Sinusoidal Regression Project

Sinusoidal Regression Project

Ann Tulley and Sam Bansil (Period 6)

For our project, we chose to analyze the sinusoidal relationship that exists within the stock market. We were especially fascinated by the Dow Average in the 1970s. Charles Johnson, president of a mutual-fund-firm, stated that no new money was going into mutual funds, “that meant in order to buy something you had to sell something else”. Similar to many other stock market indices, the Dow undertakes intervals of mainstream increase and stagnation. We decided to focus on the seventies because it was a period of high unemployment rates and thus economic hardships, as few people were willing to invest in stocks. A sinusoidal curve in the stock market is caused by the changing interest rates and the supply and demand, which will rise or fall to adjust to the inflation.

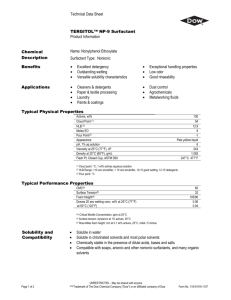

1200

Modeled DOW Averages

1000

800

600

400

200

0

0 5 10

Years (1970=1)

15

Model

1200

Historical DOW Averages

1000

800

600

400

200

0

0 5 10

Years (1970=1)

15

Raw Data

Mathematical Findings for the Modeled Trendline of DOW Averages

Equation of Trendline:

Maximum:

Minimum:

Period:

Amplitude:

Midline: y=97.380*sin(1.577x+2.244)+894.479

1072.77

748.91

3.984/approximately 4 years

97.380

910.84

In any stock market move, whether it is upward or downward, there is a significant difference in supply and demand. When there is a juxtaposition between these two groups, the prices in the market alter, the greater the disparity between supply and demand, the more significant the move will be. Thus, there are more buyers/sellers of companies in the stock market than sellers/buyers, causing the price of companies to go up/down along with the overall market.

This creates the sinusoidal curve, as demonstrated in the above graphs. It appears that the DOW

Average peaks around every 4 years, which is represented by the period of the function for the model. The increase is about 97.380 over its historical average, as indicated by the amplitude. The highest the average was in the 1970s demonstrated to be approximately 1072.77, which is also known as the “maximum” of the sinusoidal regression. According to the midline of the graph, the overall average DOW in the 1970s is about 910.84.

As we attempted to model the average DOW of the 1970s decade, we noticed a few values that had caused the graph to not be a “perfect” sinusoidal regression. One example is the year of

1978 (which is shown as year 9 on the table), when the DOW was 790. This value is significantly lower to the model DOW year, which is 829.61.Thus, our imitation of a modeled version of the averages shows a slight difference, as seen when comparing the table values. The DOW average for each year in the modeled version is higher than in the actual historical representation. Overall, the curve we found modeled the data of the historical sinusoidal curve quite well and was much closer than we hypothesized.

Web References: http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:cycle_lines http://online.wsj.com/article/SB124001598168631027.html

http://www.investopedia.com/terms/s/sinewave.asp

http://www.investopedia.com/articles/economics/09/1970s-great-inflation.asp

http://economics.about.com/od/useconomichistory/a/stagflation.htm

http://en.wikipedia.org/wiki/1973

–1974_stock_market_crash