Lecture 22

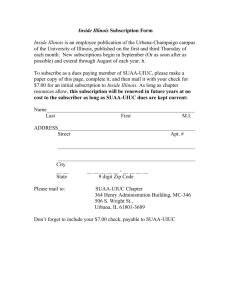

advertisement

Finance 341 Insurance Regulation Lessons from Illinois Overview • Historical Development – Insurance Regulation – Industry Structure – Antitrust Legislation • • • • Insurance Regulation in Illinois Analysis of the Illinois Auto Experience Generalization to Other Lines Conclusion History of Insurance Regulation - 1 • Objectives – Protection of the Public – Taxation • Regulation by Legislation – Charters – Financial disclosure requirements • Statutory Reporting Requirements – Massachusetts 1807 – New York 1827 • Taxation of Insurers – Massachusetts stamp tax 1785 – New York premium tax 1824 – Differential premium taxes 1827 Why Were States Regulating Insurance? • Commerce Clause of the U. S. Constitution “Congress shall have the power ... to regulate commerce ... among the several states” – Limits power of states to regulate interstate business • Paul v. Virginia 1869 – Insurance is not interstate commerce • Insurance contracts are not commerce • Policies do not take effect until delivered, so not interstate in nature – States could regulate (and tax) insurance Early Structure of the Property Insurance Industry • Primarily Fire Insurance • Adverse Effects of Competition • Rating Associations – Local – National Board of Fire Underwriters 1866 • Catastrophic Fires – – – – New York City 1835 Chicago 1871 Boston 1872 San Francisco 1906 • Insurance Bankruptcies History of Insurance Regulation - 2 • Response to “Ruinous Competition” – Merritt Committee 1910 – National Convention of Insurance Commissioners 1914 • Rating Laws Allowed Joint Ratemaking Federal Antitrust Legislation • Sherman Act 1890 – Section 1 - restraint of trade, including joint pricing – Section 2 - monopoly • Clayton Act 1914 – Strengthened Sherman Act with specific provisions – Banned price discrimination (with many exceptions) • Federal Trade Commission Act 1914 • Robinson-Patman Act 1936 – – – – Amended Clayton Act Strong restrictions on price discrimination Required justification for any price differentials Goal to protect small stores from lower prices of chain stores Watershed in Insurance Regulation • Southeastern Underwriters Association Case 1944 – – – – Regional rating bureau with restrictions on rates Legal actions began in 1922 Settlement provided payments to state officials Result challenged by Missouri Attorney General, joined by U. S. Department of Justice – U. S. Supreme Court ruled insurance was commerce • McCarran-Ferguson Act 1945 – States could continue to regulate insurance – Federal antitrust laws would be superceded by state regulation (except boycott, coercion and intimidation) – No federal law applies to insurance unless specifically stated in legislation Insurance Rate Regulation Post-SEUA • All states adopted rate regulatory laws to supercede federal antitrust laws – – – – – – State made rates Mandatory bureau rates Prior approval File-and-use Use-and-file Open competition • Rates are not to be inadequate, excessive or unfairly discriminatory Illinois Rate Regulation • • • • Adopted Prior Approval law 1947 Enacted Open Competition Law effective 1970 Open Competition Law expired in August 1971 Illinois has no rate regulatory law for most lines of business Illinois Statistics • Population 12,419,293 as of 4/1/2000 Fifth largest state • Size – 55,593 sq. mi. (25th largest) • Urban Population - 84.6% • Per capita income $31,278 (8th) How Is Illinois Faring without Auto Insurance Rate Regulation? • • • • • • • Loss ratio - Less variable Rate levels - Less variable Number of insurers - Highest in nation Premium levels - Lower than comparable areas Uninsured drivers - Lower Residual market size - Lower Cost of regulation - Lower Conclusion No need to regulate auto insurance rates Figure 2 Percent of Automobiles in Residual Market 5 Percent 4 3 Illinois National 2 1 0 1994 1995 1996 1997 1998 Figure 3 Standard Deviation Versus Loss Ratio Annual Statement Page 14 Data (1980-1998) 0.14 0.12 Standard Deviation 0.1 0.08 0.06 0.04 0.02 0 0.6 0.62 0.64 0.66 0.68 0.7 Loss Ratio 0.72 0.74 0.76 0.78 0.8 Figure 4 Standard Deviation Versus Loss Ratio Fast Track Quarterly Data (1990-2000) 0.35 0.3 Standard Deviation 0.25 0.2 0.15 0.1 0.05 0 0.7 0.75 0.8 Loss Ratio 0.85 0.9 Figure 5 Company 1 Year End Rate Levels (12/31/89=1.000) 1.5 CA CO CT FL GA IL 1.25 KY Rate Level MA MI MN MO NJ 1 NC OH OR PA SC TX VI 0.75 1989 1990 1991 1992 1993 1994 Year 1995 1996 1997 1998 1999 WI Insurance Department Budgets as Percent of Premium Volume Selected States 1999 0.25% 0.20% 0.15% 0.10% 0.05% 0.00% California Illinois Massachusetts New Jersey South Carolina Countryw ide Insurance Industry Shift • Auto Insurance is the primary line of business – Not subject to same risk of catastrophe – Rating information needs reduced • More competitive environment • Fire risk controlled – Building codes – Advances in fire protection • New catastrophe risks – – – – Hurricane Earthquake Flood Terrorism Generalization to Other Lines • Rate regulation is not needed for any line of business with competitive markets and minimal catastrophe risk • Regulation could be beneficial for particular lines that are not competitive – Title insurance • Regulation could be beneficial for coverages exposed to catastrophe risk to prevent insolvencies – – – – Hurricanes Earthquake Flood Terrorism