The Great Depression

advertisement

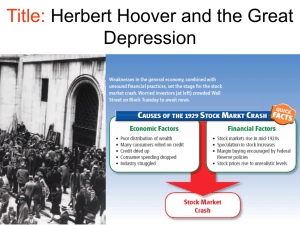

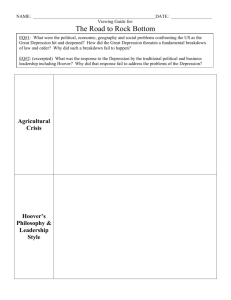

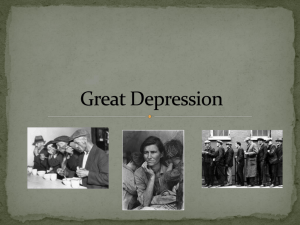

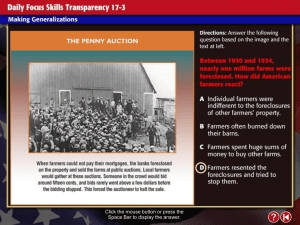

The Beginning of the Great Depression Price Support Credit Alfred E. Smith Dow Jones Industrial Average Speculation Buying on Margin Black Tuesday Great Depression Hawley-Smoot Tariff Act Industries Railroad, textiles, and steel were facing more competition Mining and lumber were also facing tough competition and were not needed as much as they once were Housing market began to fall Agriculture Prices for wheat and corn rose during the war Farmers planted more to make a larger profit – Bought new equipment on credit Annual farm income began to decline – 1919 $10 billion to 1921 $4 billion Farmers began to default on their loans and banks began to fail Save Us! Congress tried to create the McNaryHaugen bill that would have allowed for price support – The government would buy surplus crops at a guaranteed price and then sell them on the world market Cotton, corn, tobacco, wheat Pres. Calvin Coolidge vetoed the bill twice Deeper Down Since farmers had more debt they had less money to spend This had a trickle down effect Many Americans were buying on credit – Buy now, pay later with interest When faced with debt, people spent less money in order to pay off debt Only 5% of the population earned $10,000 or more per year 70% of the population earned $2500 per year Election of 1928 Secretary of Commerce Herbert Hoover Alfred E. Smith – Governor of New York – The first Roman Catholic to run for president Hoover won based on the past success of his party Stock Market Some people invested their money in the stock market The Dow Jones Industrial Average is used as a barometer of the nation’s economic health – Based off of the prices of 30 large firms traded on the NYSE The market rose steadily through the 20s About 3% of the nation owned stocks Stock Market cont. Many people were involved in speculation – Buying high risk stock with a high interest rate Others were buying on margin – Paying a small percentage of the stock price as a down payment and then borrowing the rest There was little gov’t regulation of the stock market CRASH!! Early Sept. 1929 stock prices began to fall Investors quickly began to sell their stock. Oct. 24 the market took a plunge October 29, 1929 Black Tuesday 16.4 million shares of stock were dumped People who had bought on margin were left with a huge debt but not product to show for it Other people lost their savings By mid-November $30 billion had been lost Signaled the beginning of the Great Depression The Great Depression 1929-1940 The U.S. economy plummeted and unemployment skyrocketed People began to withdraw all of their money from banks 1929- 600 banks closed By 1933 11,000 of the 25,000 had failed The government did not protect or insure banks The Great Depression cont. 1929-1932 the GNP was cut in half – $104 billion to $59 billion 90,000 businesses went bankrupt Unemployment went from 3% in 1929 to 25% in 1933 Hawley-Smoot Tariff Much of Europe was hit by the Depression as well The U.S. had difficulty importing European goods 1930: Congress tried to protect American farmers and manufactures from foreign completion with the Hawley-Smoot Tariff – Reduced the flow of European goods into U.S. – Made things worse: Europe wouldn’t buy American products Causes of the Great Depression Tariffs and war debt policies cut down the foreign market for American goods A crisis in the farm sector The availability of easy credit Unequal distribution of wealth The federal government did little to avoid disaster – Hoover encouraged Americans to stay confident