Seminar in International Risk Analysis and Management

advertisement

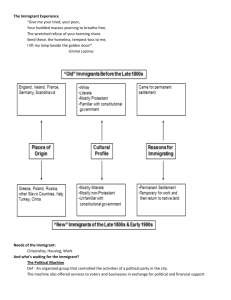

Seminar in International Risk Analysis and Management A. Introduction This course is designed to offer graduate students with better understanding of political risk, business risk. Grounded on the proposition that bad economics makes good politics, the more that condition prevails in a country, the greater is the magnitude of political risk. A standard definition of political risk is the possibility that political decisions or events in a country—usually a developing country—will affect the business climate in such a way that investors will lose money (and possibly their assets) or not make as much money as they expected when the investment was decided. The focus may be on the general political climate, specific political conditions or on specific political and social variables. The primary objective of political risk analysis is to forecast losses. A secondary objective that follows from the first is to suggest means of managing the risk or avoiding the loss. “Analysis” in this context is, more often than not, low tech and unpretentious. It typically involves, first and foremost, conceiving “risk” in terms of the political decisions, outcomes or events that can jeopardize the value or the operation of an investment overseas. What is usually missing is any discussion of the political arrangements that create incentives for political leaders to promote economic growth or to undermine the prospects for prosperity. 1. Organization Meeting: What is Risk? I. Financial Crisis and Global Systemic Risk 2. The Origin and Aggravation of 2007 Financial Crisis 3. Global Systemically Important Financial Institutions 4. Credit Rating Agency II. Risks Associated with International Investment 5. International Project Finance 6. Political Risk & Management III. The Political Economy of Political Risk 7. The Social Foundations of the Political Risk Environment 8. The Political Economy of Political Risk 9. Defining and Operationalizing Political Risk IV. Political Risk and Government Performance 10. Political Risk and the Performance of Government 11. Governance, Patronage and Political Risk 12. Political Risk and Government Instability V. Generating Information and Data 13. The Foundation of Political Risk: Quantified Judgment 14. Validating Alternative Risk Assessments 15. Country Risk and Creditworthiness 16. Sovereign Credit Ratings 17. Student Presentation 1 18. Student Presentation 2