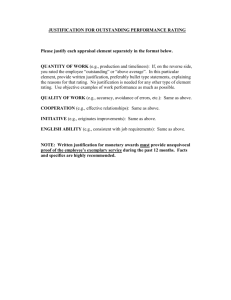

Social Security and Human Rights - Slides

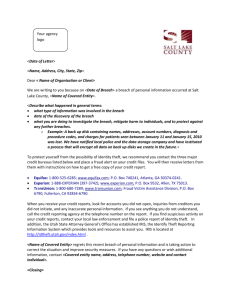

advertisement

HUMAN RIGHTS AND SOCIAL SECURITY: Highlights from the recent case law Zoë Leventhal Landmark Chambers 4th June 2015 Introduction • Wealth of relevant case law over past 18 mths, detail in paper Focus today on 3 main topics: 1) Art 14 discrimination & welfare reform • Benefit cap – SG & others v SSWP • “Bedroom tax” line of cases – MA, Rutherford, A, Hardy 2) Other key Art 14 cases to be aware of: AM, Langford, UT cases 3) Art 6 / A1P1 – the ongoing Reilly & Wilson saga Topic 1: Art 14 & welfare reform • 2 key sets of challenges to major welfare reform policies • Themes emerging: – – – – – Test is manifestly without reasonable foundation Very high threshold for socio-economic arena But…. there are limits Growing importance of international law to “illuminate” Court will scrutinise policy justification closely Benefit cap challenge: SG v SSWP • Six claimants: single mother and youngest child in 3 families due to be subject to the cap – by SC only SG remaining • Challenge to the Benefit Cap (Housing Benefit) Regulations 2012 setting “relevant amount” SG v SSWP (2) • By time of SC, challenge brought on 2 main grounds: – Indirect discrimination against lone parents = women contrary to Art 14/ A1P1 (and Art 8) – Breach of best interests duty under the UNCRC (originally as substantive breach of Art 8 but then as part of Art 14 justification) • The latter issue became determinative of the former in posthearing submissions SG v SSWP (3) • Challenge failed by a bare majority: 3/2 • Lords Reed and Hughes – no breach of Art 14/A1P1 and no breach of the UNCRC • Lady Hale and Lord Kerr – breach of both • Lord Carnwath – breach of the UNCRC (children’s rights) – but this did not translate into a breach of Art 14/A1P1 in terms of discrimination against women SG v SSWP (4): where does this leave us? • Difference in treatment not policy which must be justified • A bridge too far to use the UNCRC to alter / illuminate the ‘manifestly without reasonable foundation’ test on A1P1/14? • But NB: – CA found that benefit cap within ambit Art 8 (for Art 14) – That finding not appealed – Welcome clarity on ambit – applied in Hardy, Cotton since • Likely that further changes to the cap will prompt reformulated challenge MA and others v SSWP [2013] EWHC 2213 • Challenge by 10 disabled claimants to the so-called “bedroom tax” MA and others v SSWP [2014] EWCA Civ 13 • Housing Benefit (Amendment) Regulations 2012 reduced eligible rent for purposes of HB calculation • 14% if 1 spare bedroom, 25% where 2 + • 3 grounds: 1) Unlawful discrimination under Art 14/A1P1 2) Breach of the public sector equality duty (“PSED”) 3) Circular which prescribed HB maximums should have been in secondary legislation (this succeeded on narrow basis in Div Court) MA: Art 14/A1P1 arguments (2) • Arguments drew on Burnip v Birmingham CC & SSWP • In Burnip, measures found to have a “disparate adverse impact” (DH v Czech Republic) and/or failed to take account of differences between disabled claimants and able-bodied (Thlimmenos v Greece). • These arguments were “complementary and overlapping.” • No justification for the difference in treatment of that specific group MA: Art 14/A1P1 arguments (3) • As in Burnip, no issue on applicability of Art 14/A1P1 or status • Here, main arguments: – Indirect discrimination i.e. disproportionately prejudicial effect on the disabled; – Failure to take positive steps to accommodate the needs of disabled claimants. • By time of CA – focus on justification MA v SSWP: discrimination/justification (4) • Justification: test “manifestly without reasonable foundation” • Difference in treatment, not policy, which must be justified; • So : – SSWP entitled to take the view that impractical to exempt an imprecise class of persons i.e. those needing an extra bedroom by reason of disability (contrary to position in Burnip). – Reliance on Discretionary Housing Payment system to meet needs of disabled persons entirely rational – Policy not manifestly without reasonable foundation MA v SSWP (5) • Also rejected PSED challenge – SSWP had due regard • But NB Supreme Court granted PTA in Jan 2015 • 4 key subsequent cases grapple with the way in which DHPs can bridge the cap in practice: – Rutherford – Cotton – A v SSWP – Hardy Rutherford v SSWP • Child needing constant care from 2 people (grandparents) • Bedroom needed for carer for disabled child when grandparents could not cope • Shortfall in Housing Benefit was met by DHP from local authority • But this required annual renewal – argument was that discretionary nature of DHPs not adequate to justify discrimination in their cases Rutherford (2) • Stuart-Smith J (applying MA and Burnip) – DHPs enforceable: “The effect of Burnip and MA taken together is that, while a scheme including the use of DHPs as the conduit for payment may be justifiable, it will not be justified if it fails to provide suitable assurance of present and future payment in appropriate circumstances.” • But challenge therefore failed because in receipt of DHP to date • LA obliged to exercise its discretion rationally + in acc w HRA Cotton v SSWP • Bedroom tax impact on separated parents with shared care • C brought case on Art 8/A14 and Art 8 alone • Point was = C was in receipt of a DHP so no actual interference, only possibility + distress of future impact • Held: – Bedroom tax/HB within ambit/engaged Art 8 – SG in CA – No substantive breach = only truly exceptional – Art 14 justification – no definable category, DHPs justifiable and overall policy did not meet Stec test A v SSWP [2015] EWHC 159 (Admin) • C was a HB recipient whose council house adapted for security purposes because she was a victim of DV • But not exempted from bedroom tax so HB cut for 3 bed house • Argued that sex discrimination cont to Art 14/A1P1, breach of PSED and substantive breach of Art 8 A v SSWP (2) • Court held: – On Art 14/Art 8, although specific exemption not expressly considered, overall policy of using DHPs to plug the gap not manifestly without reasonable foundation – If DHPs not renewed then C could challenge that decision (applying Rutherford) – Rejected PSED challenge – not req’d to consider specifically – Art 8: applied Cotton, only truly exceptional, not the case here and would in any event be justified Hardy v SSWP • C succeeded on challenge to actual DHP award • Issue was whether LA entitled to treat DLA care component as part of his income for determining DHP level • Argued: – Failure to comply with DHP guidance – Disability discrimination contrary to Art 14 with 8/1P1 – PSED and breach of duty to make reasonable adjustments Hardy v SSWP (2) • Claimant succeeded on all grounds: – Policy not followed (council had misunderstood it) – Art 14 w/ A1P1: • Interesting discussion of whether a DHP (albeit discretionary) could be a possession for A1P1 purposes • Held appropriate to consider DHP in context of HB scheme as a whole and therefore A1P1 engaged – Art 8 also engaged, applying SG and Cotton – Discrimination not justified because DHP at appropriate level intended to plug the gap and here not doing Topic 2: other key Art 14 cases to be aware of… • CM v SSWP : – DLA to child u’16 in hospital, CA held policy not manifestly without reasonable foundation – SC pending on Art 14/8 ground. • Langford v SS for Defence: – Armed forces pension scheme – Qu whether C “prevented from marrying” long term partner despite being able to get a divorce from husband – Broad approach to status / personal characteristic – But “bright line” appropriate even if operates harshly Topic 2: other Art 14 cases • 2 recent decisions of Upper Tribunal: • TD v SSWP: – Rejection of Art 14/A1P1 challenge to HB shared care rule despite indirectly discriminating against men – Not manifestly without reasonable foundation • L v SSWP: – Support for mortage interest scheme – income support – Art 14/A1P1 challenge on grounds of disability failed on similar basis – adequate justification put forward 3) Reilly & Wilson v SSWP – the aftermath • Recent litigation in both Admin Ct and Upper Tribunal – interplay between Art 6, s 3 HRA and s 4 HRA • Brief reminder of SC proceedings • Challenge to JSA (Employment Skills and Enterprise Scheme) Regulations 2011 (“2011 Regs”) • Prescribed “work for your benefit schemes” for JSA and authorised imposition of sanctions for failure to participate (under 1995 Act) Supreme Court proceedings • SC upheld CA’s judgment that 2011 Regs invalid because failed to prescribe the scheme in adequate detail • Complicating factor by then: 2013 Regulations and Jobseekers (Back to Work Schemes) Act 2013 • Effect of those was to validate 2011 Regs retrospectively • Main issues before Supreme Court: A) vires of 2011 Regs (upheld) B) Lawfulness of notices served (even if valid) (upheld) C) “Prior information requirement” (upheld) C) Art 4 ECHR (rejected) Vires of 2011 Regulations: “John Citizen” • 2011 Regs were ultra vires: inadequate description • Importance/role of secondary legislation: “The Courts have no more important function than to ensure that the executive complies with the requirements of Parliament as expressed in a statute. Further, particularly where the statute concerned envisages regulations which will have a significant impact on the lives and livelihoods of many people, the importance of legal certainty and the impermissibility of sub-delegation are of crucial importance… “John Citizen” should not be “in complete ignorance of what rights over him and his property have been secretly conferred by the minister” as otherwise “[f]or practical purposes, the rule of law… breaks down because the aggrieve subject’s legal remedy is gravely impaired.” [47] Art 6/A1P1: the 2013 Act • 2013 Act introduced after CA and before SC • Retrospectively validated the 2011 Regs and specific flaws in notices identified by CA • Reilly No 2: challenge to Act as breach of Cs’ Art 6 rights and A1P1 rights because retrospectively removed benefit of CA (and then SC) judgment • Lang J upheld challenge and made a DoI on Art 6, A1P1 failed Lang J – Art 6 • Art 6 permitted retrospective legislation but where interferes with existing litigation must be justified by compelling public interest • Lang J took dim view of 2013 Act and financial justification i.e. cost to public purse of repaying sanctions to all • Arguably strayed into merits review of Parliamentary debates • CA to consider Art 6 appeal by SSWP and cross appeal on A1P1 in November 2015 Upper Tribunal – read down not a DoI? • Complicated further by parallel UT proceedings • Held that 2013 Act in fact does not affect vested appeal rights at all – statutory construction argument succeeded (by majority) • Further, that even if was retrospective, could be “read down” under s 3 HRA and no declaration of incompatibility necessary (not argued before Lang J) • CA will have to grapple with all issues - being heard together… Concluding thoughts • Justification still the main battle ground • SC has demonstrated difficulties of surmounting the “manifestly without reasonable foundation” test • But likely to be further developments on UNCRC etc, also in discretionary DHP decisions • Forthcoming decisions in MA and CM will shed further light • CA’s approach to Art 6 and s 3/4 will be interesting …