Accounting Information Systems: Essential Concepts and Applications Fourth Edition by Wilkinson, Cerullo, Raval, and Wong-On-Wing The Study of Accounting Information Systems What Is Accounting? It is the principal way of organizing and reporting financial information. It has been called the “language of business.” Accounting and information systems comprise the functional area of business responsible for providing information to the other areas to enable them to do their jobs and for reporting the results to interested parties. To that end, an accounting system is used to identify, analyze, measure, record, summarize, and communicate relevant economic information to interested parties. What Is a System? A System is an entity consisting of interacting parts that are coordinated to achieve one or more common objectives. Systems must possess SYSTEM INPUT PROCESS FEEDBACK OUTPUT INFORMATION SYSTEM INFORMATION DATA INPUT PROCESS FEEDBACK OUTPUT Data Versus Information Data are raw facts and figures that are processed to produce information Information is data that have been processed and are meaningful and useful to users. The terms “meaningful” and “useful” are value-laden terms and usually subsume other qualities such as timeliness, relevance, reliability, consistency, comparability, etc. Functional Steps in Transforming Data into Information Data collection - capturing, recording, validating and editing data for completeness and accuracy Data Maintenance/Processing classifying, sorting, calculating data Data Management - storing, maintaining and retrieving data Data Control - safeguarding and securing data and ensuring the accuracy and completeness of the same Information Generation - interpreting, reporting, and communicating information What Is an Information System? An Information system is a framework in which data is collected, processed, controlled and managed through stages in order to provide information to users It evolves over time and becomes more formalized as a firm grows and becomes more complex. It can be a manual or computerized system Firms depend on information systems in order to survive and stay competitive The Universal Data Processing Model Storage Processing Consumers Exchange Events Internal Events Environmental Events } Accounting Information System An Accounting Information System is a unified structure that employs physical resources and components to transform economic data into accounting information for external and internal users. The Business Firm as a System Environment of the Firm Business Firm Organization Information System Operational System Organization’s functions AIS Transaction Cycles Business Events from Operations System Characteristics of Business Firms Objectives Environment Constraints Input-Process-Output Feedback Controls Subsystems FUNCTIONS OF AN INFORMATION SYSTEM ENVIRONMENT Customers Suppliers ORGANIZATION INFORMATION SYSTEM INPUT PROCESS OUTPUT FEEDBACK Regulatory Agencies Stockholders Competitors TYPES OF INFORMATION SYSTEMS KIND OF SYSTEM GROUPS SERVED STRATEGIC LEVEL SENIOR MANAGERS MANAGEMENT LEVEL MIDDLE MANAGERS KNOWLEDGE LEVEL KNOWLEDGE & DATA WORKERS OPERATIONAL MANAGERS SALES & MARKETING OPERATIONAL LEVEL MANUFACTURING FINANCE ACCOUNTING HUMAN RESOURCES AIS as an MIS Subsystem Sales/ Marketing Production Info AIS Personnel Finance Relationship of AIS & MIS MIS Finance Sales/Marketing Production AIS Personnel Order entry/Sales Billing/A.Rec./Cash receipts Purchasing/A. Pay./Cash disb. Inventory Payroll General ledger Production Examples of AIS Subsystems (Merchandising) Order entry Sales System Shipping Revenue Cycle Billing/ A. Receivable Cash Receipts System Inventory System General Ledger System Purchasing/ A. Payable/ Cash Disb. System Receiving Expenditure Cycle Ext/Fin. reporting Tax & req. reporting Internal reporting Human Resource Management (Payroll) System No Planning/Control, Investment, or Production Cycles reflected here The Operational System of a Manufacturing Firm Manufacturing Firm Facilities Supporting Operations Labor (human services) Material from Supplier Acquiring Materials Producing Finished Goods Storing Finished Goods Data Shipping Finished Goods Goods to Customer Information AIS Funds Data and information flow Physical flows Funds Examples of AIS Subsystems: Production Cycle Inventory System Production System Purchasing/ A. Payable/ Cash Disb. System Production Cycle General Ledger System Human Resource Management (Payroll System No Revenue, and Investment Cycles reflected here Organizational Structure in Business Firms Hierarchical Matrix: Blend functional and project- oriented structures Decentralized Network Objectives and Users of AIS Support day-to-day operations Transaction processing Support Internal Decision-Making Trend Analyses Quantitative & Qualitative Data Non-transactional sources Help fulfill Stewardship Role Resources Required for an AIS Processor(s): Manual or Computerized Data Base(s): Data Repositories Procedures: Manual or Computerized Input/Output Devices Miscellaneous Resources Reasons for Studying Accounting Information Systems Career accountants will be users, auditors, and developers of AIS Modern-day AIS are complex because of new technologies Concepts studied in AIS are integrated into every other accounting course Information-Oriented Professionals An array of professionally trained persons from different fields of study have focused on providing information to users These professionals include system and managerial accountants and auditors, system analysts and industrial engineers Professional certifications are increasing. These include Certified Computing Professional, Certified Information Systems Auditor, Certified Managerial Accountant, Certified Fraud Examiner, etc. Roles of Accountants With Respect to an AIS Financial accountants prepare financial information for external decision-making in accordance with GAAP Managerial accountants prepare financial information for internal decision-making Roles of Accountants With Respect to an AIS Auditors - evaluate controls and attest to the fairness of the financial statements. Accounting managers control all accounting activities of a firm. Tax specialists - develop information that reflects tax obligations of the firm. Consultants - devise specifications for the AIS. Ethical Standards for Consulting Professional competence Exercise due professional care Plan and supervise all work Obtain relevant data to support reasonable recommendations Maintain integrity and objectivity Understand and respect the responsibilities of all parties Disclose any conflicts of interest