Today's Lecture - #16 Insurance Regulation

advertisement

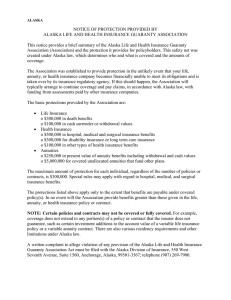

Today’s Lecture - #26 Insurance Regulation Introduction to Insurance Regulation Rationale History What Regulation Involves State vs. Federal Regulation Insurance Insolvency Current Problems with Insurance Regulation Insurance companies are one of the most heavily regulated industries. What is the most important reason to regulate insurers? A) B) C) D) E) To prevent deceptive sales practices To make sure they stay solvent To make sure they don’t set rates too high To make sure they don’t discriminate unfairly Some other reason Why Regulate Insurance? Market Power Imperfect Information Public Policy Advance Nature of Contract Insurer gets your money before fulfilling the contract Brief History of Insurance Regulation Paul v Virginia - 1869 US v Southeast Underwriters Association (SEUA) - 1944 McCarran Ferguson Act - 1946 You be the Supreme Court Judge How would you rule in the SEUA case? A) Uphold Paul v. Virginia: Insurance is not commerce B) Overrule Paul v. Virginia: Insurance is commerce and subject to Federal laws C) Compromise: Insurance is commerce but should not be subject to Federal laws What is Regulated Licensing Requirements Solvency Investments Reserves Guaranty Funds Policy Forms Rates Trade Practices Rate Regulation General Requirements Rates must be adequate, not excessive and not unfairly discriminatory Methods Prior approval File and use Open competition Classification issues What type of rating law applies in Illinois for automobile insurance? A) B) C) D) E) Prior approval File and use Open competition No rating law applies None of the above Regulation of Trade Practices Agents must be licensed Prohibited activities for agents Twisting Rebating Allowed in Florida and California Effect of agents’ interests Claim practices Underwriting practices General Advice If you are having a problem with an insurance company (billing, claims, unjustified cancellation, unfair treatment), contact the insurance department in the state where you live. In Illinois, contact: Illinois Division of Insurance 320 West Washington Street Springfield, IL 62767 217-782-4515 1-866-445-5364 (toll free) or online at: http://www.idfpr.com/DOI/Complaints/Complaints.asp State vs. Federal Regulation States Currently Regulate Insurance Only Major Industry Regulated at State Level Why? Tradition Paul v. Virginia US v. SEUA - during W.W.II Led to McCarran-Ferguson Act Recent Proposals Repeal of McCarran-Ferguson Act Would lead to Federal regulation instead of state or Dual regulation State regulation of small insurers Federal regulation of major insurers Claimed Advantages of State Regulation Have Current Knowledge Recognizes Local Conditions Encourages Experimentation Effects of Mistakes are Localized Claimed Advantages of Federal Regulation Uniformity Could get the best regulators Would be able to deal with large, multinational insurers Federal Government in Action on Insurance Related Issues Social Security Bankrupt by 2040 or earlier Political environment prevents informed discussions and solutions Federal Savings and Loans Insurance Corporation (FSLIC) 1934-1989 Inadequate regulation Political pressure to keep insolvent S&Ls open Taxpayer cost of about $200 billion Federal Government in Action on Insurance Related Issues - Cont. Pension Benefit Guaranty Corporation (PBGC) 12/31/04 financial position: negative $23.5 billion United Airlines termination in May, 2005: $9 billion Covered defined benefit pension plans Underfunded by $600 billion (termination basis) National Flood Insurance Program Expected cost from Katrina and Rita $22 billion Need to borrow from Federal government Cannot repay these loans from future premium income What Happens When Your Insurer Goes Insolvent State guaranty funds apply Limits on coverage Deductible on premium refunds Delays in payment Types of Guaranty Funds New York Pre-assessment fund 1982 Legislature “appropriated” $87 million Recently found illegal and forced to return funds All Other States Post-assessment basis Longer delays Limits on assessments Lessons from Executive Life and Mutual Benefit Executive Life Taken over by California regulators in April, 1991 Company was sold Policyholders received 70-80% of their benefits Mutual Benefit Taken over by New Jersey regulators in July, 1991 Withdrawals restricted until 1999 Significant penalties applied to withdrawals Credited interest rates lowered below contract level Basic Lessons If a company is too big, then regulators will intervene and re-write the contracts rather than declare insolvency. Current Problem Areas in Insurance Complex product Insolvencies Rising costs of liability insurance Lack of availability of property coverage in coastal areas Irresponsible regulation California - Proposition 103 New Jersey - Residual Auto Market ($3 billion in debt) Current Problem Areas in Insurance Crooked regulators – Louisiana Sherman Bernard - Commissioner 1972-1988 Convicted of taking payoffs – sentenced to 41 months in prison Douglas Green - Commissioner 1988-91 Convicted of fraud, money laundering and bribery - served 12 years in federal prison Jim Brown – Commissioner 1991-2002 Convicted of lying to the FBI – sentenced to 6 months in prison Conclusions Insurance does need to be regulated Current regulation is excessive and misdirected Focus of regulation should be on solvency Challenges presented by new financial instruments Understanding derivatives Dealing with international transactions Hedging interest rate and similar risks Expanding use of modeling Need for competent, ethical regulators