and General long-term liabilities

advertisement

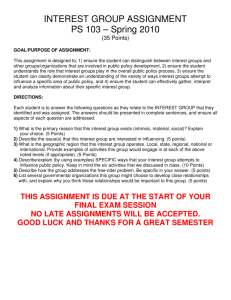

CHAPTER 9 GENERAL CAPITAL ASSETS; LONG-TERM LIABILITIES; PERMANENT FUNDS Introduction to InterfundGCA-GLTL Accounting © Prentice Hall Publishing – Governmental and NonProfit Accounting 7e 1-1 Freeman / Shoulders 9-1 OVERVIEW Concludes general government accounting of the text Discusses the relationship of and accounting for – General capital assets (GCA) and – General long-term liabilities (GLTL) to the governmental fund types Introduces “Permanent Funds” (not common) © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9-2 LEARNING OBJECTIVES For General Capital Assets and General Long-Term Liabilities – To maintain information needed for government-wide reporting purposes – To account for various types of transactions – To understand relationships and accounting for transactions with governmental funds – To understand reporting and note disclosure requirements © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9-3 LEARNING OBJECTIVES For Infrastructure – To account for and report general infrastructure capital assets properly – To understand and apply the modified approach for accounting for infrastructure capital assets For Permanent Funds – To understand the nature and use of Permanent Funds – To account for and report Permanent Funds © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9-4 GCA & GLTL ACCOUNTS OVERVIEW & ACCOUNTING GASB specifies only reporting GCA and GLTL in the government-wide financial statements Accounting procedures will vary as GASB provides none See Figure 9-1 as it 1. Summarizes the relationships of these accounts with the governmental funds and 2. Accumulates reporting information for government-wide financial statements © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9-5 GCA & GLTL ACCOUNTS General capital assets – Book value of governmental (not enterprise) funds capital assets – Classified by type (land, buildings, etc.) General long-term liabilities – Capital asset-related debt (bonds, notes) – Vacation and sick leave, claims and judgments, and non-capital debt © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9-6 GCA & GLTL ACCOUNTS NET ASSETS Invested in capital assets, net of related debt – Increases (Entries in Figure 9-1) (1) Cost of GCA acquired (5) Capital asset-related debt retired – Decreases (Entries in Figure 9-1) (2) Capital asset-related debt incurred (3) Depreciation expense (4) Net value of GCA dispositions © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9-7 GCA & GLTL ACCOUNTS NET ASSETS Restricted – Difference between restricted assets and noncapital asset-related liabilities Unrestricted – Difference between remaining assets & liabilities Increases (Entry in Figure 9-1) (7) Non-capital GLTL retired Decreases (Entry in Figure 9-1) (6) Non-capital GLTL incurred © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9-8 GENERAL CAPITAL ASSETS Examples – – – – Land Buildings and improvements Infrastructure Equipment Asset lives extend beyond single reporting period The assets are not physically consumed by use, but economic use declines over time © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9-9 GENERAL CAPITAL ASSETS Defined as “all capital assets other than those accounted for in proprietary or trust funds” Acquisition of general capital assets recorded in governmental funds as expendable financial resources are used However, capital assets are not recorded as governmental fund assets (since the assets are not financial resources) © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 10 GENERAL CAPITAL ASSETS Acquisition means by governments 1. 2. 3. 4. 5. 6. Purchase Construction (own forces or contracted) Capital lease Gift Foreclosure (taking of property for non-payment of taxes) Eminent domain (power of government to seize property, and compensate owner, for public use) 7. Escheat (reversion of property to a government in absence of legal claimants) © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 11 GENERAL CAPITAL ASSETS Initial valuation for assets acquired – Cost Value of consideration given or received All outlays incurred to bring asset to readiness – Estimated original cost Allowed by GASB standards, if cost not available – Gift Fair value when received (Continued) © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 12 GENERAL CAPITAL ASSETS Initial valuation for assets acquired – Under foreclosure; lower of 1. Amount due for taxes / assessments, penalties and interest or 2. Appraised fair value – By eminent domain Same manner as a purchase Compensation determined by the courts – Through escheat process Fair value when acquired © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 13 GENERAL CAPITAL ASSETS Classification for financial reporting – – No set GASB standard for reporting Most governments follow GFOA recommendation as follows: Land (and improvements preparing it for use) Buildings (and improvements made part of building) Infrastructure (bridges, roads, sidewalks, dams) Machinery and equipment (automotive, office) Construction in progress (Incomplete construction) © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 14 GENERAL CAPITAL ASSETS Infrastructure – Long-lived stationary (immovable) asset systems Examples; roads, bridges, tunnels, drainage, water, sewer and lighting systems, dams – Capitalization of major infrastructure assets required under GASB 34, whereas it was previously optional © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 15 GENERAL CAPITAL ASSETS Infrastructure – Capitalization (under GASB 34): Now required, whereas it was previously optional Retroactive recording not required for small governments under $10 million in 1999 revenues) 1. Permits estimated cost for recording infrastructure back to fiscal years ending after June 30, 1980 at implementation transition 2. Requires capitalization of only major asset systems acquired or significantly reconstructed or improved in fiscal years ending after June 30, 1980 © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 16 GENERAL CAPITAL ASSETS Infrastructure – initial capitalization – – Criteria to define major infrastructure assets requiring reporting under GASB 34 in first fiscal years ending after June 15, 1999 Determination of major general infrastructure assets should be at network or subsystem level 1. 2. – Asset subsystems – at least 5% of the total cost of all general capital assets or Asset networks – at least 10% of the total cost of all general capital assets Reporting of non-major networks encouraged, but not required © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 17 GENERAL CAPITAL ASSETS Capitalization policy – GAAP only applies to material and significant items in the circumstances – However, governments should consider – Legal compliance – Materiality and control considerations when developing a capitalization policy © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 18 GENERAL CAPITAL ASSETS Capitalization policy – Legal compliance Threshold levels ($1,500, $1,000, $500, $100) may not address – – Materiality or Different asset (buildings vs. equipment) classes However, dollar threshold must comply with state and local laws and regulations © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 19 GENERAL CAPITAL ASSETS Capitalization policy – Materiality Item considered material if: 1. Dollar value significant to financial statements 2. Proper accounting required regardless of magnitude Important because: – – Material items must conform with GAAP Immaterial items need not conform to GAAP Governments can set policy by asset class with different capitalization policies for each class © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 20 GENERAL CAPITAL ASSETS Capitalization policy – Control considerations May dictate capitalization of certain asset types Cost could be less than legal or materiality thresholds for items such as – Personal computers – Guns – Communication devices Immaterial items need not conform to GAAP © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 21 GENERAL CAPITAL ASSETS Recording and reporting works of art/historical treasures – Record at cost or fair value at donation date – Not required to capitalize if the collection meets all three of the following criteria 1.Held for exhibition, education, or research 2.Protected, unencumbered, cared for, and preserved 3.Policy requiring the proceeds of collection item sales to be used to acquire other collection items © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 22 GENERAL CAPITAL ASSETS Recording and reporting works of art/historical treasures – Report donations as revenues in governmentwide Statement of Activities Whether or not capitalized If not capitalized, also shown as an expense equal to the revenue amount recognized – Report depreciation if capitalized and items are exhaustible; otherwise not depreciated © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 23 GENERAL CAPITAL ASSETS Depreciation / accumulated depreciation – Recorded in the GCA accounts – Depreciation expense Reported in the governmental activities column of the government-wide Statement of Activities Not an expenditure, so Not recorded in the governmental funds – Accumulated depreciation Reported in the governmental activities column of the government-wide Statement of Net Assets © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 24 GENERAL CAPITAL ASSETS Modified approach – infrastructure – Infrastructure depreciation not required if government meets two requirements: 1. Uses an asset management system 2. Documents that infrastructure being preserved at a disclosed condition level © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 25 GENERAL CAPITAL ASSETS Modified approach – infrastructure – The asset management system for eligible infrastructure should Have an up-to-date inventory of eligible assets Perform condition assessments Estimate annually the amount to maintain and preserve the assets at the established condition level © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 26 GENERAL CAPITAL ASSETS Modified approach – infrastructure – Documentary evidence requires professional judgment to meet the second requirement that asset is being preserved 1. Complete condition assessments performed consistently at least every three years 2. Results of the three most recent condition assessments provide reasonable assurance that the assets are being preserved approximately at or above the condition level established and disclosed by the government © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 27 GENERAL CAPITAL ASSETS Modified approach – infrastructure – If eligible assets meet requirements Assets are not depreciated Expenditures incurred related to the assets are – – Expended, if for repair and replacement Capitalized, if increasing capacity or efficiency – Once requirements are no longer met, assets should be depreciated in subsequent reporting periods © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 28 GENERAL CAPITAL ASSETS Assets financed from GF or SRFs – Entry in General Fund Expenditure recorded – Dr Expenditures – Capital outlay - $29,100 – Cr Vouchers payable - $29,100 – Entry in General Capital Assets Accounts Asset capitalized – Dr Equipment - $29,100 – Cr Net assets – Invested in capital assets - $29,100 © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 29 GENERAL CAPITAL ASSETS Assets financed by capital lease – Entry in General Fund – Dr Expenditures – Capital outlay - $900,000 – Cr Other financing sources – Capital lease - $850,000 – Cr Cash - $50,000 – Entry in General Capital Assets Accounts – Dr Land – Under capital lease - $100,000 – Dr Buildings – Under capital lease - $800,000 – Cr Net assets – Invested in capital assets - $900,000 – Entry in General Long-Term Liabilities Accounts – Dr Net assets – Invested in capital assets - $850,000 – Cr Capital lease liabilities - $850,000 © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 30 GENERAL CAPITAL ASSETS Assets financed from CPFs – Entry in Capital Projects Fund Expenditure recorded – Dr Expenditures – Capital outlay - $1,270,000 – Cr Vouchers payable - $1,270,000 – Entry in General Capital Assets Accounts Asset capitalized – Dr Construction in progress - $1,270,000 – Cr Net assets – Invested in capital assets - $1,270,000 © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 31 GENERAL CAPITAL ASSETS Asset (land with an estimated value of $2,000) acquired through foreclosure for taxes, penalties and interest owed of $1,000 – Entry in Special Revenue Fund Expenditure recorded / tax lien written off – Dr Expenditures – Capital outlay - $1,100 – Cr Tax lien receivable - $1,000 – Entry in General Capital Assets Accounts Asset capitalized – Dr Land - $1,100 – Cr Net assets – Invested in capital assets - $1,100 © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 32 GENERAL CAPITAL ASSETS Assets acquired through gifts – No entry in governmental funds as no financial resources were received/expended – However, a $1,500 capital contribution revenue will be reported in the government-wide Statement of Activities – Entry in General Capital Assets Accounts Asset capitalized at its fair value – Dr Land - $1,500 – Cr Net assets – Invested in capital assets - $1,500 © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 33 GENERAL CAPITAL ASSETS Sale, retirement or replacement accounting – General Capital Assets Accounts 1. Remove the asset-carrying value by – Debiting the related accumulated depreciation account(s) and – Crediting the asset account(s) – Reducing the Net Assets—Invested in Capital Assets account – Fund receiving proceeds of sale 2. Record any proceeds as “other financing sources” in the accounts of the recipient governmental fund – Government-wide Statement of Activities Report a gain or loss on disposal in the amount of the difference between items 1 and 2 © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 34 GENERAL CAPITAL ASSETS Intragovernmental sale – Enterprise Fund sells equipment at book value to the GF - public works department – Enterprise Fund entry Dr Due from General Fund - $15,000 Dr Accumulated depreciation - Equipment - $1,000 Cr Equipment - $16,000 – General Fund entry Dr Expenditures - Capital outlay - $15,000 Cr Due to Enterprise Fund - $15,000 – General Capital Assets Accounts entry Dr Equipment - $15,000 Cr Net assets – Invested in capital assets - $15,000 © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 35 GENERAL CAPITAL ASSETS Reporting and Note Disclosures – Report in the governmental activities column of the government-wide Statement of Net Assets – Provide detailed capital assets information in the notes to the basic financial statements – Distinguish those assets associated with governmental activities from those associated with business-type activities © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 36 GENERAL CAPITAL ASSETS Reporting and Note Disclosures – Notes should disclose (Figure 9-3) GCA information by major classes of assets Any GCA that are not being depreciated Beginning- and end-of-year balances Accumulated depreciation presented separately from historical cost Acquisitions of capital assets Sales or other dispositions Current-period depreciation expense, with disclosure of the amounts charged to each of the functions in the Statement of Activities © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 37 GENERAL LONG-TERM LIABILITIES Definition – Unmatured principal of general government long-term debt – Excludes – Matured debt of governmental funds All debt of proprietary funds or trust funds – Not a liability of any specific fund © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 38 GENERAL LONG-TERM LIABILITIES Examples – Bond issues – Special assessment debt (If government obligated in some manner) – Long-term notes – Claims and judgments – Compensated absences – Capital lease liabilities – Unfunded pension contributions © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 39 GENERAL LONG-TERM LIABILITIES Relationship CPFs and GLTL accounts – Issuance of debt for Capital Projects Fund – CPF entry Dr Cash $1,000,000 Cr Other Financing Sources – Bond proceeds - $1,000,000 – GLTL entry Dr Net assets – Invested in capital projects - $1,000,000 Cr Serial bonds payable - $1,000,000 © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 40 GENERAL LONG-TERM LIABILITIES Relationship DSFs and GLTL accounts – Maturity of debt payable from DSF – DSF entry Dr Expenditures - $160,000 Cr Matured Bonds Payable - $100,000 Cr Matured Interest Payable - $50,000 Cr Fiscal Agent Fees Payable - $10,000 – GLTL entry Dr Serial bonds payable - $100,000 Cr Net assets – Invested in capital projects - $100,000 © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 41 GENERAL LONG-TERM LIABILITIES Defaulted bonds – No specific GASB guidance – Authors preferred approach Remove from General Long-Term Liabilities Report in DSF or GF Disclose default in notes to financial statements © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 42 GENERAL LONG-TERM LIABILITIES In-substance defeasance – When all conditions are met Remove defeased debt from GLTL accounts Record advance refunding bonds in GLTL accounts – If defeasance requirements are not met Old debt remains in GLTL accounts Proceeds from advance refunding bonds recorded in DSF to service the old debt New advance refunding bonds recorded and reported in GLTL accounts © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 43 GENERAL LONG-TERM LIABILITIES Reporting and Note Disclosures – Report in the governmental activities column of the government-wide Statement of Net Assets – Report the GLTL by type – Annual CAFR often includes added schedules – Provide detailed information in the notes to the basic financial statements © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 44 GENERAL LONG-TERM LIABILITIES Reporting and Note Disclosures – Notes should disclose (Figure 9-4) Beginning and end-of-year balances Increases and decreases (separately presented) Portions of each item due within one year Funds used to liquidate other long-term liabilities (such as compensated absences and pension liabilities) in prior years © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 45 PERMANENT FUNDS Account for resources held in trust by the government for the benefit of the government (or its citizenry) Principal of the trust is to be maintained intact (nonexpendable) Exceptions: – Expendable trust funds benefiting the government reported as Special Revenue Funds – Trust funds benefiting others reported as Private-Purpose Trust Funds © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 46 PERMANENT FUNDS Examples requiring use – Receiving gift or bequest with the stipulation that (a) Principal is to be kept intact and (b) Earnings are to be used for certain purposes – Establishing an employee loan fund Both principal and earnings may be maintained intact Costs might be chargeable to principal – Entering other trust agreements Maintain cemeteries, landmark buildings in perpetuity Earnings are expendable only for repairs/maintenance © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 47 PERMANENT FUNDS Financial reporting same as other governmental funds with following required – Balance sheet (Figure 9-5) – Statement of revenues, expenditures, and changes in fund balance If Permanent Fund includes both – Nonexpendable principal amounts and – Expendable earnings the fund balance may need classification between – “Fund Balance - Expendable” and – “Fund Balance - Nonexpendable’’ © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 48 PERMANENT FUNDS Sample transactions – (1) Accepting gift to maintain baseball field Dr Cash - $210,000 Cr Revenue (donations) - $210,000 – (2) Purchasing investments Dr Investments - $203,000 Dr Accrued Interest receivable - $400 Cr Cash - $203,400 © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 49 PERMANENT FUNDS Sample transactions – (3) Recognizing investment income Dr Cash - $3,000 Cr Accrued interest receivable - $400 Cr Interest revenues - $2,600 – (4) Selling investments at a gain (*) Dr Cash - $3,090 Cr Investments - $3,042 Cr Interest revenues - $35 Cr Gain on sale of investments - $13 (*) (*) Gain added to trust corpus – See entry (9) © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 50 PERMANENT FUNDS Sample transactions – (6) (a) PF-Transfer of earnings to GF (*) Dr OFU, Transfer to GF - $5,000 Cr Cash - $5,000 – (6) (b) GF-Receipt of earnings from PF Dr Cash - $5,000 Cr OFS, Transfer from PF - $5,000 (*) Earnings usually transferred to Special Revenue funds when restricted for specific use © 2003 Prentice Hall Publishing – Governmental and NonProfit Accounting 7e Freeman / Shoulders 9 - 51