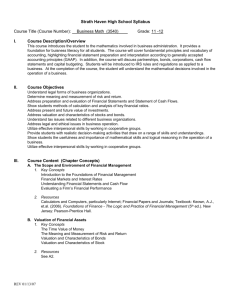

4274Fundamentals-Syllabus

advertisement

1 SEATTLE PACIFIC UNIVERSITY School of Business and Economics Problems in Corporate Finance BUS 4274, CRN 3499 Dr. Herbert Kierulff hkierulf@spu.edu Autumn Quarter, 2014 Tuesday-Thursday 12:50-2:50 Office: McKenna 215 Phone: 281-3523 Otto Miller Hall 126 Hours: TTh; 11:30-12:45 and by appointment Welcome to Autumn Quarter and BUS 4274. This class is one of two (BUS 4274 and 4275) dealing primarily with financial analysis and valuation. These two topics, along with Investments taught by Dr. Hess, represent the most challenging and essential finance areas to learn about in an academic setting. To make the learning most practical, Moss Adams (the 11th largest accounting firm in the U.S.) has given us a company to value—DEF Road Construction Corp. (the Case). The Case is real in every respect except that names and some places have been changed for confidentiality purposes. You will update the case in teams of 5 students in each team (no more, no less). We will use, among other sources, free databases from Business Valuation Resources LLC (BVR): http://www.bvmarketdata.com. These resources would cost over $5,000 per year if you had to pay for them as a non-student. BVR is internationally known as the 'go to' data and information source for appraisers, lawyers, accountants, educators, and other financial professionals who value public and private companies and other asset combinations. Over the last three years, we made a team competition out of the valuaton. Last year we added a national component and called it the Private Business Valuation Challenge℠. If you are selected as part of a team to compete in the national competition, I will work with you separately to develop your valuation for presentation in the competition. You will compete with teams from eight other universities on April 24-25, 2015 at the Columbia Tower Club in Seattle (an 2 exclusive business and social club located on the 75th floor of the Columbia Tower Building). You will get credit for having compeleted BUS 4275 at that time. Last year's team came in third in an intense competition. The team did us proud. Moss Adams valuation experts and others will judge the competition. For more information, go to our web site. Follow the Valuation Challenge on our blog in the web site. If your team is not selected, it will be automatically entered into the "2015 Valuation Challenge at SPU" in Spring 2015 assuming you continue on with BUS 4275. The best team presentation and valuation paper in the Spring class will win the SBE Award for Outstanding Performance in Valuation. COURSE OBJECTIVES AND OVERVIEW: The course’s general objectives are to improve your skills in: Doing short and long term financial planning and budgeting, strategic analysis and decision making under conditions of rapid change and uncertainty. Applying the fundamental and practical principles of valuation to pricing and to real investment opportunities. Gathering information, separating relevant from irrelevant factors, selecting and evaluating relevant options with regard to their consequences, and selecting and defending a course of action. Conceptualizing complex issues and reducing them to coherent written and oral statements. Integrating valuation and investment analysis with the other functional areas of business administration including business processes and information technology. 3 Working effectively within group settings; demonstrating friendship, civility, respect, servant leadership, and community. Integrating as appropriate the practical lessons of Christian spirituality including ethics, faith, values, and personal integrity. The course builds upon and applies tools, concepts and methodologies learned in the prerequisites for this class, but we will stick to the fundamentals of theory. The course is first and foremost a course in evaluation and application of theory rather than the introduction and examination of theory. This case based course requires you work in teams because cases discussed in teams seem to be among the best vehicles for learning. Recent research into learning reveals that most people retain: 10% of what they read 20% of what they hear 30% of what they see 50% of what they both see and hear 70% of what is discussed with other people 80% of what they personally experience 90% of what they teach to someone else Working in teams on cases places you in the 80-90% category, 90% to the extent that you learn the material and relate your knowledge to others in your team. The specific objectives of the course are for you to develop an understanding of each of the following five areas and be able to apply the tools and concepts associated with each to real business situations: I. Financial Statements and Budgets A. What they mean and how they interrelate B. Key business and financial ratios C. Concepts: required, expected, actual, cost-benefit, risk-reward 4 D. Analysis: trends, comparables, and rules of thumb; specific risk factors, the 5 C’s of credit and fatal flaws; sensitivity analysis, scenario analysis. II. Operating and capital budgeting. III. Methods of valuing A. Asset: what you can do it for (buy the components or build yourself) B. Market (comparables): what somebody else is selling / buying it for C. Income (intrinsic value): expected future net benefits 1. In terms of time: payback period, discounted payback 2. In percentage terms: ROE, ROA, ROSE, ROTC, IRR and MIRR. 3. In currency: present value, net present value IV. Discounting to present value A. Certainty equivalents B. Best estimate free cash flows V. Doing macroeconomic and industry studies relevant to a company TEXTS AND READINGS: You may obtain the Harvard cases and other material for this course at a 50% discount or free by following this course link: https://cb.hbsp.harvard.edu/cbmp/access/27980507 You must register with Harvard Business School Press to gain access. All the other assignment materials are free including BVR, Zenwealth, and the blackboard materials. The value of Zenwealth is that it has helpful practice problems with answers. You are urged to do as many of these problems as you need to feel confortable with the subject matter. However, be careful with the formulas supplied by Zenwealth author. They tend to be involved and unnecessary for this course. The subject matter of all the materials is then to be applied to Harvard Business School cases, cases that are real situations, and to the exams. I will take some exam questions from Zenwealth. 5 If you feel you need a corporate finance text, free ones (with advertising) are available at bookboon.com. Select “Textbooks” from their home page and look in “Economics and Finance” or "Business" and "Accounting and Finance" in the search box. The most popular textbook in finance is Brealey, Myers & Allen Principles of Corporate Finance. I recommend the 10th Edition because it covers all the issues we need for this class and is less expensive than later editions. It has problems at the end of each chapter, and I put the answers on blackboard. I have included relevant chapters to read each week in the Course Outline below. If you need a quick review of accounting principles, get familiar with www.AccountingCoach.com. The site features some materials we will cover in class and provides sample quizzes. PREREQUISITES AND ATTENDANCE: It is assumed that you have had the appropriate prerequisites for this course or their authorized equivalents, and retain an understanding of the fundamentals of finance. However, we will review in some detail the theory underlying all of the applications in this course. It is important that you attend all classes. ASSIGNMENTS: Harvard Case Analyses. The first day of class, I will ask you to form study groups of five people. You choose the participants in your team. Each study group will prepare responses to the case questions in this syllabus during class (and afterward, if necessary) and will email each question set to hkierulf@spu.edu and marksabo@financial-horizons.biz on or before midnight on the following Sunday. That way, I will have an idea of how well the class understands the case prior to the next time we meet. My answers to the case questions will be available on blackboard by midnight on Sunday. I will be available during class as your consultant while you work on the cases. After class, I can be reached by phone, e-mail, or special appointment. My reason for assigning the questions at the end of this syllabus is to give you some guidance and 6 organization in approaching each case. Only a few grade points are assigned to the cases because the reason for the cases is to help prepare you for the exams that do count heavily. Two or three paragraphs are generally sufficient to answer each question. Often a spreadsheet or number will do it, but you should show your calculations and defend them by enumerating your assumptions. Your team’s case lowest grade during the quarter will be dropped. However, you must do and turn in the last case in the class. Each of you should analyze the differences between my answers to the case questions and your team’s answers. You should be sure that by changing your assumptions and fixing any errors, you come up with the same spreadsheet answers I did. Because there often are no right answers to many of the issues in a case you are encouraged to submit your disagreements knowing that I will welcome (and reward) reasoned arguments based upon your experience and logic. If you don’t go back and correct your mistakes or misunderstandings you lose a great deal of learning that can be valuable on the next exam and in later business. The case analysis questions are graded very leniently. I don’t expect you to have all the “right” answers, if there are such answers. I do expect a good effort which clearly indicates that the team members have (1) studied—not just read—the case; (2) discussed it; (3) recommended decisions where appropriate; (4) backed up recommendations with reasoned arguments and (5) made a serious attempt to run the numbers if appropriate (i.e., applied the quantitative tools of financial analysis and valuation). This latter point (5) is very important. Quiz: A quiz on every other Tuesday (with the exception of 10/9) will cover one or more of the following: previous exam, readings, lectures, and case(s) from the last exam, and/or current day’s (Tuesday) readings and case. Since the course builds upon itself, a quiz may relate to concepts discussed in classes prior to the previous two weeks. A question about the current case will be designed to determine that you have read and studied the case before coming to class and are prepared to discuss it with your team. A current case question will not be technically difficult since you will not be expected to know the tools and 7 concepts to be learned in that case. The quiz will be emailed to you in class. You take the quiz during the announced quiz period (approximately 30 minutes) and email it to hkierulf@spu.edu. and marksabo@financialhorizons.biz. Please be sure to save your exam and put your last name on the exam icon before you email the exam. The exam idea is to keep you current in this class because many of these cases and learning opportunities build on past material. There is no final exam. Presentations will be made during finals time. If you cannot take an exam due to illness or family emergency I will need to know beforehand by phone or email. I will give you the average of your other grades in that case. I may require a note from a doctor or minister. If you are away from campus, you can still take the exam since I will email it to the class. You have one such opportunity. In studying for the quizzes, it is helpful to prepare reference sheets. These may be hand written or typed on 8 ½” X 11” paper. These reference sheets are useful because their preparation helps you learn and organize the information both visually and tactilely. (You learn by writing things down). Also, you will not have to memorize as much. For these reasons, you may bring one hard-copy reference sheet written on both sides to each quiz. Your laptop should have enough memory to last through the quiz period. The only thing showing on your computer should be the quiz unless I specify otherwise. I will email answers to you. You should review your exam and analyze the differences between my answers and yours. Individual participation grade determined by team members. At the end of the course each of you will have up to 400 points for a five-person team. Evaluate your team members on the basis of the quality of their participation in the analysis of cases and company analysis. You may give more or less than 100 points to another team member, but the total points you give cannot exceed 400 points. The numbers for each of your team member’s participation should be included on Exam 8. If you elect not to put individual participation numbers on that exam, I will assume that you awarded each of your other team members 100 points. 8 The scores for each team member will be averaged and multiplied by the person's average exam grade to get the individual participation grade. For example, if a person averages 95 on the exams and averages 100% on individual participation, the participation grade will be 95. If the individual points are 110, the participation grade will be 104.5. The Case Analysis. Each team will prepare an Executive Summary consisting of a one to three-page analysis of the economy as it applies to the Case, a three to five page analysis of the industry as it applies to the Case, and a seven to ten page analysis of the Case company itself along with the update to the year of valuation of Exhibits 1-7. Use the Valuation Executive Summary http://www.bvchallenge.org/fundamentals/ (under Course Materials) as a general guideline with the understanding that you must pick and choose the most important areas to work with. You may add as many appendixes as you like to the analysis. The Executive Summary should include recommendations to management based upon your evaluation—for example, do the ratios compared with the past and the RMA averages suggest action to be taken by management? (RMA refers to the Risk Management Associates Annual Statement Studies that I will provide.) The economic analysis can, in part, be taken directly from BVR’s Economic Outlook. Just provide a summary of what they have using quotation marks where you quote directly. Your analysis of the expected effect on DEF should be included in the one to three-page economic report and in the industry analysis. Remember to be careful about using information in economic reports gathered after the valuation date because those would not have been available at the time of the valuation and may be challenged. Double space all written work and use 14 point Cambria (or similar) font on a Word document. Do not submit a pdf document. Use tables, charts, and other displays when they will make your point clearer or more concise. Use The Everyday Writer as your resource. For your references, use the American Psychological Association guidelines provided in The Everyday Writer or other APA source. Please follow these instructions fully to optimize your grade on the paper. Papers not using APA and not following other requirements will lose points. 9 Please turn your papers in as attachments to an email. Do not submit hard copy documents. I will review your papers, make comments, and email them back to you. Presentations of the Case Each team will have 20 minutes to present its findings followed by 10 minutes for Q&A. The evaluation form for the presentation may be found at the end of this syllabus. GRADES AND GRADING Each exam, case, and paper will be given a number which corresponds to the following letter grades: A=94-100; A-=90-93; B+=87-89; B=84-86; B-=80-83; C+=77-79; and so on. Grades will be weighted as follows: Case questions (lowest case grade dropped) percent Exams Team participation grade Team economic and industry report Team presentation 10 percent 55 10 15 10 Extra credit for evaluating the course: two points added to your exam grades. If everyone evaluates the course and sends me an email with the Registrar's receipt of the evaluation, I will send out the papers and grades early. In the past, some students have inadvertently violated SPU standards of scholarship, particularly the rules on plagiarism. You are encouraged to review the standards published in the SPU Catalog and The Everyday Writer for guidance on this subject. Here are four tips for success in this course: (1) be present and take excellent notes, (2) study the cases thoroughly before class time, (3) use the problem sets to enhance your understanding, and (4) read this syllabus carefully with particular emphasis on the objectives of the course. To ensure your privacy, your graded exams will be returned to you by email. 10 PRELIMINARY COURSE OUTLINE Date 9-30 Topic Assignment Introduction to the Syllabus in blackboard course Valuation Factors (Website: Valuation Fundamentals) http://www.bvchallenge.org Review of Financial Statements and Ratio Analysis 10-2 Financial Statement Example (Website) Case Analysis http://www.zenwealth.com/BusinessFinanceOn line/RA/RatioAnalysis.html. Read during class and after. Do problems in these Zenwealth presentations as you need, but don’t hand in. Case Analysis Cartwright Lumber Company (Case Question 1) Cartwright Spreadsheet (remember that most of our cases have spreadsheets for your use) Cartwright Lumber Company (Case question 1) Financial Statements Ratio Analysis http://www.zenwealth.com/BusinessFinanceOnl ine/FCF/FCFEquations.html. Read prior to class, do problems, but don’t hand in. Note that working capital should include only operating working capital. Risk Management Association (RMA) Annual Statement Studies. Review in class. Review the Economic Outlook Update in www.BVLibrary.com. Use this in your team industry study. Financial Statement Analysis (Website) Do in class Financial Ratio Analysis (in blackboard). Read if you believe you need extra information on ratios. 11 10-7 Case Analysis Iteration and Solver Forecasting and Industry Analysis Taking purchase discounts 10-9 The 5 C’s of Credit Case Analysis Library Resources for Industry Studies BMA (Brealey, Meyers, Allen) Ch. 28 Cartwright Lumber (Case questions 2-5) Financial Statement Analysis (Cont.) http://www.zenwealth.com/BusinessFinanceO nline/FF/FinancialForecasting.html Prior to class, read Percentage of Sales Method only. Subscribe to BVWire Weekly E-Newsletter. It’s free. Link: http://www.bvresources.com/ BMA Ch. 29 Exam 1 Cartwright Lumber (Case questions 2-5) Guest Lecture HBS Case Note on Bank Loans 10-14 10-16 Case Analysis BMA Ch. 30 Radio One (Case questions 1 & 2) Methods of Valuation Valuation Methods (Website). We will discuss in class. Case Analysis BMA Ch. 2, 3.1, 3.5, 3.6 Radio One (Case questions 1 & 2) Transaction Multiples Market Method basic (Website) Pratts Stats and Public Stats are available from left-hand column of www.BVMarketData.com. Do in class. Read FAQs for Pratt’s Stats. How to Use Transactional Databases for Private Company Valuations: A Primer (A 2013 12 Update), BVR Free Resources and Podcasts 10-21 Case Analysis BMA Ch. 4 Exam 2 Using PitchBook Monmouth, Inc. (Case questions 1 & 2) Cash Flow, Net Present Value & Investment Criteria Free Cash Flow (Website). Discuss in class PitchBook (Guideline Public Co. Comps Tool), left-hand column: www.BVMarketData.com. Do in class. Read PitchBook FAQs in BVR. 10-23 Case Analysis Guest lecture 10-28 Case Analysis Cash Flow, Net Present Value & Investment Criteria Behavioral Finance BMA Ch. 31 Monmouth, Inc. (Case questions 1 & 2) http://www.zenwealth.com/BusinessFinanceOnl ine/FCF/FinCashFlow.html Note that Zenwealth uses actual taxes, not tax before interest. Our approach is slightly different. BMA Ch. 32 Free Cash Flow (Website). Discuss in class Three Problems (in blackboard). The Replacement Decision: Getting it Right (in blackboard). This shows you how to do Problem Two of the Three Problems http://www.zenwealth.com/BusinessFinanceOnl ine/CB/CapitalBudgeting.html Valuation Methods (Website) Free Cash Flow (Website) 13 Present Value & Terminal Value (Website) 10-30 Case Analysis Investment Strategy 11-4 Case Analysis BMA Ch. 5 Three Problems. Present Value & Terminal Value (Website) BMA Ch 6 Exam 3 Stryker Corp. Doing NPV Better Investment Analysis and Lockheed Tri Star (Read the Lockheed Case before class, but do not turn in). Do not do the case questions in the case itself. We will discuss in class. NPV: Doing it better (Website) 11-6 Case Analysis Course Materials on Cost of Capital (Website): pp. 1-4 Stryker Corp. http://www.zenwealth.com/BusinessFinanceO nline/BV/BondValuation.html Component costs of capital 11-11 Case Analysis WACC-CAPM-APV (Website) BMA Ch. 7 Radio One (Question 3) http://www.zenwealth.com/BusinessFinanceOnl ine/SV/StockValuation.html Beta Course Materials on Cost of Capital (Website): pp. 5-8 WACC-CAPM-APV (Website) 14 11-13 Case Analysis BMA Ch. 8 Monmouth, Inc. (Questions 3 & 4) http://www.zenwealth.com/BusinessFinanceOnl ine/RR/RiskAndReturn.html Note that there are several obvious errors in Zenwealth Risk and Return. They should not detract from the learning. Beta and Levering Course Materials on Cost of Capital (Website): pp. 8-end Estate of Gallagher vs. Commissioner. http://www.bvresources.com/freedownloads/ EstateofGallagher.pdf pp. 1-22 WACC-CAPM-APV (Website) 11-18 Case Analysis BMA Ch. 9 Exam 4 Midland Energy Resources WACC-CAPM-APV (Website) Estate of Gallagher vs. Commissioner. http://www.bvresources.com/freedownloads/ EstateofGallagher.pdf pp. 23-42 11-20 11-25 11-27 Case Analysis BMA Chs. 13, 19-4 Midland Energy Resources Case Analysis Valuation Basics (Website) Valuation Basics (Website) Guest Lecture THANKSGIVING HOLIDAY NO CLASS BMA Ch. 14 15 12-2 Guest Lecture Exam 5 12-4 12-9 Presentations Presentations 10:30 – 12:30 Otto Miller 126 Presentations: Teams 1-3 Presentations: Teams 4-6 FINAL PAPER DUE Team Economic, Industry and Business Study due by class time: 10:30—email it to me. CASE QUESTIONS CARTWRIGHT LUMBER COMPANY 1. Is this company healthy? A. Construct common size statements for the years 2001 through 2003 based upon sales for the income statement and balance sheet and total assets for the balance sheet. B. Do a ratio analysis using the basic ratios shown in the Cartwright Spreadsheet available on blackboard. C. Analyze the income statement and balance sheet from 2001 through 2003 explaining what they tell you, but not making specific recommendations at this time. (When depreciation is not shown separately in these cases, you may assume it is included in the cost of goods sold (cost of sales) and operating expenses.) 2. Do you agree with Mr. Cartwright’s estimate of the company's loan requirements? How much will he need to borrow to finance his expected expansion in sales? Assume a 2004 sales volume to be that mentioned in the case, that there were no purchase discounts for the period January 1 to December 31, 2004 and beyond, and that the relationships between sales and those income and balance sheet line items that vary with sales will be the same in 2004 as in 2003. Ignore the data in the case for the first quarter of 2004 in answering this question. 3. Does it make sense for Mr. Cartwright to take the purchase discounts if he can? How will this affect his cash requirements for 2004? What would the income statement and balance sheet look like if he took the discounts for the entire 2004 year? 16 4. Why would Mr. Cartwright have to borrow money to support this business? After all, he's making a profit and has been doing so for many years. 5. What would you recommend to Mr. Cartwright? To the banker? Use the 5 C’s of credit in your recommendation to the banker. RADIO ONE 1. Why does Radio One want to acquire the 21 stations? What are the benefits and risks? 2. What price should Radio One offer for the 21 stations based upon a transaction and trading multiples analysis? 3. What price should Radio One offer for the 21 new stations using the income method? You can make the following assumptions: a. Corporate expenses will be 2% of BCF for the new acquisitions. b. The tax rate is 34%. c. You may use Exh. 7to estimate working capital. Assume that the required cash is 3 % of Net Broadcast Revenue outlined in Exh 6 for 1999. Apply your working capital ratio to Net Revenue (Potential New Markets in Exh. 9) to obtain working capital for future years. d. Depreciate capital expenditures on a straight-line basis over five years. e. Assume that Net Revenue and EBITDA both grow at a 10 percent rate after 2004, but slow to 4% after 2015. f. Assume that the local marketing arrangement fees part of BCF are negligible. g. Assume Rm-Rf, the market risk premium, is 5%. Besides these assumptions, here are some hints: 17 1. Be very sure you know how BCF is calculated. 2. Be very careful what you include in working capital. Remember our definition. 3. Income taxes payable in the balance sheet are very high in 1999 probably because of the rapid growth in 1999. I would replace the $1.532 million with $300,000 to get a better long-term working capital ratio. The deferred income taxes may have had to do with the acquisitions, so they may disappear in the future. MONMOUTH, INC. 1. If you were Mr. Vincent, executive vice president of Monmouth, Inc., would you try to gain control of Robertson Tool in May 2003? 2. What is the stand-alone value of Robertson Tool based on EBIAT and Price/Earnings multiples analysis (Exhibit 6) using the market method? What is Robertson's value combined with Monmouth assuming Monmouth realizes the COGS and operating cost savings possible with Robertson? Assume taxes at 40.9%. 3. What is the stand-alone value of Robertson based upon a discounted cash flow valuation? Assume a debt beta of 0. Then, assume a debt beta of 0.2 and compare the results with those you got with a debt beta of 0. What is the value combined with Monmouth assuming the cost savings? 4. Why is Simmons eager to sell its position to Monmouth for $50 per share? What are the concerns of and alternatives for each of the other groups of Robertson shareholders? Assume a future debt to total capital ratio of 29%, and that the Robertson’s working capital to sales ratio will drop to 40%. Use the Harris-Pringle beta formulas. Assume debt cost at 5.5% pre-tax. Assume the "Other" current liabilities in Exhibit 2 are interest bearing. STRYKER CORP. 18 1. Use the projections provided in the case to compute incremental cash flows for the PCB project, as well as its NPV, IRR, and payback period. Calculate MIRR assuming a reinvestment rate of 15%. Note that architectural and engineering fees are tax deductible as expenses. Assume no capital gains or losses when the assets are valued at the end of 2009. 2. Based on your analyses, would you recommend that Stryker Instruments fund this project? 3. Assume that the cash flows came in the middle of the year but the terminal value came at the end of year 6. How would this affect the NPV? Nothing else changes. INVESTMENT ANALYSIS AND LOCKHEED TRI STAR 1. We will discuss in class. Study the Lockheed case before coming to class but do not prepare a written analysis. We'll analyze the case in class. MIDLAND COST OF CAPITAL 1. How are Mortensen’s estimates of Midland’s cost of capital used? How, if at all, should these anticipated uses affect the calculations? 2. Calculate Midland’s corporate WACC. Be prepared to defend your specific assumptions about the various inputs to the calculations. Is Midland’s choice of cost of equity (Ke) appropriate? Is the choice of EMRP appropriate? If not, what recommendations would you make and why? 3. Should Midland use a single corporate hurdle rate for evaluating investment opportunities in all of its divisions? Why or why not? 4. Compute separate costs of capital for the E&P and Marketing & Refining divisions. What causes them to differ from one another? OTHER IMPORTANT INFORMATION 19 Disability Statement. In accordance with Section 504 of the Rehabilitation Act of 1973 and the Americans with Disabilities Act of 1990, students with specific disabilities that qualify for academic accommodations should contact Disabled Student Services (DSS) in the Center for Learning. DSS in turn will send a Disability Verification Letter to the course instructor indicating what accommodations have been approved. Academic Integrity. The current edition of the SPU Undergraduate Catalog describes the University’s commitment to academic integrity, which is breached by academic dishonesty of various kinds. Among these is turning in another’s work as your own and committing plagiarism, which is the copying of portions of another’s words from a published or electronic source without acknowledgement of that source. The penalty for a breach of academic integrity is a failing grade for the work in question on the first offense and a failing grade for the course as a whole with repeated offenses. Emergency procedure: Note the emergency procedures posted in the classroom and note the emergency exits. In case of an emergency (fire, earthquake, hazardous material spillage, bomb threat, etc.), the class will evacuate the building and gather in the Nickerson parking lot next to McKenna Hall. If conditions make it impossible to meet there, meet at the Ross parking lot at the corner of 3rd Avenue W. and W. Cremona Street just north of First Free Methodist Church. Please try to stay together so that we can check that everyone has made it safely out of the building. Set up a “buddy” system in this class in case we have a campus emergency. Your buddies will be the members of your case study team. A reminder that when we do have a lockdown drill we are expected to lock the room doors, close the blinds, turn off the lights, get down on the floor and remain quiet. Inclement Weather: The University maintains an Emergency Closure Hotline (206-281-2800). In the event of inclement weather or an emergency that might close the university, please call the Hotline for the most up-to-date closure information or check the SPU website. Both will be updated before 6:00 a.m. Information on evening classes, events, and athletic games will also be updated. PRESENTATION EVALUATION 20 Student Name(s) or Team Number (in order of presentation): _______________________________________________________________ Rating: E – excellent; G – good; A – average (needs improvement); F – fair; P – poor CONTENT: How well does the presentation cover these content areas? Economic outlook Industry study Company study E G A F P E G A F P E G A F P PRESENTATION: How effective is the presentation? Has attention getter in the introduction Demonstrates genuine enthusiasm for the work Establishes rapport with audience Organization is clear, logical and structured Visual aids clarify and emphasize main points Varies voice with volume, pitch, tone Eye contact effective Presents as professional, courteous and authentic Transitions supporting and smooth Conclusion gives sense of closure Presentation stays within time limits. E G E G E G E G E G E G E G E G E G E G Yes Comments: Please use the back of this page if needed. Your participation is appreciated. Emergency Response Information A F A F A F A F A F A F A F A F A F A F No P P P P P P P P P P 21 Report an Emergency or Suspicious Activity Call the Office of Safety & Security (OSS) at 206-281-2922 to report an emergency or suspicious activity. SPU Security Officers are trained first responders and will immediately be dispatched to your location. If needed, the OSS Dispatcher will contact local fire/police with the exact address of the location of the emergency. Lockdown / Shelter in Place – General Guidance The University will lock down in response to threats of violence such as a bank robbery or armed intruder on campus. You can assume that all remaining classes and events will be temporarily suspended until the incident is over. Lockdown notifications are sent using the SPU-Alert System as text messages (to people who have provided their cell phone numbers as described below), emails, announcements by Building Emergency Coordinators (BECs), announcements over the outdoor public address system, and electronic reader board messages. If you are in a building at the time of a lockdown: Stay inside unless the building you are in is affected. If it is affected, you should evacuate. Move to a securable area (such as an office or classroom) and lock the doors. Close the window coverings then move away from the windows and get low on the floor. Remain in your secure area until further direction or the all clear is given (this notification will be sent via the SPU-Alert System). If you are unable to enter a building because of a lockdown: Leave the area and seek safe shelter off campus. Remaining in the area of the threat may expose you to further danger. Return to campus after the all clear is given (this notification will be sent via the SPU-Alert System) Evacuation – General Guidance Students should evacuate a building if the fire alarm sounds or if a faculty member, a staff member, or the SPU-Alert System instructs building occupants to evacuate. In the event of an evacuation, gather your personal belongings quickly and proceed to the nearest exit. Most classrooms contain a wall plaque 22 or poster on or next to the classroom door showing the evacuation route and the assembly site for the building. Do not use the elevator. Once you have evacuated the building, proceed to the nearest evacuation location. The “Stop. Think. Act.” booklet attached to each classroom podium contains a list of evacuation sites for each building. Check in with your instructor or a BEC (they will be easily recognizable by their bright orange vests). During emergencies, give the BEC your full cooperation whenever they issue directions. They will be the first line of contact during an actual emergency and cooperation with them should be immediate and complete. The primary evacuation area for Otto Miller is the Alumni Lot. The secondary area is the Ross Parking Lot. SPU-Alert System The SPU-Alert System provides free notification by email and text message during an emergency. Text messaging has proven to be the quickest way to receive an alert about a campus emergency. To receive a text message, update your information through the Banner Information System on the web, https://www.spu.edu/banweb/. Select the Personal Menu then choose the Emergency Alert System. Contact the CIS Help Desk if you have questions concerning entering your personal contact information into the Banner Information System. Additional Information Additional information about emergency preparedness can be found on the SPU web page at http://www.spu.edu/info/emergency/index.asp or by calling the Office of Safety & Security at 206-281-2922.