acct 567 week 1 exercises

advertisement

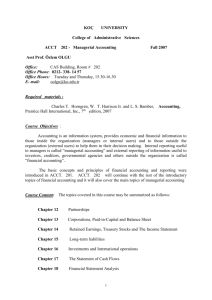

ACCT 567 http://www.homeworkmotiv ator.com/products/acct567?pagesize=12 ACCT 567 ENTIRE COURSE ACCT 567 Week 1 Exercises ACCT 567 Week 2 Case Study I ACCT 567 Week 2 Problems 3-9 and 4-4, 4-6, 4-10 ACCT 567 Week 3 Problems 5-3 and 6-5 ACCT 567 Week 4 Midterm Exam ACCT 567 Week 4 Problems 7-3 and 7-8 ACCT 567 Week 5 Case Study City of Shipley ACCT 567 Week 5 Homework Case study ACCT 567 Week 5 Problems 8-4 and 9-4 ACCT 567 Week 5 Test All Questions and Answers ACCT 567 Week 6 Problem 12-4 ACCT 567 Week 7 Problems 16-3 and 17-6 http://www.homeworkmotiv ator.com/product/acct-567entire-course ACCT 567 WEEK 1 EXERCISES Chapter 1: Exercise 1–3 http://www.homeworkmotivator.com/product/acct -567-week-1-exercises ACCT 567 WEEK 1 EXERCISES 2–3 AND 2–5 http://www.homeworkmotivator.com/product/acct -567-week-1-exercises-23-and-25 ACCT 567 WEEK 2 CASE STUDY I The General Fund of Middleville has presented you with the following trial balance as of June 30, 2011. Debits Credits Cash $ 40,000 Taxes Receivable- Delinquent 142,000 Estimated Uncollectible Taxes- Delinquent 9,100 Interest and Penalties Receivable 32,000 Vouchers Payable 24,000 Budgetary Fund Balance-Reserve for Encumbrances 10,200 Fund Balance _________ 170,700 $ 214,000 $214,000 The information that is being presented to you pertains to the transactions for the city of Middleville for the fiscal year ended June 30, 2012. The following budget was adopted by the city council: Estimated Revenues: Property Taxes $ 650,000 Fines and Penalties 44,000 Licenses and Permits 150,000 Federal Grant 85,000 929,000 Appropriations and Other Financing Uses Public Safety 402,000 General Government 263,000 Public Works 102,000 Parks and Recreation 92,000 Transfers Out 34,000 893,000 Encumbrances outstanding at the end of the year were re-opened. Property taxes of $ 660,000 were levied. It is estimated that 2.5% of the property taxes levied are expected to be uncollectible/ Purchase orders issued for the 2012 fiscal year were as follows: Public Safety, $ 395,000; General Government, $ 259,000; Public Works, $ 100,000; Parks and Recreation, $ 98,000. Cash collected for the Federal Grant from the Federal Government, $ 94,000. Cash collected and transferred in as follows: Fines and Penalties 43,000 Licenses and Permits 164,000 Cash collected on property taxes were as follows: Current taxes, $559,000, Delinquent Taxes, $ 41,000 and $ 22,000 of interest and penalties were collected. Purchase orders issued in 2012 in the following amounts were filled in at the following amounts: Estimated Actual Public Safety $ 395,000 $ 393,600 General Government $ 259,000 $ 258,200 Public Works $ 100,000 $ 99,400 Parks and Recreation $ 98,000 $ 97,500 ————— ————— $ 852,000 $ 848,700 Vouchers paid amounted to $ 840,000 and the transfer out to the Debt Service Fund, $34,000. Please reclassify the Taxes Receivable –Current and Estimated Uncollectible Taxes- Change from Current to Delinquent. http://www.homeworkmotivator.com/product/acct -567-week-2-case-study-i ACCT 567 WEEK 2 PROBLEMS 3-9 AND 4-4, 4-6, 4-10 From the textbook, complete the following problems. Problems 3-9 and 4-4, 4-6, 4-10 http://www.homeworkmotivator.com/product/acct -567-week-2-problems-3-9-and-4-4-4-6-4-10 ACCT 567 WEEK 3 PROBLEMS 5-3 AND 6-5 Make all necessary entries in the appropriate governmental fund general journal and the government-wide governmental activities general journal for each of the following transactions entered into by the City of Fordache. 1. The city received a donation of land that is to be used by Parks and Recreation for a park. At the time of the donation, the land had a fair value of $5,200,000 and was recorded on the donor’s books at a historical cost of $4,500,000. 2. The Public Works Department sold machinery with a historical cost of $35,100 and accumulated depreciation of $28,700 for $6,400. The machinery had originally been purchased with special revenue funds. 3. A car was leased for the mayor’s use. Since the term of the lease exceeded 75 percent of the useful life of the car, the lease was capitalized. The first payment was $550 and the present value of the remaining lease payments was $30,000. 4. During the current year, a capital projects fund completed a new public safety building that was started in the prior year. The total cost of the project was $9,720,000. Financing for the project came from a $9,000,000 bond issue that was sold in the prior year, and from a $720,000 federal capital grant received in the current year. Current year expenditures for the project totaled $1,176,000. The full cost is attributed to the building since it was constructed on city-owned property. 5. Due to technological developments, the city determined that the service capacity of some of the technology equipment used by general government had been impaired. The calculated impairment loss due to technology obsolescence was $1,156,000 http://www.homeworkmotivator.com/product/acct -567-week-3-problems-5-3-and-6-5 ACCT 567 WEEK 3 TEST ALL QUESTIONS AND ANSWERS 1. Question : (TCO A) Which of the following items are considered Required Supplementary Information (RSI)? Student Answer: Management’s Discussion and Analysis Budgetary Comparison Schedule Schedule of Risk Management Activities All of the above Chapters 1 and 2 2. Question : (TCO B) In addition to the government-wide statements, governmental entities are required to prepare fund financial statements for which of the following category of funds? Student Answer: Governmental type funds Proprietary funds Fiduciary funds All of the above Instructor Explanation: Chapter 2 3. Question : (TCO C) The County Commission of Hunter County adopted its General Fund budget for the year ending June 30, comprising of estimated revenues of $3,750,000 and appropriations of $3,150,000. Hunter County utilizes the budgetary accounts required by GASB standards. The budgeted excess of estimated revenues over appropriations will be recorded as Student Answer: a credit to Surplus Revenues, $600,000. a debit to Estimated Excess Revenues, $600,000. a credit to Budgetary Fund Balance, $600,000. a memorandum entry only. Instructor Explanation: Chapter 3 4. Question : (TCO D) Which of the following is a true statement regarding the use of a Special Revenue Fund? Student Answer: Special Revenue Funds may be used when a government wishes to segregate income for specific purposes. Special Revenue Funds may only be used when a substantial portion of the resources are provided by restricted or committed revenue sources. Assigned resources can be accounted for in a Special Revenue Fund. Once a Special Revenue Fund is established by the governmental entity, it will continue to be a Special Revenue Fund until all of the resources are exhausted. Instructor Explanation: Chapter 4 5. Question : (TCO B) Which of the following is true regarding the government-wide Statement of Net Assets? Student Answer: The government-wide Statement of Net Assets must be prepared in a classified format; that is, both assets and liabilities must be separated between current and long-term liabilities. A reporting entity (primary government plus component units) total column is required. The government-wide Statement of Net Assets reflects capital assets, net of accumulated depreciation, for both governmental and business-type activities. The government-wide Statement of Net Assets includes all resources entrusted to the government, including governmental, proprietary, and fiduciary. Instructor Explanation: Chapter 2 http://www.homeworkmotivator.com/product/acct -567-week-3-test-all-questions-and-answers ACCT 567 WEEK 4 MIDTERM EXAM 1. (TCOs A and B) Fiduciary funds are to use which of the following measurement and basis of accounting? (Points : 5) Economic resource measurement focus and accrual basis of accounting. Current financial resources measurement focus and accrual basis of accounting. Economic resources measurement focus and modified accrual basis of accounting. None of the above, the fiduciary funds have no revenues. 2. (TCOs A and B) Funds other than the General Fund are required to be considered to be a major fund when (Points : 5) (A) total assets, liabilities, revenues, or expenditures/expenses of that fund constitute 10 percent of either the governmental or enterprise category. (B) total assets, liabilities, revenues, or expenditures/expenses of that fund are at least 5 percent of the total of the governmental and enterprise category. The conditions of either A or B exist. The conditions of both A and B exist. 3. (TCOs A and B) Which of the following is most correct with regard to Management’s Discussion and Analysis? (Points : 5) Both state and local governments and federal agencies are required to provide a MD&A. Federal agency financial reports are required to provide a MD&A. State and local government agencies are required to provide a MD&A. Both state and local government and federal agencies are encouraged, but not required to provide a MD&A. 4. (TCOs B and C) With regards to budgetary reporting by governmental entities, which of the following is not a true statement? (Points : 5) While GASB standards guide the format of the comparison, it does not require governments to maintain budgetary accounts. GASB standards require governmental entities to present a comparison of budgeted and actual results for the General Fund and special revenue funds with legally adopted budgets. Budgetary accounts are required to appear in the general purpose financial statements. The basis of accounting used to report the actual column in the budgetary comparison schedule is prepared according to legal requirements for budget preparation even if it departs from GASB Statements. 5. (TCOs B and C) The proper journal entry to record an encumbrance would include which of the following? (Points : 5) (A) A debit to the Encumbrance Account. (B) A debit to the Reserve for Encumbrances Account. (C) A credit to the Reserve for Encumbrances Account. A and C would both be included in the journal entry. 6. (TCOs B and C)) Capital assets that are used by an enterprise fund should be accounted for in the following fund? (Points : 5) Enterprise fund but no depreciation on the capital assets should be recorded. Enterprise fund and depreciation on the capital assets should be recorded. Business-type activities journal but no depreciation on the capital assets should be recorded. Governmental activities journal and depreciation on the capital assets should be recorded. 7. (TCO E) When a government acquires general fixed assets under a capital lease agreement, how should the asset be recorded in the government-wide financial statements? (Points : 5) As an expense when payments are made. At the inception of the lease agreement at the lesser of the present value of the minimum lease payments of the fair market value of the property. As an expenditure when payments are made. None of the above 8. (TCO E) Which of the following projects would usually be accounted for in a capital projects fund? (Points : 5) (A) Payment of interest on bonds that are issued to finance the construction of a new city hall. (B) The construction of a parking garage that is operated as an enterprise fund. (C) The construction of a fire station addition. Both A and B would be accounted for in a capital projects fund. 9. (TCO E) Which of the following statements is a true statement regarding the reporting of debt service funds? (Points : 5) Debt service funds are reported in a separate column in the governmental fund financial statements. Debt service funds are reported in the other governmental funds column in the governmental fund financial statements. Debt service funds are reported in a separate column in the government-wide financial statements. Debt service funds are reported in the governmental activities column in the government-wide financial statements. 10. (TCO D) Under GASB Statement No. 33, when would a special revenue fund be considered to have satisfied the eligibility requirement of a reimbursement type federal grant? (Points : 5) Only as the work is completed for a project. When the work has started for the project. Only after the work is completely finished for the project. When a plan for the use of the funds has been developed and approved by the appropriate personnel 1. (TCO E)You are in a staff meeting with the city controller and one of your colleagues was quoted as follows: “Capital projects funds are established by a government to account for all plant or equipment acquired by construction.” Do you agree with this statement? Why or why not? (Points : 30) 2. (TCOs A and B)How are the major funds of a state or local government determined by a governmental entity? (Points : 30) http://www.homeworkmotivator.com/product/acct -567-week-4-midterm-exam ACCT 567 WEEK 4 PROBLEMS 7-3 AND 7-8 During the fiscal year ended September 30, 2011, the following transactions (summarized) occurred: 1. Employees were paid $290,000 wages in cash; additional wages of $43,500 were withheld for federal income and social security taxes. The employer’s share of social security taxes amounted to $23,375. 2. Cash remitted to the federal government during the year for withholding taxes and social security taxes amounted to $65,500. 3. Utility bills received from the Town of Fredericksburg’s Utility Fund during the year amounted to $23,500. 4. Office expenses paid in cash during the year amounted to $10,500. 5. Service supplies purchased on account during the year totaled $157,500. 6. Parts and supplies used during the year totaled $152,300 (at cost). 7. Charges to departments during the fiscal year were as follows: http://www.homeworkmotivator.com/product/acct -567-week-4-problems-7-3-and-7-8 ACCT 567 WEEK 5 CASE STUDY CITY OF SHIPLEY The City of Shipley maintains an Employee Retirement Fund; a single-employer, defined benefit plan that provides annuity and disability benefits. The fund is financed by a process that makes actuarially determined contributions from the city’s General Fund and by contributions that are made by the employees. The General Fund is handling the administration of the retirement fund and it does not have any administrative expenses. The Statement of Net Assets for the Employees’ Retirement Fund as of July 1, 2011 is shown below: City of Shipley Employees Retirement Fund Statement of Net Assets As of July 1, 2011 Assets Cash $ 60,000 Accrued Interest Receivable 160,000 Investments, at fair value Bonds 5,500,000 Common Stock 1,600,000 Total Assets $ 7,320,000 Liabilities Accounts Payable and Accrued Expenses 430,000 Net Assets Held in Trust for Pension Benefits $ 6,890,000 The following transactions took place during the fiscal year 2012: The interest receivable on investments was collected in cash. Member contributions in the amount of $ 460,000 were received in cash, the city’s General Fund also contributed $ 700,000 in cash. Annuity benefits of $ 780,000 and disability benefits of $ 200,000 were recorded as liabilities. Accounts payable and accrued expenses in the amount of $ 820,000 were paid in cash. Interest income of $ 320,000 and dividends in the amount of $60,000 were received in cash. Bond Interest Income of $ 160,000 was accrued at the end of year. Refunds of $ 150,000 were made in cash to terminated, non-vested participating employees. Common stocks, which are carried at a fair value of $ 500,000, were sold for $472,000. The amount of the sales price of the stock plus an additional $ 360,000 was invested in stocks. As of the end of the fiscal year, June 30, 2012, a determination has been made that the fair value of the stocks held by the pension plan had decreased by $ 60,000; the fair value of bonds had increased by $35,000. Temporary accounts for the year were closed. http://www.homeworkmotivator.com/product/acct -567-week-5-case-study-city-of-shipley ACCT 567 WEEK 5 HOMEWORK CASE 8-1 Case 8 – 1 a. When was CalPERS established? b. What types of employers contribute to CalPERS? c. How many individuals are served by CalPERS? d. How many and what types of funds are administered by CalPERS? e. For the most recent reporting period, what is the value of total fiduciary assets? f. For the most recent reporting period, what was the change in pension fund net assets? g. What are the funded ratios from the schedule of funding progress and what do the funded ratios tell you? h. What is the reporting relationship between CalPERS and the State of California? http://www.homeworkmotivator.com/product/acct -567-week-5-homework-case-8-1 ACCT 567 WEEK 5 PROBLEMS 8-4 AND 9-4 The county collector of Lincoln County is responsible for collecting all property taxes levied by funds and governments within the boundaries of the county. To reimburse the county for estimated administrative expenses of operating the tax agency fund, the agency fund deducts 1 percent from the collections for the town, the school district, and the townships. The total amount deducted is added to the collections for the county and remitted to the Lincoln County General Fund. The Village of Dover administers a defined benefit pension plan for its police and fire personnel. Employees are not required to contribute to the plan. The village received from the actuary and other sources the following information about the Public Safety Employees’ Pension Fund as of December 31, 2011. http://www.homeworkmotivator.com/product/acct -567-week-5-problems-8-4-and-9-4 ACCT 567 WEEK 5 TEST ALL QUESTIONS AND ANSWERS 1. Question : (TCO F) Any activities that produce goods or services to be provided to other departments or other governmental units would be reported in which fund? Enterprise Fund Internal Service Fund Advance Fund Agency Fund 2. Question : (TCO F) Government units use which fund type to account for services provided to the general public on a user-fee basis? General Fund Enterprise Fund Internal Service Fund Permanent Fund 3. Question : (TCO G) A fund that is the result of an agreement between a contributor and a government that the principal and/or income of trust assets that is for the benefit of individuals, organizations, or other governments is a(n) Private-Purpose Trust Fund. Investment Trust Fund. Pension Trust Fund. Agency Fund. 4. Question : (TCO H) Which of the following would be considered a performance audit under the Governmental Auditing Standards? : An investigation into whether a social service agency of a state government improved the lives of the clients. An investigation into whether a purchasing department of a government was operated efficiently. Both of the above Neither of the above 5. Question : (TCO J) Which of the following kinds of information would not be provided by management’s discussion and analysis (MD&A)? : A description of the government’s financial condition. A discussion of economic factors and the budget and tax rates approved for the next year. A forecast of revenues and expenditures for the next three fiscal years. A narrative explanation of the contents of the CAFR. 6. Question : (TCO H) Which of the following would be considered “contribution revenue or support” of a not-for-profit organization? Monies received from a fund-raising campaign. Investment earnings. Money received from rental of surplus office space. Gain on disposal of capital assets. 7. Question : (TCO H) Describe the different types of governmental audits and attestation engagements. 8. Question : (TCO F) Internal Service Fund, Statement of Cash Flows. Prepare a statement of cash flows for the internal service fund for the city of Pearman from the following information: http://www.homeworkmotivator.com/product/acct -567-week-5-test-all-questions-and-answers ACCT 567 WEEK 6 PROBLEM 12-4 Quad-States Community Service Agency expended federal awards during the most recent fiscal year in the following amounts for the programs shown: Additional information indicates that Programs 4 and 10 were audited as major programs in each of the two preceding fiscal years, with no audit findings reported. Required a. Which programs would be considered Type A programs and why? Type B programs? b. Based on the information provided, which programs would you select for audit and why? c. If you found out that a new manager with no previous experience was now in charge of Program 4, would your answer to part b change? If so how? http://www.homeworkmotivator.com/product/acct -567-week-6-problem-12-4 ACCT 567 WEEK 7 PROBLEMS 16-3 AND 17-6 Elizabeth College, a small private college, had the following transactions in fiscal year 2011. 1. Billings for tuition and fees totaled $5,600,000. Tuition waivers and scholarships of $61,500 were granted. Students received tuition refunds of $101,670. 2. During the year the college received $1,891,000 cash in unrestricted private gifts, $575,200 cash in temporarily restricted grants, and $1,000,000 in securities for an endowment. 3. A pledge campaign generated $626,000 in unrestricted pledges, payable in fiscal year 2012. 4. Auxiliary enterprises provided goods and services that generated $94,370 in cash. 5. Collections of tuition receivable totaled $5,380,000. 6. Unrestricted cash of $1,000,000 was invested. 7. The college purchased computer equipment at a cost of $10,580. 8. During the year the following expenses were paid: http://www.homeworkmotivator.com/product/ acct-567-week-7-problems-16-3-and-17-6 HomeworkMotivator.com