Chapter 17 Lecture

advertisement

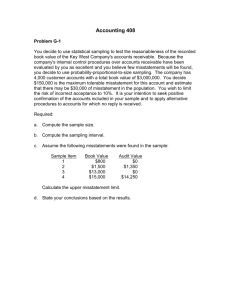

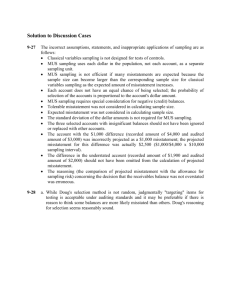

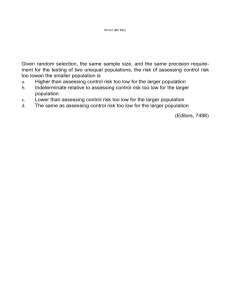

Chapter 17 Audit Sampling for Tests of Details of Balances Presentation Outline I. The 14 Steps of Audit Sampling for Tests of Details of Balances II. The 7 Steps of Monetary Unit Sampling III. Alternative Procedures When a Population is Projected IV. ARACR and ARIA I. The 14 Steps of Audit Sampling for Tests of Details of Balances The 14 steps required in audit sampling for tests of details of balances parallel the 14 steps used for sampling for tests of controls and substantive tests of transactions. Any differences are noted on the following slides. Audit Sampling for Tests of Details of Balances Step 1: State the objectives of the audit test. When auditors sample for tests of details of balances, the objective is to determine whether the account balance being audited is fairly stated. Audit Sampling for Tests of Details of Balances Step 2: Decide whether audit sampling applies Audit sampling applies whenever the auditor plans to reach conclusions about a population based on a sample. Audit Sampling for Tests of Details of Balances Step 3: Define Misstatement Conditions Misstatement conditions are any conditions that represent a monetary misstatement in a sample item. Step 3 for Tests of Controls and Substantive Tests of Transactions would be: Define attributes and exception conditions. Audit Sampling for Tests of Details of Balances Step 4: Define the population In testing for the existence objective, the recorded dollar population is the population. If the completeness objective is a concern, the sample should be selected from a different source. Audit Sampling for Tests of Details of Balances Step 5: Define the Sampling Unit The sampling unit for nonstatistical audit sampling in tests of details of balances is almost always the item making up the account balance. Monetary unit sampling (MUS) is a statistical technique in which the sampling unit is the individual dollars that make up an account balance. Audit Sampling for Tests of Details of Balances Step 6: Specify Tolerable Misstatement As discussed in Chapter 9, the auditor starts with a preliminary judgment about materiality and uses that total in deciding tolerable misstatement for each account. Step 6 for Tests of Controls and Substantive Tests of Transactions would be: Specify the tolerable exception rate. Audit Sampling for Tests of Details of Balances Step 7: Specify Acceptable Risk of Incorrect Acceptance (ARIA) There is an inverse relationship between ARIA and required sample size. When internal controls are effective, control risk can be reduced, permitting the auditor to increase ARIA. Step 7 for Tests of Controls and Substantive Tests of Transactions would be: Specify acceptable risk of assessing control risk too low. Audit Sampling for Tests of Details of Balances Step 8: Estimate Misstatements in the Population This estimate is based on prior experience with the client, inherent risk, control risk, etc. Planned sample size increases as the amount of expected misstatements in the population increases. Step 8 for Tests of Controls and Substantive Tests of Transactions would be: Estimate the population exception rate. Audit Sampling for Tests of Details of Balances Step 9: Determine the Initial Sample Size Table 17-3 on page 525 summarizes the primary factors that influence sample size for nonstatistical sampling. Figure 17-2 on page 525 presents a table for computing sample size based on the AICPA Audit Sampling Auditing Guide. MUS uses a statistical formula illustrated on page 538. Audit Sampling for Tests of Details of Balances Step 10: Select the Sample For nonstatistical sampling, auditing standards permit the auditor to use any of the selection methods discussed in Chapter 15. MUS uses PPS sampling that allows the physical inclusion of an item more than once in the sample. Audit Sampling for Tests of Details of Balances Step 11: Perform the Audit Procedures Auditor applies the appropriate audit procedures to each item in the sample to determine whether it is correct or contains a misstatement. Audit Sampling for Tests of Details of Balances Step 12: Generalize from the Sample to the Population A common approach to is assume that misstatement in the population are proportional to misstatements in the sample. (See pages 526-527). For MUS, the process involves a four-step process. (See page 533-534). Auditor must consider that the true population misstatement may be larger due to sampling error. Audit Sampling for Tests of Details of Balances Step 13: Analyze the Misstatements The reason for the misstatement must be considered. It could be from an isolated error. However, it could have arisen from the consistent misapplication of accounting procedure. Such causes could represent a large effect on the financial statements. Step 13 for Tests of Controls and Substantive Tests of Transactions would be: Analyze the exceptions. Audit Sampling for Tests of Details of Balances Step 14: Decide the Acceptability of the Population With nonstatistical population the auditor uses judgment to decide if the potential misstatement in the population is greater than tolerable misstatement. MUS computes misstatement bounds that provide an objective evaluation. II. The 7 Steps of Monetary Unit Sampling Monetary unit sampling (MUS) is a statistical method of sampling that is also called dollar unit sampling, cumulative monetary amount sampling, and sampling with probability proportional to size. This section discusses the seven steps of MUS and the MUS decision rule. Note: The computation of the appropriate sample size for MUS is illustrated on page 538. Monetary Unit Sampling (MUS) Step 1: Determine misstatements for each sample item. CUST. No. RECORDED ITEM VALUE AUDITED ITEM VALUE MISSTATEMENT 2073 6,200 6,100 100 5111 12,910 12,000 910 5206 4,322 4,450 (128) 7642 23,000 22,995 5 9816 8,947 2,947 6,000 Monetary Unit Sampling (MUS) Step 2: Calculate misstatement per dollar unit in each sample item. CUST. No. RECORDED ITEM VALUE AUDITED ITEM VALUE MISSTATEMENT MISSTATEMENT / RECORDED ITEM VALUE 2073 6,200 6,100 100 .016 5111 12,910 12,000 910 .07 5206 4,322 4,450 (128) (.03) 7642 23,000 22,995 5 .0002 9816 8,947 2,947 6,000 .671 Monetary Unit Sampling (MUS) Step 3: Layer misstatements per dollar unit from highest to lowest, including the percent misstatement assumption for sample items not misstated. OVERSTATEMENTS RECORDED POPULATION VALUE MISSTATEMENT PERCENTAGE ASSUMPTION 0 1,200,000 1.0 * 1 1,200,000 .671 2 1,200,000 .07 3 1,200,000 .016 4 1,200,000 .0002 UNDERSTATEMENTS RECORDED POPULATION VALUE MISSTATEMENT PERCENTAGE ASSUMPTION 0 1,200,000 1.0 * 1 1,200,000 .03 * See Appropriate Percent of Misstatement Assumption on page 533. Monetary Unit Sampling (MUS) Step 4: Determine upper precision limit from attributes sampling table (Table 15-9 on page 470) and calculate the percent misstatement bound for each misstatement (layer). OVERSTATEMENTS RECORDED POPULATION VALUE MISSTATEMENT PERCENTAGE ASSUMPTION UPPER PRECISION LIMIT PORTION* 0 1,200,000 1.0 .030 1 1,200,000 .671 .017 2 1,200,000 .07 .015 3 1,200,000 .016 .014 4 1,200,000 .0002 .014 UNDERSTATEMENTS RECORDED POPULATION VALUE MISSTATEMENT PERCENTAGE ASSUMPTION UPPER PRECISION LIMIT PORTION* 0 1,200,000 1.0 .030 1 1,200,000 .03 .017 * ARIA OF 5%. Sample size of 100. Monetary Unit Sampling (MUS) Step 5: Calculate initial upper and lower misstatement bounds for each layer and total. OVERSTATEMENTS RECORDED POPULATION VALUE MISSTATEMENT PERCENTAGE ASSUMPTION UPPER PRECISION LIMIT PORTION MISSTATEMENT BOUND 0 1,200,000 1.0 .030 36,000 1 1,200,000 .671 .017 13,688 2 1,200,000 .07 .015 1,260 3 1,200,000 .016 .014 269 4 1,200,000 .0002 .014 3 .090 51,220 Totals UNDERSTATEMENTS RECORDED POPULATION VALUE MISSTATEMENT PERCENTAGE ASSUMPTION UPPER PRECISION LIMIT PORTION MISSTATEMENT BOUND 0 1,200,000 1.0 .030 36,000 1 1,200,000 .03 .017 612 .047 36,612 Totals Monetary Unit Sampling (MUS) Step 6: Calculate point estimate for overstatements and understatements. Sum of Unit Misstatement Assumptions X Sample Size Recorded Population Value Point Estimate = Overstatement Point Estimate: ( .671 +.07 +.016 + .0002 ) X 1,200,000 = 9,086 = 360 100 Understatement Point Estimate: .03 100 X 1,200,000 Monetary Unit Sampling (MUS) Step 7: Calculate adjusted upper and lower misstatement bounds. Most MUS users believe that the approach is overly conservative when there are offsetting amounts. The adjustment of bounds for offsetting amounts is made by reducing each bound by the opposite point estimate. Initial understatement bound Less overstatement point estimate Adjusted understatement bound 36,612 (9,086) 27,526 Initial overstatement bound Less understatement point estimate Adjusted overstatement bound 51,220 (360) 50,860 The MUS Decision Rule If both the lower misstatement bound (LMB) and upper misstatement bound (UMB) fall between the understatement and overstatement tolerable misstatement amounts, accept the conclusions that the book value is not misstated by a material amount. Otherwise, conclude that the book value is misstated by a material amount. Tolerable misstatement Tolerable misstatement ($40,000) $40,000 Reject ($27,526) ($50,860) LMB UMB III. Alternatives When a Population is Rejected A. Take No Action Until Tests of Other Audit Areas are Completed B. Perform Expanded Audit Tests in Specific Areas C. Increase the Sample Size D. Adjust the Account Balance E. Request the Client to Correct the Population F. Refuse to Give an Unqualified Opinion A. Take No Action Until Tests of Other Audit Areas are Completed Offsetting misstatements in other parts of the audit may make a balance acceptable. B. Perform Expanded Audit Tests in Specific Areas After a problem area is corrected, the remaining misstatements may be within an acceptable range. May be effective when errors are of a specific type. C. Increase the Sample Size When the auditor increases sample size, sampling error is reduced if the rate of misstatements in the expanded sample, their dollar amount, and their direction are similar to those in the original sample. This could satisfy the auditor’s tolerable misstatement requirements. May be helpful when initial sample is not representative of the population. D. Adjust the Account Balance When the auditor concludes that an account balance is materially misstated, the client may be willing to adjust the book value based on the sample results. Even when the client adjusts the book value the auditor must consider whether sampling error to exceed tolerable misstatement. Appropriate when client balance is misstated. E. Request the Client to Correct the Population When the client’s records are filled with significant misstatements, the auditor may request the client to correct the population before an effective audit process can begin. F. Refuse to Give an Unqualified Opinion If the auditor believes that there is a reasonable chance that the financial statements are materially misstated, it would be a serious breach of auditing standards to issue an unqualified opinion. The audit process must have some teeth in it! IV. ARACR and ARIA A lower control risk requires a lower acceptable risk of assessing control risk too low (ARACR). This requires a larger sample size for tests of controls. If tested controls are effective, the auditor can increase acceptable risk of incorrect acceptance (ARIA). This means that the auditor can use smaller sample sizes for tests of details of balances. Summary Steps of Audit Sampling for Tests of Details of Balances The Statistical Technique of Monetary Unit Sampling The Rejection of a Population ARACR and ARIA