log returns are independent and identically normally distributed then

advertisement

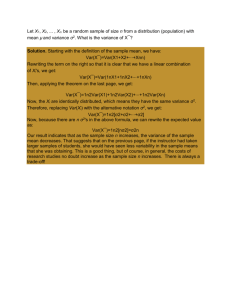

COMM 472: Quantitative Analysis of Financial Decisions Part 1: Fundamental Properties of Returns Equity Returns • Throughout this section, we will make extensive use of the dynamic properties of equity returns: – Returns are dynamic in the following sense: what happens to returns today may, and in fact does, effect how returns behave tomorrow. Preliminary Concepts and Notation • We’ll focus our attention on equity returns. – Random returns are the result of one or both of the following effects: • Future dividends (usually random), • Future prices (usually random). R t 1 D t 1 Pt 1 Pt Preliminary Concepts and Notation • Note that returns are the sum of two components: – The Dividend Yield: Dt 1 DYt Pt – The Capital Gain: cg t 1 R Pt 1 Pt Preliminary Concepts and Notation • Note: – This definition is of a gross return (i.e. net return = gross return - 1). – The return relates to a price change over some specific period of time. That time period can be an instant, a day, a month, a year, etc. depending on the application. (We’ll spend a lot of time in this course talking about the effect of time horizon on returns.) Preliminary Concepts and Notation • Returns can also be stated in their logarithmic form: rt 1 ln(R t 1 ) ln( D t 1 Pt 1 ) ln( Pt ) • So that: Rt 1 e rt 1 Multiperiod Returns • Returns over long horizons show the effect of compounding: – For simple returns (no dividends): R t,t T Pt T Pt 1 Pt 2 Pt 3 Pt T Pt Pt Pt 1 Pt 2 Pt T 1 – Long-horizon returns are the product of shorthorizon returns. Multiperiod Returns • For log returns (no dividends), long-horizon returns are the sum of short-horizon returns, since: Rt ,t T Rt 1Rt 2 Rt 3 Rt T rt 1 rt 2 rt 3 rt T e e e e rt 1 rt 2 rt 3 rt T e Multiperiod Returns • When we choose whether to work with simple or log returns we make a tradeoff: – Simple returns are more convenient when aggregating returns of stocks in portfolios. (The weighted average of simple returns is the simple return on the portfolio. This is not true for log returns.) – Log returns are more convenient when aggregating returns of a stock or index across time (For statistics, it is more convenient to work with sums than products. For example, the sum of normally distributed log returns is normal whereas the product is not.) The Distribution of Returns • Returns are usually random. We can add some structure to the return process if we specify a distribution for the returns. • One common specification is that single period log returns are normally distributed. • Is this a reasonable assumption? Estimating Moments of Returns • Random variables can be characterized by their “moments”. • Typically, we work with the first two moments – the mean and the variance. ˆ ˆ 2 1 rt T 1 2 ˆ (rt ) T Other Moments • Higher moments are sometimes of interest: Sˆ Kˆ 1 3 (r ˆ ) 3 t Tˆ 1 4 (r ˆ ) 4 t Tˆ – These moments are called the skewness and kurtosis. For a standard normal distribution (mean 0, variance 1) the skewness is 0 and the kurtosis is 3. Dynamic Portfolio Strategies Part 2: Dynamic Properties of Returns Statistical Properties of Long Horizon Returns • The properties of long-horizon returns can be derived from their short-run properties. • We make use of the following properties of expectations and variances: E(rt 1 rt 2 ) var(r t 1 rt 2 ) E(rt 1 ) E(rt 2 ) var(r t 1 ) var(r t 2 ) 2 cov( rt 1 , rt 2 ) Case 1: IID Normal Returns • If “1-period” log returns are independent and identically normally distributed then the mean and variance of the returns distribution grows proportionally with the horizon. – Remember that: rt , t T rt 1 rt 2 rt 3 rt T Long-Run Mean Returns • So: E(rt , t T ) • Notice that: E (rt 1 ) E (rt 2 ) E (rt T ) TE (rt 1 ) – No one return provides information about any other (returns are independent). – Each return has the same mean (identically distributed). Long-Run Variance var(r t , t T ) var( rt 1 ) var( rt 2 ) var( rt T ) T var (rt 1 ) • Notice that: – Returns are uncorrelated so that no covariance terms show up (independent). – All variances are the same (identically distributed). IID Return Dynamics • This model of return dynamics, although very simple, has been the mainstay of “Dynamic Asset Pricing” for many years. – Black-Scholes pricing is based on this model of returns. • Question: Does the data support this hypothesis? Empirical Properties of LongHorizon Returns • Are returns independent? – Independence has broader implications, but we will focus on whether or not returns are uncorrelated. • Two methods of testing: – Directly measure “autocorrelations” of returns. – Examine “variance ratios”. Empirical Properties of Long Horizon Returns • Why do we worry about independence of returns? – Dependencies, as we will see, have dramatic effects on long-run return properties. – One example: “time diversification” • If returns from one time period are negatively correlated with those from another, then long horizon returns will be less risky than would be predicted if they were assumed independent. Autocorrelation • Definition: – The autocorrelation coefficient measures the correlation between two random variables from a time series (eg. two returns on an index). – The autocorrelation must be specified with respect to some “lag length” (the time between measurements of the random returns): k cov( rt , rt k ) var( rt ) var( rt k ) Autocorrelation • We’ll assume throughout that return series are “covariance-stationary”: – One-period returns at all dates have the same variance. – The covariance between returns at different dates depends only on the lag (k): cov( rt , rt k ) cov( rt -k , rt ) k var( rt ) var( rt ) Estimating Autocorrelations • Correlation coefficients can be calculated by using sample averages: ˆ (k ) ˆ (k ) cov(rt , rt k ) T -k 1 (rt ˆ )( rt k ˆ ) T t 1 ˆ (k ) 2 ˆ Testing Significance • In order to assess the statistical significance of these autocorrelations we need to know the sampling distributions of the statistics. – If we assume returns are IID: ~ T ˆ (k ) N (0,1) ~ (k ) T ~ (k ) ~ T-k T-k 2 ˆ ˆ (k ) 1 (k ) 2 (T - 1) N (0,1) Testing for IID Returns with Autocorrelations • One problem with testing for IID returns using autocorrelations is that it is not clear what lags to use to test for zero autocorrelation. – If returns are IID all autocorrelations should be zero. • One solution is to use a statistic that summarizes many autocorrelations. Portmanteau Statistic • The Q-statistic simply sums the squares of many autocorrelation statistics: m Qm T ˆ (k ) 2 k 1 • This statistic tests for zero autocorrelation at all of m lags, giving power to test against a broad variety of alternative hypotheses for return dynamics. Testing for IID Returns with the Portmanteau Statistic • The Q-statistic has a “chi-squared” distribution with m degrees of freedom. • This distribution can be used to determine, statistically, whether or not the statistic is significantly different from zero. Variance Ratio Statistics • We saw earlier that if returns are IID, the variance of long-horizon returns is proportional to the horizon. This result serves as the basis for using “Variance Ratios” to test whether or not returns are IID. • Definition: – The q-horizon variance ratio statistic is the ratio of the variance of the q-period return to the variance of the 1period return, divided by q. Variance Ratio Statistics VR( q) var(r t , t q ) q var( rt ) • Note that for IID returns this statistic should be identically 1 for all horizons. Variance Ratio Statistics • eg. With two-period IID returns: VR( 2) var(r t , t 2 ) 2 var( rt ) var( rt 1 ) var( rt 2 ) 2 cov( rt 1 , rt 2 ) 2 var( rt ) 2 var( rt ) 2 cov( rt 1 , rt 2 ) 2 var( rt ) 1 Variance Ratio Statistics • As an alternative, suppose returns are autocorrelated: VR( 2) var(r t , t 2 ) 2 var( rt ) var( rt 1 ) var( rt 2 ) 2 cov( rt 1 , rt 2 ) 2 var( rt ) 2 var( rt ) 2 cov( rt 1 , rt 2 ) 2 var( rt ) 1 (1) Variance Ratio Statistics • This is an important result that has implications for portfolio choice: – The investing horizon can have dramatic effects on the risk-return relationship. • In particular, if returns are negatively autocorrelated, long horizon investors will face less variable equity returns than will short horizon investors. Testing for IID Returns with Variance Ratio Statistics • The null hypothesis is that returns are IID normal: rt t with t IID N (0,1) • We’ll work with 2n+1 log prices to determine the VR(2) statistic: 1 2n ˆ rt k 2n k 1 2n 1 2 ˆ ˆ a2 (r ) t k 2n k 1 2n 1 2 ˆ ˆ b2 (p p 2 ) t 2k t 2 k -2 2n k 1 Testing for IID Returns with Variance Ratio Statistics • Note that: 1. With log returns, the mean return is simply the geometric average return (the last log price minus the first log price divided by 2n). 2. The mean of the two period return is twice the one period return. 3. Only n two-period returns are used to estimate the two-period return variance. Testing for IID Returns with Variance Ratio Statistics • The variance ratio statistic is normally distributed: ˆ VR(2) ; ˆ 2 b 2 a ~ 2n VR(2) 1 N 0,2 Testing for IID Returns with Variance Ratio Statistics • The general case: ˆ ˆ a2 1 nq rt k nq k 1 1 nq 2 ˆ (r ) tk nq k 1 ˆ b2 (q) 1 n 2 ˆ (p p q ) t qk t qk -q nq k 1 Testing for IID Returns with Variance Ratio Statistics • An improvement (correct bias and overlap): a2 (q) 1 nq 2 ˆ (r ) t k nq 1 k 1 (q) 1 nq 2 ˆ (p t k p t k -q q ) m k q q q(nq q 1) 1 nq 2 c m Variance Ratio Statistics: Distribution of Test Statistics • The variance ratio statistics are normally distributed: 2 ˆ b (q) ˆ VR (q ) ; 2 ˆ a c2 (q) VR (q ) ; 2 a nq VRˆ (q ) 1 ~ N 0,2(q 1) 2(2q 1)( q 1) ~ nq VR (q ) 1 N 0, 3q