Brand Manager Speciality Beer

advertisement

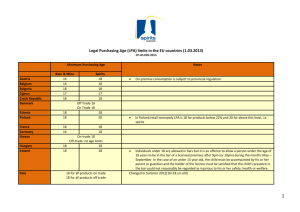

2014 Galatea • Head office: Stockholm, Sweden • Founded: 1994 • Turnover 2012: 850 MSEK (~97 million € / ~126 million $) • Sales volume 2012: Approx. 280 000 hectoliters ( 28 M. Lit / ~240 000 barrels) • Employees: 70 (incl. distribution and warehouse) • Product range: Beer, Spirits, Cider, RTD, Wine • Distribution: National distribution through affiliate company KGA Logistics AB • Warehousing: Central warehousing by affiliate company KGA Logistics AB Galatea team Torbjörn Sundwall (CEO and founder) Mats Folkesson (vCEO and part owner) Dan Samson (Senior Brand Manager Beer & Wine) Marc Eysermans (Export Manager & Senior Brand Manager Beer) Stefan Johansson (Brand Manager Speciality Beer) Marcus Friari (Brand Manager Swedish Products) Peter Edin (Brand Manager Spirits) Maria Hernodh (Market & Export Coordinator) Nesrin Kaya (Market Assistant) Daniel Edin (PR & Events manager) Ola Malmquist (Sales Manager) Sales reps x 10, expanding with 2 Christina Larsson (CFO) Accounting team of 5 Sören Sörensen (Business Development Manager and product developer) Torsten Lööf (IT manager and part owner) IT team of 2 KGA Logistics Roger Törnkvist (CEO KGA Logistics) Warehouse co-workers x 30 plus seasonal Telesales and customer service desk and administration x 8 Galatea • Galatea - is Scandinavia’s largest importer of beer. - have it’s own warehousing and distribution, which is only matched by the domestic breweries. - majority volume is based on import products. - owns a craft brewery and produce two brands. - have a big portfolio, but with dedicated brand management and a experience to place and segment each product and brand we reach a very good setup with every producer. - offers transparent value chain, stock levels, and sales figures. Import Brands – a selection from the portfolio Background Galatea have a big portfolio of products that all play certain roles in our assortment all agreed with our suppliers. This means that we have brands performing as a base in our portfolio, on over that with medium sized and a growing potential, on top are brands that play an exclusive role in the portfolio with small supply of more expensive and sought after products. Brands can move in this scale as Lagunitas have from entering as in the mid level and avancing to be a base brand ending up at about 7000 barrels 2014 after only two years in the market. Exclusives Craft Beer Classic ales Samuel Adams, USA Lagunitas Brewing Company, USA Ballast Point Brewing, USA Coronado Brewing Co, USA Anderson Valley Brewing, USA Thornbridge Brewery, UK Marstons, UK Shepheards Neame, UK Belgian ales Mid Base Duvel, Bosteels, Westmalle Lagers Pabst Brewing Co, USA Budejovicky Budvar (Budweiser Budvar), Czech Republic Hofbräu, Germany Bitburger, Germany Galatea’s own brands Craft beer brands produced in our own brewery : Galatea’s own brands Our own developed spirits (organic vodka and gin, rum, brandy) and muld wine. Distribution & logistics • KGA is an affiliate company, owned by Galatea. • KGA Logistik AB are managing logistics and warehousing in Karlskoga. Distributing around 3,5 million cases yearly. • The KGA warehouse is 15.000 square meters (about 150.000 square foot) and expanding with 8.000 square meters more, placed in the old Bofors armory facilities with unlimited growth potential. • Our national logistics set-up is offering an high qualitative delivery in line with any other player and our price-per-case is very competitive, most often lower than the Swedish breweries. • KGA is offering 100% transparency and add-on services like own tele-sales, POS handling, promotions, empty kegs management, complaint handling etc. • In order to maximize our service to our partners Galatea/KGA often plays a role as a panScandinavian hub, distributing to several markets in northern Europe. • Our supply chain management has long experience of importing alcoholic drinks from all corners of the world: Europe, Northern America, South America, Africa, Asia and the South Pacific region. KGA is one of the largest distributors of alcoholic beverages in Sweden. We supply alcoholic beverages to Systembolaget (the Swedish Alcohol Retail Monopoly), wholesalers and restaurants all over the country. We aim to make life that little bit easier for our customers. We do this by employing a highly skilled staff, using an up-to-the minute stock-keeping system and ensuring 100% transparency in cost and goods flows. Transporting 3,5 million cases per year Off-Trade and On-Trade. Shipments organized by Galatea/KGA from the world We pick up ex works / FOB from the breweries, in reefer containers Sweden Sweden is ~1590 km or 1000 miles from north to south. All accounts, both on- and offtrade supplied directly and individually within 48 hours from order. Major cities are between 3 and 5 hours drive from the warehouse. There are no three-tier system, but we can use distributers/wholesalers for added volume. Consolidated transports from KGA to Scandinavia KGA Finland & The Baltics Galatea partner in Finland is Servaali which is Finland’s largest importer and stand for ~50% of import beers. Servaali have expanded into the Baltic countries and are growing every day. Denmark Galatea is very strong in Denmark with a joint venture setup together with Braunstein. Braunstein is the second largest distributor. We consolidate weekly containers to Denmark and reach full distribution in Denmark. Braunstein close relationship with COOP enables us to reach ALL 1200 shops. Staff and account training We are investing at least one full day per month in staff traning. Our own brewmaster do tastings, brewing knowledge, taste and smell references, and so on. Brand managers introduce new products and internal parallell tastings between brands. Producers are also invited to do tastings and push their own brands. Retail tastings are only for the on-trade as we cannot invite off-trade monopoly store staff. Alcoholic Beverage Market Sweden Total alcoholic beverage market On-trade Off-trade monopoly Daily Food Sector Duty free border trade • Galatea reaches full distribution in off-trade Systembolaget and DFS (maximum 3,5% ABV) • Galatea reaches full distribution in on-trade (through own sales force, partnerships and wholesalers) Galatea and the total market • A small importer have maximum 10% on-trade sales and at least 90% sales through the off-trade monopoly. The biggest challenge for an importer is to get a route to the on-trade market which requires a big setup. • Galatea have about 25% on-trade sales and 75% off-trade, which is exactly what the big domestic breweries have but the difference being that our majority volume come from imports. On-trade market • The on-trade market in Sweden consist of roughly 9 000 permits. • Minimum age is 18 years. • The top players are the domestic breweries that ties up the outlets on long term contracts. • The key is to have route to market, and a cost-effective setup (import, warehousing, distribution). • The producer / importer can deliver direct to the outlets. • A third party distribution is possible through wholesalers which acts as resellers. Wholesalers main business is food and uses beverages, restaurant equipment, snacks, and much more as add-ons. Galatea and the on-trade market Galatea is 4th largest supplier to Swedish on-trade No other supplier with majority of volume based on import matches that position. Fourth place means a position in between five biggest breweries all focusing on their own domestic produced brands. On-trade market • The on-trade market in general have been more or less +/- 0 during the last 5 years. • On such a market with no overall volume development Galatea is growing rapidly. 2012 we grew 18% and 23% during 2013. • A big reason of the growth rate is due to having a wide assortment and being able to supply different kind of outlets and so being the most interesting partner. • A wider craft portfolio and a set focus on that have made Galatea the best craft supplier with 13% of our total on-trade volume being craft, and that is excluding Samuel Adams volumes. • The biggest partners are the major chains, for instance – The Bishop’s Arms (40 premium pubs, and growing) – New bottle accounts are O’learys sports bars and restaurants (77 venues and growing), will be draft accounts starting from January 1st Daily Food Sector (Supermarkets) • Beer of maximum ABV of 3,5% is allowed to be sold. • Minimum age of the consumer is 18 years. • High consumer price compared to off-trade price points. • Fairly difficult to get listings, all depends on price. • In the recent couple of years we have seen an increased range of beers from domestic and specially local craft beers showing up in these Supermarkets. • Roughly 25 million liters (~225 000 bbls) but it is a declining market with several percent per year. Border Trade • The border trade is manily located in northern part of Germany. • Beer is super-cheap and Danish, Norwegian, and Swedish citizens go there to fill up their cars. • The Swedish Brewery Association estimate the border trade ‘private import’ volume to Sweden to 150 million liters (~1 300 000 bbls). • A Swedish citizen is allowed to bring in 250 liters (~2,2 bbls) per border crossing. • The border trade is a genuine problem but difficult for the government to handle. • Galatea have no business with the border trade since it basically means zero margin. Off-trade market (Systembolaget) • The off-trade market in Sweden consists of 426 governmental owned and controlled stores . • Minimum age of the consumer is 20 years. • There is a permanent assortment, seasonal listings, and one offs (exclusive listings), plus the preorder assortment. • Permanent products are introduced through extensive offering process on tenders, and launched beers are decided by blind tasting. • Products are evaluated by sales in each segment and given a distribution (a certain number of stores) based on previous sales. • About 75% of all alcohol volume sold in Sweden is sold by Systembolaget. • Roughly 210 million liters is sold annually where of beers stand for. Off-trade market (Systembolaget) • No in store advertisement allowed. • We cannot approach store managers or staff to promote our brands. • All deadlines are final. • Basically it’s a very good partner when you play their game and get listings. • Being a very professional supplier, we are asked to supply them with input what to be looking for in the coming years. • Galatea wins more than 30% of all listings. Galatea and Systembolaget (off-trade monopoly) Galatea is • 5th largest supplier of Beer to Systembolaget (only breweries with own domestic brands ahead of us) • 7th largest supplier of Cider to Systembolaget • 9th largest supplier of Spirits to Systembolaget and last but not least… • 6th largest supplier of all categories to Systembolaget Top 10 beer suppliers to Systembolaget 2013 These are the big domestic breweries liters % GL Brands is the holding company for SAB Miller has their own setup Sweden 1 brands barrel = 117,2in liters Heineken The next two import companies and Övriga meaning the rest. Beer market in Sweden, cont. • • • Beer accounted for about 50% of Systembolaget’s total volume and 22,7% of the value. The sales volume for 2009 to 2013 is more or less the same. But in the same time, value have grown a lot. Beer market in Sweden, cont. trends per segment. • • • Lager is completely dominant with ~93% of the total beer volume. Pale canned lager stands for ~74% of the total volume. +1% in 2013 after declining a couple of years. Beer lager bottle international, saw an increase during 2012 and quite large fluctuations in 2013 due to a new distribution model. Beer market in Sweden, cont. trends per segment. • • • Specialist beers (or specialty beers) make up 6% of the volume and 9% of the value. Grew 13% in 2011, 16% in 2012, and staggering 30% in 2013. The motor in the segment is Ale, and more specific modern craft beers. Beer market in Sweden, cont. trends per segment. • • Organic beer now stands for 1,2% of total beer sales. Organic beer sales dropped last year, but Systembolaget stands firm on adding on numerous of new organic products to the assortment. Social media/events/fairs Galatea launched www.craftbeer.se during Stockholm Beer & Whisky Festival (SBWF) 2013. Through this digital platform connected with our Facebook page we advertise new products, release information and share supplier info. We also push pre-order products and have increased our Systembolaget non-permanent listing sales to an undreamed-of level. No other importer match this setup. SBWF is a festival with about 40.000 visitors and very important to Galatea. We attend a lot of other festivals over the year. We organize events at on-trade accounts with or without the presence of the supplier. We are not allowed to give away free beers according to the law. So events are mostly focused on attracting consumers to tap take overs and beer tastings/beer dinners. Expansion Sigtuna / St Eriks brewery We have started expanding our craft brewery with a factor of 5 in terms of production size to meet the demand. Today we produce about 12.000 barrels. KGA Warehouse Expanding with additional space and planning to add on adding temperature controlled space. Sales force We are adding on 2 more ending up at 12 sales reps, to be compared with the biggest domestic lager breweries that have 30 each. On-trade We estimate this year to end up at about 20% plus in on-trade sales. Craft is booming! O’learys chain with almost 80 outlets have reasently been signed and will start with bottles in September and draft in January. I hope that this presentation shows that Galatea is a professional and reliable partner, and that we have good position on the Swedish and Scandinavian markets. I will be available for questions and further discussion, and I sincerely hope for a future prosperous collaboration. www.galatea.se