price_controls (new window)

advertisement

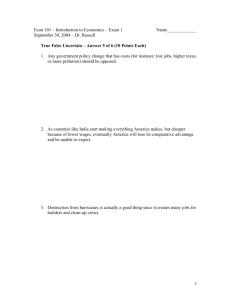

PRICE CEILINGS AND PRICE FLOORS ECO 2023 Principles of Microeconomics Dr. McCaleb Price Ceilings and Price Floors 1 TOPIC OUTLINE I. Price Ceilings II. Price Floors Price Ceilings and Price Floors 2 Price Ceilings Price Ceilings and Price Floors 3 PRICE CEILINGS Price Ceiling Definition A maximum legal price for a good, service, or activity. A price ceiling that is set below the equilibrium price is a source of inefficiency in the market, resulting in a deadweight loss from underproduction. A price ceiling set above the equilibrium has no effect on the market. Except for temporary aberrations, the market price would not rise above the equilibrium even without the price ceiling. Price Ceilings and Price Floors 4 PRICE CEILINGS Example: Rent Controls Rent controls are a form of price ceiling Rent controls are government regulations that make it illegal to charge more than a specified rent for housing. All price ceilings have similar effects, but because there is a long history of rent control in New York City and also a shorter history in some other localities, especially in California, we have lots of experience with rent control. That makes rent control particularly useful for illustrating the effects of price ceilings. Price Ceilings and Price Floors 5 PRICE CEILINGS Efficiency in the Rental Housing Market In a free market, the demand for and supply of housing determine the equilibrium rent of $550 a month and the equilibrium quantity of 4,000 units of rental housing. Price Ceilings and Price Floors 6 PRICE CEILINGS Efficiency in the Rental Housing Market In a free market with no rent controls, the equilibrium quantity of rental housing is efficient. The marginal benefit of rental housing at the equilibrium quantity equals its marginal cost. The sum of consumer and producer surplus is maximized. Price Ceilings and Price Floors 7 PRICE CEILINGS Rent Controls Create a Rental Housing Shortage Suppose a rent ceiling of $400 a month is imposed. At the rent ceiling . . . • the quantity of rental housing supplied is 3,000 units. • the quantity of rental housing demanded is 6,000 units. • there is a shortage of 3,000 rental housing units. Price Ceilings and Price Floors 8 PRICE CEILINGS Inefficiency of Rent Controls A rent ceiling limits the quantity supplied below the efficient quantity. There is underproduction of rental housing. Marginal benefit at the rentcontrolled quantity exceeds marginal cost. Consumer surplus (green area) and producer surplus (blue area) are both smaller than in the free market equilibrium. Price Ceilings and Price Floors 9 PRICE CEILINGS Inefficiency of Rent Controls The reduction in consumer and producer surplus is a deadweight loss. What happens to the surplus below the marginal benefit at the rentcontrolled quantity and the rentcontrolled price? You might think it is a gain to consumers. But in fact it may simply be wasted in excess search costs. Price Ceilings and Price Floors 10 PRICE CEILINGS Inefficiency of Rent Controls Because of the shortage of rental housing, consumers may use up any gains in • wasteful search activity • bribes, side payments, and other legal or illegal payments to secure housing • evasion of the law. Even though the price is lower, the opportunity cost of housing may actually be higher than in a free market without rent controls. Price Ceilings and Price Floors 11 Use statements I and II to answer the question. I. Rent controls result in underproduction of rental housing. II. With rent controls, the sum of consumer and producer surplus is less than at the free market equilibrium. 1. Both I and II are true. 2. Both I and II are false. 3. I is true; II is false. 4. I is false; II is true. Price Ceilings and Price Floors 12 Use statements I and II to answer the question. I. Rent controls result in a shortage of rental housing and wasteful search activity to find and obtain rental housing. II. The true opportunity cost of rental housing may be higher with rent controls than in an uncontrolled free market even though the price is lower. 1. Both I and II are true. 2. Both I and II are false. 3. I is true; II is false. 4. I is false; II is true. Price Ceilings and Price Floors 13 PRICE CEILINGS Example: Rent Controls Effects of rent controls on rental housing markets In addition to increasing the costs to consumers of finding rental housing, rent controls have three other major effects on the rental housing market. • Decline in the quality of rental housing • Decrease in the quantity of rental housing • Inefficient use of rental housing space Price Ceilings and Price Floors 14 PRICE CEILINGS Example: Rent Controls Decline in quality of rental housing The rent ceiling prevents rents from increasing to cover cost increases. Therefore, landlords have an incentive to limit cost increases by reducing maintenance and renovation expenses. Because of the rent ceiling, landlords who invest in maintenance and renovation are often unable to obtain a reasonable return on their investment. The result is a deterioration of rental housing, often ultimately leading to abandonment. Price Ceilings and Price Floors 15 PRICE CEILINGS Example: Rent Controls Decrease in the quantity of rental housing Over time, the quantity of rental housing decreases because of • conversion of existing rental housing to other uses—for example, commercial rental property, condominiums, and cooperatives. • withdrawal of rental housing units from the market • absence of new construction to replace existing rental housing as it wears out or to increase the rental housing stock to keep pace with increases in demand. Price Ceilings and Price Floors 16 PRICE CEILINGS Example: Rent Controls Inefficient use of housing space Landlords are often permitted to raise rents when a housing unit is vacated and re-rented. Therefore, tenants have incentives not to move. Turnover of rental housing is low even when it would be efficient for tenants to move to larger or smaller units. This results in inefficient use of rental housing space, called housing gridlock. Rental housing is not occupied by people who value it the most. Older singles and childless couples continue to occupy large housing units. Younger families with children are relegated to smaller housing units. Price Ceilings and Price Floors 17 PRICE CEILINGS Example: Rent Controls Who gains from rent controls? Consumers who obtain rent-controlled housing units and who don’t move gain (provided they don’t exhaust the additional consumer surplus in search costs or side payments). These are most likely to be people who • • • • are older, more established, longer-term, less transient are middle and upper income with good credit are better connected with better access to market information possess skills valued by landlords Price Ceilings and Price Floors 18 PRICE CEILINGS Example: Rent Controls Who loses from rent controls? Landlords, of course, but also consumers who are unable to find the quality and quantity of rental housing they desire and for which they are willing to pay. These are most likely to be people who • are younger, newer to the community, more transient • have lower incomes with no or poor credit • lack connections and do not have access to good market information • have families, especially larger families. Price Ceilings and Price Floors 19 PRICE CEILINGS Example: Rent Controls Other losers from rent controls Individuals who choose not to live in the community because of the shortage of rental housing, the high search costs, and the inferior quality of rental housing. Taxpayers, who bear the cost of enforcing rental housing ordinances. In the long run, even people in rent-controlled apartments may lose if they pay a lower price for housing of inferior quality that is either larger or smaller than they really desire. Price Ceilings and Price Floors 20 Which of the following is NOT a likely effect of rent controls ? 1. The quality of rental housing deteriorates 2. The quantity of rental housing declines. 3. Rental housing space is used inefficiently. 4. Rental housing is more available and affordable for low income people. Price Ceilings and Price Floors 21 Which of the following is most likely to be better off with rent controls than in an unregulated free market? 1. A young, middle income couple with 3 children who recently moved to New York City. 2. A single professional person working in New York who wanted to live near work but settled for living in (egad!) New Jersey. 3. A poor single mother who often has to move because of poor credit and inability to pay rent on time. 4. An older, upper income couple living in the same rentcontrolled apartment for the last 25 years. Price Ceilings and Price Floors 22 Price Floors Price Ceilings and Price Floors 23 Is This an Effective Anti-Poverty Program? 25%-50% of the people targeted by the program do not live in poor households. More than half the people who do live in poor households do not benefit from the program. Even among people in poor households who benefit from the program, the benefits are insufficient to lift them out of poverty. The program pushes some poor people further into poverty. Price Ceilings and Price Floors 24 PRICE FLOORS Price Floor Definition A minimum legal price for a good, service, or activity. A price floor that is set above the equilibrium price is a source of inefficiency in the market, resulting in a deadweight loss. A price floor set below the equilibrium has no effect on the market. Except for temporary aberrations, the market price would not fall below the equilibrium even without the price floor. Price Ceilings and Price Floors 25 PRICE FLOORS Example 1: Minimum Wage A minimum wage is a price floor A minimum wage (also referred to now as a “living wage”) establishes a minimum legal price that employers must be to hire labor. Minimum wages are the best-known and perhaps most common examples of price floors. Price Ceilings and Price Floors 26 PRICE FLOORS Efficiency in the Labor Market In a free market, the demand for and supply of fast-food servers determine the equilibrium wage of $5.00 an hour and the equilibrium quantity of 5,000 servers. Price Ceilings and Price Floors 27 PRICE FLOORS Efficiency in the Labor Market In a free market, the equilibrium quantity of employment is efficient. The marginal benefit of labor to employers equals the workers’ marginal cost to work. The sum of employers’ (consumer) surplus and workers’ (producer) surplus is maximized. Price Ceilings and Price Floors 28 PRICE FLOORS A Minimum Wage Creates Unemployment Suppose a minimum wage of $7 an hour is imposed. At the minimum wage . . . • the quantity of labor demanded is 3,000 workers. • the quantity of labor supplied is 7,000. • there is an excess supply of labor, or unemployment, of 4,000. Price Ceilings and Price Floors 29 PRICE FLOORS A Minimum Wage Is Inefficient A minimum wage limits the quantity demanded below the efficient quantity. Employers’ marginal benefit of labor exceeds workers’ marginal cost. Employers’ surplus (green area) and workers’ surplus (blue area) are both smaller than in the free market. Price Ceilings and Price Floors 30 PRICE FLOORS A Minimum Wage Is Inefficient The minimum wage gives rise to a deadweight loss in the labor market. Because of unemployment and the shortage of jobs, it is difficult for minimum-wage workers to find jobs and they waste resources in unproductive search activity. Price Ceilings and Price Floors 31 PRICE FLOORS Example 1: Minimum Wage Who gains from a minimum wage? Workers who succeed in obtaining as many hours of employment as they want to work at the higher minimum wage. They earn more than without the minimum wage. Higher wage workers, often unionized, for whom low-wage, unskilled workers are substitutes. By raising the wage that employers must pay for the lower-wage, unskilled workers, the minimum wage makes those workers less competitive with the higher wage workers. Price Ceilings and Price Floors 32 PRICE FLOORS Example 1: Minimum Wage Who loses from the minimum wage? Employers, of course. Low-wage, unskilled workers who are unable to find work or whose whose hours of work are limited because of the minimum wage. Even workers who initially find jobs at the minimum wage may lose if they use up all of their wage gains searching for a job. All low-wage, unskilled workers may lose in the long run if employers substitute capital for labor because of the higher minimum wage. Price Ceilings and Price Floors 33 A minimum wage _____ the quantity demanded of labor by employers and ___ the quantity supplied of labor by workers. 1. Increases; increases 2. Increases; decreases 3. Decreases; increases 4. Decreases; decreases Price Ceilings and Price Floors 34 True (T) or false (F): A minimum wage benefits all low-wage workers by raising their incomes. Price Ceilings and Price Floors 35 PRICE FLOORS Example 2: Agricultural Price Supports Agricultural price supports are an example of a price floor Government establishes minimum prices or price floors for many agricultural products. Unlike the minimum wage, government does not make it illegal to buy or sell below the price floor. Instead, government provides an incentive to farmers not to sell below the price floor. Government does this by agreeing to buy any amount that farmers want to sell at the price floor. In other words, government “supports” the price floor by being a buyer of last resort. Price Ceilings and Price Floors 36 PRICE FLOORS How a Price Support Works With no price support, the equilibrium price is $25 and the equilibrium quantity is 25 million tons. At a support price of $35, QD is 20 million tons and QS is 30 million tons. There is a surplus of 10 million tons. To prevent the price from falling below $35, government buys up the surplus. The amount of the resulting subsidy to farmers is shown by the pink rectangle. Price Ceilings and Price Floors 37 PRICE FLOORS Inefficiency of Price Supports The competitive market equilibrium quantity, 25 million tons, is efficient. But with the price support, QS=30 million tons. The market with a price support is inefficient because of overproduction, which results in a deadweight loss shown by the gray triangle. Price Ceilings and Price Floors 38 Use statements I and II to answer this question. (I). Agricultural price supports result in surpluses which must be purchased by the government. (II). Agricultural price supports increase economic efficiency by guaranteeing farmers a market for their products. 1. Both I and II are true. 2. Both I and II are false. 3. I is true; II is false. 4. I is false: II is true. Price Ceilings and Price Floors 39 PRICE FLOORS Minimum Wage Disemployment effect and earnings effect Disemployment effect The loss in total earnings due to the reduction in employment caused by the higher minimum wage. Earnings effect The gain in total earnings due to the increased wage paid to workers who are employed at the higher minimum wage. Price Ceilings and Price Floors 40 APPLICATIONS: PRICE FLOORS Disemployment Effect With a minimum wage of $7.00 an hour, employment falls to 3,000 workers. The disemployment effect (the green area) is the loss in earnings from the reduction in employment. Wage rate (dollars per hour) The equilibrium wage rate is $5.00 an hour and the equilibrium level of employment is 5,000 workers. 12 10 S 8 Minimum wage 6 4 2 0 0 1 2 3 4 It is equal to the decrease in employment times the equilibrium wage. D Disemployment effect 5 6 7 8 9 10 Quantity (thousands (thousands of of workers) workers) Price Ceilings and Price Floors 41 APPLICATIONS: PRICE FLOORS Earnings Effect With a minimum wage of $7.00 an hour, the 3,000 workers who are employed earn $7.00 an hour instead of $5.00 an hour. The earnings effect (the blue area) is the increase in earnings from the higher wage. It is equal to the increase in the wage times the number of hours employed at the higher minimum wage. Wage rate (dollars per hour) 12 10 S 8 Minimum wage 6 4 Earnings effect 2 D 0 0 1 2 3 4 5 6 7 8 9 10 Quantity (thousands (thousands of of workers) workers) Price Ceilings and Price Floors 42 APPLICATIONS: PRICE FLOORS Minimum Wage Does a minimum wage raise or lower the earnings of low wage workers? If the disemployment effect is larger than the earnings effect, the minimum wage has a negative net effect on total earnings of low wage workers. If the disemployment effect is smaller than the earnings effect, the minimum wage has a positive net effect on total earnings of low wage workers. Price Ceilings and Price Floors 43