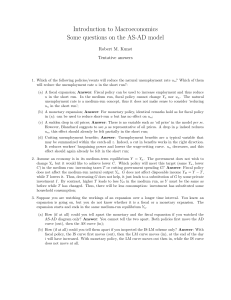

XII. Keynesian stabilization in an open economy

advertisement

XII. Keynesian stabilization in an open economy XII. 1 Aggregate demand in the short run Net export and real ExR • In the short-run, export depends on foreign demand and real exchange rate, import depends on domestic AD and real exchange rate • Usual assumption: Marshall-Lerner condition, i.e. net export depends on real exchange rate only (see Krugman, Obstfeld) NX NXe , NXe 0 • Consequently, assume: – The lower the real exchange rate, the less competitive domestic goods and services are, the higher the current account deficit (NX drops) – And vice versa Aggregate demand and real ExR • Considering relation between demand for real output and real ExR, ceteris paribus, i.e. when all other variables (interest, taxes, etc.) unchanged – and standard assumption: economy at the potential output (full employment) equilibrium • AD = C + I + G + NX , but if only Y and real ExR allowed to vary, we might schematically write AD = AD(Y,e) Output determination in the short run • Short run : prices (and wages) assumed fixed, than real ExR depends of nominal ExR only • Closed economy in the short run: relation between output and interest (ISLM) • Open economy in the short run: relation between output and ExR (interest considered as given) • “ISLM-type” adjustment (see next slide): – Excess demand → inventories↓ → output↑ – Excess supply, vice versa • Combinations of output and ExR, keeping goods market in short run equilibrium: DD curve (see next slide again) AD AD E 2 AD E1 45 o E Y1 Y2 Y DD E2 E 2 E1 - depreciati on E1 Y1 Y2 Y What shifts DD curve? • In general: any disturbance, raising AD, shifts DD to the right; disturbance, lowering AD, shifts DD to the left • In our framework, following factors might be relevant: – Expenditures G, taxes T, investment I, domestic price P, foreign price P*, changes in autonomous consumption, demand shifts between domestic and foreign goods – Check yourself XII.2 Asset market in the short run Output and ExR on the asset market • Asset market: interest parity condition r r * E e -E E • Interest rate determined by equilibrium on domestic money market (see LXI): MS P LY, r • Short run: expectations, foreign interest rate, price and money supply given • Infinite combinations of output and ExR, keeping asset market in equilibrium: AA curve (see next slide) E E E1 E1 AA E2 E2 Return on foreign deposits r1 returns r2 L(Y1 , r) L(Y2 , r) MS P Y2 Y1 M P Y1 Y2 Y What shifts AA curve? • • • • • Change in domestic money supply MS Change in price P Change in expectations Ee Change in foreign interest rate r* Shifts in demand for money function XII.3 Short run equilibrium in an open economy Equilibrium and adjustment • Equilibrium both on goods and asset market: intersection of DD and AA curves • Adjustment speed: faster adjustment on assets market than on goods market E DD AA ● C B● A Y XII.4 Policies XII.4.1 Temporary policies • Short term policies, expected to be reversed in the future, i.e. expections remain constant • Prices, wages, expectations fixed • Adjustment obvious – see above what changes DD and AA curves Monetary policy Fiscal policy E E DD AA DD1 DD 2 AA 2 AA1 Y Y Use (and many warnings) • Both expansionary monetary and fiscal policies – Increase output – Monetary → depreciation, fiscal → appreciation • Application: short term reaction to exogenous shocks • Many pitfalls – Inflation bias – Time lags – Unclear origins of disturbances, etc. XII.4.2 Permanent policies • Policies that are not reversed → change of expected ExR • Considering long term effects – after full adjustment of prices, wages and volumes • Starting point – potential output, natural values, ExR expectation equals actual ExR → domestic interest equals “foreign” interest Robert Mundell • 1932 – • Stanford University • International institutions (namely IMF) • International economics • Mundell-Fleming model • Nobel price in 1999 Monetary policy • Money supply increase → shift of AA curve, but larger than in case of temporary case – Shift due to MS increase – Shift due Ee increase • Long term adjustment: price increase due to larger money supply (next slide: red color means final positions): – Real appreciation → domestic goods relatively more expensive → fall of foreign demand → shift of DD curve “up and left” – Real money supply falls → AA curve, after an initial shift „up“, shifts “down and left” DD2 E DD1 E2 2 3 E3 AA2 E1 AA3 1 AA1 Yf Y2 Y Monetary policy efficiency • Long term adjustment: – Return to potential output – Higher price level – Nominal depreciation • However – in the short term (within a concept of Keynesian policy stimulation) monetary policy is efficient – Increase of output and employment • Remember ExR overshooting (see LXI) Fiscal policy • Permanent fiscal expansion – In reality usually accompanied by permanent tax increase, otherwise unsustainable – Remember: balanced budget multiplier = 1 • Open economy – Short term shift of DD curve “up and right” – Permanent fiscal change → increase of Ee → shift of AA curve “down and left” E DD1 DD2 1 E1 X AA1 E2 2 Yf AA2 Y Fiscal policy efficiency • Adjustment on the currency market extremely fast → after initial DD shift, change in expectation moves the AA curve immediately „down“ • There is no increase of output (and employment) even in the short term (economy will never reach point X) • Long term adjustment in closed economy – Return to potential output, government spending crowds-out private investment, inflation • Open economy – Remains at potential output at appreciated currency – Aggregate demand for domestic product crowded-out by demand for foreign products (as they became cheaper) • Fiscal policy inefficient XII.5 Fixed exchange rate Notice • When ExR fixed, but market pressures against the fix, then Central Bank must intervene – Pressure towards appreciation → purchase of foreign assets – Pressure towards depreciation → sale of foreign assets • Link between Central Bank intervention and money supply – Purchase of (foreign) assets → increase in money supply – Sale of (foreign) assets → decrease in money supply Fixing the rate • Commitment of Central Bank to trade domestic currency at given rate • Why fix? – There is no ideal floating in reality – Arrangements for countries in a transitory stage of economies – Lessons from the past – Regional currency areas (e.g. Euro) Equilibrium under Fix • Fix – expected ExR equals actual one • Interest rate parity implies that domestic interest must equal foreign interest • Implications for domestic money market – e.g. in case of output increase: – Push towards increase of domestic interest rate → push towards appreciation – To keep currency fixed, Central Bank must intervene → purchase of foreign assets → increase of money supply → interest rate and ExR remain at original levels • Under fix – automatic accommodation of monetary policy E E1 r* Ee - E E r1 L(Y1,r) M1 P M2 P M P L(Y2,r) r Stabilization policies under fix (1) • Only short term effects, try to derive yourselves diagrammatically • Monetary policies, e.g. increase of money supply by purchasing domestic assets → pressure towards decrease of interest and depreciation (shift in AA) → Central Bank must intervene selling foreign assets → decrease of money supply • No effect on output and employment, but decrease in foreign reserves exactly equal to original purchase of domestic assets Stabilization policies under fix (2) • Fiscal expansion → increase of AD, shift of DD → increase of output and pressure towards appreciation, at the same excess demand for money and pressure towards interest increase → Central Bank must intervene, buying foreign assets to increase money supply (and to keep fix) → shift of AA → further increase of output, ExR remains at fix • Fiscal policy has an impact on output (and employment) Stabilization policies under fix (3) • Changes in ExR, assume that Central Bank is credible, i.e. people accept new expected ExR immediately • Devaluation → increase of exports and AD (why?) → increase of output, excess demand for money, pressure towards interest increase → Central Bank intervention, buying foreign assets → expansion of money supply, shift of AA, new equilibrium XII.6 Conclusions for stabilization policies The efficiency of fiscal, monetary and trade policy differs according the exchange rate regime • Flexible exchange rate (float) – Fiscal policy very little efficient – Monetary policy very efficient • Fixed exchange rate – Fiscal policy very efficient – Monetary policy very little efficient – Changes in ExR efficient Literature to Ch. XII • Krugman, Obstfeld, ch.15-17. Basic text and references there. • Dornbush, Fischer, ch. 6. Slightly different way of explanation, but it might seem more comprehensive to some