Pablo Fernancez (2013) If you cannot see this message clearly

advertisement

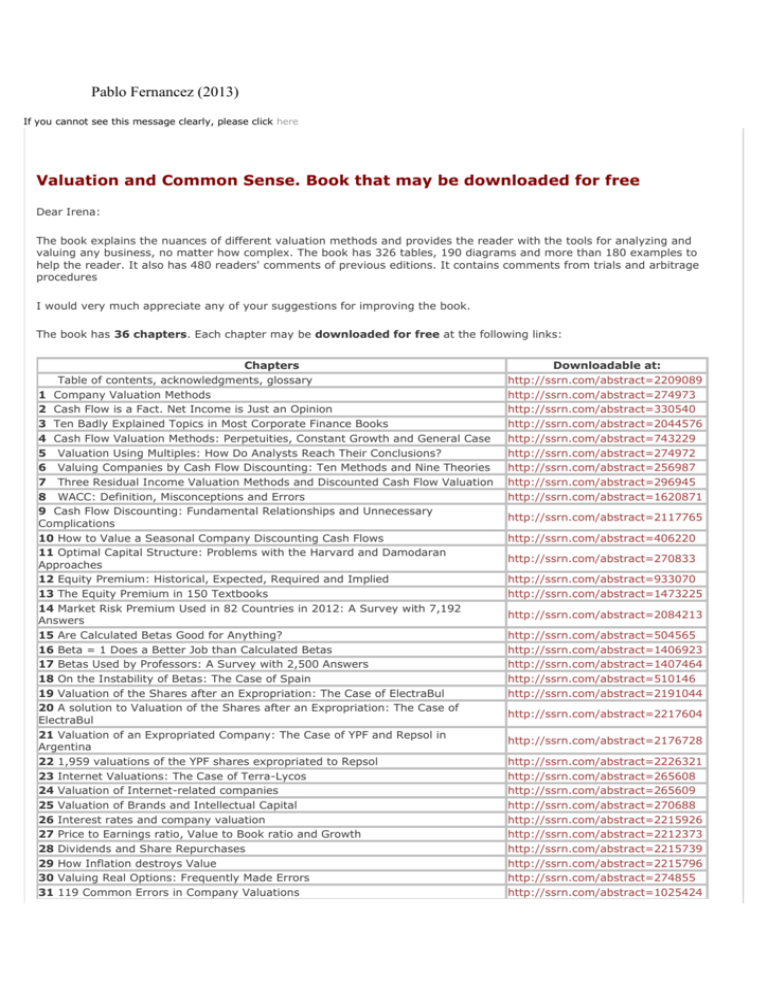

Pablo Fernancez (2013) If you cannot see this message clearly, please click here Valuation and Common Sense. Book that may be downloaded for free Dear Irena: The book explains the nuances of different valuation methods and provides the reader with the tools for analyzing and valuing any business, no matter how complex. The book has 326 tables, 190 diagrams and more than 180 examples to help the reader. It also has 480 readers' comments of previous editions. It contains comments from trials and arbitrage procedures I would very much appreciate any of your suggestions for improving the book. The book has 36 chapters. Each chapter may be downloaded for free at the following links: Chapters Table of contents, acknowledgments, glossary 1 Company Valuation Methods 2 Cash Flow is a Fact. Net Income is Just an Opinion 3 Ten Badly Explained Topics in Most Corporate Finance Books 4 Cash Flow Valuation Methods: Perpetuities, Constant Growth and General Case 5 Valuation Using Multiples: How Do Analysts Reach Their Conclusions? 6 Valuing Companies by Cash Flow Discounting: Ten Methods and Nine Theories 7 Three Residual Income Valuation Methods and Discounted Cash Flow Valuation 8 WACC: Definition, Misconceptions and Errors 9 Cash Flow Discounting: Fundamental Relationships and Unnecessary Complications 10 How to Value a Seasonal Company Discounting Cash Flows 11 Optimal Capital Structure: Problems with the Harvard and Damodaran Approaches 12 Equity Premium: Historical, Expected, Required and Implied 13 The Equity Premium in 150 Textbooks 14 Market Risk Premium Used in 82 Countries in 2012: A Survey with 7,192 Answers 15 Are Calculated Betas Good for Anything? 16 Beta = 1 Does a Better Job than Calculated Betas 17 Betas Used by Professors: A Survey with 2,500 Answers 18 On the Instability of Betas: The Case of Spain 19 Valuation of the Shares after an Expropriation: The Case of ElectraBul 20 A solution to Valuation of the Shares after an Expropriation: The Case of ElectraBul 21 Valuation of an Expropriated Company: The Case of YPF and Repsol in Argentina 22 1,959 valuations of the YPF shares expropriated to Repsol 23 Internet Valuations: The Case of Terra-Lycos 24 Valuation of Internet-related companies 25 Valuation of Brands and Intellectual Capital 26 Interest rates and company valuation 27 Price to Earnings ratio, Value to Book ratio and Growth 28 Dividends and Share Repurchases 29 How Inflation destroys Value 30 Valuing Real Options: Frequently Made Errors 31 119 Common Errors in Company Valuations Downloadable at: http://ssrn.com/abstract=2209089 http://ssrn.com/abstract=274973 http://ssrn.com/abstract=330540 http://ssrn.com/abstract=2044576 http://ssrn.com/abstract=743229 http://ssrn.com/abstract=274972 http://ssrn.com/abstract=256987 http://ssrn.com/abstract=296945 http://ssrn.com/abstract=1620871 http://ssrn.com/abstract=2117765 http://ssrn.com/abstract=406220 http://ssrn.com/abstract=270833 http://ssrn.com/abstract=933070 http://ssrn.com/abstract=1473225 http://ssrn.com/abstract=2084213 http://ssrn.com/abstract=504565 http://ssrn.com/abstract=1406923 http://ssrn.com/abstract=1407464 http://ssrn.com/abstract=510146 http://ssrn.com/abstract=2191044 http://ssrn.com/abstract=2217604 http://ssrn.com/abstract=2176728 http://ssrn.com/abstract=2226321 http://ssrn.com/abstract=265608 http://ssrn.com/abstract=265609 http://ssrn.com/abstract=270688 http://ssrn.com/abstract=2215926 http://ssrn.com/abstract=2212373 http://ssrn.com/abstract=2215739 http://ssrn.com/abstract=2215796 http://ssrn.com/abstract=274855 http://ssrn.com/abstract=1025424 32 33 34 35 36 Shareholder Value Creation: A Definition Shareholder value creators in the S&P 500: 1991 – 2010 EVA and Cash value added do NOT measure shareholder value creation Several shareholder returns. All-period returns and all-shareholders return 339 questions on valuation and finance http://ssrn.com/abstract=268129 http://ssrn.com/abstract=1759353 http://ssrn.com/abstract=270799 http://ssrn.com/abstract=2358444 http://ssrn.com/abstract=2357432 Tables (with all calculations) and figures are available in excel format here. Best regards, Pablo Fernandez, Professor of Finance, IESE Business School, Madrid, Spain Ph.D. in Business Economics, Harvard Universiy fernandezpa@iese.edu and pfernandez@iese.edu In compliance with the Personal Data Protection Act, we inform you that the personal information obtained and derived from your relationship with IESE is confidential and will be kept in our files in order to help us manage said relationship, as well as to deliver information to you about the activities carried out at IESE or its associated academic entities, including by electronic transmission means. If you do not wish to receive our correspondence and to exercise your rights of access, rectification, cancellation and opposition, you may write to IESE University of Navarra, Professor Assistants, Camino del Cerro del Águila, 3 (Ctra. de Castilla, km. 5,180) 28023 Madrid, Spain, or you can email pfernandez@iese.edu © IESE Business School - University of Navarra Barcelona (+34) 93 253 42 00 Madrid (+34) 91 211 30 00 www.iese.edu Munich (+49) 89 24 20 97 90 New York (+1) 646 346 8850