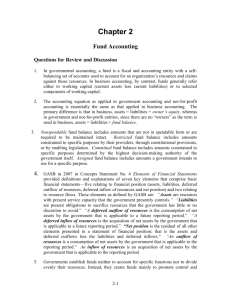

Management Discussion and Analysis

advertisement

Management’s Discussion and Analysis: What you need to say BY: MATT HJELM, CPA, CFE KIM DARE, CPA, CFE GALUSHA, HIGGINS, & GALUSHA, PC The Key Points Introduction Year to year comparisons Analysis of financial position Discussion of the basic financial statements Condensed GW financial information Analysis of fund activities Analysis of budget to actual variations Description of capital asset and debt activities Description of known facts or conditions that are expected to have a significant affect on operations Introduction Who wrote the MD&A? What is the purpose of the MD&A? MANAGEMENT DISCUSSION AND ANALYSIS – JUNE 30, 2013 This Management Discussion and Analysis (MD&A) written by the Business Manager/District Clerk of the Galusha School District provides an overview of the financial position and governmental financial activities for the fiscal year ending June 30, 2013. Please read it in conjunction with our audit report financial statements. Certain comparative information between the current year and the prior year is required to be presented in the MD&A. Year to Year Comparison – The Highlights Emphasize the current year! Discuss both positive and negative aspects of the year’s operations. Reserves Cash flows Tax items Mill levies Valuation Capital Improvements Other postemployment benefits Multi-district cooperative agreements The Basic Financial Statements Discussion on the district-wide financial statements Accrual method of accounting Be sure to use up to date terminology Ask the auditor Check your numbers and percentages if you use them! Keys to keeping the reader’s attention…… sure Give a general overview of what you are discussing Be descriptive but concise Keep it simple The Basic Financial Statements Statement of Net Position General Overview Assets, Liabilities and Net Position Makeup of categories A. The Statement of Net Position on Page 13 shows the assets, liabilities, and the net position of the school district. The statement categorizes assets to show that some assets are very liquid, such as cash and cash equivalents. Some assets are restricted for certain purposes or reserved for emergencies and cash flow purposes. Some assets are invested in fixed or capital assets, such as buildings, equipment and other long-lived property; and some assets are available to fund budgets of the following year. Assets exceed liabilities by $X,XXX,XXX as of June 30, 2013. For current year net position, capital assets and restricted net position compose 90% of the total of net assets and 10% are unrestricted or liquid. Last year capital assets and restricted net assets composed 90% of the total net assets and unrestricted or liquid assets comprised 10% of the total. This allocation has remained the same for the last four years. Deferred inflows and outflows if you have them The Basic Financial Statements Statement of Activities Discussion on revenue types General Program-specific General overview of expenditure activity The Statement of Activities on Page X shows the amounts of program-specific and general school district revenues used to support the various functions of the school district. General revenues from taxes and other sources for general school supported 81 percent of expenditures, while 19 percent of expenditures were supported with sources other than taxes, called program revenues. Program revenues for Galusha Schools include grants, purchased meals and community education fees. Significant Fund Activities Discuss the major funds presented in the financial statements How to determine major funds Proprietary funds if you have them Fiduciary responsibilities i.e. extracurricular accounts Refer to the schedule of extracurricular activity Method of accounting Governmental funds – modified accrual Proprietary and Fiduciary funds – Full accrual Refer to the reconciliations included in the financial statements to determine what makes up the differences between the district-wide financial statements and the fund financial statements Condensed Financial Information Keyword here is condensed! Summarize the district-wide statements only Make sure you update terminology if there has been guidance changes Ask your auditor about this Condensed Financial Information Statement of Net Position 2013 2012 Net Position: Current assets Capital assets - net Total assets 2,984,900 17,624,587 20,609,487 2,919,265 18,179,360 21,098,625 Current liabilities: Non-current liabilities Total liabilities 622,115 12,121,732 12,743,847 598,425 12,176,506 12,774,931 Net Position: Net investment in capital assets Restricted Unrestricted Total net position 7,054,587 1,900,372 (1,089,319) 7,865,640 7,049,360 1,625,622 (351,288) 8,323,694 Condensed Financial Information Statement of Activities 2013 Revenues: Program revenues: Charges for services Federal grants State program funding Other Total program revenues General revenues: Property taxes County retirement distribution State aid Interest Other Special Item Gain/(Loss) on disposal of assets Total general revenues Total Revenues 2012 201,756 1,111,428 945,898 90,179 2,349,261 211,742 1,009,345 920,106 84,360 2,225,553 3,486,356 785,126 5,141,420 10,435 62,756 3,456,701 820,260 5,077,667 18,735 77,959 0 9,486,093 11,835,354 (8,202) 9,443,120 11,668,673 2013 Expenses: Regular pograms Special programs Vocational programs Adult education Supporting services Operations and maintenance Student Transportation Food Services Extracurricular Interest Debt issuance costs Unallocated depreciation Total expenses 5,691,310 665,146 393,762 6,928 2,620,414 1,171,021 546,198 686,847 36,630 474,850 300 0 12,293,406 2012 5,352,596 633,628 313,046 7,856 2,404,804 997,949 515,522 666,912 37,668 496,450 300 2,844 11,429,575 Budget to Actual Results Discuss any changes between the original, approved budget and the final budget General description for any modifications Highlight any large variances between final budgeted amounts and the actual amounts for the year Capital Assets and Debt Activity Capital Assets Annual balance in each category i.e. land, buildings, etc. General information on capital additions or disposed assets Annual depreciation expense Debt Activity Type of Debt i.e. Bonds, Capital Leases, Intercap loans Include general information i.e. Maturity dates and interest rates Outstanding amounts at year end Make sure to include your OPEB information Note: Will include pension liability information starting in FY15 – Talk to your auditor if you unaware of this change Currently Known Information Make sure to highlight key changes that have happened or are expected to happen in the near future Mill levies Changes to tax base or valuations Include significant items such as tax protests Enrollment trends Changes to state/federal funding Contact Information for the District District Superintendent District Clerk/Business Manager Mailing/Physical Address Phone Number Helpful References OPI Finance & Grants Accounting GASB34 Tab • Model MD&A • MD&A Checklist • Samples Background on Presenters Firm: Founded in 1919 7 offices Audit clients include 20+ school districts and education co-ops as well as other governmental entities Matt Hjelm: Graduated MSU 6+ years experience auditing governments including schools, cities, Indian tribes Kim Dare: Graduated MSU-B 15+ years experience auditing governments including schools, cities, Indian tribes Both licensed in the State of Montana and Certified Fraud Examiners Questions Contact: 406-248-1681 matth@ghg-cpa.com or kimberly@ghg-cpa.com