Complaint Reviews - Financial Ombudsman Service

advertisement

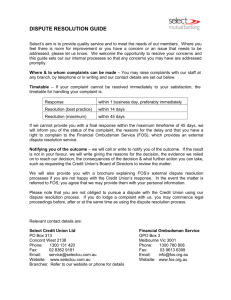

Debt Recovery Disputes A realistic alternative to the Courts Diana Ennis – Manager Dispute Resolution Discussion Points Terms of Reference Expedited dispute resolution process Dispute data Jurisdiction Hot topics: – – Preservation of assets Settlement agreements Case studies TOR paragraph 13.1 Legal proceedings and debt recovery action – The Circular Issue 3 www.fos.org.au/publications Defined as: “a proceeding commenced in a court by the FSP to obtain judgment for a debt, or for recovery of possession of an asset provided by a debtor or guarantor as security for a credit facility” While FOS is dealing with a Dispute lodged by an App the FSP must not instigate legal proceedings against the App relating to the subject of the Dispute (13.1(a)(i)) TOR paragraph 13.1 While FOS is dealing with a Dispute lodged the FSP must not pursue legal proceedings relating to debt recovery instituted before lodgement unless the Applicant has taken a step in those proceedings beyond lodging a defence or defence and counterclaim (13.1(a)(ii)) The FSP must not seek judgment in those proceedings TOR paragraph 13.1 A step beyond lodging a defence/defence & counterclaim includes App: - defending application for summary judgment - issuing notice for discovery or subpoenas - issuing application for further and better particulars of the claim - serving interrogatories - issuing a notice to produce A step beyond lodging a defence/defence & counterclaim does not include: - lodging an amended defence - directions hearing/consent orders of procedural nature TOR paragraph 13.1 While FOS is dealing with a Dispute lodged the FSP must not take action to recover a debt that is the subject of the dispute, to protect assets securing that debt or to assign any right to recover that debt (13.1(a)(iii)) This includes: - taking possession of secured property - appointing a Receiver & Manager - serving of demands or notices - collection calls - assigning the debt - making a credit listing TOR Paragraph 13.1 Two exceptions subject to FOS consent and terms: FSP may issue legal proceedings where the relevant limitation period will shortly expire (13.1(b)(i)) FSP may exercise any rights to freeze or preserve assets the subject of the Dispute (13.1(b)(ii)) TOR obligations FSP obligations arise out of membership contract and FOS Constitution (clause 3.7) FSP failure to comply with FOS requirements concerning legal proceedings and debt recovery action can result in: - serious misconduct reported to ASIC (11.3) - cancellation of FOS Membership - requirement that legal proceedings be discontinued at no cost to App Background December 2009, ASIC approved the FOS TOR subject to certain conditions, including: 1 Identify: 2 Expedite: 3 Dispute data: Early identification where debt recovery legal proceedings commenced Treat the dispute as urgent and expedite the dispute resolution process Provide data to ASIC for a review in July 2011 Criteria for LPPI Date and time of lodgement of dispute with FOS or other EDR scheme (if referred on from other EDR scheme) - 6.5 TOR Legal proceedings must be issued and filed in a Court prior to lodgement Default notices/letters of demand alone are not legal proceedings Legal proceedings must relate to the repayment of a debt which is the subject of dispute 1 Assessed upon lodgement of dispute: – – – Information provided by App relied upon Documentation or verbal information Online dispute form Onus on FSP to tell us not LPPI – – Identify You know, we don’t We will assume LPPI unless told otherwise We rely on you to provide: – – Relevant Court documentation Current status of proceedings 2 Expedite Initial IDR period (21/45 days) waived Registration • Internal Dispute Resolution Acceptance Case Management • Review • Negotiation • Conciliation • Investigation Outcome • Recommendation • Determination 2 Immediately progressed to Acceptance – Referral within 2 business days Prioritised over other disputes – – – Expedite Expedited referral to FSP and review of response Expedited allocation to compulsory TCC Expedited decision Only where shorter timeframes met by FSP Expedite 2 Upon initial referral of dispute FOS will request: – Relevant Court documentation: – Defence or defence and counterclaim Notice of discontinuance dated prior to lodgement of dispute Judgment (if applicable to demonstrate OTR) Interlocutory applications/documentation Documentation relevant to the issues raised by App including response to App Copies of prior settlement agreements /repayment arrangements important 2 This will not occur when: – – – Expedite Incomplete FSP response received FSP response not received within 14 days FSP requests extension of time to respond If de-expedited usual dispute resolution process timeframes apply TCC still compulsory LPPI $1,000 surcharge applies from Review status regardless of when or whether dispute deexpedited 2 $500 Expedite - LPPI costs Initial case management fee Expedited referral Payable even where no LPPI or OTR Cost if documented resolution within 14 days $1,000 LPPI surcharge Payable if progressed Applies to all LPPI disputes (expedited/deexpedited) at Review status $.... Usual case fee Determined at closure Depends on closure status and complexity level 2 Expedited disputes result in speedier outcomes 59% dealt with expeditiously – – – Expedite 56% resolved within 60 days 25% resolved between 60 - 90 days Overall resolution 81% within 90 days 41% LPPI disputes de-expedited – – – 16% resolved within 60 days 20% resolved between 60 - 90 days Overall resolution 36% within 90 days Expedite 2 Above 180 121 - 180 Days 91 - 120 61 - 90 31 - 60 < 30 De-expedited 0% Expedited No. of Days < 30 31 - 60 61 - 90 91 - 120 121 - 180 Above 180 5% 10% 15% 20% Expedited 23% 33% 25% 10% 6% 2% 25% 30% 35% De-expedited 4% 12% 20% 17% 27% 20% 2 Outcomes Facilitated negotiation prior to TCC – this is where FSPs need to focus Settlement agreement reached during/post TCC Where no resolution expedited to decision within 7 days Recommendation Ombudsman’s Case Conference 2 Expedited Determination (8.6) – – – Outcomes proceed to final decision where appropriate all parties to the dispute notified reasonable opportunity for parties to make submissions and exchange information Criteria to expedite – – – dispute involves financial difficulty issues only property securing debt may need to be sold App has not agreed to or taken any steps to repay outstanding debt 2 Expedite Compulsory TCC - 83% resolution rate in 2010 100% 90% 80% 70% 60% 50% Not resolved 40% Resolved 30% 20% 10% 0% Expedite - TCC outcomes 2 70% Conciliated outcomes: – repayment arrangements 61% – agreed sale timeframe 26% 60% 50% 40% 30% 20% 10% 0% Repayment arrangement / variation Timeframe for sale of asset or refinance debt APRA release Debt waiver Other Commercial Resolution Expedite 2 Expedited V De-expedited (%) 80% 70% 60% 50% 40% 30% 20% 10% 0% De-expedited Expedited 3 FOS has collated data on: – – – – – – Dispute Data LPPI disputes received Number of days dispute open Whether App is individual or small business OTR reason Nature of dispute Numbers of disputes expedited and de- expedited Quarterly reports provided to ASIC ASIC review post 30 June 2011 3 Dispute Data Volume Received 160 March 2011 141 per month 140 120 100 Feb 2010 61 per month 80 60 Growth of LPPI disputes 40 Increasing challenge for all to expedite 20 0 3 Dispute Data Open V Closed 160 140 120 100 80 60 40 20 0 Opened Closed 3 Dispute Data Closed: expedited V de-expedited 80 70 60 50 40 30 20 10 0 Expedited closed De-expedited closed 3 Dispute Data Who lodges disputes? Business Finance 93% Consumer Credit Guarantees Which products? – – 93% consumer credit products 6% business finance What is the nature of the dispute? – Majority Financial Difficulty (81%) 1% 6% 3 Dispute Data Within TOR 60% OTR Outcome 10% 40% 18% 61% Within TOR OTR Dealt with by Court More appropriate place Not a current FOS member Jurisdiction Where dispute assessed as within TOR documentation must be provided to show otherwise – – FSP written submission with reasons for why considered OTR App provided 30 days to object Misguided Terms of Reference submissions result in delays Common misconceptions to exclude: – – – A dispute which is lacking in merit is not necessarily frivolous or vexatious Complex factual and legal issues Eroding security – court timeframes apply equally where defended in court Preservation of Assets We recognise it may be necessary for FSP to preserve assets that are subject of dispute FSP to request in writing & provide supporting documentation explaining: – What action it wants to take – Why it is more likely than not asset will be lost or destroyed if consent not given – erosion of equity alone not generally sufficient Each application considered on individual merits Case study App small business which operated real estate agency. FSP entered into various facilities one of which was to assist in the purchase of rent roll FSP had fixed and floating charge over business (including rent roll), personal guarantees & mortgage over property Deficiency in trust fund relating to the rent roll, estate agents licence cancelled and guarantors bankrupt FOS dispute concerning financial difficulty lodged. Substantial arrears and App seeking time to refinance FSP provided full details of loans and current status, documentation about trust fund deficiency and documentation to show discussions had been held between App and third party about sale of rent roll FOS consented to appointment of Receiver & Manager on basis rent roll at risk of sale to third party. FOS did so on condition that R&M take no action to sell asset while FOS file open Case Study App lodged a dispute concerning financial difficulty in relation to a car loan which was in arrears. The car had been in the possession of a repairer for a year because App could not afford to pay for the repairs. FOS consented to the FSP taking possession of the car on the basis that the car not be sold while the FOS file remains open App lodged a dispute with FOS concerning financial difficulty in relation to a car loan. The car was insured and registered and in the possession of App’s mother who was his authorised representative. FSP said that loan was in arrears and App in jail. FSP requested consent to repossess the car on basis no repayment arrangement could be made while App in jail. FOS did not consent to repossession on the basis that the car was at no additional risk of loss or damage. Settlement agreements FOS will not generally consider a dispute which has previously been settled unless exceptional circumstances apply. This is because liability of FSP is discharged at law Exceptional circumstances may apply if agreement harsh or unconscionable, FSP induced/misled App to enter into agreement/App agreed to enter into settlement under duress (illegitimate pressure) Informing an App that an FSP intends to exercise its contractual rights if the agreement is not met is not in itself considered duress Each dispute assessed on a case by case basis. Settlement agreements Provide finality Bendigo and Adelaide Bank Limited v Tombs and Anor [2010] NSWSC 1427 at 40 Must reflect agreement between parties without addition Deal with consequences of non-compliance Deal with current legal proceedings: – Discontinue – Should not require consent to judgment Reflect resolution is in full and final settlement of FOS dispute Case study App lodged a dispute concerning financial difficulty and seeking time to sell security properties. App had been in financial difficulty for some time and negotiations had been entered into resulting in a Moratorium Deed being signed by the parties prior to lodgement of the FOS dispute The Deed set out the terms of settlement which included the following: - various payments to be made on specific dates - App acknowledgment that legal advice had been obtained by App prior to entering the deed/opportunity had been provided to obtain such advice - App acknowledgment that if he failed to make payments FSP entitled to enforce its rights in full in accordance with the T&Cs of securities FOS assessed the dispute as OTR by applying the general exclusion under 5.2 TOR on the basis that the dispute had previously been settled. Timely and cost effective resolution Ensure the dispute remains expedited: – – – Be commercial and flexible – – – Provide substantive responses Provide timely responses Increased chance of resolution within 90 days if expedited Exhaust opportunities to resolve - don’t wait for a TCC! Think creatively and laterally Approach dispute with fresh eyes Document settlement agreements Resolution Questions?